In the CBD industry, few challenges are critical as well as misunderstood as KYC(know your customer) and underwriting. While CBD products are legal under the 2018 Farm Bill, they remain heavily regulated by federal agencies such as FDA.

It creates a uniquely high-risk environment for banks, payment processors, and merchant service providers. As a result, KYC and underwriting play an essential role in determining whether a CBD business can obtain and maintain a stable CBD merchant account.

Because CBD merchants operate in a sector with frequent labeling issues, inconsistent product quality and strict rules around marketing and ingestibles, financial institutions must carefully evaluate every business before approving payment processing.

This is where KYC comes in. KYC requires processors to confirm the merchant’s identity, ownership structure, business model, product lineup, and compliance history. For CBD companies it includes reviewing corporate documents, website claims, product descriptions, COAs, and supply-chain transparency.

Underwriting goes even deeper. Whereas KYC verifies who the merchant is, underwriting determines whether their business practices meet required banking and regulatory standards.

CBD underwriting usually includes examining third-party lab reports, THC levels, manufacturing processes, SKU lists, GMP compliance, and the marketing language of marketing to ensure no unapproved health claims are present.

The goal is to assess risk and ensure that the business adhere to federal guidelines before any transactions are processed. Strong KYC and underwriting protocols protect both the merchant and the payment processor.

For merchants, successful underwriting leads to more reliable CBD payment processing, fewer account holds, and reduced risk of termination. For processors, it ensures regulatory safety and avoids exposure to non-compliant products.

In an industry as scrutinized as CBD, effective KYC and underwriting are not optional; rather they are the backbone of secure, compliant financial operations.

Also Read: CBD Payment Compliance

Why CBD Merchants Face Such Intense Compliance Scrutiny

1. CBD Is Legal, but Still Not Fully Approved:

The 2018 Farm Bill made the hemp and its derivatives legal including if the product contains no more than 0.3% THC, but it still has not legalized CBD as a dietary supplement or food additive.

As a result, CBD exists in a confusing state between legality and ongoing regulatory restriction. It is because hemp farming and hemp extraction, CBD production is legal.

CBD sales are legal but heavily regulated, while CBD in food or beverages is not completely legal at the federal level. Also CBD as a dietary supplement remains unapproved by the FDA.

Because of this fragmented landscape, CBD brands operate under intense scrutiny. The FDA continues to issue warning letters to companies which market CBD with unverified medical claims who add CBD to ingestible products without proper approval or mislabel potency and ingredients.

Even when a CBD product is technically legal under the Farm bill, it may still violate FDA rules governing how ingestible products can be formulated, marketed, or sold.

This is why payment processors become cautious. Banks and processors must ensure that every merchant they support complies with federal regulations.

If a CBD company sells products that may violate FDA guidance like CBD gummies, beverages, tinctures marketed as supplements, or products with health claims where processors consider them as high-risk. Supporting a non-compliant merchant can put banks at risk of legal liabilities, fines, or regulatory reviews.

Due to such risks, payment processors often decline CBD merchants or require detailed documentation, testing, lab reports, and compliance audits.

In short, though CBD is legal to produce and sell, but not approved in the ways which matter most to regulators making the industry one of the most inspected categories in modern commerce.

Also Read: Is CBD Legal in all 50 states

2. The CBD Market Has High Variability in Product Quality:

One of the biggest reasons CBD merchants face intense compliance scrutiny is due to the wide variability in the product quality across the industry. Unlike traditional consumer packaged goods, CBD products do not yet come under a standardized federal regulatory framework.

Because rules are not consistent, product quality, safety, and labeling can change a lot from one brand to another. Several undercover studies by private labs, universities, and investigative journalists have revealed major inconsistencies in many CBD products.

One of the most common issues is variability in CBD potency. Many products contain significantly more or less CBD than advertised sometimes by a margin of 50% or more. This not just misleads consumers but also signals to regulators and payment processors that quality control is inconsistent.

Similarly THC limits are frequently violated in the unregulated CBD marketplace. Even though federal law allows hemp-derived products with less than 0.3% THC, testing has shown that some CBD items sold in stores still exceed that limit.

Products which exceed 0.3% THC are legally categorized as marijuana and not hemp which lead to serious compliance and legal consequences for everyone in the supply chain, even the banks that process payments.

