Introduction

CBD merchants are often caught between a rock and a hard place, due to which they are forced to select between costly payment solutions and the risk of not having essential banking support.

Although the 2018 Farm Bill has legalized hemp-derived CBD products federally, the industry is still labelled as “high-risk” industries by most payment processors and traditional banks.

In reality, an industry report in 2023 suggests that over 70% of CBD businesses have experienced at least one payment processing issue owing account closures or denied applications.

It clearly means that traditional merchant accounts aren’t an option for CBD businesses. Rather, CBD businesses must work with high-risk merchant accounts – specialized payment processors designed to work with industries that have increased regulatory inspection and higher chargeback rates.

This means that as a CBD business owner, you cannot opt for traditional merchant accounts. Rather, CBD businesses must seek high-risk merchant accounts – specialized payment processing solutions to serve industries with increased regulatory inspection or higher chargeback rates.

Reserve requirements in CBD accounts can restrict cash flow, impacting daily operations and business scalability.

All types of businesses require merchant accounts to accept both credit and debit card transactions. But every account is not the same – some are considered low risk while others are considered high risk.

But what does it mean to be a high-risk merchant account? A high-risk merchant account is a particular kind of payment processing account which is essential for certain businesses as they are exposed to higher chances of chargebacks, fraud, regulatory instability, etc.

Businesses in such categories includes – CBD, supplements, adult products, and travel – often needed to pay higher fees and need to meet stricter conditions to process credit card payments.

So, why do CBD businesses fall into this category, and what are the consequences for your business?

CBD payment processing requires specialized solutions to handle regulatory scrutiny and reduce chargeback risks effectively. This is where CBD Merchant Solutions come into the picture offering tailored support and reliability.

Through this blog we will walk you through what a high-merchant account is, why CBD companies require high-risk merchant accounts, and how to negotiate the challenges while capitalizing on the opportunities it provides.

Also Read: Is CBD Legal in all 50 States

What is a High-Risk Merchant Account?

A high-risk merchant is designed for businesses that are considered as “high-risk”. Such types of businesses have a greater chance of chargebacks, fraud, or other financial risk factors.

High-risk businesses require accounts that accept both debit and credit card payments.

Also Read: How to Get a CBD License

Characteristics of High-Risk Accounts

- Higher processing fees: processing fees between 3-7% per each transaction.

- Rolling reserves: A percentage of each transaction is held back by the processor for around 30-180 days.

- Longer settlement times: funds may require several days to be released.

- Additional documentation: high-risk processors often require more paperwork and ongoing updates.

