Introduction:

In the quickly expanding CBD market, one of the most challenges merchants face is not product quality or demand rather it’s managing CBD chargebacks. When a customer challenges a transaction through their bank, then the payment is reversed and the merchant’s account is debited, then this is a chargeback.

Although chargebacks affect many industries, it is particularly common and damaging in the CBD sector due to its classification as high-risk by financial institutions. CBD businesses are often under stricter scrutiny from banks and payment processors, given the industry’s evolving legal framework and widespread misconceptions about hemp-derived products.

Beyond financial loss, chargebacks can also threaten reputation and long-term sustainability which will impact its long-term growth. It can cause fines, higher processing fees, or even placement on monitoring lists like Visa’s Chargeback Monitoring Program.

A large number of CBD merchant accounts experience chargebacks because of improper labeling , overstated product claims, shipping delays, or customer misunderstanding about CBD’s legal status.

So, in order to achieve success in the CBD sector, it is essential for merchants to not just understand how chargebacks occur but also take effective steps to prevent them and reduce chargebacks in CBD. That is where CBD Merchant Solution comes into the picture. Every factor like clear communication, regulatory compliance, strong fraud prevention and fair refund practices which is important to maintain a strong CBD chargeback prevention strategy.

Through this blog we will walk you through the main causes of chargebacks in the CBD industry, discuss proven prevention strategies, and share best practices to help merchants protect revenue, maintain processor trust, and develop lasting customer trust. Whether you are an emerging CBD or an established merchant, effective chargeback management is essential for protecting revenue and sustain long-term business growth.

Also Read: How to Avoid Fraud and Chargebacks in CBD Industry

What Are Chargebacks?

A chargeback occurs when a cardholder or their bank reserves a completed transaction, returning the funds to the customer’s account. Usually, chargebacks are used as a consumer protection mechanism when there is a dispute or fraud related to a credit or debit card transaction usually claiming that the transaction was unauthorized, incorrect, or unsatisfactory.

So, when a chargeback occurs then the funds that we initially transferred from the cardholder’s account to the business’s account are returned to the cardholder. Chargebacks happens due to many reasons because of which a cardholder might initiate a chargeback, including:

1. Unauthorized transactions:

Whenever a cardholder notices a transaction on their account that they did not authorize or nor do they recognize, then they can request a chargeback to challenge and reverse the transaction.

Also Read: Secure Payment Processing for CBD Ecommerce

2. Fraudulent Activity:

Chargebacks usually occur when someone uses a customer’s card without consent, and the bank reverses the payment, taking the funds back from the merchant’s account.

Also Read: Top 5 Challenges in CBD Payment Processing and How to Overcomer it

3. Dissatisfaction with Goods or Services:

When customers are not happy with the quality, description, or performance of a product or service they ordered, then they may file a chargeback with their bank to recover the amount paid for the purchase.

Also Read: Selling CBD Products Online

4. Non-delivery of Goods or Services:

If a cardholder pays for a product or service that is never delivered or fails to meet expectation, then they might request a chargeback to reclaim their funds.

Chargebacks can adversely impact finances and credibility of a business. Along with returning the disputed amount to the customer, merchants often face additional fees, penalties, and administrative costs. If there are frequent chargebacks can damage a company’s reputation, prompt closer monitoring by banks and payment processors, and result in higher processing rates and impact long-term operational stability.

Also Read: Best Ecommerce Platform for CBD

Types of Chargebacks:

1. Merchant Error Chargebacks:

Such chargebacks occur when a business makes a mistake during the payment or order process, causing a customer to challenge the transaction. Such chargebacks often result from human mistakes, operational oversights, or technical issues that can cause inaccurate billing or unauthorized oversights.

Since the error occurs from the merchant’s side, the business is held responsible for resolving the issues and reimbursing the customer. Reducing such chargebacks is essential for maintaining customer trust and avoiding unnecessary financial losses.

Common merchant errors include duplicate charges, where a customer is billed multiple times for the same transaction, or incorrect amounts, if there is a typo or pricing mistake that results in overcharging.

Another frequent cause is non-compliance with card network rules like failing to obtain proper authorization, missing refund deadlines, or breaching network policies set by Visa, Mastercard, or American Express.

