Introduction:

The CBD industry has experienced rapid growth in recent years, with entrepreneurs launching online stores, dispensaries, and wellness brands across the country. However one of the biggest challenges faced by CBD businesses is payment processing.

Because CBD is categorized as a high-risk industry, most traditional banks and mainstream processors such as PayPal, Stripe, or Square either refuse CBD transactions or charge high rates in order to compensate for the added risk. Due to which merchants keep struggling with high fees, unstable accounts, and limited access to dependable payment gateways.

To solve such problems, many business owners are turning to zero-fee credit card processing for CBD businesses. Under this model, merchants avoid processing costs by transferring them to customers through a small, clearly disclosed surcharge or managed through a cash discount program. The result is that merchants can accept card payments without paying transaction fees, significantly improving profit margins and cash flow.

For CBD merchants, this approach can make a major difference by reducing overhead costs. It ensures consistent revenue and allows more flexibility in pricing and promotions. However, implementing zero-fee processing requires strict compliance with card network rules like Visa, MasterCard and state regulations regarding surcharges and disclosures.

In this comprehensive guide, we will explain how zero-fee processing works for CBD businesses, outline its benefits and potential drawbacks, and offer best practices for finding the right CBD-friendly payment processor like CBD Merchant Solution. Whether you operate a physical CBD store or an online e-commerce platform, understanding this payment model can help to maximize profits, maintain compliance, and strengthen financial stability in an evolving market.

What “Zero-Fee Processing” Really Means

The term “Zero-fee processing” appears to offer an ideal way for CBD merchants who are tired of paying high credit card processing fees. Many payment companies advertise this model as a way for merchants to avoid monthly or per-transaction fees altogether. However, in reality, zero-fee processing does eliminate costs rather it shifts them from the merchant to the customer or hides them within other parts of the transaction. Though this model can reduce direct expenses for CBD merchants, it comes with important rules, compliance requirements, and potential trade-offs.

Below is how “zero-fee” processing usually works in three main forms:

1. Surcharging or Customer Fee Model:

In this setup, the payment processor adds a small “service fee” or “credit card processing fee” to the customer’s bill at checkout. The merchant will receive the full sale amount before the fee, and the processor takes its revenue from the added surcharge. For instance, if there is a CBD order for $100 then there might be a 3% service fee, so the customer will pay $103.

This is the most common model of zero-fee processing which is legal in most U.S. states provided only if the surcharge is clearly disclosed. For online CBD stores, this model can be an efficient way to reduce expenses, but transparency is crucial in order to avoid customer dissatisfaction or compliance violations.

Also Read: Top 5 Challenges in CBD Payment Processing

2. Cash Discounting or Price Offsetting:

Another approach is offering customers a discount for paying with cash or low-cost payment methods. Essentially customers who choose to pay with a credit card end up covering the processing costs through a small increase in the purchase price. It works particularly well for CBD dispensaries or retail locations where cash payments are common. The important thing is transparency and making sure customers know that they are getting a discount for paying with cash rather than a surcharge for using a card.

Also Read: How Much Does it Cost to Open a CBD Dispensary

3. Hidden Spread or Markup Model:

Some processors advertise “zero fees” but quietly recover costs through hidden markups, inflated exchange rates, or bundled service charges. The transaction statement might appear without any fee but merchants still pay indirectly. This can be misleading if the processor is not transparent about pricing or if the merchant does not audit statements regularly.

While zero-fee processing for CBD businesses can improve profits, it’s essential to verify how the model works, and also confirm compliance with Visa, MasterCard, and state laws, and ensure customers are fully informed. In the high-risk CBD space, transparency and compliance matter as much as cost savings to maintain long-term account stability.

Also Read: What is CBD Merchant Account

Why CBD Businesses Are High Risk (And Why Zero-Fee Is Tricky Here)

Before adopting a “zero-fee” payment model, CBD business owners must know that their industry has unique financial and regulatory challenges which makes such programs more complex than they appear. CBD merchants’ accounts operate in a high-risk environment due to compliance uncertainties, unpredictable underwriting standards, consumer disputes, and restrictive card network policies. All these factors shape how processors structure their fees and why “zero-fee” models are difficult to sustain without hidden costs or strict controls.

