In today’s growing wellness and eCommerce environment, CBD businesses not just have extraordinary opportunities but also risk. While the demand for CBD products continues to rise, the regulatory and financial areas surrounding this industry remain complex and tightly monitored.

For many merchants, one of the most common and expensive challenges is getting their CBD merchant account shut down without warning. Such disruptions can instantly stop payment processing, freeze funds, damage customer trust, and ruin business operations.

A CBD merchant account is essential for processing credit card transactions and maintaining smooth online sales. However, because CBD is considered a high-risk industry, many payment processors and banks impose stricter rules, ongoing reviews, and compliance audits.

Even a minor oversight from mislabeled products or unclear refund policies to excessive chargebacks or incomplete documentation can cause account suspension or termination.

Avoiding a CBD payment processing shutdown is not just about compliance; rather it’s about proactive management, transparency, and risk reduction. Merchants who understand the expectations of processors and follow consistent operational standards can maintain stable, long-term relationships with financial institutions.

This guide explores how to prevent CBD merchant account closures by emphasizing compliance, trust, and responsible business practices. From understanding policies and maintaining accurate product descriptions to managing disputes and ensuring regulatory alignment you will learn how to protect your payment infrastructure and your brand reputation in a rapidly evolving market.

Also Read: Why CBD Business are Considered High-Risk

Why CBD merchant accounts get shut down

Processors shut down CBD merchant accounts when the business looks non-compliant or risky. Top reasons include illegal health claims, mislabeled products, missing COAs, and shipping into restricted areas.

Processors flag merchants for weak security like old plugins, non-PCI checkout, breaches and for risk signs such as high chargebacks, refund spikes, card testing, and unclear billing names.

If underwriting documents don’t match the storefront or ownership records, acquirers lose confidence and treat it as a red flag. If risk teams can’t confirm your controls, they will freeze payouts, impose rolling reserves, and may terminate your processing.

Also Read: Top 5 Challenges in CBD Payment Processing And How to Overcome it

Common Reasons of Merchant Account Shutdown:

1. Unlawful product claims or labeling:

Regulators and payment processors act quickly when merchants make disease or drug-like claims such as “treats anxiety”, “cures cancer”. The FDA has repeatedly warned CBD sellers over illegal claims and over adding CBD to foods or dietary supplements in interstate commerce.

2. Regulatory mismatch:

Selling food or beverage CBD products across state lines or stocking intoxicating hemp derivatives such as delta-8 or delta-10 in jurisdictions that restrict them, invites scrutiny from regulators and payment partners.

Regulators have actively tightened rules around intoxicating hemp products and sales are increasingly imposing patchwork restrictions.

3. High dispute or fraud ratios:

Excessive chargebacks indicate that your customers are unhappy and your fraud or operational controls are weak. When dispute rates exceed set thresholds, Visa and Mastercard can place merchants in monitoring programs with escalating fines that may end in account termination.

4. Security gaps:

Acquirers treat unsecured checkouts, outdated plugins, and missing PCI protection as serious risk indicators. PCI DSS v4.0.1 is the active standard, and the previously future-dated controls shifted from “best practice” to mandatory in 2025.

5. Incomplete underwriting file:

Processors expect clean KYC such as verified owners, current licenses, batch COAs, and a clearly defined shipping scope. If documents are missing or what you sell online does not match what you disclosed as risk teams can close the account.

Also Read: How to Choose the Right CBD Merchant Account

Know your Federal Baseline:

Begin with federal basics such as the 2018 Farm Bill legalized hemp which is less than 0.3% delta-9 THC but didn’t authorize CBD in foods or dietary supplements.

FDA still restricts ingestibles and any medical claims as FTC requires evidence. Because federal law doesn’t override state rules, shipping, labeling, and allowable products can differ sharply by state and change over time.

1. 2018 Farm Bill:

It removed “hemp” that is less than or equal to 0.3% delta-9 THC by dry weight from the Controlled Substances Act, enabling hemp-derived CBD commerce. However it did not authorize CBD in foods or dietary supplements nationwide, and it did not override stricter state regulations.