Such mistakes not just lead to chargebacks but can also attract fines and increased scrutiny from payment processors. To reduce chargebacks caused by merchant errors, businesses should adopt clear policies, maintain strict internal checks, and use reliable management systems for greater accuracy and transparency.

Also Read: What is High Rich Merchant Account Why CBD Needs One

2. Chargeback fraud:

Chargeback fraud happens when criminals gain unauthorized access to a cardholder’s account and make purchases without their permission, leaving the valid cardholder to face the consequences.

Such type of fraud usually happens due to stolen credit card information, phishing attacks, or data breaches because of which sensitive financial details are compromised.

Once such unauthorized transactions are found, then the cardholder can file a chargeback to recover the stolen funds.

Financial institutions and businesses can help avoid such fraud by implementing strict authentication processes, using encrypted payment systems and educating customers about online safety in order to protect their personal and financial

Also Read: Understanding CBD Payment Terms

3. Friendly Fraud:

Friendly fraud happens when valid customers challenge valid transactions because of misunderstanding, dissatisfaction, or intentional misuse of the chargeback system.

Unlike traditional fraud, that involves stolen payment details, friendly fraud comes directly from the real buyer, due to which it is difficult for merchants to prove the validity of the transaction.

Common scenarios include buyer’s regret , where customers regret a purchase and falsely claim it was unauthorized instead of seeking a refund through proper channels.

This type of fraud not just causes financial loss but also damages the merchant’s reputation and relationship with payment processors showing the need for clear policies and strong transaction documentation.

Also Read: How to Protect Your CBD Business From Payment Processor Shutdowns

How Chargebacks Work

1. Purchase:

The process begins when a customer buys a product or service online or in-store using a credit or debit card. The transaction is processed through the merchant’s payment gateway and recorded by the issuing bank.

Also Read: How Much Does it Cost to Open a CBD Dispensary

2. Dispute Filed:

If the customer believes that the charge is fraudulent, incorrect, or unsatisfactory, then they contact their issuing bank to file a dispute, officially initiating the chargeback process.

Also Read: How to Get a CBD License

3. Investigation:

The issuing bank reviews the transaction details and requests evidence like receipts, delivery proof, or communication logs from the merchant’s payment processor.

Also Read: How to Create an Effective CBD Business Plan

4. Decision:

After reviewing the evidence, the bank decides whether the claim is valid.

If the claim is accepted, the cardholders get their money back and if it’s declined, then the payment is credited back to the merchant.

Also Read: Comparing CBD Payment Gateways

5. Fees & Consequences:

Each chargeback includes fees like $20 – $100 per case which may damage the merchant’s reputation, increase processing costs and stricter investigation from payment networks.

In the CBD industry, even valid customer disputes can turn into chargebacks if merchants fail to provide prompt refunds, clear receipts, or reliable proof of delivery.

Also Read: How Zero Processing Fee Works for CBD Business

Why CBD Merchants Face Higher Chargeback Rates

The CBD industry is widely categorized as high-risk by banks and payment processors because of regulatory uncertainty, inconsistent state laws, and frequent chargebacks.

The CBD industry is widely classified as high-risk by banks and payment processors due to regulatory uncertainty, inconsistent state laws, and frequent chargebacks.

Due to these factors, financial institutions have to be cautious as CBD businesses have higher risk and are more vulnerable to fraud, refund disputes, and compliance challenges than usual merchants. CBD Merchant Solution provide tools to manage disputes, track transactions, and maintain compliance with card network rule

1. Regulatory Gray Area:

CBD laws differ by state and change constantly. Mislabeling or unclear THC content can lead to consumer mistrust and refund requests.

Also Read: How to Expand Your CBD Business to a New Market

2. Limited Processor Options:

High-risk merchants usually depend on smaller, offshore, or specialized processors that charge higher transaction fees, impose stricter compliance standards, and higher fees.

Also Read: Why Traditional Bank Rejects CBD Merchant

3. Consumer Misunderstanding:

Many customers mistake hemp-derived CBD for marijuana products containing THC, which often results in canceled orders or false “unauthorized transaction” disputes.