1. Regulatory Scrutiny and Compliance Risk:

CBD remains one of the most regulated industries in the U.S., especially for ingestible, vape or health-related products. Federal and state regulations are constantly changing, with strict oversight now covering everything from product labeling and health claims to how CBD products are marketed or advertised. Agencies like the FDA and FTC along with major card networks all play a role in setting the rules for how CBD products can be promoted and sold.

Processors handling CBD transactions must constantly verify that merchants stay compliant with all applicable rules from COA(Certificate of Analysis)validation and QR-code traceability to THC thresholds and accurate ingredient disclosures. Even small errors like making unverified health claims or misleading a product can lead to account reviews, funding holds, or even immediate termination.

This poses a challenge for zero-fee processing models, which depend on consistent, compliant transaction activity to remain sustainable. Such models depend on a stable flow of compliant transactions to effectively recover costs through surcharges or pricing adjustments. If a merchant is flagged or suspended for noncompliance then it interrupts the revenue flow of the processor and increases their financial risk. And this is why CBD processors enforce stricter compliance checks and frequently ask merchants to provide updated COAs, product catalogs, and marketing materials to stay verified.

Also Read: The CBD Industry Trends Challenges and Future Outlook

2. Elevated Chargeback and Refund Risks:

CBD businesses experience higher than average chargeback rates while compared to traditional retail or service merchants. This happens for several reasons as product expectations differ widely, shipping delays are commonly mostly with USPS or international orders, and some customers claim dissatisfaction with product effectiveness.

Even valid customer disputes can quickly add up, and card networks keep a close watch on merchant’s chargeback ratios closely. If a merchant’s chargebacks exceed 1% of their monthly transactions in chargebacks, they may be classified as a high-risk or “excessive” account by card networks. To protect against this, processors serving CBD merchants require rolling reserves that hold back 5-10% of each transaction for 90-180 days.

With a zero-fee model, the processor has little flexibility to manage such risks, as the merchant is not directly paying any processor costs. To manage this risk, many processors adjust surcharge structures, raise reserve holdbacks, or offer zero-fee programs only to merchants with dependable processing track records. For new CBD sellers or startups without a track record, these stricter terms can make it nearly impossible to qualify.

Also Read: Why CBD Business are Considered High-Risk

3. Bank and Underwriting Limitations:

Not all banks or Independent Sales Organizations(ISOs) are willing to support CBD transactions. Even the banks that accept CBD merchants typically enforce strict underwriting, demanding licenses, product catalogs, COAs for every SKU, website reviews, and financial documentation. Underwriting teams review the merchant’s business operations, financial strength, and adherence to compliance standards. Since CBD exists in a legal gray zone which is legal federally but regulated differently by states so banks face potential scrutiny from regulators and card networks if they onboard noncompliant merchants.

Few banks who are willing to underwrite CBD accounts result in limited processor choices and more restrictive approval terms. For zero-fee programs that operate on narrow margins, thorough underwriting becomes even more important. Banks require assurance that surcharge programs meet state regulations and that merchants can consistently keep dispute rates low. If the risk profile changes, underwriting may demand higher reserves, insurance coverage, or even conversion to a traditional fee-based model to safeguard exposure.

Also Read: How to Open CBD Business Bank Account

4. Network Policy and Gateway Restrictions:

Card networks like Visa, MasterCard, and American Express periodically issue police updates regarding CBD products. Such updates can include outright bans on certain product types for instance ingestible CBD, gummies, or vape cartridges or stricter data requirements during sale.

Payment gateways integrated with processors must enforce such rules like blocking prohibited transactions in real time. This requires advanced monitoring systems that identify product categories, keyword violations, and merchant descriptors.

In a zero-free environment, the challenge increases. Each time a transaction is filtered, blocked, or reversed, it interferes with the processor’s ability to recover fees through its surcharge system.

Each time a transaction is filtered, blocked, or reversed, it disrupts the processor’s fee recovery mechanism which depends on surcharge application. Maintaining compliance while managing surcharges add complexity to gateway configurations making the program costlier to operate.