2. FDA and CBD today:

The FDA continues to restrict selling CBD as a dietary supplement or using it as a food additive in interstate commerce. The FDA is still issuing warning letters over improper disease claims and has urged Congress to create a dedicated regulatory pathway; until that happens, ingestible CBD and health-related claims carry elevated enforcement risk.

3. FTC advertising standards:

Health claims must be supported by competent, and reliable scientific evidence. Avoid making disease or drug claims; actively monitor affiliates and user-generated content, and keep a documented claims register with supporting studies for every claim.

Also Read: Why Traditional Banks Rejects CBD Merchants

Respect the state-by-state patchwork:

1. Build a living state matrix:

Maintain a state-by-state matrix covering allowed product types such as topical, ingestible, or intoxicating hemp, total THC thresholds, age-gating rules, warnings, required registrations or permits and label elements such as QR-to-COA, lot or batch ID, net weight, and per-saving cannabinoid content.

2. Make the site state-aware:

Make PDPs and checkout state-aware by displaying destination-specific

notices, auto-hide restricted SKUs/variants, require age confirmation where applicable, and surface COA links with all mandated disclosures.

3. Enforce at fulfillment:

Block restricted destinations, apply carrier rules, include compliant packaging or labeling and retain COA and permit records to satisfy audits and acquirer reviews.

4. Govern and audit:

Assign a compliance owner, review the matrix quarterly or whenever laws change. It is also essential to maintain a changelog with evidence links, and keep an underwriting packet like matrix, labels, COAs, and policies updated and ready for processor reviews and audits annually.

Also Read: Is CBD Legal in All 50 States

Decide what to sell:

1. Intoxicating hemp derivatives :

Regulations shift quickly and many states restrict or ban them. If you list these SKUs, expect stricter underwriting, higher reserves, volume caps, and stricter age-gaping.

Reduce risk with geofenced availability, state-specific PDP notices, adult-signature delivery, and proactive SKU suppression as regulations tighten.

2. Pet and animal ingestibles:

Because the FDA closely scrutinizes unapproved animal CBD products, keeps claims conservative, include clear disclaimers, and publish batch-specific COAs for every pet item.

FDA scrutiny remains high for unapproved animal products so if you sell them, use conservative claims, prominent disclaimers, and batch-matched COAs.

3. Ingestible CBD across state lines:

Because ingestible CBD remains risky under FDA policy, many brands prioritize topicals and limit ingestibles to permitted states. So it is essential to build a state matrix, auto-block ineligible destinations at checkout, and maintain a backup CBD-friendly processor.

Expect stricter terms like rolling reserves or caps or the need for a specialist high-risk acquirer.

Also Read: Is CBD Legal in all 50 States

Build an underwriting-ready documentation vault

1. Corporate & KYC:

Make sure you keep a single folder with entity docs, EIN, DBA, ownership chart, principal IDs, and a bank letter or voided check. Also make note of CDD or beneficial-owner verification to satisfy bank audits.

2. Licenses & product evidence:

Store state licenses or registrations and batch-level COAs in final product form which match label claims. Include label art with QR links to the COA where required.

3. Policies & marketing compliance:

Ensure you keep updated refund, shipping, age-gate, subscription, and privacy policies along with a detailed claims log, required disclaimers, and an approval record for all ads, emails, and landing pages.

4. Security attestations:

Store your latest PCI SAQ, quarterly ASV scan reports, WAF and bot-mitigation details, penetration-test summaries, patch or change logs, and verified evidence showing active AVS, CVV, and 3-D Secure controls that are in production.

