Introduction

As a CBD business owner, handling payment processing can feel like walking on thin ice. While the CBD market keeps growing exponentially, many traditional banks still consider it as “high-risk” creating obstacles that hardly mainstream retailers face.

One of the biggest hurdles in the CBD market is understanding CBD payment processors – complex, often unclear, and filled with hidden fees.

Even if you are launching your first dispensary or scaling a CBD store online, selecting the wrong payment processor – or misunderstanding the terms – can cost you penalties of thousands.

From excessive transaction fees to hidden monthly minimum fees, and unclear chargeback policies, knowing how to interpret is essential. Avoiding hidden costs starts with knowing the terms and fees to look for in your merchant agreement.

Begin by reviewing the transaction fees, that includes a percentage of each sale and a flat fee per transaction. While such fees may seem small, they add up quickly – if you are processing high volumes. And also one must be aware of monthly fees, gateway fees, and PCI compliance charges which are often included within the final charges.

Another crucial aspect is the reserve requirement – Certain CBD payment processors like CBD Merchant Solutions may withhold a portion of your sales in reserve to reduce risks, significantly impacting your cash flow.

Look out for termination fees or long-term contracts with automatic renewals. Well established CBD-friendly processors provide transparent terms, flexible contracts, and no hidden penalties.

Ultimately, also consider the payment schedule. By understanding your CBD payment terms and asking the right questions upfront will protect your company profits and avoid unwanted expenses.

This blog will walk you through the crucial payment terms every CBD merchant should know, avoid common traps, and provide you with practical tools to negotiate better rates and avoid hidden fees.

Do you understand the terms and conditions of your current CBD merchant account?

- Yes

- Somewhat

- No idea.

Also Read: CBD Terms of Payment

Why is CBD Payment Processing Different?

CBD payment processing varies significantly from traditional merchant services because of the industry’s legal complexities and high-risk classification.

Though hemp-derived CBD is legal federally in the United states due to the 2018 Farm Bill, inconsistent state laws and changing FDA regulations often create uncertainty that many traditional banks and payment processors would avoid.

Due to this, CBD businesses are frequently identified as “high-risk”. This kind of labelling to CBD businesses is due to potential legal liabilities, a higher-risk of chargebacks, and compliance issues.

Hence, many mainstream payment providers like PayPal, Stripe, and Square refuse to work with CBD merchants or apply strict limitations. This pressurizes CBD businesses to search for specialized high-risk payment processors to understand the unique requirements and usually charge higher fees.

Such processors often require transaction fees(4-6%), monthly account fees, and rolling reserves, where a certain percentage of sales is withheld for a period of time to cover potential risks.

Processing fees also make a marked difference. While other typical retail operations might pay 1.5% to 2.9% per transaction, CBD businesses often might have to pay between 4% to 7%. This markup shows the perceived risk, like chances for chargebacks, legal disputes, and regulatory fines.

On top of that, approval for a CBD merchant account requires a rigorous underwriting process. Processors will require Certificates of Analysis(COAs), a compliant website(free of medical claims), and proof of regulatory adherence.

In summary, CBD payment processing is distinct due to its regulatory uncertainty, higher financial risk and strict compliance demands. Understanding such challenges is the first important step towards seeking reliable and long-term payment solutions.

“Have you ever faced delays or rejections while setting up a CBD payment processor?”

What are your answers?

- Yes, multiple times

- Just once

- Not yet, but I’m preparing

- No, every process was smooth

Also Read: How to Secure Your CBD Business from Payment Processor ShutDowns

What Are CBD Payment Terms?

CBD payment terms to the contractual details set between CBD businesses and their payment processors, banks, or merchant providers about how and when payments are processed, settled.

CBD payment terms define the timeframe in which funds from customer’s payment transactions are transferred to the business’s bank account, which usually takes place daily, weekly, or longer based on the perceived risk of the CBD industry.

Payment processors impose strict conditions like rolling reserves, longer settlement periods, and higher processing fees due to regulatory uncertainties and the high-risk nature of CBD products.

A rolling reserve means to withhold a portion of funds to cover potential chargebacks or fraud, often held for 90-180 days.

Some CBD payment terms include:

- Transaction fees: the percentage charged per sale of CBD products(usually 4% – 7%).

- Monthly minimums: includes the minimum amount charged for each processing every month.

- Rolling reserves: a portion of funds withheld (certainly 10%) temporarily by the processors as a risk buffer.

- Chargeback policies: includes rules and fees owing disputed transactions.