Because of all these risks like compliance irregularity, chargebacks, underwriting constraints, and network policies then zero-fee processing in the CBD industry is rarely straightforward. So what looks like a cost-saving advantage on paper can quickly turn into a financial and operational challenge if compliance issues or chargeback increases.

CBD merchants exploring these models should carefully evaluate providers, ensure surcharge or cash-discount programs that meet state regulations, and understand how reserves, refunds, and card network policies are managed. In many situations, selecting a clear, low-rate traditional processor such as CBD Merchant Solution can deliver more stability than a zero-fee deal that hides risk in finger print.

Also Read: Comparing CBD Payment Gateways

How Zero-Fee Processing Can Be Structured for CBD Merchants

Zero-fee payment processing can be a good option for CBD merchants who already face higher-than-average transaction costs due to their industry’s high-risk classification. However, implementing such programs in the CBD space requires careful structuring, clear communication, and full regulatory compliance.

As CBD products are regulated at both the federal and state levels and because card networks have strict rules where processors must customize zero-fee models with extra caution. Below are the primary methods which are used to achieve a zero-fee structure and the risks and considerations that accompany each one.

1. Customer Surcharge / Service Fee:

1. How It Works:

This model adds a small service fee usually between 3% and 4% on top of the sale amount at checkout. The merchant receives the full sale price, while the processor collects the surcharge to cover transaction costs. Essentially, the customer funds the processing fee rather than the business.

Also Read: Secure Payment Processing for CBD Ecommerce

2. Considerations / Risks:

Though common in other industries, surcharging in CBD requires extra care. Card brands such as Visa and MasterCard have strict rules on how surcharges can be displayed and applied. For instance, surcharges can only be added to credit card transactions (not debit or prepaid cards) and must be clearly disclosed before the transaction. Receipts must list the surcharge separately, and visible signage at the checkout must notify customers about the additional fee. Some states like Connecticut, Massachusetts and Colorado limit or ban surcharging altogether. CBD merchants in these states must choose another payment model, as noncompliance can lead to penalties, chargebacks, or even account termination.

Also Read: What is High-Risk Merchant Account

2. Cash Discount Model:

1. How It Works:

Instead of adding a surcharge, this model lists prices at a “card-inclusive” rate and offers customers a small discount(often 3-4%)for paying with cash or other low-cost methods. The goal is to encourage cash payments and recover processing costs through the standard card price.

2. Considerations / Risks:

Although it may seem simpler, this model can confuse customers if not communicated clearly. All pricing and signage must specify that the displayed price includes the card rate and that a discount is available for cash payments. Additionally, some states restrict “dual pricing” structures or require transparent disclosure of both cash and card prices.

For CBD businesses, the cash discount model is often easier to justify legally, as it emphasizes customer savings rather than added fees. Still, it requires clear labeling, compliant receipt formatting, and clear employee training to avoid misunderstandings or legal issues.

Also Read: Top 5 Challenges in CBD Payment Processing

3. Markup / Spread Hidden in Price:

1. How It Works:

In this model, the processing fee is included within the product’s overall retail price. The merchant raises prices slightly to cover the card fee instead of showing it as a separate charge.

2. Considerations / Risks:

While this approach appears effortless to customers, it raises transparency concerns. Regulatory and consumer protection agencies may view undisclosed markups as deceptive, especially if customers later discover that they are indirectly paying processing fees. The CBD space is already under scrutiny for labeling and marketing claims and this lack of transparency can damage credibility or trigger regulatory attention.

This structure is sometimes used for eCommerce CBD merchants seeking simplicity but it’s generally not recommended unless pricing charges are communicated clearly and remain consistent across all payment types.

Also Read: How to Protect Your CBD Business from Payment Processor Shutdowns

4. Hybrid / Risk Buffer Model:

1. How It Works:

A hybrid model combines several methods, where the processor adds a small surcharge or base fee and keeps a reserve to manage risk. Most of the costs are covered by customer-paid customer surcharges, while a small share remains with the merchant to fund reserves or cover chargebacks.

