The CBD sector has grown rapidly in recent years, and it is also expanding into the eCommerce space. This is a booming market but it also faces diverse challenges such as navigating a complicated ecosystem of laws, customer preferences, and technology developments followed by finding a trustworthy, safe, and effective payment processing partner.

However, as you are aware, in the fast-paced world of e-commerce, where every click matters, the efficiency, dependability, and security of payment processing can make or break a business. From assuring security measures to preventing fraud, and enhancing customer satisfaction – mastering e-commerce payment processing is critical for long-term success.

Whether you are new to an eCommerce business and are looking to find a reliable payment processor or maybe an established one(who wants to expand to an eCommerce space – this blog has got you covered.

We will explore the basics of CBD payment processors, the specific challenges faced by CBD businesses when it comes to payment processing, and the best practices for secure CBD processing.

Let’s get started.

Also Read: How to Choose the Best CBD Payment Processing Company?

Understanding the Payment Processing Services for CBD Businesses!

It is critical to understand payment gateways in the context of online transactions since they serve as the vital link between customers and businesses in the CBD market.

CBD merchant services are tailored platforms that enable secure and effortless payments for CBD products. Because of the regulatory constraints and the unique nature of the CBD market, traditional payment processors are typically reluctant to partner with CBD companies. This is where CBD merchant services come in, offering a solution tailored to the unique needs of CBD merchants.

These gateways provide features including fraud protection, age verification, and adherence to industry rules.

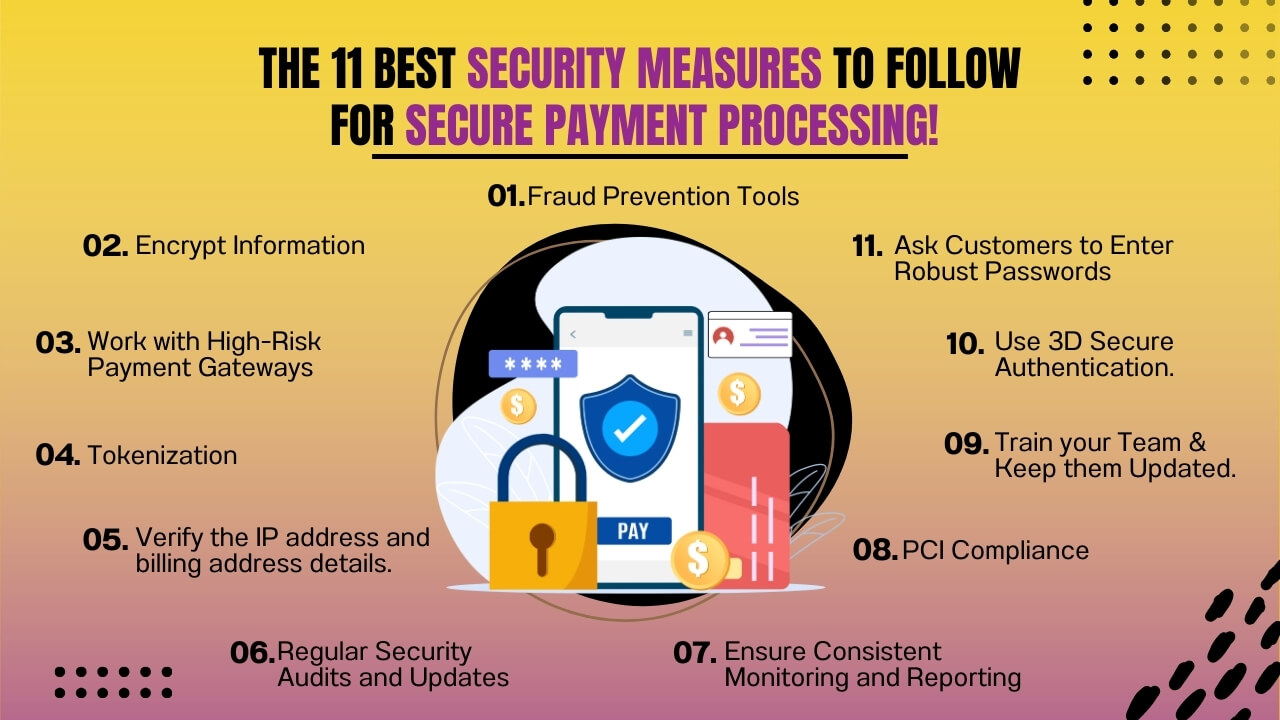

The 11 Best Security Measures to Follow for Secure Payment Processing!

1. Fraud Prevention Tools

Given the high-risk nature of the CBD industry, frauds and chargebacks are quite common for CBD eCommerce businesses. So, fraud & chargeback prevention should be a top priority.