- Payout schedules: The timeline to receive your funds – daily, weekly or longer.

Such terms are crucial as it impacts your cash flow, operational flexibility, and overall profitability. Understanding your CBD payment terms ensures that you are taken aback by hidden costs and better evaluate and compare providers.

Also Read: How to Integrate CBD Payment Solution With Ecommerce Platforms

Hidden Fees in CBD Payment Processing:

CBD Merchant Solutions emphasizes that hidden fees in CBD payment processing is a common concern, which is due to the high-risk transaction nature of CBD transactions and the tiering pricing structures utilized by payment processors.

CBD businesses should be aware of the fraudulent practices and search for processors with transparent pricing and clear fee structures. Arranging rates and reviewing statements is important to avoid overpaying.

Hidden feeds can be an underhanded way for payment processors to increase their profits at the expense of the merchants.

Also Read: Why do Business Struggle With Payment Processing and how can they Fix it

How Hidden Fees Happen in Payments?

Hidden fees can be at times accidental, but most of the times they are usually intentional – and unfortunately, such fees are more frequent than most merchants realize. Such fees can arise due to many reasons that include:

- The contract is written in a complex and intricate manner which will be difficult to understand about the fees.

- The merchant account sales person explains verbally about the fees, but the actual contract will be different than what was communicated. In such scenarios payment processors expect that the merchant will not fully review the actual contract.

- If new fees are added without any such terms in the contract in the first place. This would be one of the most untruthful ways of conducting business and if you are working with a processor as such then you should switch.

Also Read: How to Avoid Frauds and Chargebacks in CBD Payment Processing

Key Statistics on Hidden fees in Payments:

- Recent statistics suggest that 65% of small businesses experience hidden fees in their payment processing agreements.

- Almost 52% of merchants reveal that they are not fully aware about the fees written in their payment processor contracts.

- Reports suggest that 1 in 3 businesses in high-risk categories like CBD are paying about 10-15% more yearly due to undisclosed or poorly explained fees.

- Around 78% of businesses were unaware of the clause until they attempted to cancel with early termination fees between $250 – $1000.

- Over 40% of businesses are charged with PCI compliance non-fulfillment fees, that should be avoidable, which costs merchants up to $40/month.

- Nearly 60% of the businesses are affected by rolling reserves that last for up to 180 days, which is a common hidden fee in high-risk industries.