Another ongoing issue is label accuracy. Many CBD products are mislabeled or do not have crucial information such as cannabinoid profiles, ingredient lists, batch numbers, or QR codes causing third-party lab reports.

Inaccurate or incomplete labeling increases warnings who expect transparency and traceability especially for ingestible products. Perhaps most concerning, is the presence of contaminants.

Studies have found that pesticides, heavy metals, residual solvents, microbials, and even synthetic cannabinoids in some CBD products. While contaminated goods have direct health risks to consumers which is a major liability for financial institutions which are connected to the merchant.

All these issues like potency variations, THC overages, mislabeled products, and contamination create enormous legal exposure for banks and payment processors.

Financial institutions are held to strict compliance standards under federal law including anti-money laundering rules and FDA regulations. If a bank processes payments for a CBD merchant whose products are later found non-compliant, contaminated, or mislabeled, regulators may view the bank as facilitating unlawful commerce.

Due to this reason, payment processors inspect CBD merchants far more aggressively than traditional retailers. They often require third-party lab certificates, batch-testing documentation, manufacturing audits, and proof of supply-chain transparency before approving an account.

The high variability in product quality does not just create consumer risk, it directly impacts the risk tolerance of the financial system, prompting processors to be selective and highly cautious about the CBD merchants they onboard.

Also Read: Selling CBD Products Online

FDA, FTC, and State Enforcement Is Common

CBD merchants operate under constant regulatory oversight, making federal and state enforcement actions have become a regular part of the landscape. Each year, the FDA and FTC issue more than a hundred warning letters to CBD companies for violations for improper marketing or product safety concerns.

These agencies closely monitor the industry because CBD remains unapproved as a dietary supplement or food additive, and because many brands continue to push the boundaries of compliant marketing.

One of the most common violations involves medical claims. Many CBD companies imply or directly state their products can treat conditions like anxiety, pain, inflammation, or sleep disorders.

Because these claims which are not backed by FDA-approved research they immediately cause enforcement. Similarly the FTC targets misleading advertisements particularly when companies exaggerate effectiveness, misrepresent ingredients, or use deceptive testimonials.

Safety issues also remain a top concern. Regulators routinely indicate CBD brands for unsafe products including items that contain contaminants or fail to meet quality standards.

Many warnings also involve missing lab tests, incomplete Certificates of Analysis, or the absence of batch-level testing which proves the accuracy and safety of the product.

Another recurring issue is mislabeling THC content. Products which exceed the 0.3% THC threshold violate federal hemp rules and are treated as illegal marijuana products, leading to serious legal consequences.

Because enforcement is so frequent, payment processors must protect themselves by avoiding merchants who are likely to attract regulatory action.

Banks and processors cannot risk being associated with companies selling mislabeled, contaminated, or illegally marketed CBD products. As a result, even minor compliance issues can cause an application to be denied or an active CBD merchant account to be terminated.

Also Read: Understanding CBD Payment Terms

1. High Chargeback Risk:

CBD businesses experience significantly higher chargeback rates than traditional ecommerce merchants, largely because of the unique challenges and expectations surrounding the industry.

One key factor is shipping delays, which frequently occur because of warehouse backlogs, carrier limitations, and additional verification checks required for hemp-derived products. When customers wait longer than expected, chargebacks become more likely.

Another key factor is product dissatisfaction. CBD affects individuals differently, and many customers expect immediate or dramatic results while expectations are often shaped by aggressive or misleading marketing. When customers don’t experience the outcomes they expected, they may dispute the charge rather than seek a refund.

Subscription disputes also contribute heavily to CBD chargeback rates. Automated refill programs can lead to customer confusion, forgotten sign-ups, or frustration when cancellation processes are not clear or easy.

Additionally many customers still misunderstand what CBD does. Without FDA-approved guidelines, consumers depend on online claims, influencer hype, or assumptions about therapeutic benefits. When the product does not match their expectations, they may initiate a chargeback instead of contacting support.

In the end, when compliance is weak, customer experiences almost always suffer. Merchants who fail to set accurate expectations, provide proper labeling, publish COAs, or maintain transparent websites tend to generate more complaints, cancellations, and disputes.

Because high chargeback ratios put payment processors at risk, CBD merchants must maintain strong compliance to protect both their business and their payment accounts.