2. Considerations / Risks:

This model offers more flexibility and security for processors working with high-risk CBD accounts. Customer surcharges cover most expenses, but the merchant still contributes a small portion to maintain reserves or manage chargebacks. However, since merchants still cover a small part of the cost, “zero-fee” serves more as a marketing term rather than an exact reality.

Transparency is essential here. The processor should explain how fees are split, how reserves are held, and how chargebacks or refunds impact the merchant’s balance.

Also Read: Why Traditional Banks Reject CBD Merchants

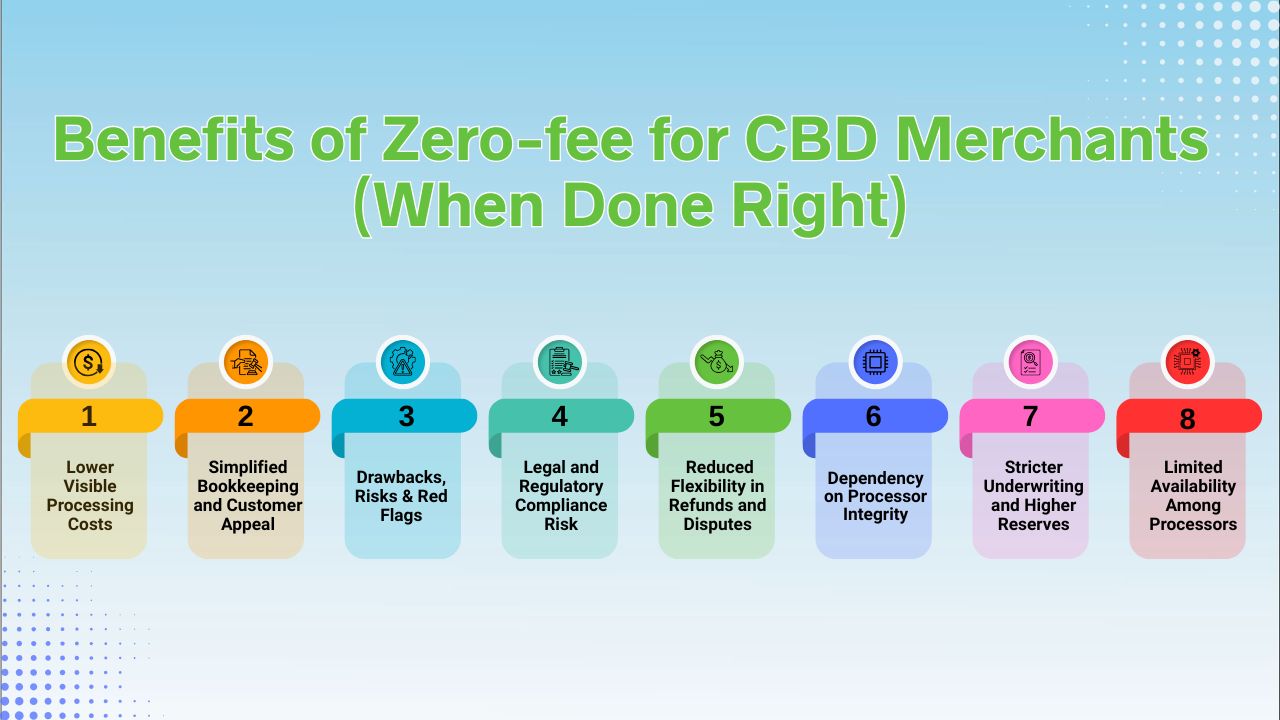

Benefits of Zero-Fee for CBD Merchants (When Done Right)

If implemented properly with full compliance and transparency then a zero-fee model offers many advantages to CBD merchants who are operating in low margins and high processing costs. However, such benefits are achievable only when the program is managed with transparency, compliance , and strong risk management. Below are four key advantages CBD businesses can experience when zero-fee processing is done the right way.

1. Lower Visible Processing Costs:

One of the main attractions of a zero-fee model is that it appears to eliminate or greatly reduce merchant processing fees. So, instead of seeing 3-5% transaction fees deducted from every sale, merchants may see “$0.00” in processing costs on their statements. While customers technically cover the fees through surcharges or adjust pricing, the merchant’s operating expenses decrease significantly. For CBD businesses whose profits are often tightened by high-risk fees, this setup can result in significant monthly savings.