Also Read: How to Get a CBD License

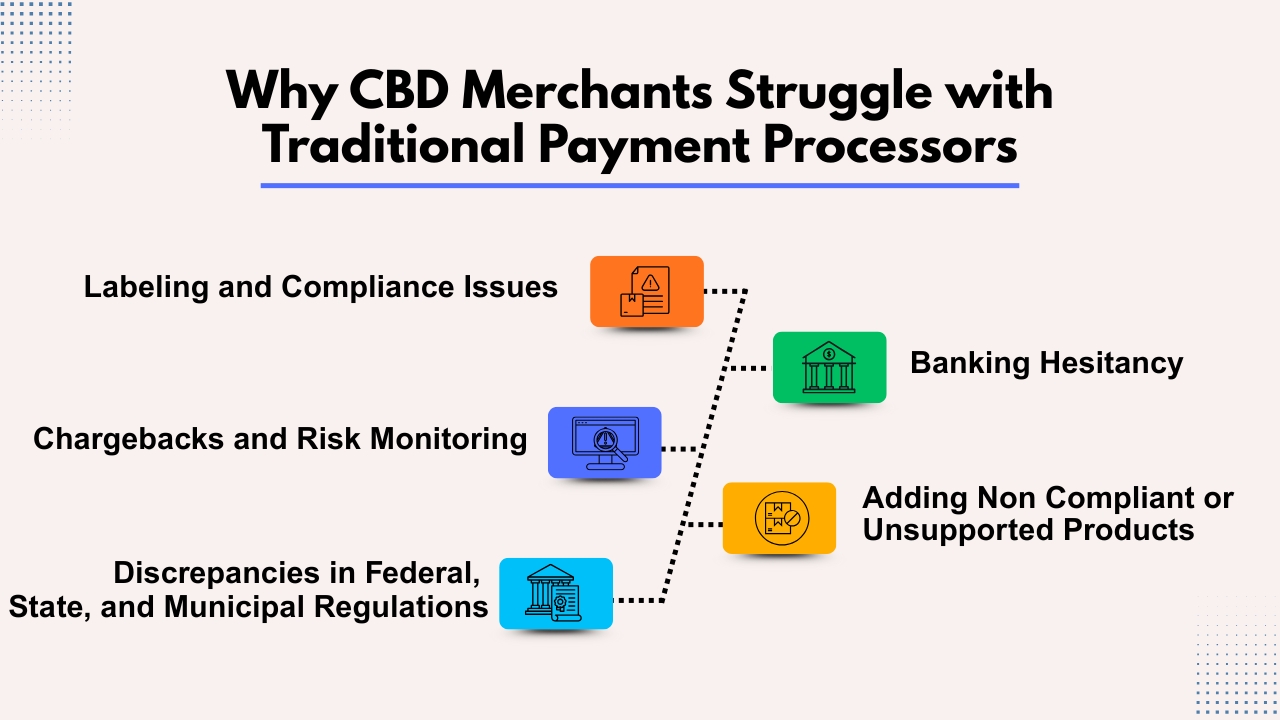

Why CBD Merchants Struggle with Traditional Payment Processors

Despite being federally legal under the 2018 Farm Bill, CBD remains one of the most misunderstood sectors in payment processing. Here is why:

1. Labeling and Compliance Issues:

Payment processors and their partnering banks operate with extreme caution prioritizing risk control over rapid expansion. If your product labels are unclear or confusing then make unapproved health claims, or don’t match what’s listed on your website, then regulators are most likely to flag your business.

Also Read: How to Start a CBD Dispensary in California

2. Banking Hesitancy:

Even today, many acquiring banks consider CBD the same as marijuana. Most banks either avoid these accounts entirely or approve them only through niche underwriting channels that mainstream processors rarely offer.

Though many CBD merchants receive initial approval from aggregator platforms, only to have their accounts abruptly shut down once the bank performs a detailed review or revises its risk guidelines.

Also Read: Which Bank Supports CBD Business

3. Chargebacks and Risk Monitoring:

Health and wellness merchants already experience above average chargebacks. Combine that with recurring subscriptions, shipping delays, and unclear refund terms, and processors see a high-risk profile.

Once your chargeback ratio exceeds usual thresholds which is above 1% for Visa and Mastercard then your MID can be penalized, placed in monitoring or even terminated.

And if you are on a shared MID or aggregator account then you may receive no advance warning before a sudden account shutdown, frozen payouts and an immediate disruption in your ability to accept payments.

Also Read: How to Avoid Frauds and Chargebacks in CBD Payment Processing

4. Adding Non Compliant or Unsupported Products:

Only because your account was approved does not give you the ability to add any “CBD” product on the market. Because of the popularity of Delta, Kratom, CBD Flower, and other related products many CBD merchants think they can add any product to their offerings.

But the fact is not all funding banks will support the sale of all CBD products. Because some may support CBD and Delta derivatives but not something like Kratom. While they may support CBD products extracted directly from the Hemp plant but no isolated derivatives.