Also Read: CBD Terms of Payment

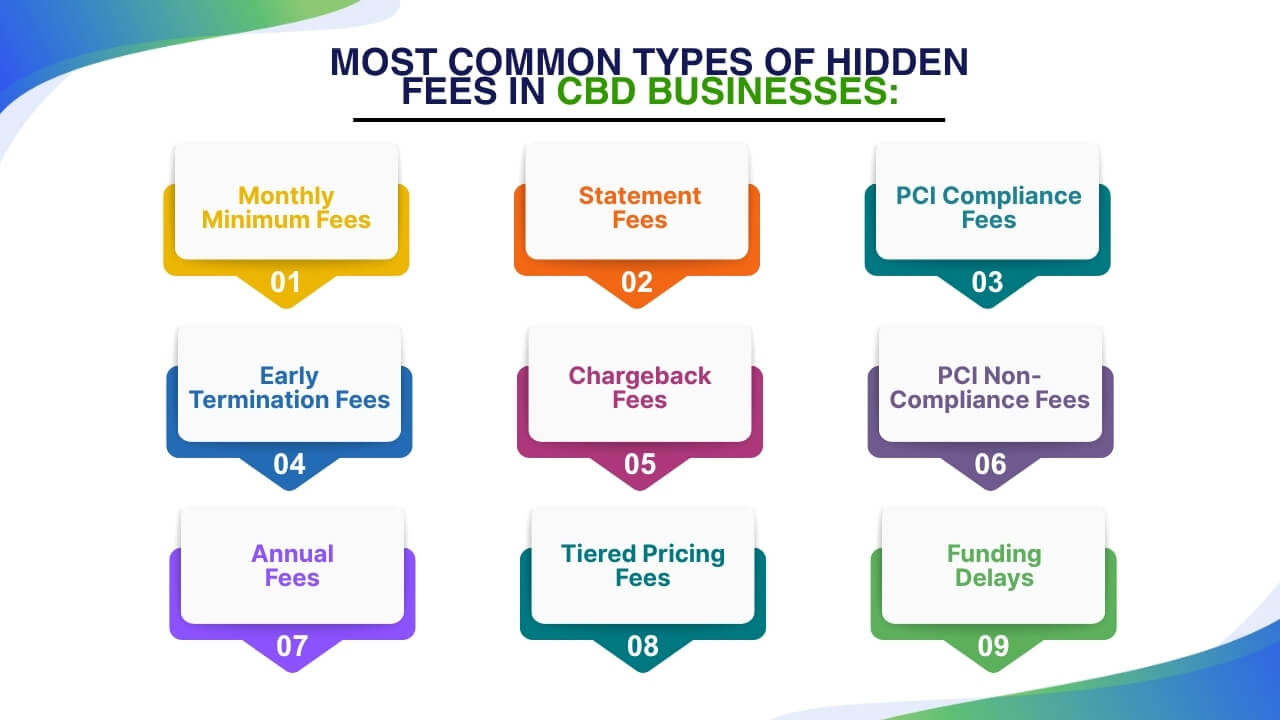

Most Common Types of Hidden Fees in CBD Businesses:

Most of the fees considered are standard fees, though at many times, certain fees are not verbally communicated or sometimes not included in the merchant account contracts. Some of the most common hidden fees that surprises merchants includes:

1. Monthly Minimum Fees:

This fee is applied when a merchant fails to reach a minimum required amount in transaction processing fees for a month. Such fees may discourage merchants as the fee is charged even during months with little or no transaction activity.

Also Read: How do Fast Payouts Can improve Your CBD Business CashFlow

2.Statement Fees:

This fee is applied for the delivery of paper or electronic statements.Though this fee seems straightforward, some merchants are unaware of these fees until they view them on their first bill.

Also Read: Selling CBD Products Online

3. PCI Compliance Fees:

Payment Card Industry(PCI) compliance is compulsory fees for businesses processing credit card transactions. Such processors charge yearly for the PCI compliance review. PCI compliance fees are certain times hidden or not fully disclosed.

Also Read: How to Choose the Right CBD Merchant Account

4. Early Termination Fees:

This fee is applied when a merchant decides to end their contract before the agreement period. The terms for early termination fees can be complex and the charges for early exit can be hundreds to thousands of dollars.

Also Read: Why Traditional Banks Rejects CBD Merchant

5.Chargeback Fees:

Though this fee is not entirely hidden, the chargeback fees are often not discussed in detail. Each chargeback may have a substantial fee, which is beyond the cost of the refunded transaction.

6. PCI Non-Compliance Fees:

This fee is applied when a merchant fails to maintain PCI compliance which will be substantial monthly non-compliance fees.

Also Read: Is CBD Legal in all 50 States

7. Annual Fees:

Certain processors charge an annual fee for using their services. Annual fees are billed due to account maintenance, software updates, or overall service keep up.

Also Read: Can You Sell CBD on TikTok

8. Tiered Pricing Fees:

Tiered pricing is a form of pricing method where the price of a product or service differs on the basis of quantity purchases or the level of features included. It often leads to higher fees because types of transactions are grouped into categories which might result in overcharge for some transactions.

Also Read: How Fast Payout Can Improve CBD Business CashFlow

9. Funding Delays:

Though funding delays cannot be considered as hidden fees, it impacts your cash flow. It occurs when payment processors hold payments to merchants due to risk or fraud which is unexpected charges for merchants.

Also Read: How Much Money is Needed to Start a CBD Business

Is there Regulation in CBD Payment Processing?

Though there are no specific federal regulations for processing CBD transactions, some payment processors may have their own guidelines or instructions. It is important to review policies before selecting a processor to ensure compliance.

Due to the legal grey areas surrounding CBD and FDA’s lack of approval, are the main reasons why CBD businesses are often considered high-risk which may impact payment processing.

Even though hemp-derived CBD is federally legal under the 2018 Farm bill(but it should contain less than 0.3% THC), the absence of federal guidance on payment processing makes many merchants operate a complex working CBD environment.

There is no such single regulatory authority that looks after how CBD payment processors operate. Rather, merchants must comply with:

- Federal financial laws

- Card network rules(Visa, mastercard, etc.)

- State specific CBD laws

- Internal policies of individual processors and sponsor banks

Such a segregated environment results in inconsistent policies on reserves, chargebacks, compliance requirements.

Also Read: How to Choose the Best CBD Payment Processing Company

Card Network Influence:

Mastercard and Visa have their own guidelines for high-risk industries like CBD. It includes transaction monitoring and reserve fund requirements. Yet such policies are not often communicated clearly, leading to unexpected fees or account suspensions.

Why Regulation Matters?