Also Read: How to Open a CBD Business Account

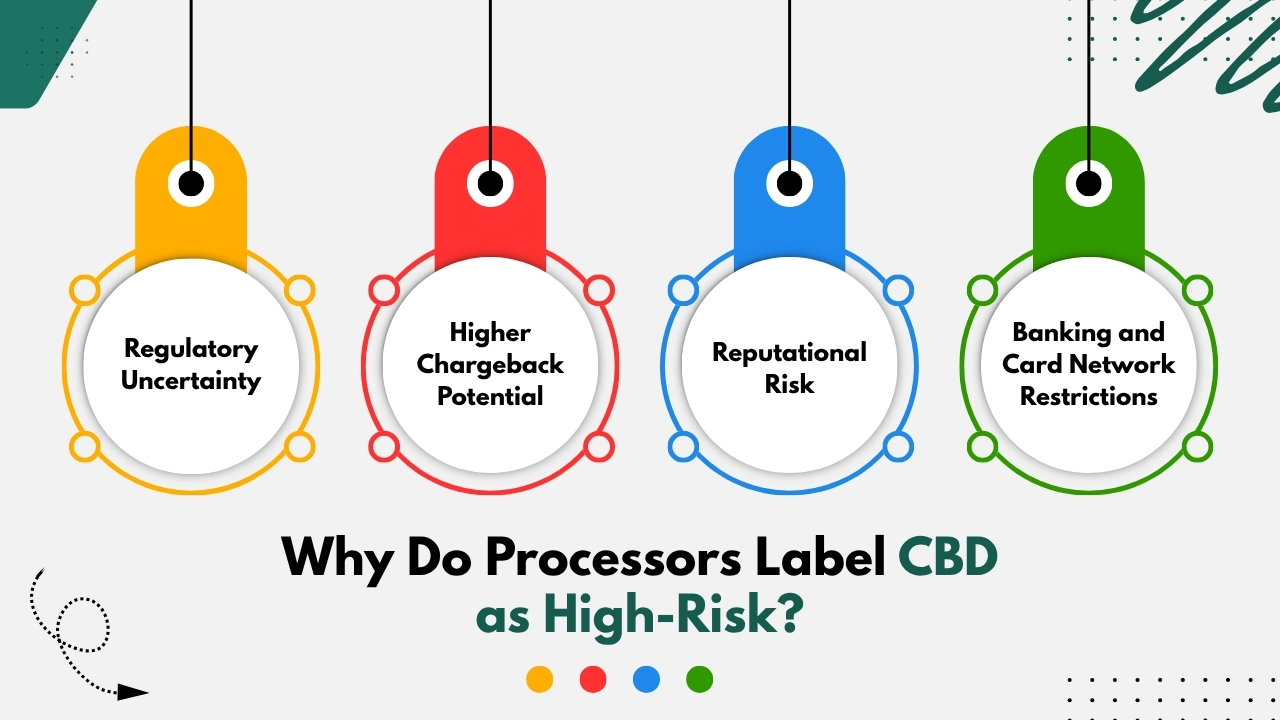

Why Do Processors Label CBD as High-Risk?

1. Regulatory Uncertainty:

Though hemp-derived CBD is federally legal, state laws differ significantly and are constantly changing. Some states can regulate certain types of CBD products or require specific labeling, testing or licensing.

These guidelines of regulation create uncertainty for payment processors making them cautious of potential legal exposure.

Also Read: CBD Merchant Account Vs Regular Merchant Account

2. Higher Chargeback Potential:

CBD Merchant Solutions emphasizes that CBD products often make health-related claims which can lead to disputes or dissatisfaction. On top of that, delays in shipping or subscription misunderstandings can lead to chargebacks.

High chargeback rates pressurize the processor’s risk profile, due to which the CBD industry is considered as a red flag industry.

Also Read: How to Avoid Charge and Fraud backs in CBD Payment Processing

3. Reputational Risk:

Though CBD is not intoxicant like THC, it is well associated with cannabis. So, many banks and processors worry about their reputation and compliance obligations when serving businesses related to the broader cannabis space. This form of stigma leads to lesser processors to take on CBD clients.

Also Read: How Much Money is Needed to Start a CBD Business

4.Banking and Card Network Restrictions:

Some prominent card networks and banks have internal policies or restrictions for processing CBD transactions.

Such limitations raise the complexity and risk for third-party processors who must negotiate these barriers and ensure legal compliance.

Such factors make CBD businesses less fascinating to traditional payment processors, making them into the high-risk category.

Also Read: Which Bank Supports CBD Business

Why do CBD Businesses Need a High-Risk Merchant Account?

1. Denied by Traditional Banks:

Traditional banks often avoid CBD industries that are not clearly regulated. Most of the CBD merchants do not get standard accounts, even if they are operating business legally.

Also Read: How to Start a CBD Dispensary in California

2. Payment Gateway Compatibility:

High-risk accounts are often associated with secure, CBD-friendly payment gateways that integrate with eCommerce platforms like Shopify, WooCommerce, and BigCommerce.

Also Read: Understanding CBD Payment Terms

3. Protecting Against Sudden Shutdowns:

CBD businesses pose a risk that their accounts might get frozen or terminated with little notice if they do not operate with high-risk accounts, which leads to loss in revenue and customer trust.

Also Read: Why Traditional Banks Reject CBD Merchants

4. Compliance Support:

Specialized providers are more aware of CBD regulations and will help to keep your business compliant, thus reducing the chances of fines or legal trouble.