CBD Merchant accounts are under continuous monitoring for website and product changes. Once a new product is added the site is automatically reviewed for compliance with the funding bank and federal standards. Make sure you work with the CBD payment processor actively when your business grows and wants to add new products.

Also Read: How Zero Fee Processing Works for CBD Businesses

5. Discrepancies in Federal, State, and Municipal Regulations:

Although CBD is federally legal, many states and even municipalities have created their own regulations around CBD and what is acceptable or even legal and what can be sold, labeled, advertised, and shipped.

And for banks funding such transactions requires a truly strong compliance program. And this compliance is not something most banks want to deal with so to fund such transactions, banks must validate SKUs, review packaging and claims, enforce age and geography restrictions and monitor chargebacks continually.

Also Read: What is CBD Merchant Account

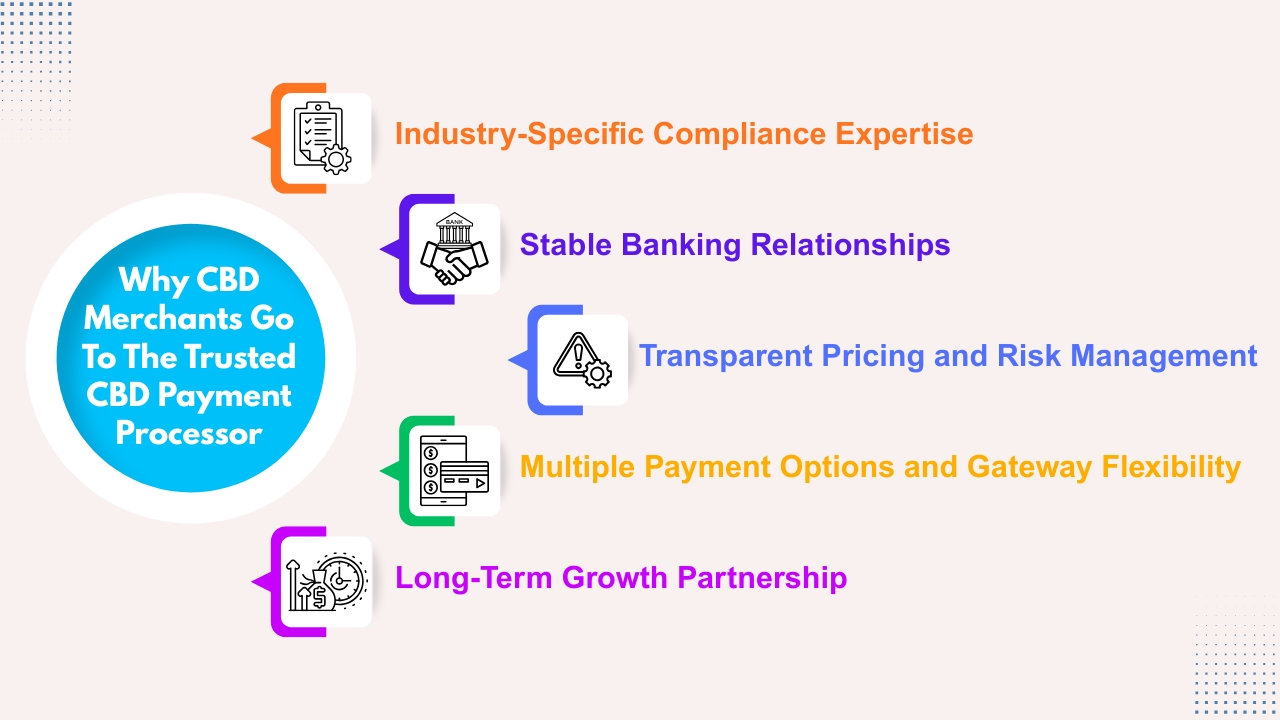

Why CBD Merchants Go To The Trusted CBD Payment Processor

Running a CBD business today requires more than a great product and strong branding rather it demands a payment partner which understands the complex regulatory and financial landscape of the CBD sector.

Though CBD is federally legal in the United States, it is still in a gray zone for many banks and card networks, causing rejected applications, frozen funds, and account closures.

This is why experienced CBD merchants prefer to work with a trusted CBD payment processor like CBD Merchant Solution, as they not only just handle transactions but also provide stability, compliance, and growth support.