CBD is considered high-risk as the processors mostly impose stricter terms without oversight, that include rolling reserves, higher-than-average fess, and compliance expectations. Such hidden fees might attract inspection if they are left unchecked.

Also Read: How Much Does it Cost to Open a CBD Dispensary

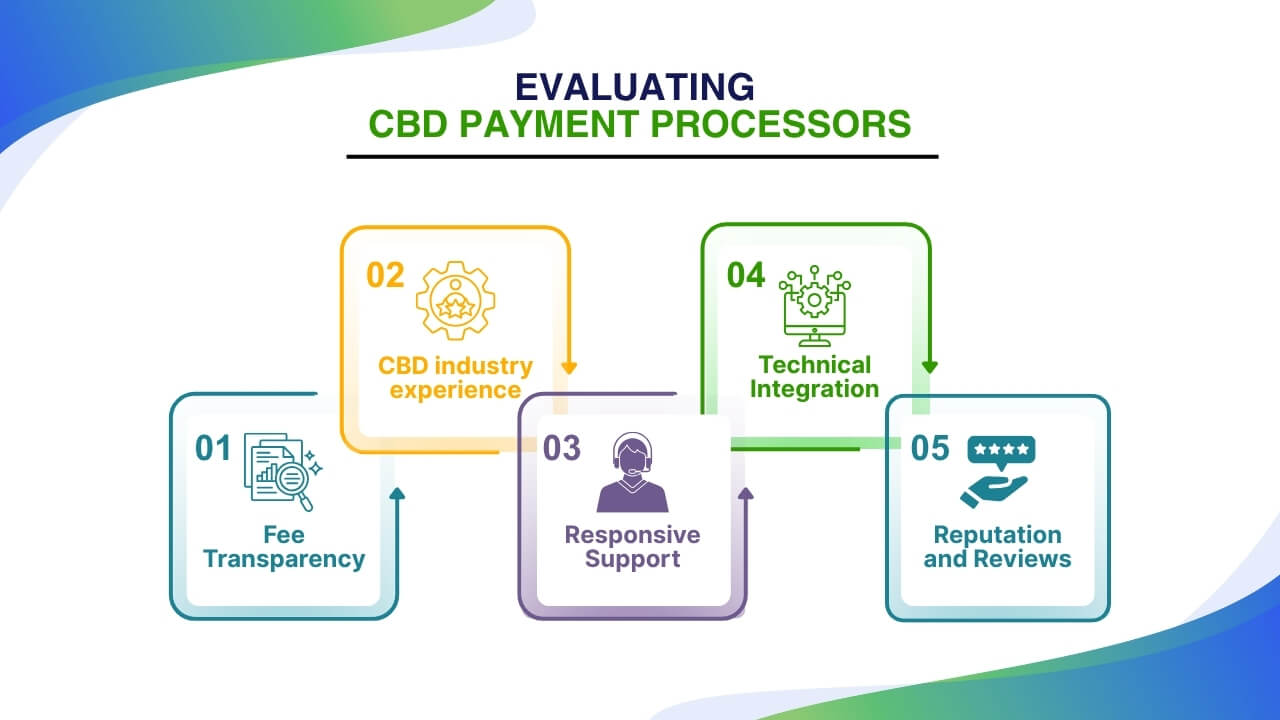

Evaluating CBD Payment Processors:

Choosing a payment processor for CBD business is not just about selecting the cheapest option – rather, it’s about finding a long-term partner that provides specialized features for high-risk industries, specially required for the CBD sector.

Below are five important factors to evaluate:

1. Fee Transparency:

Search for processors with complete transparency on all fees: setup, transaction, reserve, chargeback, and monthly charges. Try to avoid processors with unclear pricing models.

Also Read: CBD Merchant Account Vs Regular Merchant Accounts

2.CBD Industry Experience:

Select a processor with a proven track record in the CBD or hemp industry. Such experiences help with risks of unexpected account closures, fee changes, surprise fee hikes, or compliance mistakes that could interrupt your CBD operations.

Also Read: The CBD Industry Trends, Challenges, and Future Outlook

3. Responsive Support:

Try to ensure that customer service is reliable, accessible via phone or live chat, and knowledgeable about CBD-related concerns.

Also Read: How to Expand Your CBD Business to New Market

4. Technical Integration:

Integrate your processors with your POS, eCommerce cart, and inventory systems to prevent data silos or operational inefficiencies.

Also Read: CBD POS System

5. Reputation and Reviews:

Try to inquire about references and check how the processors handle disputes and chargebacks. Research online reviews, testimonials, and case studies.

