Introduction

CBD, derived from a cannabis plant, is considered as a high-risk product category by most traditional payment processors even when it is frequently sold throughout the nation. Although legal, processing payments in this area poses some risks to banks and processors. This indicates that there are not so many payment processors available that are ready to handle CBD businesses.

Selling CBD items has its own unique challenges, mainly in terms of payment processing. Due to regulatory challenges and banking limitations, businesses need to find CBD-supportive payment processes to achieve error-free transactions. Through this blog we are trying to address the main elements of CBD payment processing, legal factors and best practices.

As a result, legal complexities surrounding CBD poses serious issues for CBD sellers in receiving payment and obtaining necessary banking services.

The unclear legal status of CBD products is the main reason behind this high-risk classification by banks, payment processors, and insurance providers.

In this blog, we will explain in more detail why CBD is considered “high-risk,” and also offer a complete guide on how to select the ideal CBD payment processor, mentioning some of the choices available to utilize.

Also Read: How to Choose the Best CBD Payment Processing Company

Why Is CBD “High-Risk” in Payment Processing?

CBD poses a “high-risk” factor in payment processing due to its association with the cannabis industry, has prevailing uncertainty in regulations, and there is high risk for chargebacks and fraud. Consequently, financial institutions apply more rigorous inspections to transactions involving CBD.

Here’s a more detailed explanation:

1. Association with the Cannabis Industry:

CBD, which comes from cannabis, tends to be associated with the cannabis industry, which by itself faces legal and regulatory constraints and thereby creates an anxiety of possible legal consequences and regulatory offenses for the banks.

Also Read: The Best Marijuana Marketing Strategy

2. Regulatory Uncertainty:

The legal situation with regard to CBD is uncertain at the state level and is subject to change, creating a gray area for payment processors and banks.

Also Read: How to Expand your CBD Business to New Market Without Payment issues

3. Reputational Concerns:

Reputational risk is exposed to payment processors and banks in case they become aligned with companies marketing products which are not strictly regulated or formerly problematic.

Also Read: How Fast Payout can improve your CBD Business CashFlow

4. Chargebacks and Fraud:

CBD businesses particularly online are open to chargebacks and fraud. Online CBD companies are vulnerable to fraud and chargeback due to cardless transactions. There could be chances for consumer’s dissatisfaction with the efficiency of product purchased are the issues that may lead to chargebacks and fraud.

Also Read: How to Avoid Chargebacks and Frauds in CBD Payment Processing

5. High-Risk Merchant Accounts:

Businesses in the CBD sector especially require merchant accounts that specialize in high-risk sectors, which usually come with higher fees and strict conditions.

Also Read: How to Get a Merchant Account for CBD Business

6. Unverified Claims:

CBD products often make claims that are difficult to verify, which might lead to customer dissatisfaction and increase in number of customer complaints.

