Introduction

The CBD industry is experiencing speedy growth all over the world, with products like oils, edibles, topicals, and supplements gaining accepted popularity. Despite the strong consumer demand, CBD businesses face one of the biggest difficulties faced in securing reliable CBD Payment Processing solutions.

CBD merchants are often categorized as high-risk merchants by most banks and financial institutions. This classification is mainly due to changing CBD regulations, unclear legal frameworks, frequent chargeback risks, and the overall stigma associated with cannabis-related products.

It means that most common payment gateways like PayPal, Stripe, or Square, often refuse to work with CBD businesses. So even when a merchant account is approved, there is always the risk of sudden account termination, excessive processing fees, rolling reserves, and less access to banking services.

As such obstacles often create instability, it becomes hard for CBD companies to focus on growth, customer satisfaction, and brand credibility. These challenges are not just for local transactions but for many CBD retailers who are willing to expand globally often face strict cross-border payment restrictions, complex compliance rules, and higher costs for international transactions.

On top of that, there are the risks of frauds, unclear refund policies, and recurring billing disputes because of which it is clear why payment processing remains one of the toughest parts of running a CBD business.

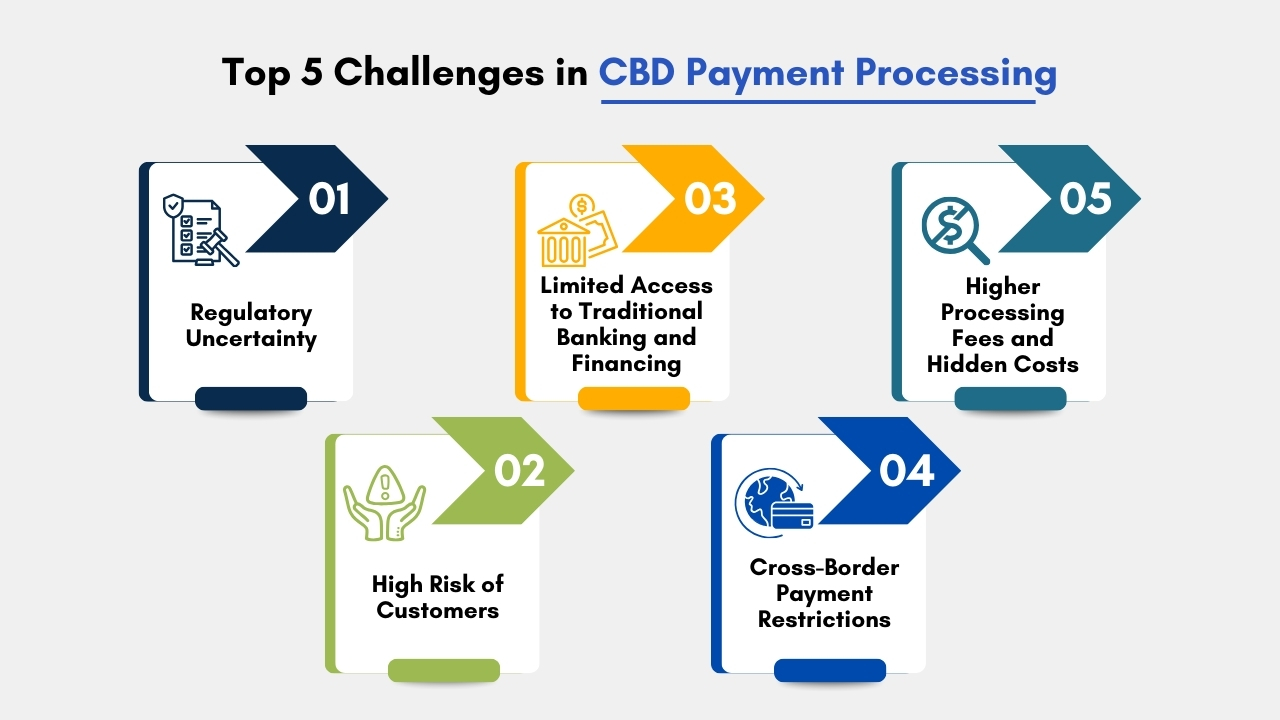

Through this blog we will explore the top 5 challenges in CBD payment processing from regulatory uncertainty, high transaction fees, and will outline proven strategies to overcome them. It is only by addressing such issues proactively that your CBD business can build a secure, compliant, and profitable payment ecosystem.

Also Read: Why CBD Business Struggle With Payment Processing

Top 5 Challenges in CBD Payment Processing:

1. Regulatory Uncertainty:

The Challenge:

The CBD industry operates in a regulatory gray area. Though the 2018 U.S. The Farm Bill has made the hemp-derived CBD with less than 0.3% THC, but the state and federal rules continue to change. Where some states impose stricter restrictions, international markets often follow entirely different rules.