Below are five key reasons why CBD businesses choose trusted, specialized processors over mainstream providers.

1. Industry-Specific Compliance Expertise:

CBD payment processors are experts at navigating the complex patchwork of state and local laws that determine what is permitted, restricted, or prohibited in the CBD industry.

They have deep knowledge of FDA labeling rules, age verification requirements, product classifications, and shipping restrictions in the areas where traditional banks often struggle.

Well, a trusted CBD processor incorporates compliance from the start, carefully reviewing each merchant’s website, product ingredients, and marketing claims to confirm they meet banking and card network policies.

Such proactive compliance reduces the risk of sudden shutdowns or frozen accounts, giving merchants peace of mind and uninterrupted payment flow.

Also Read: The CBD Industry Trends Challenges and Future Outlook

2. Stable Banking Relationships:

Many mainstream banks avoid CBD entirely or only after temporary access through aggregator platforms, which often end in abrupt account terminations.

However trusted CBD processors maintain direct relationships with underwriting banks who are comfortable with the industry. Such relationships are crucial because they create predictability.

Merchants benefit from dedicated MIDs, predictable processing limits, and dependable funding timelines. So instead of worrying about routine audit flags, CBD brands can focus on marketing, product expansion, and elevating customer experience confidently that their payments are secure.

Also Read: Which Banks Supports CBD Business

3. Transparent Pricing and Risk Management:

High-risk merchants often face marked-up fees and hidden charges. A reputable CBD payment processor provides clear, upfront pricing that include per transaction fees, chargeback thresholds, and rolling reserve.

It also helps merchants to actively manage chargeback ratios by providing fraud prevention tools, detailed reporting dashboards, and chargeback alerts.

As the CBD sector naturally faces higher dispute rates because of product misunderstandings or shipping delays, working with a processor that monitors risk in real time can save thousands in potential losses.

Also Read: What is a High-Risk Merchant Account

4. Multiple Payment Options and Gateway Flexibility:

Trusted CBD processors know that convenience of offering credit and debit cards, ACH transfers, digital wallets, and even subscription for regular customers increases conversions.

So it is essential for customers to integrate with major platforms such as Shopify, WooCommerce, and BigCommerce, to ensure smooth checkout experiences. Some processors even support international CBD transactions which provide them access to new markets and revenue streams along with ensuring compliance with cross-border laws.

Also Read: Comparing CBD Payment Gateways

5. Long-Term Growth Partnership:

A trusted CBD processor is a strategic partner, not just a service provider. They offer dedicated support, detailed analytics, and scalability tools to help merchants expand into new product lines or states.

So even if you are launching a new brand or growing a multi-state CBD business, having a processor who understands your growth creates a major difference. Such experience helps you adapt to changing rules, lower costs, and maintain the compliance foundation which is required to grow business sustainably.

Warning Signs of Account Instability and How to Protect Your Merchant Account

It is essential to maintain a stable payment processing relationship for any business especially in high-risk industries such as CBD, supplements, or e-commerce.

And if there is merchant account instability then it can cause withheld funds, frozen deposits, or even sudden account termination which can disrupt cash flow and damage customer trust.

Only by understanding the warning signs of instability and taking proactive measures that help merchants to protect their financial operations and also reputation. Below are some important areas that every business should monitor closely.

1. Inconsistent Business Information and Account Details:

One major warning sign for payment processors is when a business shows inconsistency in business details across its platforms and accounts.

In case if there is a mismatch between your legal business name, address, or tax information on your website, bank account, and merchant profile, then it raises suspicion.

When your legal business name, address, or tax information does not match between your website, bank account, and merchant profile, it raises suspicion.

Payment processors mostly depend on accurate data to ensure compliance and verify legitimacy. So even if there is minor mismatch as company names on your website than on your bank statement can lead to internal reviews or account freezes.

Similarly, sudden or unexplained rise in transaction volume may indicate instability, suggesting that the business may be taking on unsustainable growth or involved in risky sales behavior.

To avoid such issues, it is essential for business to maintain clear, consistent, and verified information across all channels or platforms. Make sure that your payment processors always have updated contact information, ownership details, and website links.