Also Read: CBD Content Strategy

5. Interactive Feature: Compare Merchant Account Types:

Use interactive comparison tables to easily evaluate high-risk vs. traditional merchant accounts on the basis of fees, support, features and restrictions.

Also Read: 8 Best Marijuana Marketing Strategies

Key Features of a High-Risk Merchant Account:

1. Rolling Reserves:

High-risk processors may hold back 5-10% of each transaction for almost 30-180 days. It helps to cover potential chargebacks or fraud.

Also Read: How Fast Payouts Can Improve Your CBD Business Cash Flow

2. Chargeback Protection and Monitoring:

High-risk accounts often use tools to monitor chargebacks in real time. Most providers like CBD Merchant Solutions provide fraud detection, alert systems, and dispute management platforms that help merchants to stay under the 1% chargeback rates.

Also Read: How to Protect Your CBD Business From Payment Processor ShutDowns

3. Customized Payment Solutions:

CBD merchants gain from different features like recurring billing, mobile payment options, ACH transfers, and even crypto acceptance. Such customized tools help various business models that includes subscriptions, direct-to-consumer, and wholesale.

Also Read: Why Every CBD Business Needs a Customized POS System

4. Dedicated Account Management:

High-risk processors often assign dedicated and experienced account managers in negotiating CBD industry regulations unlike standard accounts. It helps to assist in setup, compliance audits, and scaling operations.

Also Read: How Do You Integrate CBD Payment Solution With Ecommerce Platforms

5. Secure Integration Options:

CBD Merchant Solutions emphasizes that strong integration options ensure smooth connection to your POS, online store, or accounting software.

API-based tools provide adaptability for custom-built websites and multi-channel platforms.

Try to select features you need most and create a list of recommended providers.

Also Read: Understanding CBD Payment Terms

How to Choose the Right High-Risk Merchant Account Provider ?

Assume that a CBD startup lost millions in revenue when their payment processors unexpectedly froze their account because of a sudden policy shift. Selecting the right high-risk merchant account provider is important in order to avoid such setbacks and ensure long-term stability, compliance and profitability. That is the main reason CBD Entrepreneurs turn to CBD Merchant Solutions, a Provider known for transparency and industry expertise.

Below are few points to consider while searching merchant account:

1. Industry-Specific Experience:

Try to work with providers who have many years of experience and also have a proven track record in the CBD industry. Their in-depth understanding of local, state, and federal regulations can have a positive impact that lead to smooth processing and prevent account termination.

Demand for CBD client case studies or testimonials to validate their experiences.

Also Read: Best Website Builders for CBD Business

2.Transparent Pricing Structure:

Most of the providers fascinate merchants with low rates, only to sometimes unknowingly spend on hidden fees later. Hence, demand on full disclosure for:

- Monthly and annual account fees

- Set up and application fees.

- Transaction and chargeback fees

- Rolling Reserve requirements

- Early termination clauses.

Ask for a sample contract and a third party(legal or consultant) to review the contract before you commit.

Also Read: How Much Does it Cost to Open a CBD Dispensary

3. Scalability and Flexibility:

You might start your CBD business on a small scale but could scale quickly. Ensure that the provider can serve higher volumes, multi-currency support, recurring billing and mobile payments as your operations expand.

Also Read: The CBD Industry Trends Challenges and Future Outlook

4. Technology Compatibility:

Ensure that your payment processor must integrate smoothly with existing solutions stack – even if you are using Shopify, WooCommerce, Magento, or a custom-built platform.

Inquire about:

- API documentation

- PCI Compliance

- Plugin support

- Multi-device POS compatibility

Also Read: Email Marketing for CBD Business

5. Chargeback Mitigation Tools:

The high-risk label is given to CBD business because of potential chargebacks. Experienced providers offer tools like:

- Fraud detection

- Chargeback alerts

- Dispute resolution platforms

- Real-time monitoring dashboards

Also Read: Best Ecommerce Platforms for CBD

6. Customer Service and Support:

Assess the responsiveness and quality of their customer service. Investigate about whether they provide:

- 24/7 phone and email support

- Dedicated account managers

- Onboarding assistance and training

Try to cultivate a team that understands the urgency of payment issues and gives timely, knowledgeable support.