Because of lack of clarity banks and processors are often uncertain and label CBD merchants as high-risk. Due to compliance issues, many payment processors and banks classify CBD businesses as high-risk merchants.

As a result, businesses experience sudden account freezes, rejections from traditional payment gateways, and difficulty in maintaining long-term stability.

This creates several issues:

- Less access to mainstream processors like PayPal, Stripe, or Square.

- CBD merchants often face increased monitoring by banks and processors.

- Sudden account closures without prior warning.

- CBD merchants struggle to secure consistent, long-term payment processing solutions such as CBD Merchant Solution.

For CBD businesses, this lack of clarity of laws often leads to interrupted sales, damaged brand credibility, and increased operational stress.

Also Read: CBD Merchant Account Vs Regular Merchant Account

How to Overcome It:

1.Work with high-risk payment processors:

Rather than depending on mainstream processors, choose payment providers that specialize in CBD. Such companies have customized solutions for strict compliance-driven markets.

Also Read: What is High-Risk Merchant Account

2.Stay up-to-date on legal changes:

You must keep track of FDA updates, state rules, and global regulations for cross-border sales, and use CBD trade associations or newsletters to stay updated.

Also Read: Is CBD Legal on all 50 States

3.Full Transparency with your processor:

It is essential to share complete product information, testing documentation, and website content upfront helps prevent abrupt account shutdowns.

Also Read: CBD Terms of Payment

4.Invest in compliance consultants:

For growing CBD businesses, working with compliance professionals helps to ensure that operations meet both federal and state rules.

By adopting compliance proactively, you can reduce risks and build long-term trust with financial institutions.

Also Read: Understanding Payment Terms

2. High Risk of Customers:

The Challenge:

Another major challenge in CBD payment processing is the high risk of chargebacks. Since CBD is classified as a high-risk industry, banks and processors closely monitor disputes, and even a small increase in chargeback rates can put a merchant account at risk.

Chargebacks often occur when customers are not clear about recurring subscription charges, misunderstood product benefits, or receive delayed shipments. Due to poorly defined return policies, frauds often increase the number of chargebacks.

If chargebacks exceed the standard 1% limit, then the merchants may risk fines, frozen reserves, or abrupt account termination which can threaten business continuity.

In order to overcome such challenges, CBD merchant Solution does provide clear product descriptions, avoid unverified health benefit claims, and use transparent billing practices.

It is only by offering easy-to-understand return policies, timely customer support, and fraud prevention tools like AVS and CVV checks can further reduce disputes. It is important to proactively manage chargebacks to strengthen trust with both customers and payment providers.

- Customers will be confused about frequent subscription charges.

- Credit card companies classify CBD as a high-risk industry by default.

- Consumers are often dissatisfied due to unrealistic claims or delayed shipping.

- Fraud customers can take advantage of weak refund policies.

Most acquiring banks monitor chargeback rates strictly, and if your chargeback rates rise above the 1% threshold, then most banks may shut down your merchant account.

Also Read: What is High-Risk Merchant Account

How to Overcome It:

1. Clear product descriptions:

Avoid any medical claims like “CBD cures anxiety” which violates FDA rules. Rather provide accurate dosage, ingredient lists, and lab testing results.

2. Transparent billing practices:

Make sure customers are aware of subscription auto-renewals and provide email or SMS reminders before each renewal.

3. Strong Refund and return policy:

It is essential to have a transparent refund policy and quick handling of valid returns reduce the chances of chargebacks.

4. Fraud detection tools:

To stop any unauthorized purchases use address verification service(AVS), CVV checks, and fraud prevention software to stop unauthorized purchases.

5. Chargeback alerts:

You must partner with services like Ethoca or Verifi that notify you before a chargeback is finalized, giving you time to resolve disputes.

It is only by lowering chargebacks that you can not only protect your merchant account but also improve customer satisfaction.

Also Read: How Fast Payouts Can Improve Your CBD Business Cash Flow

3. Limited Access to Traditional Banking and Financing:

The Challenge:

One of the most constant challenges in CBD payment processing is the lack of access to traditional banking and financing. Despite the legalization of hemp-derived CBD, many banks still view CBD companies as high-risk merchants due to regulatory uncertainty and potential compliance issues.

As a result, CBD businesses often face denied applications for business accounts, offering limited access to credit cards, and difficulty securing loans. Even if their accounts are accepted, merchants are frequently subject to high reserve requirements, strict underwriting, or excessive processing fees. Such restrictions often make it difficult for CBD merchants to manage cash flow, invest in growth, or scale operations.

To overcome such challenges, CBD businesses should work with high-risk friendly banks or processors, negotiate rolling reserves on the basis of strong sales history, and explore alternative financing options like merchant cash advances, private investors, or peer-to-peer lending platforms. Maintaining accurate financial records also reassures financial partners of business stability.