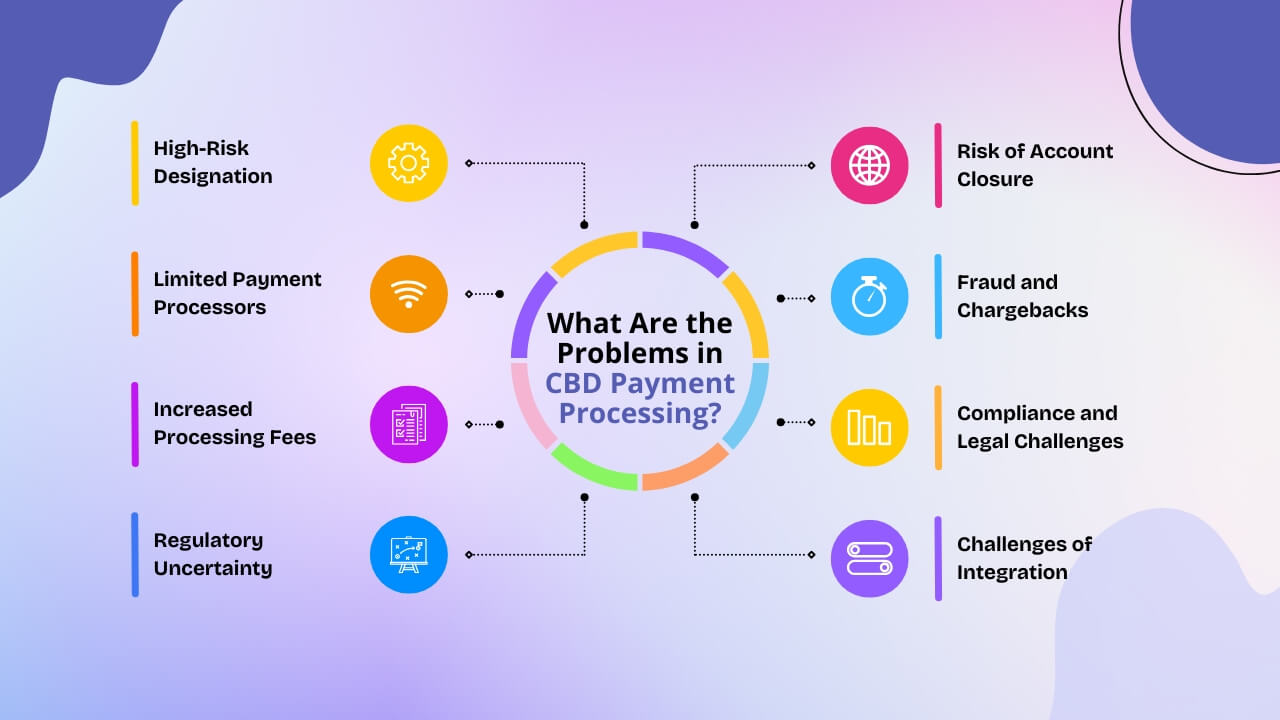

What Are the Problems in CBD Payment Processing?

CBD businesses struggle a great deal with payment processing due to the industry’s “high-risk” designation, leading to difficulty finding compliant payment processors, higher fees, and potential account closure.

Here’s the analysis of the key issues:

1. High-Risk Designation:

CBD products, even with their growing legality, tend to be classified as “high-risk” by banks, resulting in hesitancy to process transactions.

Also Read: How to Protect your CBD Business From Payment Processor ShutDowns

2. Limited Payment Processors:

CBD products frequently come with assertions that are challenging to substantiate, resulting in customer dissatisfaction and an increase in grievances.

Also Read: Why Every CBD Business needs a Customized POS System

3. Increased Processing Fees:

CBD companies usually pay higher transaction fees and other expenses related to being considered a high-risk business.

Also Read: Why Do CBD Business Struggle With Payment Processing

4. Regulatory Uncertainty:

The law around CBD is still in flux, generating uncertainty and making it hard for payment processors to evaluate and deal with risk.

5. Risk of Account Closure:

CBD companies are prone to unexpected closure of accounts by payment processors or banks if they feel the company is breaching terms or policies.

Also Read: How to Open CBD Business Bank Account

6. Fraud and Chargebacks:

The inseparable risks associated with the industry result in higher incidences of fraudulent transactions and chargebacks, thereby increasing expenses for CBD companies.

Also Read: How to Avoid Frauds and Charge Backs in CBD Payment Processing

7. Compliance and Legal Challenges:

CBD businesses must invest a significant amount of time researching upon the set of rules and regulations surrounding the products, often a complex task for the companies.

8. Challenges of Integration:

Payment gateway integration with current systems can be complicated, particularly for CBD companies with special needs.

What Makes Your CBD Business Need a Specialized Payment Processor?

In the beginning, it is important to acknowledge the challenges associated with CBD industry, irrespective of its quick expansion, is still considered as uncertain for partnerships by banks and other payment service providers.

This type of classification to the industry is due to the varying rules in different regions,public opinions, frequent chargebacks and a complex regulatory environment which can be challenging even to the most experienced business owners.

Due to the legal complexities and proximities of financial losses, often traditional payment gateways avoid collaborating with CBD merchants.The perceived risks are too substantial, leading to a situation where CBD merchant accounts are not only denied but may also face sudden termination.

This is where specialized CBD payment processors become invaluable. Such processors are highly experienced in knowledge of the legal intricacies and have specifically tailored their services to meet the risks involved in selling CBD, which is important for maintaining stable and uninterrupted business operations.

In addition to transaction processing, CBD payment gateways provide essential guidance on maintaining compliance with legal requirements, a service that standard processors may not offer. Furthermore, they often include additional resources and services, such as assistance with fraud prevention, chargeback management, and even financial solutions like loans, all specifically designed for CBD enterprises.

Also Read: Secure Payment Processing for CBD Ecommerce

How to Select a CBD Payment Processor?

Selecting a CBD payment processor for your retail business is not to be taken lightly because of the special regulatory context that comes with CBD products. Here is an in-depth guide to help you navigate the process:

1. Search for CBD-Friendly Processors:

Not every payment processor is amenable to working with CBD companies because of the risk that the industry is believed to pose. Most traditional payment processors, such as PayPal and Stripe, do not accept CBD payments. Investigate payment processors that fully comprehend the CBD industry and laws and are familiar with processing CBD payments.