Negotiating Better Payment Terms:

Don’t assume that your payment processing terms are fixed – many payment providers are open to negotiation. In the competitive CBD market, the right strategy will result in lower fees, fewer restrictions, and stronger long term financial stability.

1.Know your Numbers:

Before negotiations, understand your transaction volume, chargeback rate, and refund history. Such data gives you support to argue for lower fees or reserves.

2.Request Fee Reductions:

If you process high volumes or have a clean track record, then many processors will accommodate. Due to which you may ask for lower transaction percentages, reduced rolling reserves, or waived set up fees.

3.Negotiate Trial Periods:

Recommend a 3-6 month trial with less fees or flexible terms. Demonstrate your reliability during the window period and use it as support for permanent adjustments.

4. Push for Transparency:

Request for a detailed breakdown of all fees and hold on for clear language and keep away from processors who oppose full disclosure.

5.Get It in Writing:

Ensure you always confirm negotiations through email or contract addendum, because verbal agreements mean little.

Staying Compliant and Fee-Savvy:

CBD Merchant Solutions emphasizes that being in the CBD industry, staying compliant is not just about legally – it’s about securing your merchant account and preventing costly penalties.

Payment processors frequently impose strict terms on high-risk businesses, and even small blunders can lead to hidden fees or sudden account closures.

Begin with PCI DSS compliance – your business must ensure that your business meets these security standards in order to protect customer data and prevent monthly non-compliance fees.

Track chargeback ratios, and it should be below the 1% threshold. High chargebacks not just damage your reputation rather also invite additional fees or stricter reserve requirements.

Practice regular statement reconciliation to find errors or unexpected charges. Ensure you review your processor agreement every 6-12 months to confirm that the terms have not been changed. And if you find unclear or inflated fees, then immediately document them and prepare to renegotiate.

Educate your team on how to handle transactions, refunds, and disputes properly. Many times, small operational changes can significantly reduce processing costs.

Utilize Monthly Cost Calculator to guide your fees and identify what exactly you should be paying based on volume and transaction type. By staying money-smart and compliant, you not just protect your cash flow- you build a resilient and scalable CBD business.

Conclusion:

Understanding CBD payment terms and avoiding hidden fees in CBD payment processing is important for businesses in the cannabis industry.

CBD payments are considered high-risk, higher transaction fees, potential reserve accounts, delayed payouts, and stricter underwriting requirements.

Due to which businesses should carefully review contracts, ensure they understand all fees, compliance, chargeback fees and select payment processors specializing in high-risk transactions.This process isn’t just a matter of cost – rather a matter of survival in an increasingly competitive and regulated industry.

Too many merchants unknowingly lose thousands every year to hidden fees, inflexible contracts, and unclear compliance expectations. But with the right knowledge, you can turn your payment processor from a financial burden into a strategic partner.

By excelling at terms like rolling reserves, settlement times, and PCI compliance, you place your business at a place to avoid common dangers. Evaluating processors with transparency and industrial experience helps to ensure long-term success.

Perhaps, actively negotiating and auditing your feeds keep your business margins healthy.

Your Action Plan:

- Review your current processing agreement.

- Utilize payment term glossary, calculator, and script tools to find and overcome hidden fees.

- Compare processors using interactive tables.

- Take our compliance quiz to measure your risk.

In the CBD business, being proactive about payment terms isn’t optional – it’s essential. Transparency, education, and assertive negotiation are the best tools for fixing fair payment terms and growing sustainably.

Take charge of your CBD business by eliminating confusion around payment terms—transform hidden fees into strategic savings and protect your margins with informed choices and proactive financial oversight.

If you are still having any confusion about CBD payment terms or surrounding hidden fees, then you may reach us at CBD Merchant solutions expertise and we are more than happy to assist you.

Frequently Asked Questions (FAQs):

1. What are hidden fees in CBD payment processing?

Hidden fees include transaction charges, service fees, chargeback fees, or unexpected costs due to compliance checks. Such fees are not disclosed upfront, but often lead to surprises when the bill arrives.

2. How can I avoid hidden fees in CBD payment processing?

To avoid hidden fees, ensure you thoroughly read your contract, ask for a breakdown of all costs, and ensure the payment processor is transparent about all charges. Additionally, you must consider working with processors who specialize in CBD businesses for clearer terms.

3. How can hidden fees affect my CBD business?

Hidden fees can significantly impact your profits, making it harder to manage operating costs and maintain competitive pricing. Understanding your payment terms up front helps prevent unexpected costs which could impact your CBD business.