Whenever your business grows or rebrands, ensure you proactively communicate the change before making it public. Being consistent builds trust and reduces the chances of unnecessary account scrutiny.

Also Read: Why Every CBD Business Needs a Customized POS System

2. High Chargeback Ratios and Declined Transactions:

One of the other major causes of account instability is a high chargeback rate as it indicates customer dissatisfaction or operational inefficiency. When there are too many customer chargeback rates, then processors may suggest it as unreliable or non-transparent.

If the chargeback ratio exceeds more than 1% may lead to fines, higher fees, or even account termination. And if there are frequent declined transactions then it may suggest technical issues, insufficient funds, or even fraud attempts.

So, ensure you provide accurate product descriptions, transparent refund policies, and responsive customer service. It is also essential to implement transaction monitoring to detect and resolve issues early.

Offering real-time order tracking, confirmation emails, and easy cancellation options that can reduce disputes and build customer confidence.

Additionally monitor your chargeback data regularly and identify recurring issues. If certain products or campaigns create more disputes, reevaluate their marketing claims or fulfillment process. A proactive approach can prevent your account from being flagged by processors or card networks.

Also Read: How to Avoid Frauds and ChargeBack in CBD Payment Processing

3. Fraudulent Activities and Security Vulnerabilities:

Fraud is one of the most serious challenges to merchant account stability. Whenever there are suspicious patterns like unusually large orders, repeat transactions from the same IP address, or inconsistent billing and shipping information can indicate potential fraud.

While misleading advertising and unethical sales tactics are equally harmful as they ruin both regulatory compliance and customer trust. Cybercriminals also exploit weak security systems, targeting businesses with outdated software or unsecured checkout pages.

After a breach, merchants not only face chargebacks and revenue loss but also regulatory penalties for non-compliance with PCI DSS and other data protection requirements.

To safeguard against such risks, businesses must adopt strong fraud prevention strategies. Use secure payment gateways with in-built fraud filters, enable two-factor authentication, and regularly update systems and keep all systems patched to close known vulnerabilities.

Also maintaining ethical marketing practices is equally important. Avoid exaggerated product claims, misleading promotions, or hidden fees. While ethical, transparent operations not just protect your account but also develop long-term customer trust and brand credibility.

Also Read: Secure Payment Processing for CBD Ecommerce

Choose the right payment architecture:

1. Work only with verified CBD-friendly processors:

Select acquirers and gateways that explicitly allow hemp-derived CBD and understand regulations of each state. Get written confirmation covering all current and upcoming products to prevent sudden account closures or account freezes.

Also Read: Why do CBD Business Struggle With Payment Processing and How to Fix it

2. Maintain a backup MID:

Keep a second CBD-approved merchant account for continuity during audits, volume increases, or processor transitions. Allocate transaction volume clearly between accounts to stay compliant with acquirer policies.

Also Read: The Best Marijuana Marketing Strategies

3. Strengthen fraud prevention:

Enable 3-D Secure (SCA) for risky transactions, international cards, or recurring billing to reduce liability and disputes. Combine with AVS/CVV verification and velocity checks for layered protection.

4. Use transparent descriptors:

Use a clear “doing business as” name and an easily recognizable support URL on every customer statement to avoid “unrecognized charge” disputes, reduce chargebacks, and reinforce brand credibility and customer trust after each transaction.

Also Read: How to Create Google Business Profile for CBD Business

Advertising, claims, and UGC:

1. No drug claims:

Any explicit or implied disease or treatment language causes FDA or FTC action. Emphasize non-medical benefits and avoid any language suggesting your product diagnoses, cure, or prevents disease.

Also Read: Innovative Cannabis Marketing Tips

2. Substantiate rigorously:

Substantiate every health-related claim with competent, dependable human evidence aligned to your product, dosage, route, and target audience. Keep audit-ready study documentation, and do not generalize rodent or in-vitro findings to humans unless supported by rigorous, peer-reviewed, clinical support, and documented protocols.

Also Read: How to Advertise Your CBD Business in Best Possible Manner

3. Disclaim and police the ecosystem:

Place required disclaimers prominently and pre-approve influence scripts. Moderate UGC and review your repost. Remove violative content fast via a takedown SLA and documented enforcement log.