7. Contract Terms:

There are many providers who may lock you into long-term contracts with high cancellation fees.

Search for:

- Month-to-month options

- Reasonable termination clauses

- No volume penalties

A provider will be confident in their service if they have transparent and flexible terms.

8. Reputation and Reviews:

Before selecting your provider ensure you check industry forums, Google reviews, and better business bureau ratings. Search for patterns – if many users mention experience of frozen accounts or unexplained fees, then it is not a good indication.

9. Reserve Requirements:

Reserve requirements in the CBD business are basically funds held by payment processors to cover chargebacks or disputes. Around 5-15% of monthly sales is held back to prevent any financial risk owing to the high-risk CBD industry. Reserves can hold back your cash flow.

Look for:

- Shorter holding times

- Lower reserve percentages

- Clear reserve release policies

Providers that provide upfront transparency on reserves only express reliability.

10. Compliance Support:

Search for processors who stay up to date with CBD regulations and proactively help your business to stay compliant. Some features might include:

Features should include:

- Automated ID verification

- Age verification

- Lab report documentation tools

By carefully assessing providers across different factors, you can avoid unnecessary risk, save money, and develop a strong financial foundation for your CBD business.

Traditional vs. High-Risk Merchant Accounts:

CBD businesses should understand the main differences between traditional and high-risk merchant accounts to select the right fit for your business. Traditional accounts serve mainstream industries with predictable risk profiles, while high-risk accounts are for businesses frequently facing regulatory audits, fraud risks or industry instability.

1. Approval and Onboarding Process:

- Traditional Merchant Account: serve mainstream industries with predictable risk profiles.

- High-risk accounts: serve businesses facing increased regulatory scrutiny, fraud risks, or industry instability.

2. Fee Structures:

- Traditional Merchant Account: offer lower transaction fees that range between 1.5 – 2.9%.

- High-risk accounts: offer higher fees that range between 3-7%, which is due to the increased risk they undertake. High-risk accounts include monthly fees, setup costs, and rolling reserves.

3. Chargeback Handling:

- Traditional Merchant Account: Traditional accounts may suspend or terminate service if chargeback rates go beyond 1%.

- High-risk accounts: High-risk providers provide tools to actively manage chargebacks, that includes alerts and fraud detection, which helps CBD merchants to maintain accounts smoothly.

4. Compliance and Support:

- Traditional Merchant Account: offers industry-specific compliance assistance.

- High-risk accounts: such accounts are more engaging, and provide help with CBD-specific regulations like labeling, testing documentation, and age verification systems.

5. Account Stability:

- Traditional Merchant Account: CBD businesses with traditional accounts might face sudden shutdowns as if a processor labels your business as risky, then your account could be frozen.

- High-risk accounts: High-risk processors expect volatility and are designed to support businesses like CBD from the first day itself. Understanding such differences ensures that your businesses align with a processor that supports both compliance and long-term scalability.

Common Pitfalls to Avoid:

The CBD business is distinct – and so are the challenges of setting up a high-risk merchant account. Though the right payment processor can fuel your growth, the wrong choices can often lead to account freezes, unexpected costs or even more worse – payment blacklisting from reputable providers. Below are some common mistakes that CBD Businesses can avoid.

1. Signing the Contract without reading the fine print:

For high-risk accounts, contracts are mostly long and dense, but skipping over any points is a costly mistake. Due to which merchants may unknowingly agree to high rolling reserves, early termination fees, or automatic renewal clauses.

So, before signing any contract, consider having your legal advisor or compliance team to carefully review the contract. Focus on fee escalation clauses, cancellation terms, and volume commitments that could probably lock you into an unfavorable deal.

2. Choosing on the basis of Price Alone:

Though it’s tempting to opt for the processor offering the lowest rates, this decision often causes failures. Low-cost providers may invest less on fraud prevention, chargeback support, or customer service – all are crucial parameters to check in high-risk industries.