Also Read: Comparing CBD Payment Gateways

2. Simplified Bookkeeping and Customer Appeal:

Avoiding regular processing fee deductions helps to simplify accounting and improve cash flow management. For some merchants, especially smaller CBD retailers or eCommerce sellers, a cleaner structure makes financial tracking easier. From a customer perspective, seeing consistent pricing without visible merchant fee changes can also improve trust and clarity. When it is executed transparently then this model ensures customers recognize they are paying for convenience rather than any hidden costs.

Also Read: Best Website Builder for CBD Business

3. Drawbacks, Risks & Red Flags:

While zero-fee processing can seem to reduce costs, it has challenges in the CBD sector, where regulations are complex and risks are high and require careful consideration and compliance.

Below are major drawbacks CBD merchants should carefully consider before committing to a zero-fee model.

4. Legal and Regulatory Compliance Risk:

CBD merchants face strict rules from financial institutions and also from state and federal regulators. Improperly applied surcharges, hidden fees, or lack or clear disclosure can lead to violations of state laws and card network compliance standards. For instance, some states restrict surcharges entirely, and Visa or MasterCard may issue fines for improper or noncompliant implementations. If surcharges are not clearly disclosed or disguising fees within product prices can result in fines, account suspension, or termination.

5. Reduced Flexibility in Refunds and Disputes:

When a refund or dispute occurs, then handling surcharges becomes complicated. When a customer receives a full refund which includes the surcharge then the merchant ends up covering the processing fees out of his pocket. So without clear refund policies or coordination with the processor, merchants may face financial discrepancies or disputes between merchants and processors.

Also Read: How to Set Up Online CBD Payments in Less than 24 Hours

6. Dependency on Processor Integrity:

Zero-fee models depend mainly on the accuracy and transparency of the processor. So if the processor calculates surcharges incorrectly, fails to collect fees properly, or changes terms without any notice then the merchant’s revenue may suffer. Selecting a reputable processor offering with clear reporting and reliable support is important to prevent financial disruptions.

Also Read: How to Expand Your CBD Business to New Market Without Payment Issues

7. Stricter Underwriting and Higher Reserves:

As CBD business is classified as a high-risk industry, processors offering zero-fee options often enforce extra measures like higher rolling reserves, stricter documentation, or more frequent reviews. Such measures protect the processor but may restrict a merchant’s available funds and delay cash flow.

8. Limited Availability Among Processors:

Most zero-fee programs are designed for low-risk merchants in industries like retail or hospitality. Few high-risk processors offer these models to CBD merchants, and when they do, approval typically depends on transaction volume, business history, and compliance record. As a result, CBD merchants may struggle to find reliable providers that can legally and effectively support a zero-fee setup.

Also Read: CBD POS Systems

What to Look for / Checklist When Evaluating a Zero-Fee CBD Processor

While comparing merchant processing offers that advertise as a “zero-fee”, it is important for CBD businesses to understand how the model truly works and what risk it carries. Every “zero-fee” program operates differently, and misunderstanding their structure can lead to compliance violations or unexpected costs. Here are eight essential points to evaluate before choosing a provider:

1. How “Zero-Fee” Is Achieved:

Understand how the “zero-fee” model functions like whether it relies on surcharging, cash discount, or built-in markups that hide the actual processing costs. Begin by understanding exactly how the “zero-fee” model operates whether it depends on surcharges, cash discounts, or hidden markups that recover processing expenses.

2.Legality in Your Jurisdiction:

Both card networks and local regulations govern how surcharging and similar pricing models can be applied. Several U.S. states prohibit or limit surcharging, so always verify that your processor’s model complies with the laws in your operating region.

Also Read: The Best Marijuana Marketing Strategies

3. Transparency & Disclosure:

Demand full transparency about every fee, markup, and surcharge so that both you and your customers clearly understand the true cost of each transaction. A lack of transparency may lead to customer disputes, regulatory scrutiny, or even fines from card networks.

