Introduction

The global CBD market has grown remarkably in recent years. This analysis indicates that the demand for CBD products is expanding at a rate above thirty percent annually in both the US and the EU.

In spite of the continuous legal complications associated with cannabis, selling CBD products has shown to be a profitable business. With more than 25 states legalizing marijuana sales in some form, an increasing number of cannabis businesses rely on banks for their everyday operations.

As per the latest data provided by the Associated Press, over 300 banks and credit unions in the United States are capable of managing transactions related to cannabis enterprises.

Nevertheless, finding appropriate business banking for CBD businesses might be difficult because many traditional banks are hesitant to accept these products until further study is done. In this blog, we will provide insights and ideas to help CBD businesses avail the best banking services.

Let’s dig in & get started!

Also Read: Which Banks Support CBD Businesses?

What are CBD-friendly Banks?

With the rise of CBD, there has also been an increase in CBD-friendly banks. For a very long time, banks and other financial institutions refused to work with CBD products.

Since there are significant legal and regulatory variations across states and hemp products are highly contentious, it is extremely difficult to sell and ship CBD throughout the different parts of the world.

This created problems for CBD companies, which made banks hesitant. If you’re a cannabis entrepreneur, it used to be difficult to set up a bank account, get finance, or obtain a loan.

Even if you received one, you had to pay hefty interest. Fortunately, things have somewhat improved, and as of right now, even some of the largest banks are willing to take a chance on CBD businesses.

Well, let’s understand more about the challenges that CBD banks face, their solutions, and how to open your business bank account with a simple guide!

Also Read: How to Choose the Best CBD Payment Processing Company?

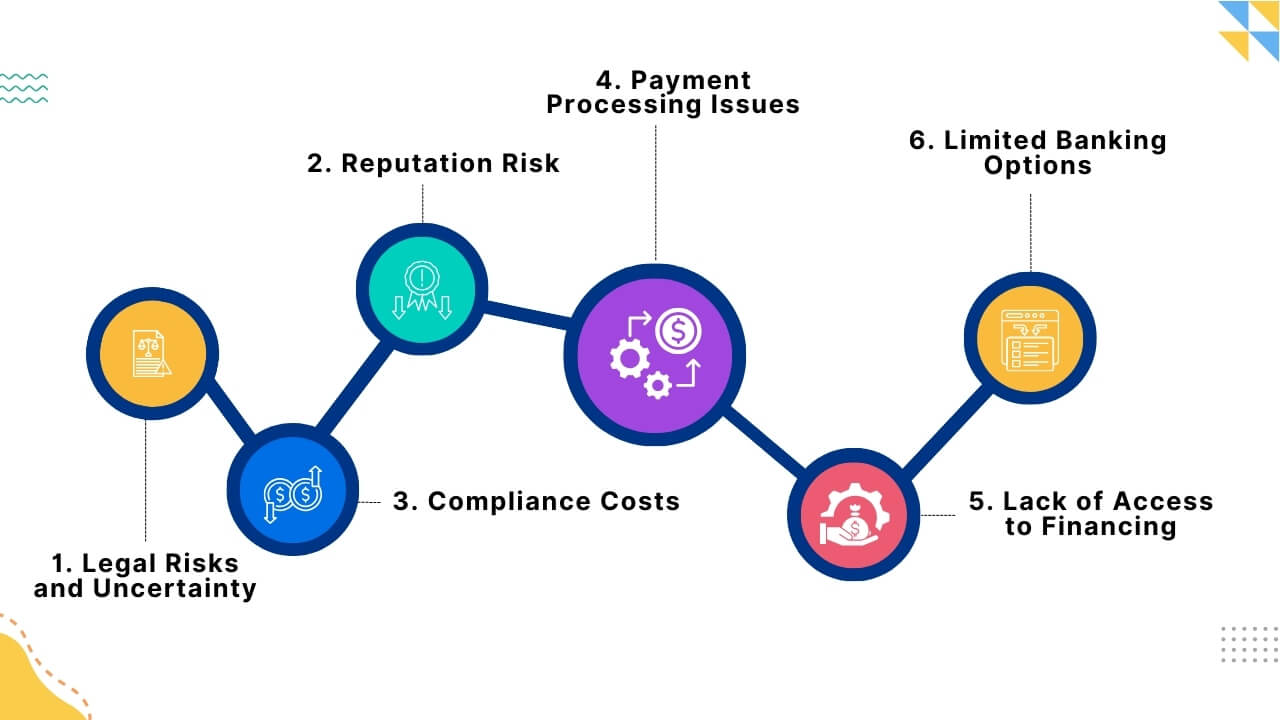

Challenges that CBD Businesses Face While Opening their Bank Accounts & for their Financing Needs?