Also Read – How Much Does Average CBD Store Make

2. Compare Fees and Rates:

CBD businesses must find payment processors with secure payment gateways, fraud protection systems and PCI compliance for safeguarding your customer’s information. One of the best examples is CBD Merchant Solutions. Also check about the payment options supported by the processors like credit cards, debit cards, e-wallets and mobile payments.

It is also essential to find different fees for integrating the payment gateway into the systems that involve set up fees, transaction fees, monthly fees and other expenses.

Request the customer support provided by the payment processor, such as response time, sensitivity, and industry expertise.

Also Read: Guide to Start a CBD Business

3. Examining Payment Processor Needs:

Payment processors will also have certain needs for documentation and information from your company, like licenses, permits, product descriptions, and marketing materials. The proper CBD payment processing company will have a “TRUE CBD Program“ that collects all the documents necessary for CBD paperwork to authenticate your business is real.

Be prepared to offer a comprehensive business plan, financials, and documentation of compliance with state and federal laws. Certain payment processors can demand a reserve or rolling reserve to offset the risk of CBD transactions.

Also Read: How to Create an Effective CBD Business Plan

4. Thinking about Integration and User Experience:

Assess how easy it will be to integrate the payment processor into your current eCommerce platform, website, or CBD POS system.

For instance, the top-rated CBD POS system KORONA POS safeguards CBD retail business owners against the inconvenience of payment processor halts. KORONA POS is built with CBD businesses in mind and integrates processing agnostic.

This is to say that you can use any payment processor that suits you. In case you do not know what CBD payment solution is and how to use it, we can assist you in selecting a payment processor that easily interfaces with our system so that you can concentrate on operating your business.

Make sure the payment processor ensures a smooth checkout process for your consumers like CBD Merchant Solutions, that is, responsive design and mobile optimization. Get a payment processor that gives full reports and analyzes, so that you can analyze transactions, look at sales tracking, and catch trends.

5. Checking for Other Services:

Certain payment processors could also provide support services such as chargeback administration, recurring bills, and offshore payment processing that could be an asset to your business. Payment processors that deliver merchant account options mean you receive credit card payment directly without relying on a third-party processor.

Seek advice from industry consultants and peers

Reach out to industry specialists, attorneys, and other CBD companies to obtain information and suggestions on trusted CBD payment Solutions. Join CBD business organizations or discussion forums to exchange with other industry players and tap into their expertise in the usage of multiple payment processors.

Through meticulous comparison of CBD payment processors with these guidelines, you are able to find a reliable business partner well accustomed to the details of the CBD market and capable of providing compliant, secure, and fast payment processing services to your business establishment.

Also Read: CBD Social Media Marketing

Which are the Best Payment Processors for CBD business?

While numerous payment processors are available for merchants, only a select few are willing to work with high-risk accounts, such as those in the CBD sector. Fortunately, most CBD retailers can establish an account with the following three options, all of which are compatible with KORONA POS:

1. Square:

Processing Fees: The Square CBD Program features fees that differ from standard processing rates. These fees apply to all transactions conducted through Square, including those unrelated to CBD. Below is a summary of the fees you can anticipate:

– In-person transactions (tap, dip, or swipe): 3.5% + 10¢

– Online transactions (card-not-present): 4.4% + 15¢

– Recurring payments (card on file): 4.4% + 15¢

– API and Invoice transactions: 3.8% + 30¢

– ACH payments: 1.0%

Simplified Application Process: Joining the Square CBD Program is not a complex process. You will need to submit basic information regarding your business, such as:

– Typical transaction volume

– Details of your refund policy

– Recent bank statements

– Descriptions of your CBD products

– Links to your online store and social media accounts

– Certificates of Analysis (COAs) proving the Delta-9 THC content of each product

Commitment to Compliance: Square is focused on a safe and compliant platform for sellers as well as buyers. With evolving laws around CBD, they implement a strict application process so that all products are in compliance with federal and state regulations. They ban claims that CBD products can treat, cure, or reduce certain health ailments. To learn more about Square, see our review of Square POS.

Also Read: The Best Marijuana Marketing Strategies

2. Clearent by Xplor:

Services Provided: Clearent offers a comprehensive range of payment processing services specifically designed for CBD businesses. They deliver secure and dependable credit card processing tailored to the CBD industry. Clearent’s offerings encompass eCommerce, mobile, in-app payment processing, recurring billing, and invoicing solutions. Xplor services are customized as per the unique requirements of CBD business.