4. Refunds & Chargeback Handling:

Clarify how the processor handles surcharges or offsets when processing refunds or resolving disputes. If a full refund includes the surcharge then you could lose that amount as a loss.

Also Read: The Ultimate Guide of CBD Social Media Marketing

5. Underwriting & Risk Buffer:

Thorough underwriting safeguards the processor but can restrict your cash flow through rolling reserves, delayed settlements, or funding holds. Always review the reserve policy in detail to understand its impact on your business cash flow.

6. Industry Experience:

Select a processor familiar with CBD and hemp merchants who understands COAs, labeling compliance, and THC limits.

7. Support and Accountability:

A reliable processor should provide a dedicated account manager, transparent reporting, and accessible customer support.

8. Exit & Contingency Planning:

Know the terms if your account is closed. Understand how your data, funds, and transaction records are handled to avoid disruption in your operations.

Also Read: How to Market Your CBD Business on Social Media

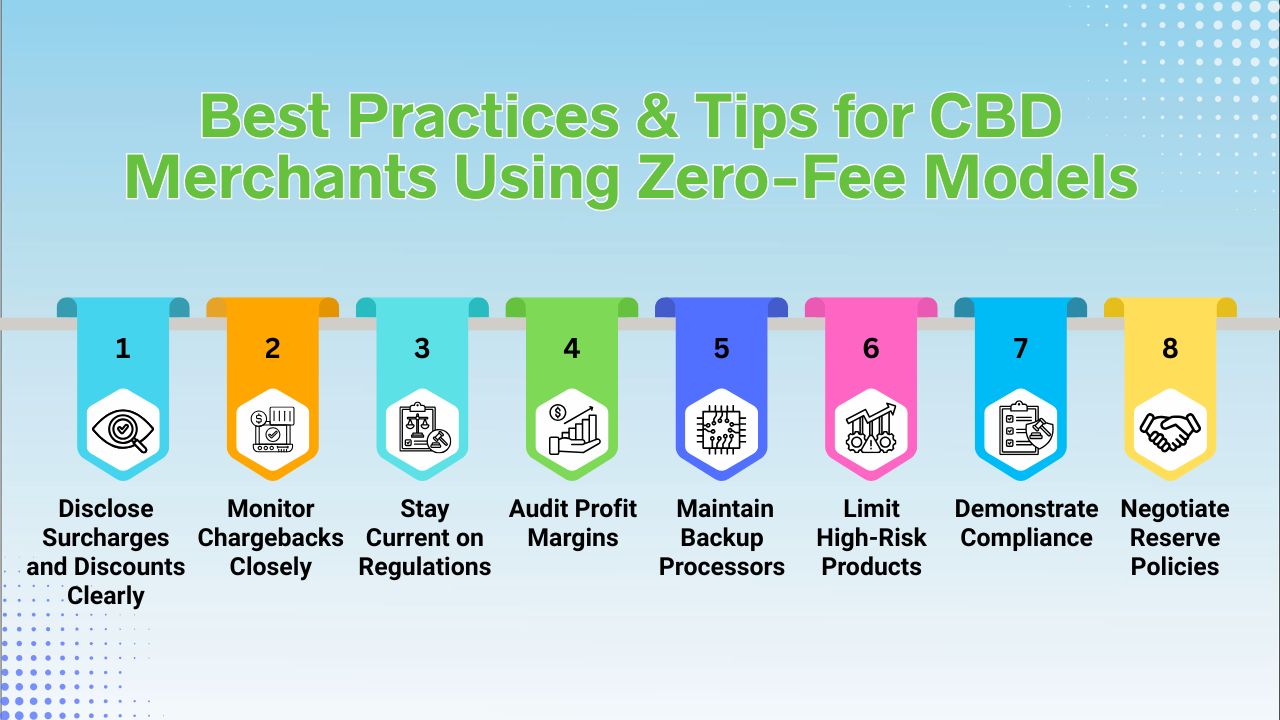

Best Practices & Tips for CBD Merchants Using Zero-Fee Models

Operating on a “zero-fee” payment model can be beneficial for CBD merchants who are seeking to reduce transaction costs, but it also comes with unique challenges in compliance, customer relations, and financial management. Following these best practices can help to ensure smoother operations, sustained profits, and maintain a positive relationship with your payment processor.