Many banks still hesitate to work with CBD merchants due to perceived legal risks. This creates hurdles like:

- Denied applications for business checking accounts.

- Often lead to higher reserve requirements like banks holding back 5-10% of monthly sales.

- Rejection for loans or credit lines to expand operations.

- Excessive processing fees as compared to mainstream industries.

- For small to mid-sized CBD businesses, such financial exclusion often makes growth more challenging.

How to Overcome It:

1. Seek high-risk friendly banks:

Some of the regional and community banks often specialize in supporting emerging industries like CBD. So, building relationships locally can help.

2. Negotiate rolling reserves:

If your payment processor demands reserves, then negotiate terms based on your sales history and chargeback record.

3. Explore alternative financing:

CBD companies often depend on merchant cash advances, peer-to-peer platforms, and private investors to secure funding.

4. Diversify accounts:

CBD merchants must avoid depending on one bank rather maintain multiple accounts which reduces risks of sudden closures.

5. Maintain detailed financial records:

Thorough bookkeeping gives banks and processors confidence that your CBD operations are transparent and reliable.

Though access to traditional banking is limited, diversifying financial strategies ensures business continuity.

Also Read: Can You Advertise CBD on Instagram

4. Cross-Border Payment Restrictions:

The Challenge:

Expanding into international markets can be highly profitable for CBD merchants but also comes with significant cross-border payment restrictions.

So what may be legal in the United States under the 2018 Farm Bill is not always permitted abroad. For instance, some countries ban CBD while others impose stricter THC limits or require special licenses.

Such differences may create confusion for both merchants and payment processors often leading to declined transactions or blocked accounts.

On top of that, cross-border payments often come with higher processing fees, longer settlement times, and increased risk of chargebacks due to shipping delays or unexpected custom duties.

Most of the global banks remain cautious about working with CBD businesses which further complicate international sales.

To overcome such barriers, CBD merchants should research each target market’s regulations, partner with international-friendly high-risk processors, and clearly communicate shipping costs, taxes, and delivery timelines to customers. Local fulfillment centers can also reduce delays and improve customer confidence.

CBD businesses often aim to sell internationally, but cross-border payments are complicated due to:

- Differing regulations across countries about what is legal in the U.S. may be banned in Europe or Asia).

- Currency exchange issues.

- International banks refusing to process CBD-related payments.

- Higher processing fees for international transactions.

Due to which global expansion is complicated and costly.

How to Overcome It:

1. Research target country regulations:

Before launching globally, check CBD legal rules in each market. For instance, the EU has stricter THC limits than the U.S.

2. Partner with international-friendly processors:

Some high-risk payment processors specialize in multi-currency and cross-border solutions for CBD.

3. Offer multiple payment options:

Accept credit cards, ACH payments, and e-wallets like Apple Pay or Google Pay in order to expand accessibility.

4. Local fulfillment centers:

Shipping delays may often lead to chargebacks. So working with local warehouses reduces delivery times and improves customer trust.

5. Transparent checkout process:

Show shipping fees, customer duties, and delivery timelines clearly before checkout. CBD businesses can expand internationally without any legal or financial risks only by adopting a compliant, multi-payment strategy.

Also Read: Best Ecommerce Platform for CBD

5. Higher Processing Fees and Hidden Costs:

The Challenge:

One of the biggest challenges in CBD payment processing is the higher processing fees and hidden costs which merchants often face. Since CBD is considered a high-risk industry by many financial institutions, payment processors typically charge high transaction rates compared to standard businesses.

Additionally, merchants may experience hidden costs like rolling reserves, monthly account maintenance charges, or early termination penalties mentioned in contracts. Such unexpected expenses can quickly impact profits and make it difficult for CBD businesses to stay competitive.

In order to overcome such issues, transparency and research are key. Merchants should thoroughly review processing agreements, and ask for a clear breakdown of all fees, which include setup fees, monthly fees, per-transaction fees, and incidental charges.

So, selecting a processor that specializes in high-risk industries like CBD can also reduce unexpected costs, as such providers are more familiar with compliance and industry requirements.

Negotiating for lower reserves or exploring multiple processor options can help CBD businesses to secure fair rates and ultimately help them to scale sustainably.

CBD merchants often have to pay 2-4 times higher processing fees than other businesses. This includes:

- Setup fees.

- Monthly account fees.

- Transaction fees as high as 6-8%

- Rolling reserves or reserve holds.

Hidden penalties for exceeding sales volume.

Higher cost may often impact profits, due to which CBD businesses are less competitive in pricing.

How to Overcome It:

1. Shop around for specialized processors:

Every high-risk processor does not charge the same. So it is essential to compare pricing models and read contracts carefully.