Being a CBD business owner, before opening a bank account for your business financing and other needs, it’s important to be fully aware of the challenges that comes with it, and following up with the best practices to ensurea seamless process later on is quite important.

So, let’s find out about it.

1. Legal Risks and Uncertainty

Problem: CBD businesses face confusing laws. Even though the 2018 Farm Bill made hemp-derived CBD legal federally, marijuana is still illegal at the federal level. This mix of laws makes banks worry they might accidentally break federal rules by working with CBD businesses. Plus, the rules keep changing, making it hard for banks to stay compliant.

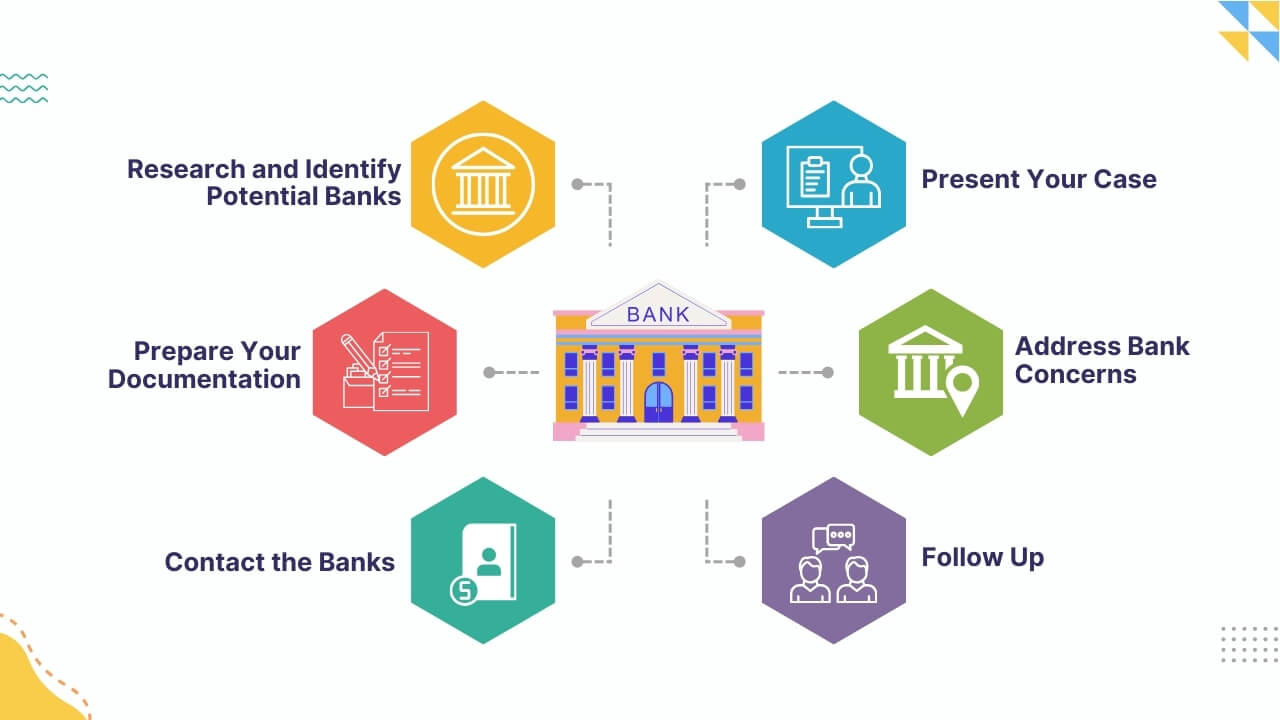

Solution: CBD businesses should keep detailed records of their operations, like where they get their CBD, how they produce it, and how they sell it. Hiring legal experts who know cannabis laws can help ensure they follow all rules. Sharing this information with banks can make them feel more secure about working with the business.

Also Read: How to Get a CBD License?

2. Reputation Risk

Problem: Banks care about their public image and worry that helping CBD businesses might hurt their reputation. Some people still confuse CBD with marijuana, and banks fear backlash from conservative customers or increased scrutiny from regulators.

Solution: CBD businesses can help by educating the public and banks about the differences between hemp-derived CBD and marijuana. Providing clear, factual information and engaging in public awareness campaigns can change perceptions. Additionally, targeting banks that already support high-risk industries or the CBD industry can reduce reputation concerns.