Even if you are investing slightly, higher transaction fees can be well worth it if it means to pay for reliable uptime, stronger compliance assistance, and long-term stability – focus on overall value, rather than just cost.

3. Overlooking Integration Needs:

Try to ensure that your payment processor works smoothly with your existing systems – whether that’s an eCommerce platform, POS systems, or accounting software.

If you fail to integrate with POS systems can often cause costly manual workarounds or lost sales. Seek for plugin compatibility lists, API documentation, and must test integration on a staging environment before launching.

4. Underestimating the Risk of Chargebacks:

Chargebacks are one of the leading reasons why high-risk merchant accounts get closed. Most of the CBD business owners believe that a good product will protect them – but chargebacks may occur due to shipping delays, product misunderstandings, or unauthorized transactions.

While a chargeback rate of above 1% is a bad indication to most processors. Also try to implement real-time alerts, strong fraud detection tools, and transparent refund policies to passionately manage disputes and secure your account.

5. Failing to Monitor Compliance Changes:

CBD laws are continuously evolving, and payment processors mostly change their internal policies to review the latest federal and state guidelines. If you fail to keep pace with such changes it may often lead to sudden account freezes.

Select a merchant account provider that actively provides updates on regulatory shifts and provides compliance tools like age verification, uploads lab results, or for categorizing products.

Conclusion:

CBD merchants often face a hard road when it comes to payment processing. Regulatory uncertainties, changing legal frameworks, and high chances for chargebacks place these businesses straightly into the “high-risk” category.

While this classification may seem like a burden for CBD businesses, it actually paves way for specialized payment processors that can ensure long-term growth.

A high-risk merchant account isn’t just a band aid solution – it’s a foundational tool for navigating the CBD industry’s complex environment. Such accounts provide stability, chargeback prevention, fraud protection, and integration flexibility that traditional processors mostly do not offer.

For CBD businesses, the risks are high: payment processing is not about collecting money – it’s about gaining customer trust, smooth transactions, and consistent cash flow.

When you select the right provider, you get more than a payment processor you get a strategic partner who knows your industry and proactively works to safeguard your business.

The right merchant account provider will help to navigate evolving regulations, minimize losses from chargebacks, avoid account freezes or closures, and adapt as your business grows across channels and markets.

Always think of your high-risk merchant account provider as a part of your operational team. Their support will decide if you will flourish or just survive in a competitive market.

Nevertheless, all high-risk providers are not the same, so must review contracts closely. One must pay attention to warnings like unclear reserve policies, high early termination fees.

Look out for transparency, industry experience, responsive support, and technological compatibility while selecting a merchant account provider for your CBD business.

Never hesitate to negotiate as many providers are open to discussing terms – especially when you have thoroughly researched about CBD business and have clear expectations.

Recommend for lower reserves, shorter settlement times, or reduce fees whenever possible. Your profit is crucial, and a good provider will be flexible with reason.

At last, the right high-risk merchant account provides you the peace of mind in order to focus on what actually matters: establishing your brand, serving your customers, and expanding your market share.

If you still have any query about high-risk merchant accounts or why CBD requires a high-risk merchant account, then you may reach us at CBD Merchant Solutions expertise and we are more than happy to help you.

Frequently Asked Questions (FAQs):

1. Can CBD businesses use regular merchant accounts?

Generally, no. Because most traditional banks and low-risk processors avoid CBD transactions due to federal regulatory concerns. So, CBD businesses must work with high-risk processors which understand and support their industry.

2. What are the benefits of using a high-risk merchant account for CBD?

High-risk merchant accounts enable CBD businesses to accept credit cards online or in-store, access chargeback protection, and also work with providers who are familiar with regulatory compliance and product labeling requirements.

3. Are high-risk merchant accounts more expensive?

Yes, high-risk merchant accounts often come with higher processing fees, rolling reserves, and stricter contractual terms which provide essential access to payment infrastructure for high-risk sectors like CBD.