2. Negotiate better terms:

Use your strong sales record and chargeback rate in order to negotiate better processing fees.

3. Optimize average order value(AOV):

Reduce the impact of fees by bundling products, offering subscriptions, or upselling complementary items.

4. Use ACH payments:

Automated Clearing House(ACH) transfers cost less than credit cards due to which it is gaining popularity in recurring CBD subscriptions.

5. Avoid early termination:

Most of the processors include heavy penalties for early cancellation, so clarify contract terms before signing.

So, it is only by carefully managing processor selection and maximizing your sales model, you can minimize fee impact and improve profitability.

Also Read: How to Setup Online CBD Payments in Less than 24 hrs

Additional Tips for CBD Merchants:

Other than these top 5 challenges, here are extra strategies to future-proof your payment processing:

1. Website Compliance:

For CBD websites, compliance is crucial. So, avoid making any unverified health claims, ensure SSL certificates are active, display clear privacy policies, and implement strict age verification measures in markets where regulations require restrictions on access for minors.

Also Read: Best Website Builders for CBD Businesses

2. Reputation management:

Reputation management is important for CBD businesses. So it is only by encouraging and showcasing positive customer reviews that builds trust, strengthens brand credibility, which helps to reduce the high-risk labelling often associated with the industry, making it easier to attract and retain loyal customers.

Also Read: How to Choose the Right CBD Merchant Account in 2025

3. Subscription models:

Subscription models , while implemented with transparency will improve customer loyalty and ensure predictable revenue streams. It is only by implementing transparent billing, simple cancellations, and reliable delivery make subscriptions a strong growth tool for CBD businesses.

4. Backup processor:

Maintaining a backup payment processor is important for CBD businesses. It protects against sudden account shutdowns, ensures uninterrupted transactions, and provides stability which will help merchants to continue operations smoothly without risking revenue loss due to processor interruptions.

5. Education and transparency:

Education and transparency are important for CBD businesses. It is only by clearly informing customers about product legality, safety, and benefits, merchants build trust and reduce misunderstandings, and minimize disputes which lead to stronger relationships and long-term customer loyalty.

Also Read: CBD Content Marketing

What to look for in a CBD payment gateway:

When choosing a CBD payment processing gateway, businesses must consider several factors in order to ensure smooth operations and long-term growth.

It is essential for a CBD payment gateway to be reliable and compliant, so your gateway should specialize in high-risk industries like CBD and stick to all regulatory requirements.

Transparent pricing is also important for CBD businesses and there should not be hidden fees. So it is important to search for gateways that provide competitive rates, low reserves, and flexible terms.

Security features like SSL encryption, PCI compliance, and fraud prevention tools that help to protect sensitive customer data and reduce risks. Additionally, smooth integration with your website or eCommerce platform is important for a smooth checkout experience.

Also multi-currency support and ACH payment options can further expand your reach and lower costs. Ultimately, responsive customer support ensures issues are quickly resolved, minimizing interruptions.

It is only by focusing on compliance, security, and cost-effectiveness, CBD businesses can select a gateway that supports both growth and customer trust.

Conclusion:

CBD payment processing often has unique challenges that can often feel overwhelming for merchants, but with the right approach, such challenges can be successfully managed.

Higher fees, hidden costs, and stricter compliance requirements, risk of sudden account shutdowns, and due to the high-risk classification, such hurdles will require proactive strategies.

And the key to overcoming such challenges includes a combination of preparation, transparency, and adaptability. It is only clearly evaluating processors, keeping websites compliant, and having backup options that will help CBD businesses to reduce financial risks and prevent any costly expenses.

Building customer trust is equally important. Clear billing practices, transparent subscription models, and educational content not just strengthen credibility but also reduce disputes and chargebacks.

It is only by using customer reviews and open communication that will keep the negative perception linked to high-risk industries away. Also by searching alternate payment methods like ACH transfers will lower costs, and improve efficiency.

So, success in CBD payment processing must depend on compliance and trust as non-negotiable priorities and also focusing on cost control and operational stability.

With such practices CBD businesses can secure reliable payment solutions like CBD Merchant Solution to develop long-term customer loyalty, and achieve continuous growth irrespective of the challenges of operating in a high-risk market. If you still have any query with the challenges in CBD payment processing or how to overcome then you may book a free demo to CBD Merchant Solutions and we are more than happy to assist you.

Frequently Asked Questions (FAQs):

1. Why are the processing fees higher for CBD merchants?

Payment processors often charge higher fees in order to neutralize the risks of working with CBD businesses. It includes the risks for compliance requirements, stricter monitoring unlike traditional industries.

2. What are the alternatives to credit card payments for CBD businesses?

You can use ACH transfers and digital wallets as alternatives to credit card payments which have lower fees and are useful for subscriptions.