Also Read: How to Market Cannabis

4. Shipping Delays & Product Quality Issues:

As CBD products require third-party lab testing and specialized shipping, delivery delays and errors are common, increasing the chances of customer complaints and higher chargebacks.

Also Read: Best Website Builders for CBD Business

5. Recurring Subscription Problems:

Recurring billing and auto-ship programs often cause disputes when customers forget about their subscription, miss renewal reminders, or face cancellation difficulties which causes surprise charges and chargeback claims.

Also Read: Why Ever CBD Business Needs a Customized POS System

6. Bank Bias:

Some banks continue to flag or reject CBD-related transactions automatically which causes unnecessary payment failures, frustrated customers and increased chances of post CBD transaction disputes and chargebacks for valid merchants.

As a result, CBD merchants must maintain stricter operational and documentation standards to keep chargebacks below acceptable thresholds(usually under 1%).

Also Read: How to Open a CBD Business Bank Account

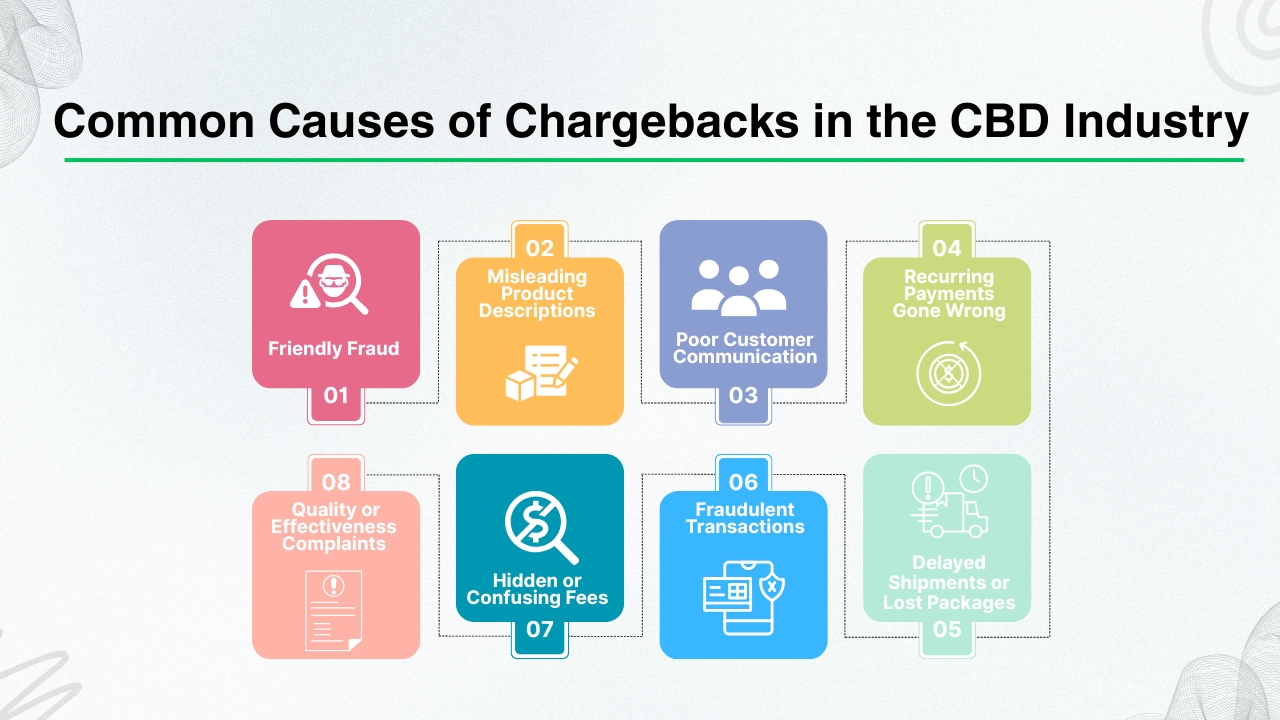

Common Causes of Chargebacks in the CBD Industry

Chargebacks are a regular challenge for CBD merchants because of strict regulations, payment restrictions, and ongoing consumer misunderstandings about the legality and nature of CBD products. Understanding the common causes helps businesses to actively reduce disputes and protect revenue.