Also Read: How to Avoid Frauds and Chargeback in CBD Payment Processing

2. Understanding KYC: What It Means in CBD Payments:

Know your customer(KYC) is a mandatory compliance framework used by all banks, payment processors, and financial institutions to confirm the identity, legitimacy, and risk profile of the businesses which they serve.

While KYC applies to every merchant, CBD businesses undergo a far more extensive and rigorous version of the process. Such stricter oversight is driven by the fact that CBD overlaps with farming, wellness, ingestible goods, and controlled substances, making it one of the most highly regulated industries today.

For CBD merchants, KYC is not just about proving who they are. It is about demonstrating lawful operations, responsible supply-chain practices, product safety, and transparency.

Processors must ensure that the merchant’s products comply with federal hemp regulations, avoid unapproved medical claims, follow labeling requirements, and maintain accurate third-party lab testing.

The ultimate goal is to avoid fraud, avoid regulatory penalties, and ensure that financial institutions are not unintentionally facilitating illegal or unsafe commerce.

Also Read: How to Setup Online CBD Payments in Less than 24 hrs

3. Identity Verification Requirements:

The first step in KYC is confirming the identity and background of the person or people who own or control the CBD business. Because CBD is classified as a high-risk vertical, processors must conduct deeper background checks to ensure that the merchant is trustworthy and compliant.

Payment processors typically confirm:

- The legal identity of the business owner.

- Their personal and financial background.

- Whether they appear on fraud, sanctions, or AML lists.

- Whether they previously operated terminated or blacklisted merchant accounts.

This process is designed to prevent onboarding merchants with a history of chargeback abuse, illegal activity, or regulatory violations.

Common documents required include:

- A government-issued ID(driver’s license or passport).

- SSN or TIN verification.

- Business EIN confirmation.

- Legal business registration documents.

- Proof of personal and business address.

These documents help processors to validate that the merchant is who they claim to be and that the business is being run by individuals with a verifiable legal identity.

In CBD, this step protects banks from unknowingly partnering with merchants who may have been shut down for selling illegal or unsafe products.

Also Read: How to Expand Your CBD Business to New Market

4. Business Entity Validation:

Beyond identity verification, processors must confirm that the business itself is legitimate, legally registered, and properly authorized to operate. Because CBD has differing regulations at the state and local level, entity validation becomes more intensive than standard e-commerce underwriting.

Underwriting teams must ensure:

- The business exists as a legal entity.

- It is authorized to conduct the activities it claims.

- It is properly registered within its jurisdiction.

- It has no history of fraudulent or prohibited activity.

- It is compliant with state hemp and CBD regulations.

Underwriting teams must ensure:

- The business exists as a legal entity.

- It is authorized to conduct the activities it claims.

- It is properly registered within its jurisdiction.

- It has no history of fraudulent or prohibited activity.

- It is compliant with state hemp and CBD regulations.

To validate this, processors request formal business documentation such as:

- Articles of incorporation.

- LLC or LLP registration documents.

- Operating agreements

- Business licenses

- Sales tax permits or reseller certificates.

- State hemp or CBD permits when required.

CBD merchants operating without proper licensing have a high regulatory risk, especially those selling ingestible products. Therefore, processors examine these documents carefully to ensure that the merchant meets all applicable legal requirements before approval.

Also Read: Marketing ideas for CBD Business

5. Bank Account Verification:

Payment processors must also verify that the merchant’s bank account is:

- Active and legitimate

- Owned by the same business entity applying for processing.

- Located in an appropriate jurisdiction.

- Not previously flagged for anti-money-laundering violations.

This step prevents fraud, money laundering, and financial misrepresentation. CBD merchants attempting to process payments through mismatched or personal accounts will almost always be rejected.

Such level of scrutiny is crucial because CBD transactions are regulated financial activity. Processors must ensure that payouts are sent to a lawful business bank account and that the account holder matches the business on file.

Also Read: Why Traditional Banks Reject CBD Merchants

6. Product Legitimacy Verification:

In CBD underwriting, product verification is the most intensive step. So banks must confirm that the merchant’s products are:

- Derived from legal hemp containing less than 0.3% Delta-9 THC

- accurately labeled.

- include accessible, verifiable batch-level Certificates of Analysis(COAs).

- Should not contain restricted or illegal cannabinoids.