3. Compliance Costs

Problem: Banks have to spend a lot on ensuring they comply with laws when working with CBD businesses. This includes thorough checks and ongoing monitoring, which require extra staff and resources. These high costs make banks hesitant to work with CBD businesses.

Solution: CBD businesses can reduce these costs for banks by having strong internal compliance systems. This means regular audits, detailed record-keeping, and following industry best practices. Showing banks that the business is committed to compliance can make them more willing to offer their services.

4. Payment Processing Issues

Problem: Payment processors often see CBD businesses as high-risk, leading to higher fees and stricter terms. Many popular processors, like PayPal and Stripe, don’t work with CBD businesses, limiting their payment options.

Solution: CBD businesses should look for payment processors that specialize in high-risk industries and have experience with CBD. Building good relationships with these processors and showing compliance with legal requirements can help get better terms. Exploring alternative payment methods, like cryptocurrencies or CBD-specific platforms, can also provide more options.

Also Read: Secure Payment Processing For CBD Ecommerce

5. Lack of Access to Financing

Problem: CBD businesses often find it hard to get loans or credit from traditional lenders because of the perceived risks. Without access to financing, it’s tough for these businesses to grow and operate smoothly.

Solution: CBD businesses can look for alternative funding sources. This includes seeking investments from venture capitalists who understand the CBD market, using crowdfunding platforms, and joining cannabis industry groups that offer financial support. Keeping strong financial records and having a clear business plan can also make them more attractive to lenders and investors.

Also Read: Guide to Start a CBD Business

6. Limited Banking Options

Problem: Many banks refuse to open accounts for CBD businesses because of the legal and financial risks. This leaves CBD companies with few options for managing their finances, making everyday transactions and financial planning difficult.

Solution: CBD businesses should find banks or credit unions that specialize in high-risk industries or have a history of working with CBD companies. This can include smaller regional banks or online financial service providers. Networking, attending industry events, and joining trade associations can help businesses connect with these banks. Demonstrating strong compliance and financial stability can also improve their chances of getting banking services.

Also Read: Which Banks Support CBD Business?

To Conclude

Medical marijuana and CBD products are already legal in a variety of states and nations, and CBD is going toward full, transparent legalization rather than the other way around. All indications suggest that the cannabis sector will inevitably experience significant growth and potential profits.

Although, opening a bank account for your CBD business can be challenging due to regulatory complexities and financial industry hesitancies. However, by understanding and addressing the common challenges, following best practices, and following our simple guide, you can open your bank account and get your finances sortef.

Additionally, if you’re looking for further support in streamlining transactions and financing, consider reaching out to CBD Merchant Solutions. Our team of experts understands the unique needs of CBD businesses and can provide you with the best-in-class payment processing platform and POS system to further enhance your operations.

Don’t hesitate to reach out to us today and let’s get started on taking your CBD business to the next level.

Frequently Asked Questions(FAQs)

How quickly can I set up business banking for my CBD business?

With accurate paperwork, some providers banks, or credit unions can activate your account within 24 hours, but timeframes may vary. To get an accurate idea, you can ask the bank about the same, an expert, or even a competitor to get a better idea about the timeframes.

What are the typical costs of business banking for CBD?

The costs for business banking will vary from bank to bank, the location of your bank or the credit union; the location of your business, etc. You also need to consider the application fees, monthly service charges, separate transaction fees, and other costs. To get an accurate idea of that as well you need to consult with your bank or finance partner.

Which Are Some American Banks That Accept CBD?

There are a few banking alternatives that are CBD-friendly in the United States. Notable examples include Silicon Valley Bridge Bank, Timberland Bank, Keystone Bank, and various credit unions. Although their services and costs may differ, several financial institutions are willing to work with CBD businesses.

Why should I choose CBD Merchant Solutions over other providers?

CBD Merchant Solutions is dedicated exclusively to serving the CBD industry, providing tailored solutions that address the unique challenges and regulatory requirements of CBD businesses. Our expertise, comprehensive services, and commitment to compliance set us apart from general payment processing providers.

How do I get started with CBD Merchant Solutions?

Getting started with us is quite simple. You can reach out to us through our website. Just fill up the form with all the details and or team will get back to you. You can discuss all the queries you have and we’ll address it. On top of that, you can book a free demo to know how well it fits within your organization. If everything goes well, we’ll guide you through the process of setting up your merchant account, payment processing, or POS system, ensuring a smooth transition.