Look for a payment processor that offers robust fraud detection tools to identify and flag unusual purchasing behavior or suspicious activities – followed by reliable support when it comes to verifying chargebacks and stuff. These measures can help reduce chargebacks and protect your business from fraudulent activities.

2. Encrypt Information

Transport Layer Security (TLS) and SSL Secure Sockets Layer (TLS) and other protocols encrypt and authenticate data as it flows over the Internet. SSL (Secure Socket Layer) encryption is non-negotiable for any e-commerce site, especially in the CBD industry, where the stigma surrounding legality can make customers extra cautious.

SSL encryption secures the communication between your website and your customers, ensuring that sensitive information—like credit card numbers, billing addresses, and login credentials—remains private. An SSL certificate also signals trustworthiness to your visitors, as most modern browsers will flag unsecured websites. It’s a basic, yet critical, security feature that helps protect your transactions and build trust.

Also Read: How to Get a CBD License?

3. Work with High-Risk Payment Gateways

One of the most important steps in securing payment processing is selecting an explicitly CBD-friendly payment provider. Due to regulatory restrictions, many traditional payment processors (like PayPal or Stripe) may not process payments for CBD products.

Instead, look for a processor that specializes in high-risk industries like CBD, hemp, and cannabis. These processors are well-versed in navigating the legal landscape and can ensure compliance with state and federal laws.

Additionally, they can easily handle the specific needs of industries like CBD, offering features such as higher chargeback tolerance, customizable fraud protection, and better risk management.

Also Read: Which Banks Support CBD Businesses?

4. Tokenization

Tokenization substitutes critical payment data with unique tokens, lowering the risk of theft during transactions. This method ensures that even if a breach occurs, hackers would only get useless tokens instead of real customer data.

Using tokenization helps reduce the risk of payment fraud and can provide an added layer of protection for your customer’s payment information. Furthermore, tokenization increases client trust and simplifies recurring payments.

5. Verify the IP address and billing address details.

Verifying information submitted at the time of the transaction can assist in identifying a possibly fraudulent transaction and safeguard the company before fraud happens. Address Verification Service (AVS) matches the buyer’s IP address to the billing address of the credit card to ensure that the client is the cardholder ensure the security of the transactions and reduce frauds or chargebacks.

Plus, also add the Two-factor authentication (2FA) adds extra security by requiring an additional verification step. These methods collectively reduce fraud risks and improve security for CBD businesses.

Also Read: Guide to Start a CBD Business

6. Regular Security Audits and Updates

CBD businesses are legalized after 2018, but there are quite a lot of laws and restrictions around it that keep on changing. Plus hackers are always on the lookout to exploit these high-risk businesses. So, being compliant is your only way to ensure a satisfied customer experience and ensure legal compliance as well.

And for that, make sure to conduct regular security audits, keep your software up to date and even your e-commerce platform and payment processing systems secure against updated security patterns and even evolving threats.

Many cyber-attacks exploit outdated software vulnerabilities, so it’s critical to apply security patches and updates as soon as they’re available. Regular audits will help identify any potential weaknesses in your security infrastructure and ensure compliance with industry standards.

Also Read: Marketing Ideas for CBD Business

7. Ensure Consistent Monitoring and Reporting

Another secure payment processing best practice for your CBD eCommerce business is effective monitoring and real-time reporting capabilities. So, while choosing the best CBD merchant platform, look after the consistent monitoring and reporting capabilities.

It helps you track suspicious transactions on the go and spot anomalies instantly so you can take the right actions promptly and ensure less or no harm. Following that – detailed reporting features can also help you monitor key metrics like chargebacks, refunds, and payment trends, giving you better control over your business’s financial health and security.

8. PCI Compliance

The PCI Security Standards Council is an international organization that upholds and advocates for compliance guidelines for handling cardholder data on all online payment systems and e-commerce websites and CBD eCommerce businesses are no exception.

PCI compliance is mandatory for merchants who handle, store, or send credit card information. Plus, it adds to the security & reliability of payment processors. A non-compliant company may face severe repercussions from a data breach, including expensive fines and penalties as well as serious harm to its brand.

Businesses should be proactive in understanding their responsibilities and compliance regulations, even while payment processors are crucial in helping merchants manage and maintain compliance.

So, while choosing the payment processing for your CBD eCommerce business, make sure it is PCI compliant and follows all the best practices.

9. Train your Team & Keep them Updated.

Make sure that everyone on your team is aware of what online payment security is and knows the best practices as well.

Your staff should be aware of the general process, and best practices, know when there is a (situation), and also be aware of how to handle a situation. They should also be able to answer any injuries and respond appropriately.

For that, you need to organize training sessions and seminars to fully guide your employees on data protection policies, various security measures and procedures, and other relevant subjects.

Also, CBD rules and merchant regulations are consistently changing – so keep your staff updated(throughout).