Also Read: How Much Money is Needed to Start a CBD Business

4. Document and audit:

Keep a claims inventory such as claim, placements, evidence link, owner, and approval date. Reaudit quarterly or on SKU or campaign changes and also train staff and send any ambiguous claims to legal counsel for review before publishing.

Also Read: How to Get a CBD License

Shipments and fulfillment rules you must respect:

1. Carrier rules & records:

USPS allows domestic hemp or CBD with less than or equal to 0.3% delta-9 THC and under Pub 52; no international or military addresses. UPS permits compliant shipments with added restrictions.

Keep per-shipment records such as COAs, licenses, product specifications, and destination eligibility for at least two years or your carrier’s retention period.

2. Packaging, labeling, delivery:

Always use discreet, tamper-evident packaging with truthful labels, and for allowed B2B cross-border shipments complete customs paperwork exactly and never misdeclare the contents.

Add adult-signature where required, and retain tracking, delivery confirmation, and photo evidence to satisfy audits and defend “item not received” disputes.

3. State-aware checkout & fulfillment:

Integrate state-specific age limits, product restrictions, and labeling requirements directly into PDPs and checkout flows. Auto-block restricted SKUs or destinations, display state-specific notices, surface batch COA links, enforce address validation, and run a pre-shipment compliance check before generating labels to prevent avoidable carrier or processor issues.

Compliance Checklist:

1. Entity & banking:

Align Articles/EIN/DBA with your site’s branding. Maintain an ownership chart and IDs for principals, noting beneficial-owner verification under the CDD Rule. Keep bank letters or voided checks handy for underwriting.

2. Product & labeling:

Maintain batch-specific COAs in final product form that match label potency or ingredients. Whenever required, include a scannable QR or link to the batch COA, and lot or batch, net contents, and per-serving cannabinoids. Avoid making any statements which implies that your product can diagnose, treat, or prevent disease.

3. Website essentials:

Ensure you include visible links to your Terms clearly, Privacy, Refund, Shipping, and Contact pages in the website footer. Show per-serving content, net quantity, batch details, and a COA QR code on each PDP, and apply age verification and destination-based shipping restrictions at checkout.

4. Payments & security:

Get a CBD-approved processor in writing and keep a backup MID. Keep PCI compliance up to date with current SAQs and quarterly scans, enforce HTTPS/HSTS, use WAF and bot protection, and activate AVS, CVV, optional 3DS, and velocity or country-based controls.

5. Marketing & shipping:

Keep a claims inventory with supporting evidence and FTC-compliant disclosures; moderate affiliates or UGC. Comply with USPS and UPS hemp shipping policies, keep shipment records such as COAs and licenses on file, and avoid sending direct-to-consumer international orders through USPS.

Conclusion:

Keeping your CBD merchant account active is not just about processing payments rather it’s about proving you run a compliant, transparent, and well-controlled business.

Processors and regulators look for clear documentation, accurate labeling, and secure operations. So if your website, policies, or records increase uncertainty, your account can be flagged as high-risk.

To avoid that, make sure that you focus on fundamentals like operating within the law, maintain updated COAs, and product labels, and never make unverified health claims.

Stay PCI-compliant, monitor chargebacks, and use CBD-approved processors that understand your business model. Enforce age gates, follow carrier rules, and keep audit-ready documentation such as licenses, COAs, KYC files and security records organized and up to date.

Train staff to recognize compliance red flags and escalate issues early. A proactive build credibility with acquirers and reduce costly interruptions. In a market as tightly regulated as CBD, trust and traceability are everything.

When you treat compliance as a daily discipline not a one-time checklist so you protect your brand, preserve banking relationships, and ensure steady cash flow. Your best strategy for stability is simple, which is to stay transparent, stay current, and stay ready to prove it.

Frequently Asked Questions (FAQs):

1. How can I prevent chargebacks?

Make sure you use clear product descriptions, transparent refund policies, and recognizable billing descriptors. Also provide excellent customer support, use AVS or CVV verification, and enable 3D Secure for high-risk orders.

2. What documents should I keep for compliance?

Maintain COAs for each batch, business licenses, KYC documents, shipping records, refund and privacy policies, and up-to-date PCI scans or SAQs. These are often reviewed by acquirers during audits.