Below are the eight factors behind chargebacks in the CBD sector.

1. Friendly Fraud:

Friendly fraud happens when a valid customer challenges a real transaction due to confusion, regret, or forgetfulness. Some customers might fail to recognize the billing name on their statement, mistakenly believe the charge is unauthorized, or simply change their mind about keeping the product. Such type of fraud is mostly seen in e-commerce CBD sales where customers purchase impulsively and then reconsider.

Also Read: How to Expand Your CBD Business to New Market

2. Misleading Product Descriptions:

If product descriptions, dosage descriptions, or health claims are unclear, exaggerated, or unclear, customers may feel they have been misled and file a chargeback.

As benefits of CBD vary for each individual, overstating results or failing to disclose ingredients can cause dissatisfaction and disputes.

Merchants should ensure transparent labeling, avoid unverified health claims, and maintain consistency between marketing materials and actual products.

Also Read: How to Advertise Your CBD Brand in Best Possible Manner

3. Poor Customer Communication:

When customers struggle to receive support or receive unclear responses about refunds, then they tend to skip the merchant and contact their bank directly. Such lack of communication often leads to unnecessary chargebacks.

Having an easy to understand return policy, quick customer support, and clearly displayed contact details can help resolve issues early and prevent chargebacks from rising.

Also Read: How to Create Google Business Profile for CBD Business

4. Recurring Payments Gone Wrong:

Subscription and auto-ship plans are commonly used for CBD items like oils, gummies, and wellness supplements. However, if customers forget they subscribed, fail to receive renewal notices, or find it difficult to cancel, then they may dispute the charge as unauthorized.

It’s essential to offer transparent opt-in consent and simple cancellation procedures to avoid misunderstandings and disputes.

Also Read: How to Setup Online CBD Payment in less than 24 Hours

5. Delayed Shipments or Lost Packages:

Due to compliance checks, third-party lab testing, or carrier restrictions, CBD shipments often take longer to arrive. If tracking updates stop or delivery is delayed, then customers may assume fraud and initiate a chargeback. By offering proactive tracking updates and realistic delivery timelines helps to prevent this.

Also Read: Why CBD Business are Considered High-Risk

6. Fraudulent Transactions:

CBD websites are often targeted by fraudsters using stolen cards or false identities, especially when selling high-value bundles. So when the right cardholder notices unauthorized charges, then they initiate a chargeback. Merchants should use fraud prevention tools such as address verification(AVS), CVV checks, and 3D Secure authentication.

Also Read: How to Advertise CBD Business on Instagram

7. Hidden or Confusing Fees:

If taxes, shipping costs, or surcharges are not clearly disclosed during checkout, then customers may feel deceived and dispute the transaction. Transparent pricing and itemized receipts reduce this risk.

Also Read: How Fast Payouts Can improve Your CBD Business Cash Flow

8. Quality or Effectiveness Complaints:

As CBD affects each person differently, customers may sometimes feel disappointed if results don’t match their expectation which lead to disputes like the “product didn’t work”. Setting realistic expectations through clear education and honest marketing helps to prevent such claims.