1. Disclose Surcharges and Discounts Clearly:

Ensure you clearly show any surcharges or discounts at checkout, on receipts, and within your policy pages which helps to maintain transparency and avoid any customer confusion. It is essential to be transparent about fees and discounts with the customer which helps to gain customer trust and prevents any disputes or regulatory issues.

2. Monitor Chargebacks Closely:

Monitor your chargeback ratio consistently. A sudden rise in disputes can make processors suspect non-compliance, hidden fees, or high-risk product issues, which results in account reviews, penalties, or even account termination.

Also Read: Can You Sell CBD on TikTok

3. Stay Current on Regulations:

CBD payments are heavily regulated and surcharging rules vary by state and card network. Regularly review updates to ensure your practices remain compliant and legal.

4. Audit Profit Margins:

Review your profit margins regularly as surcharges or offsets in “zero-fee” setups can influence overall pricing. Regularly doing cost analysis ensures your margins remain strong, sustainable, and aligned with your business goals and market conditions.

Also Read: Guide to Start a CBD Business

5. Maintain Backup Processors:

Always have a backup payment processor solution ready, as zero-fee processors may suspend or restrict services for specific high-risk products like new ingestibles or topicals. Having alternative options ensures uninterrupted operations and payment continuity.

6. Limit High-Risk Products:

Be cautious while expanding into product lines like vapes or edibles unless clearly approved by the processor to prevent sudden account closures as unapproved expansion can lead to compliance violations, account suspension, or unexpected service termination.

7. Demonstrate Compliance:

Show your commitment to compliance by providing COAs, using clear disclaimers, implementing age verification, and maintain accurate labeling. Following these measures prove your business follows regulations and operates responsibly with CBD industry standards.

8. Negotiate Reserve Policies:

Carefully review and negotiate reserve or rolling reserve terms to ensure that they are transparent and balanced. Fair reserve terms safeguard both the processor and the merchant while preserving healthy cash flow, smooth daily operations, and steady long-term cash flow.

Following these best practices will improve compliance, build stronger processor partnerships, and create a more stable and reliable payment setup for CBD business.

Conclusion

CBD merchants who face high transaction costs may find zero-fee processing to be a good solution. But, zero-fee processing is not a universal solution and it needs careful evaluation before implementation. The zero-fee model transfers processing costs to customers by adding a surcharge at checkout or providing cash discounts for selecting lower-cost payment options. Though this strategy can reduce expenses to a large extent but also demands careful execution and regulatory awareness.

As CBD businesses operate in a high-risk category, making compliance, transparency, and processor reliability essential for long-term stability. Every zero-fee model is compliant with state laws or card network rules due to which misunderstanding can lead to chargebacks, fines, or account termination. Merchants should clearly display all fees and disclosures, inform customers before payment, and align refund policies with their processor’s rules in order to maintain transparency and compliance.

On top of that, zero-fee processing does not remove financial risk completely. Many factors like rolling reserves, refund handling, and underwriting requirements can still impact cash flow. That’s why merchants should partner only with processors experienced in high-risk industries who understand CBD regulations, COA documentation, labeling compliance, and customer verification.

In short, zero-fee processing can help CBD merchants preserve margins and remain competitive if implemented transparently, regulatory compliance, and careful operational oversight. So, the key is to balance savings with compliance, select partners who understand your niche and maintain a proactive risk management strategy that safeguards both your revenue and reputation.

Frequently Asked Questions (FAQs):

1. Is zero-fee processing legal for CBD payments?

Yes, but legality differs by state and card network payments. Where some U.S. states restrict or ban surcharges, and networks like Visa and MasterCard enforce strict disclosure rules, so it is essential to verify compliance before adopting a zero-fee program.

2. Do all processors offer zero-fee options for CBD merchants?

No, only a few specialized high-risk processors provide zero-fee solutions for CBD merchants and approval usually depends on transaction volume, compliance history, and overall business history.