3. Paybotic:

Paybiotic is one of the leading CBD Payment Solutions for CBD business, widely known for its compliant and customized services for uncertain industries like CBD and cannabis. It involves unique features that make Paybiotic the best choice for CBD companies for payment processing.

Paybotic offers a variety of payment methods, including debit processing for PIN-based transactions and eCheck/ACH(ACH direct debit) for electronic checks and online payments. It also provides Level 2 and Level 3 data processing along with multiple gateway integrations.

Paybiotic has no setup fees and also there is a swift 48-hour approval process, from the very next-day funding which business can benefit from due to quick and economical onboarding experience. It involves virtual terminals, invoice billing, and options for recurring and installment billing, that gives CBD business a flexible and secure billing solutions.

Improved merchant services: Specializing in cannabis payment processing, Paybotic understands the intricacies of the industry and provides cost-saving solutions that include a complete cannabis banking program and intelligent safe cash storage. In addition, Paybotic provides merchant cash advances as a substitute for traditional business loans, giving companies flexible financial options.

Paybiotic also has business improvement initiatives which involve additional services like gift card programs, cannabis business insurance, and adjusted payment processing solutions for CBD and hemp. These offerings are designed to assist businesses in bolstering their brand, reducing risks, and increasing revenue opportunities.

What are the alternative payment methods available for the sale of CBD?

Unconventional Payment Solutions for CBD

A frequently asked question regarding CBD payment Solution is, “Is PayPal permitted for CBD transactions?” This inquiry often extends to other payment processing companies, but the answer is not simple. Each payment provider has its own policies concerning these products; for example, the CBD policy of Stripe differs from that of PayPal. Recognizing these distinctions is crucial.

Given that many conventional payment methods can pose challenges for CBD enterprises, it is worthwhile to explore some alternative options.

Integration of Cryptocurrency

The recent expansion of cryptocurrency and blockchain technology in the market makes it essential that these methods have been essential for transactions involving CBD products. This approach may serve as a practical solution for businesses facing challenges with conventional payment systems.

For individuals looking to explore cryptocurrency further, our article on choosing the right high-risk merchant service provider for your CBD enterprise is a valuable resource.

Transactions Using Stable coins

Stable coins are more stable as compared to traditional cryptocurrencies which are usually unpredictable. But they still enable companies to utilize the benefits of blockchain technology.

What are the policies of CBD payment processing?

Venturing into the Policies of Major Payment Platforms.

We have briefly introduced PayPal and Stripe, so we will now look deeper into the major payment platforms and where they stand when it comes to CBD payment processing.

Even though PayPal is one of the default payment platforms, it backs of from dealing with high-risk accounts that encompass transactions related to CBD products. This policy has been unchanged for a few years, although changes could happen in the future. Are there other alternatives? Having a third-party facilitator might be a possibility, but seeking other alternatives might result in a more simple and less complicated solution. PayCompass, for example, is a good alternative to PayPal.

The Evolution of Stripe’s CBD Policy

If you are inquiring, “Does Stripe allow CBD payments?” The response is unfortunately no. This well-known payment gateway has a similar policy to PayPal on CBD transactions, deeming them high-risk and therefore not allowing such payments. Although there may be potential future policy changes, it is best at this time to look at alternatives to Stripe.

Square’s CBD Program Overview

Then there’s Square. The good news here is that Square’s CBD policy is a bit more relaxed; however, taking part involves enrolling in their particular CBD program.

Conclusion:

The CBD business payment processing environment offers unique challenges, including bank restrictions, high-risk designation, and the requisite for regulatory compliance. Standard payment networks such as PayPal and Stripe are not friendly to CBD transactions, so companies look for payment processors that are favorable to the CBD sector.

For CBD businesses to work smoothly it is required to expand their payment options that includes credit and debit card processors, ACH and cryptocurrencies. Complying with federal and state laws will help avoid account shut-offs or legal issues.

Through the right selection of payment processors, maintaining transparency, and implementing fraud prevention mechanisms, CBD companies can create stable, long-term payment channels while successfully building their brand.

Frequently Asked Questions (FAQs)

1. What are the Benefits of CBD One Credit Card?

A CBD-One Credit Card or a payment processor that accommodates CBD transactions is essential for businesses aiming to accept credit and debit payments in a secure and compliant manner.

2. Is CBD accepted by Shopify Payments?

Shopify Payments doesn’t support the sale of hemp, cannabidiol (CBD), and tetrahydrocannabinol (THC) products.