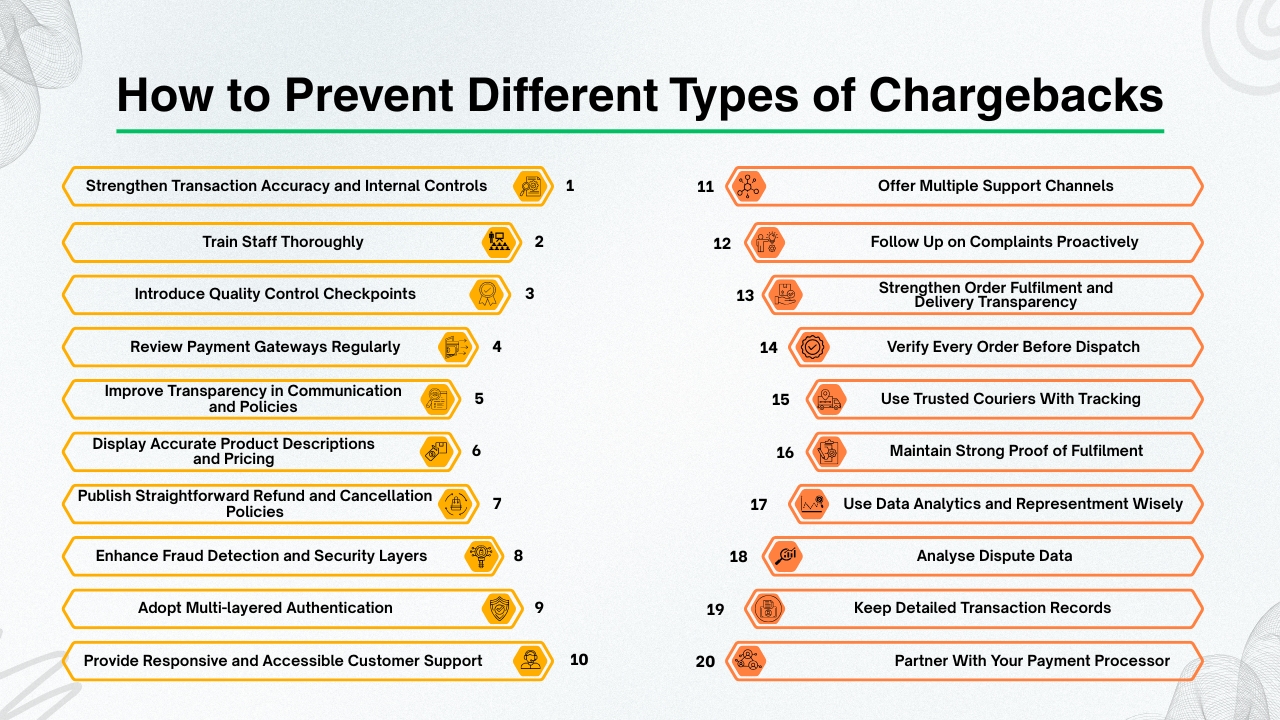

How to Prevent Different Types of Chargebacks

Chargebacks are a costly and time-consuming challenge for merchants. Whether chargebacks are caused by genuine errors, fraud, or customer misunderstandings, then they disrupt cash flow and damage reputation.

Although it’s impossible to remove chargebacks entirely, merchants can severely reduce their frequency by combining process accuracy, fraud prevention, and clear communication.

Below are different practical strategies to avoid different types of chargebacks effectively.

1. Strengthen Transaction Accuracy and Internal Controls:

Many chargebacks occur from avoidable and simple business errors like incorrect billing, duplicate transactions, or delays in payment processing. While to prevent such chargebacks requires strong internal systems and attention to detail.

2. Train staff thoroughly:

Train your staff property on payment procedures, authorization protocols, and refund workflows. Staff must be well-trained to verify card information correctly, find inconsistencies, and make sure that every payment is authorized before processing.

Also Read: Guide to Start a CBD Business

3. Introduce Quality Control Checkpoints:

Before finalizing orders, implement quality control checkpoints, especially for high-value or customized products to verify accuracy, find potential errors early and maintain smooth, reliable CBD transaction processing.

Regular periodic audits of your POS and e-commerce systems can show recurring issues like duplicate charges, incorrect tax applications.

4. Review payment gateways regularly:

Regularly track payment gateways to ensure operations are smooth, and quickly issues like duplicate payments, failed refunds, and secure your cash flow and gain customer trust.

Also Read: The Best Marijuana Marketing Strategies

5. Improve Transparency in Communication and Policies:

Customer misunderstanding is one of the main causes for chargebacks. With clear and transparent communication regarding pricing, policies, and product details helps to set the right expectations and avoid disagreements which cause chargebacks.

6. Display accurate product descriptions and pricing:

Providing accurate product descriptions and transparent pricing helps customers clearly understand what they are buying. Avoid hidden fees or unclear shipping charges which is crucial to prevent confusion, frustration, and potential chargebacks.

7. Publish straightforward refund and cancellation policies:

Make your refund and cancellation policies clear, simple, and easy to access.

Clearly explain who can return procedures to ensure transparency, reduce confusion, and prevent disputes which may result in chargebacks.