- Should not violate FDA rules about supplements, food additives, or medical claims.

Processors do check the website of the merchant, product pages, and labels to confirm compliance. They also review every SKU to ensure nothing illegal is being sold.

This includes examining products like:

- CBD edibles

- CBD beverages

- Vapes and cartridges

- Tinctures and extracts

- Delta-8, Delta-10 and other hemp-derived cannabinoids.

Each of these product categories has different compliance risks. For instance, edibles and beverages are heavily inspected because CBD is not fully approved for use in food.

Delta products are scrutinized because state laws vary widely. Vape products are scrutinized for safety and age-restriction compliance.

To pass underwriting, merchants must provide:

- Recent COAs from accredited labs.

- Hemp sourcing documentation

- Accurate cannabinoid testing

- Proof that products remain below the legal THC threshold

Such level of verification protects processors from regulatory action and helps ensure that unsafe, mislabeled, or illegal products do not enter the financial system.

- CBD KYC is far more rigorous than standard e-commerce because financial institutions must verify identity, legality, product safety, and regulatory compliance.

- Product legitimacy verified through COAs, labeling, and hemp sourcing is the most critical component as it determines whether a merchant can legally operate under federal and state regulations.

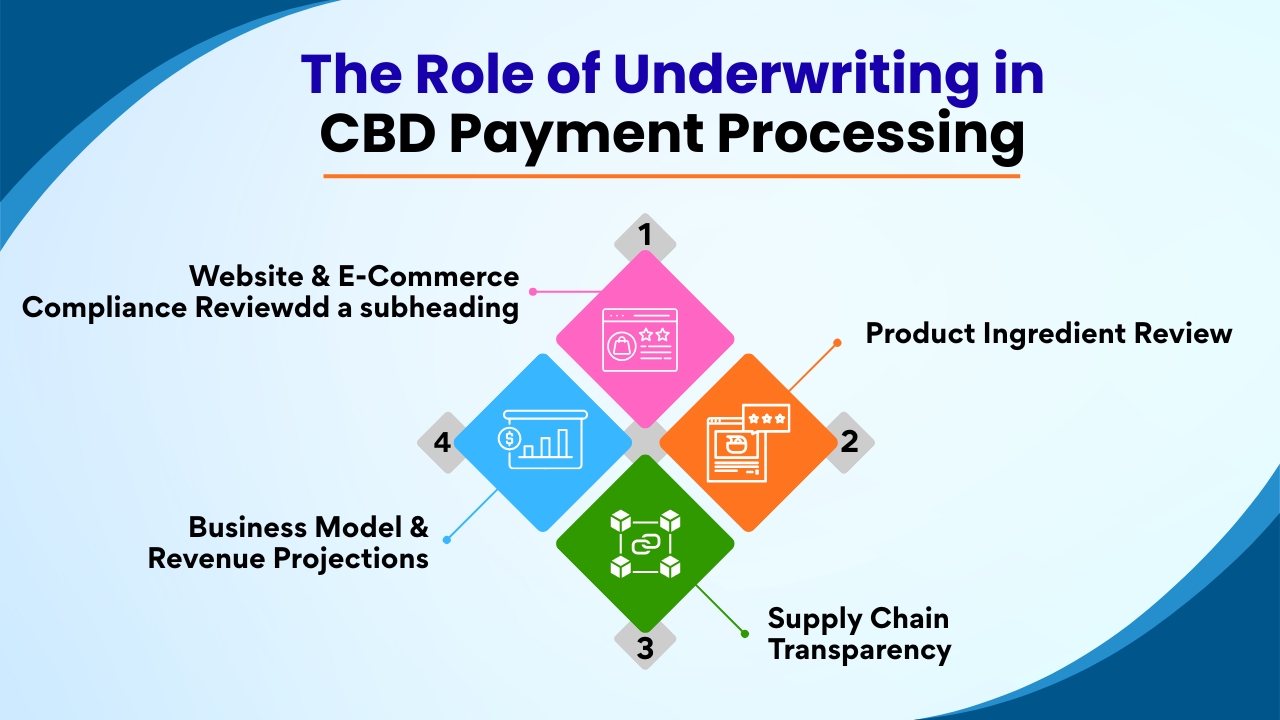

The Role of Underwriting in CBD Payment Processing

Underwriting is the in-depth investigation banks and payment processors perform to determine whether a CBD business is safe, compliant, and suitable for merchant processing.