10. Use 3D Secure Authentication.

The 3D Secure authentication system provides CBD e-commerce merchants with vital protection against chargebacks resulting from fraudulent transactions, while also preventing unauthorized card use.

It strengthens transaction security by involving multiple parties—financial institutions, card networks, and merchants—in an information-sharing process that verifies each transaction in real time.

When a customer initiates a payment, 3D Secure adds an extra layer of authentication. If a fraudulent transaction does occur despite this extra verification, the liability for chargebacks may shift to the issuing bank, rather than the merchant.

So, make sure to choose the CBD payment processor that supports 3D Secure for robust customer authentication, minimizing unauthorized transactions, and enhancing overall trust among customers.

11. Ask Customers to Enter Robust Passwords

Cybercriminals attempt to get access to user accounts by using common names, birthdays, and easy numbers that are often used. To counter this, it’s crucial for CBD eCommerce businesses, to add strong password requirements for their customers.

A strong password policy should encourage the use of complex passwords with a mix of uppercase and lowercase letters, numbers, and special characters, making unauthorized access significantly harder.

Protecting customer accounts with a strong password can provide an extra layer of security. If the consumer is unable to remember their strong password, a “forgot your password” method must be in place to allow them to access their account.

This recovery method typically includes verifying the customer’s identity through a secure link sent to their registered email or a code sent to their phone. It ensures that only authorized users regain access to their accounts, maintaining both security and convenience for customers.

Bonus Point: Keep Your Customer Updated!

Last but not least – keep your customers updated about all the security measures you have in place. It helps you build trust but also enhances their confidence when shopping with your CBD e-commerce business.

Regularly updating customers on practices like strong password policies, two-factor authentication, and transaction verification reassures them that their personal and payment information is well-protected.

Transparent communication—whether through emails, website banners, or FAQ sections—empowers customers to take an active role in account security, reinforcing their sense of safety and loyalty to your brand.

Also Read: 10 Best CBD Business Ideas to Start

CBD Merchant Solutions has Got you Covered for your Payment Processing Solutions!

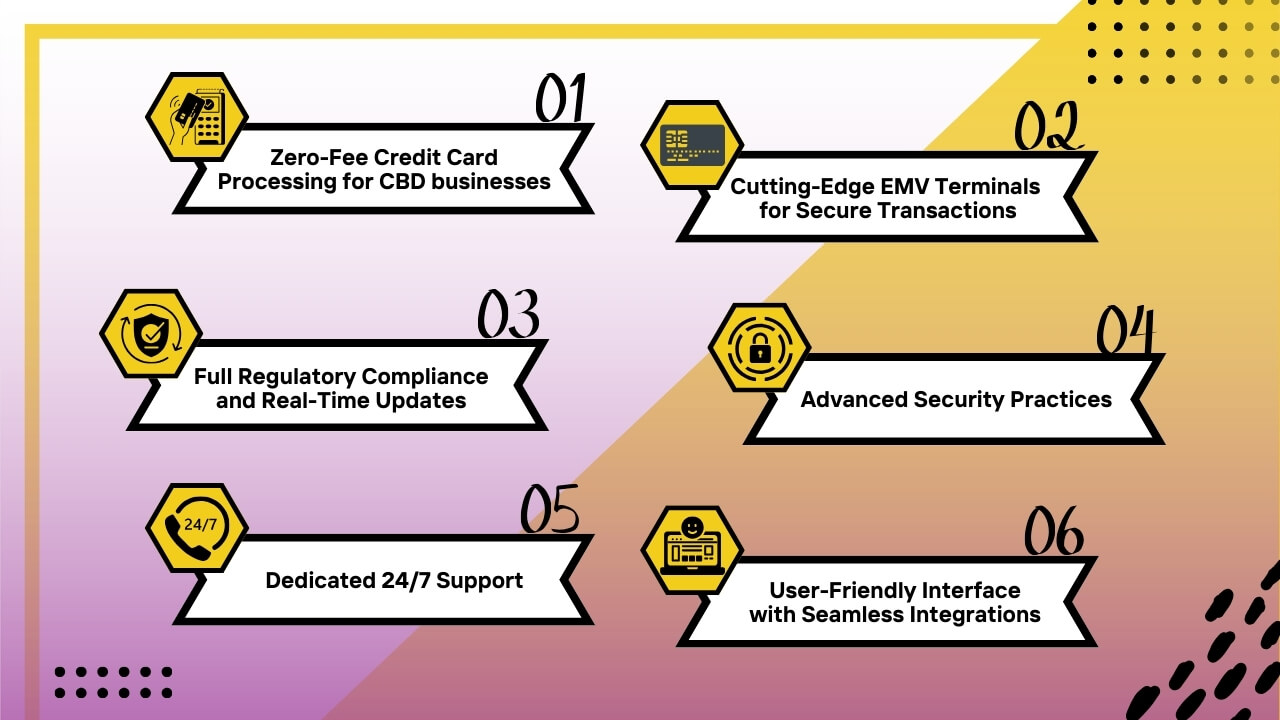

In the CBD industry, where regulations are complex and transaction security is critical, your business needs a payment processing partner who knows the ins and outs of both compliance and customer convenience. With extensive experience working alongside top CBD merchants across the USA, we’re committed to providing reliable, secure, and efficient payment solutions that help your business thrive. Here’s why so many CBD businesses trust us:

-

Zero-Fee Credit Card Processing for CBD businesses:

In times when payment processors charge hefty fees and have hidden costs – we offer businesses with zero-fee credit card processing solution without hidden fees. Better solutions, and affordable charges.

-

Cutting-Edge EMV Terminals for Secure Transactions:

We have integrated advanced EMV terminals with the latest chip technology to ensure each transaction is processed safely. These terminals also offer contactless payment options, enhancing customer convenience and risks associated.

-

Full Regulatory Compliance and Real-Time Updates:

Navigating the regulatory landscape of the CBD industry can be overwhelming. Our team stays on top of all compliance changes and ensures your business aligns with the latest requirements.

-

Advanced Security Practices:

Your security is non-negotiable, which is why we implement top-tier security measures, including full PCI compliance, tokenization, encryption, and end-to-end verification to name a few. These features protect customer data at every stage, reducing the risk of fraud and ensuring safe, secure transactions every time.

-

Dedicated 24/7 Support:

Issues can arise anytime, so we offer around-the-clock support to resolve problems quickly and keep your operations smooth. Our experienced support team is just a call away, ready to assist so that your business continues without interruptions.

-

User-Friendly Interface with Seamless Integrations:

Our platform features an intuitive, easy-to-learn interface designed to streamline your payment management. With seamless integrations into your existing tools and systems, you can efficiently track, process, and analyze transactions without disrupting your workflows.

To Conclude

Maintaining the security of online payments has become essential to operating a profitable CBD eCommerce company. One small flaw in the security system can provide criminals access to client information, allowing them to commit financial fraud. The client may suffer financial losses and your business may face severe legal consequences, such as penalties, tarnished reputation, lesser customer satisfaction, and decreased retention.

We are lucky to have access to cutting-edge security procedures that enable you to take consumer payments online safely while protecting your consumers’ personal information. Follow all available online payment security procedures in your company in order to provide clients with a safe and dependable experience.

One point that you shouldn’t forget is partnering with a secure, reliable, compliant CBD merchant payment processor.

If you are looking for one, check out our CBD merchant solutions. We are the leading CBD-compliant, secure, and efficient payment processor. To know more about us, how it works, and why we are the best us – connect with our team and we will guide you better.

Frequently Asked Questions(FAQs)

Why Choose CBD Merchant Solutions?

At CBD Payments, we recognize the unique challenges faced by CBD merchants and provide reliable customized payment solutions accordingly.

- Our credit card processing service ensures strict adherence to regulations.

- Transparency is at the core of our CBD merchant solutions company with clear and transparent transactions.

- You will get easy, instant, and next-day approvals. No more waiting for days and months to get the approval.

- Process with EMV/NFC & Virtual Terminal, or Online Processing as per your business needs.

Are Payment Gateways for CBD Lawful?

CBD payment gateways are lawful as long as they follow the restrictions established by the relevant authorities. To guarantee compliance and seamless processing, it’s critical to select a payment gateway that specializes in CBD transactions, abides by all the regulations and ensures secure & reliable services.

What are the fees associated with CBD payment gateways?

The fees for CBD merchant services vary from provider to provider. It is critical to investigate and evaluate many possibilities to determine which one provides the most competitive rates and transparent cost structure for your company.

Can I integrate a CBD Payment Gateway into my existing e-commerce platform?

Yes, through most of the CBD payment processing platforms, you can easily integrate it with your existing e-commerce platform and other business tools as well. However, while choosing the CBD payment processor for your CBD business – you need to ensure it is compatible with your existing tools.

Do you provide support and assistance for your customers?

We are aware that operational issues with processing payments can occur at any time. That is why we provide our customers with on-the-go help around the clock. In addition to regular payment services, we provide unique solutions intended for long-term growth.

When you work with us, you’ll be joining an innovation hub designed specifically for the success of your company, whether you need extensive training for your staff or want to be on the cutting edge of technology innovations.

What should I do if I experience a security breach?

If a security breach occurs, immediately inform your payment processor and follow their protocol for reporting the incident. Conduct a thorough investigation to assess the extent of the breach, notify affected customers, and take steps to mitigate any damage.