8. Enhance Fraud Detection and Security Layers:

Improve fraud detection and security measures to avoid true chargeback fraud, where stolen or unauthorized cards are used. Use proactive monitoring, verification, and authentication measures to identify risks and protect CBD transactions.

Also Read: How to Start a CBD Oil Business

9. Adopt multi-layered authentication:

Implement multi-layered authentication methods such as CVV verification, Address Verification Service(AVS), and two-factor authentication(2FA) to strengthen transaction security and reduce the risk of fraud or unauthorized card use.

10. Provide Responsive and Accessible Customer Support:

Ensure customer support is fast and accessible, because slow or poor communication drives customers to avoid merchants and file chargebacks, creating preventable disputes, lost revenue, and damaged relationships and reputations.

11. Offer multiple support channels:

Offer multiple support channels like live chat, phone, and email, and respond promptly during business hours to resolve issues quickly, preventing frustration from turning into disputes or chargebacks.

12. Follow up on complaints proactively:

Proactively follow up on customer complaints to show attentiveness and care. When customers feel supported and valued, then they are far less likely to contact their bank or initiate chargebacks.

13. Strengthen Order Fulfilment and Delivery Transparency:

Improve order fulfilment and delivery transparency is crucial, as delays or shipping errors often result in customer dissatisfaction and avoidable chargebacks. Ensure accurate processing, reliable shipping, and timely tracking updates to reduce disputes, maintain transparency, and build lasting customer trust and satisfaction.

Also Read: CBD Business Ideas to Start

14. Verify Every Order Before Dispatch:

Carefully review all orders to ensure accurate products, quantities, and secure packaging. Thoroughly reviewing each order helps to remove errors and prevents customer complaints due to wrong, missing, or incomplete items.

15. Use Trusted Couriers with Tracking:

Partner with dependable delivery services that offer real-time tracking and confirmations to ensure transparency and a smooth, trustworthy customer experience. Providing customers with tracking details helps to build confidence and transparency throughout the shipping process.

16. Maintain Strong Proof of Fulfilment:

Keep signed delivery receipts, timestamps, or electronic confirmations as evidence of completed deliveries. Clear documentation helps to resolve false “non-delivery” claims, reduces chargebacks, and strengthens overall customer satisfaction and trust.

Efficient logistics and documentation not only prevent chargebacks but also improve overall customer satisfaction.

Also Read: How Much Average CBD Store Make

17. Use Data Analytics and Representment Wisely:

Even with strongest preventive measures chargebacks may still occur. The key is to respond strategically.

18. Analyse Dispute Data:

Even with strong prevention measures, chargebacks can still happen. Use analytics tools to analyze recurring product issues, high-risk regions, or repeat claimants.

Identifying such trends helps businesses to improve internal policies, strengthen fraud filters, and proactively find many causes of chargebacks.

19. Keep Detailed Transaction Records:

Keep accurate and detailed records for every transaction, including receipts, invoices, emails, delivery confirmations, and refund logs. Such documents serve as critical evidence allowing you to challenge invalid or fraud chargebacks effectively.

20. Partner with Your Payment Processor:

Partner with your payment processor to automate chargeback alerts, track dispute timelines, and smooth documentation submission. Some processors like Stripe, offer built-in chargeback protection which automatically covers eligible disputes, reducing revenue loss and ensuring smoother, faster resolution of chargeback cases.

The Financial Impact of Chargebacks

Chargebacks have both direct and indirect costs. While merchants lose revenue directly due to shipping costs, and product value. High chargeback ratios can indirectly harm your reputation with the payment process, leading to stricter oversight, higher fees, or even suspension of your merchant account.

1. Direct Financial Losses:

Every chargeback results in immediate revenue loss as the transaction amount is reversed. Merchants also lose the value of shipped goods, packaging, and delivery costs.

Additionally processors charge non-refundable chargeback fees for each dispute further reducing profit margins. Every chargeback results in immediate revenue loss, as the transaction amount is reversed.

Merchants also lose the value of shipped goods, packaging, and associated delivery costs. Additionally, processors charge non-refundable chargeback fees for each dispute, further reducing profit margins.