While KYC verifies the identity of the business and its owners, underwriting goes much deeper, analyzing how the business operates, what it sells, how it markets its products, and how much financial risk it introduces to the processor.

For CBD merchants, underwriting is especially rigorous. Because the industry is regulated unevenly across federal and state lines and because CBD products often involve ingestibles, alternative cannabinoids, and biologically active compounds, processors must evaluate legally, product safety, and complete stability before approving an account.

Underwriting has three essential goals like verify legality, assess risk exposure, and ensure long-term compliance reliability.

The following sections explain exactly what CBD underwriters examine.

1. Website & E-Commerce Compliance Review:

One of the first components of CBD underwriting is a full audit of the merchant’s website or e-commerce store. The site is reviewed line by line to ensure it does not violate FDA or FTC rules. Underwriters examine:

- If there is any medical or therapeutic claims

- FDA-compliant language

- Age-verification systems

- Refund policy clarity

- Privacy policy and data usage disclosures

- Terms and Conditions

- Visible contact information

- Proper disclaimers

- Shipping and return rules

- Accurate, legal product descriptions

- No restricted items

Even if there is a single non-compliant can lead to automatic denial. Common red flags include:

- CBD cures anxiety

- CBD eliminates pain instantly

Since regulators actively monitor CBD advertising, processors cannot sponsor merchants whose websites expose them to FDA or FTC enforcement.

Also Read: Best Ecommerce Platform for CBD

2. Product Ingredient Review:

Next step is that underwriters review the specific ingredients and formulations of the merchant’s products. As CBD products can contain several cannabinoids, botanicals, terpenes, and additives, processors must confirm that each product is legal, safe, and properly tested.

Underwriters verify:

- Hemp source and legality

- Extraction method(CO2, ethanol, hydrocarbon, etc.)

- Potency accuracy

- THC levels

- Contaminant screening.

They require batch-level Certificates of Analysis(COAs) for every SKU. A general certificate is not enough. COAs must include:

- Full cannabinoid profile

- Heavy metals testing

- Pesticide analysis

- Residual solvent screening

- Microbial contamination tests.

If COAs are missing, outdated, or incomplete, the underwriting stops immediately. In high-risk CBD ingestibles such as gummies, oils, or beverages product safety is non-negotiable.

Also Read: How Much Does it Cost to Open a CBD Dispensary

3. Supply Chain Transparency:

Processors also evaluate the transparency and reliability of the merchant’s supply chain. Since CBD products pass through farmers, extractors, manufacturers, white-label labs, and distributors, banks have to confirm that each link in the chain is legitimate and following the law.

Underwriters usually request:

- Supplier licenses

- GMP(Good Manufacturing Practice) compliance letters

- Manufacturing facility details

- Chain-of-custody documentation

Also Read: How to Get a CBD Merchant for Your CBD Business

4. Business Model & Revenue Projections:

Finally, underwriters evaluate how the business operates financially. It helps processors to predict risk, chargeback chances, and long-term stability. Key elements include:

- Monthly processing volume

- Average order value

- Subscription billing practices

- Refund and chargeback rates

- Order fulfillment speed

- Marketing channels

CBD merchants with aggressive subscription billing, slow fulfillment, or high dispute ratios are considered high-risk. Underwriters prefer businesses with stable order flows, low refund rates, and transparent customer service practices. Reliable fulfillment and honest marketing greatly improve the chance of approval.

Also Read: How to Market Cannabis the Dos and Dont’s of CBD Marketing

Chargeback Management in CBD Underwriting

Chargeback prevention is a major focus of CBD underwriting because high dispute rates expose processors to regulatory and card-network penalties.

Underwriters evaluate whether the merchant provides clear product descriptions, honest marketing claims, fast and reliable shipping, transparent refund policies, tracking numbers, and organized CRM records.

Such elements demonstrate strong customer communication and reduce the chances of disputes. Excessive chargebacks can push merchants into VISA’s monitoring programs (VISA Dispute Monitoring Program) and VFMP(VIDA Fraud Monitoring Program).

CBD merchants must maintain strict compliance and also prioritize customer satisfaction at every step to avoid fines or account termination.