2. Hidden and Indirect Consequences:

In addition to direct costs, high chargebacks can increase processing fees, cause frozen funds or rolling reserves, and limit a business’s cash flow. Merchants with regular high chargeback ratios cause account termination and being listed on industry databases like the MATCH list, which makes it difficult to secure future processing accounts.

3. Heightened Risk for CBD Businesses:

In high-risk sectors like CBD, processors closely monitor chargeback activity. It is essential to maintain a chargeback ratio below 1%. While exceeding that limit can cause fines, higher reserves, or complete account termination which impact stability and reputation of the business.

Building a Chargeback-Resistant CBD Business

To build a sustainable CBD brand, merchants must combine operational discipline with data-driven prevention tools.

1. Documentation Is Everything:

Keep detailed records of every transaction such as order confirmations, invoices, COAs, shipping logs, and communication history. So that in case of disputes, strong documentation can help to challenge and reverse invalid or unjustified chargebacks effectively.

2. Use Transparent Payment Gateways:

Partner with gateways who are experienced in high-risk industries. They offer tools for dispute management, early alerts, and fraud monitoring customized to CBD merchants.

3. Maintain Good Standing with Your Processor:

Excessive chargeback ratios can cause payment processors to impose reserve holds or conduct detailed reviews of your merchant account. Maintain regular and open communication with your payment processor to resolve issues early before they turn into serious account problems.

4. Monitor Metrics Regularly:

Create dashboards to monitor chargeback ratios, refund rates, and dispute reasons. Clear data insights help to identify potential issues early allowing to take corrective actions before it turns into recurring issues.

How to Respond to Chargebacks

Even the most diligent CBD business will face chargebacks occasionally. The key is handling them efficiently.

1. Gather Evidence Promptly

Submit proof of transaction, delivery confirmation, product photos, refund policies, and communication with the customer.

2. Respond Within Deadlines

Most issuing banks provide a 7-14 day window to respond to chargeback notices, and failing to meet such deadline results in an automatic loss.

3. Use Professional Language

Remain objective and professional when presenting representment evidence. Avoid emotional reactions and focus solely on verified facts, supporting documents.

4. Work with Your Processor

Most high-risk processors have dedicated chargeback departments and they use their expertise to strengthen your evidence.

5. Learn from Every Case

Consider every chargeback as a learning opportunity to identify and fix weaknesses in your operations, identifying patterns to strengthen prevention strategies and reduce future disputes and financial losses.

Conclusion

Chargebacks are an unavoidable part of the CBD industry but with the right strategies, they don’t have to disrupt your operations or harm your business growth. It is only by understanding the main causes, following compliance protocols, and using modern prevention tools, lets merchants maintain chargebacks ratios well below the 1% threshold.

Some of the strongest tools for preventing disputes are transparency, documentation, and proactive communication. It helps to maintain trust with both customers and payment partners.

So it is essential to work with experienced high-risk processors who understand CBD compliance, invest in fraud detection, and educate your customers at every point.

In a highly regulated and trust-driven industry like CBD, preventing chargebacks is not about protecting finances; rather it’s important to ensure long-term business stability and maintaining credibility with customers and payment partners.

A strong chargeback prevention strategy shows your professionalism, regulatory compliance, and dedication to providing customers with a secure and reliable shopping experience.

So focusing on transparent communication, accurate labeling, secure payment processes, and responsive customer support, CBD merchants can effectively reduce disputes and strengthen customer trust.

Proactive chargeback management not just protects revenue but also strengthens relationships with both processors and consumers. Having the right systems in place, CBD businesses can operate more securely, maintain compliance, and scale confidently in an increasingly competitive and closely monitored marketplace.

Frequently Asked Questions (FAQs)

1. What happens if my chargeback ratio exceeds 1%?

When a chargeback ratio exceeds above 1% then it can cause processor penalties, rolling reserves or account termination. So it is essential to stay below this threshold to maintain stability and reputation of payment processing.

2. Why is proactive communication so important in chargeback prevention?

Proactive communication helps resolve issues before they escalate. When customers feel heard, informed, and supported, they’re less likely to file chargebacks and more likely to stay loyal to your brand.