Ongoing KYC Monitoring (Post-Approval)

Approval is just the beginning for CBD merchants. As the industry is high-risk and heavily regulated, payment processors conduct ongoing KYC and KYB monitoring to ensure continued compliance.

Merchants must regularly provide updated COAs for every batch, current website screenshots, revised shipping and refund policies, refreshed ingredient labels, and valid state hemp or CBD licenses.

Processors use this information to confirm that products, marketing practices, and business operations remain lawful and consistent with underwriting standards. Continuous monitoring helps prevent regulatory violations, reduces processor liability, and ensures that the merchant’s account stays active and in good standing.

Also Read: Kratom and CBD Key differences in Payment Regulations

How CBD Merchants Can Pass Underwriting Smoothly

Successfully passing CBD underwriting requires preparation, transparency, and strict adherence to regulatory guidelines. Processors assess every aspect of a merchant’s operations from marketing claims to product safety so proactive compliance is critical.

The following five strategies help CBD businesses secure approvals quickly and maintain long-term processor relationships.

1. Use FDA-Compliant Marketing:

Avoid any medical or therapeutic claims. Instead of saying products “treat anxiety” or “cure pain” use language like “supports wellness” or “promotes relaxation”.

Underwriters treat overpromising claims as high-risk, so using careful and compliant wording can greatly improve your chances of getting approved.

2. Provide All COAs Upfront

Submit full-panel Certificates of Analysis(COAs) for each SKU before applying. Make them easily accessible on your website to demonstrate potency, THC limits, and contaminant testing. Providing COAs upfront reduces delays and builds processor confidence in product safety.

3. Add Proper Website Disclaimers

Include mandatory disclaimers such as:

- FDA compliance notice

- Age restriction or verification gate

- Legal compliance statement

- Hemp sourcing disclosure

Clear disclaimers show underwriters that your website meets federal and state regulations.

4. Maintain Transparent Business Policies

Underwriters favor businesses with clear refund policies, fast shipping, and honest product descriptions. Properly managed customer experiences reduce chargebacks and highlight operational reliability.

5. Prepare All Documents in Advance

Keep these documents ready such as your EIN letter, articles of incorporation, recent bank statements, utility bills, and detailed supplier information.

Staying organized speeds up approval and shows processors that your business is both legally compliant and well run. Following these steps positions CBD merchants for smoother underwriting, faster account approval and a stronger long-term relationship with processors.

Conclusion

KYC(Know your Customer) and underwriting are the two important steps which help CBD merchants to use payment systems safely. Unlike most high-risk industries, CBD combines hemp agriculture, food, supplements, topicals, and ingestible products where each is governed by its own set of rules.

As federal guidance is unclear and state laws can conflict, so the FDA actively monitors claims and labeling that increases risk for processors.

Through detailed KYC processes, banks and payment providers verify the identity of business owners, confirm legal registration, and check financial and operational history.

Underwriting even goes further, inspecting websites, product ingredients, COAs, supply chains, business models, and revenue projections. All these processes protect processors from regulatory enforcement, chargebacks, and reputational damage but also ensure that CBD merchants maintain compliance with changing laws.

For CBD businesses, understanding and proactively addressing KYC and underwriting requirements is not optional rather it is essential. With clear marketing, transparent policies, proper documentation, and consistent product testing reduce risk and enable smoother approvals.

Ultimately, strong KYC and underwriting establishes a safer and more stable CBD payments ecosystem, allowing compliant merchants to operate confidently and processors to reduce liability while supporting the growth of a complex and rapidly evolving industry.

If you still have any query regarding the role of KYC and Underwriting in CBD payment processing then feel free to write to us at CBD Merchant Solutions and we are more than happy to assist you.

Frequently Asked Questions (FAQs):

1. Why is KYC important for CBD payment processing?

KYC(Know Your Customer) is important because CBD is a highly regulated industry with strict compliance requirements. KYC helps banks to verify the legitimacy of the business, confirm product legality, and ensure that merchants are not selling restricted items like high-THC cannabis.

2. Why is underwriting stricter for CBD businesses compared to other industries?

CBD faces inconsistent state laws, FDA oversight, THC compliance limits, and product-safety concerns. Due to such risks, banks require deeper underwriting to verify the supply chain, ingredients, labeling, testing standards, and claims being made online. It ensures the merchant is fully compliant before receiving approval.