Introduction

The CBD industry is one of the globe’s quickest-developing sectors, with a range of offerings from wellness supplements to skincare. Popular as it is, however, CBD merchants struggle to find decent financial services.

Most CBD businesses are regarded by traditional banks as high-risk merchant accounts due to ongoing regulatory regulations, federal regulations, and legal complexity concerns around hemp-derived items.

As a result of these concerns, traditional banks are likely to decline merchant accounts, limit payment processing, and enforce strict compliance. Issues like regulation of THC content, chargeback concerns, and complex underwriting policies present additional challenges for CBD entrepreneurs.

Therefore, it is not uncommon for CBD companies to be denied merchant accounts, suffer frozen funds, or have their credit card processing privileges cut off suddenly without notice.

This restricts merchants from providing convenient payment options to customers, threatening both sales and brand credibility.

Fortunately, there are measures that consist of CBD-friendly banks, high-risk payment gateways, and specialized merchant service providers.

CBD business banking involves specialized solutions for high-risk merchants.

By knowing why banks don’t want to deal with CBD Solutions and looking into other payment processing options, business owners can discover secure, compliant methods of handling transactions and expanding their brand in this changing market.

Corepay, PayKings, Nomupay, QuadraPay, Easy Pay Direct, and AlliedPay are examples of high risk merchant providers.

Through this blog, we are trying to shed some light on why traditional banks do not accept CBD merchants and what the alternative payment methods are to be implemented.

Also Read: How to Open CBD Business Bank Account

Why is a CBD Business Considered High-Risk?

1. Federal Regulations:

CBD shops are typically classified as “high-risk” businesses by banks and payment processors because of a mix of regulatory risk and reputational risk.

The federal government’s attitude towards CBD is unclear, and state laws have varied greatly, which makes it an unpleasant position for CBD shops.

This uncertainty keeps payment processors at bay, fearing legal or reputation risk, particularly as CBD is a derivative of the federally controlled substance cannabis.

The federal position on CBD continues to change, while many states legalized or decriminalized CBD products.

Also Read: Which Bank Supports CBD Business Account

2. THC Content Regulations:

THC content laws for cannabis differ considerably worldwide, with some nations completely banning cannabis and others being more relaxed, such as legalizing cannabis for medical or recreational purposes.

In legalizing nations, THC content levels could be controlled for items to be sold, and the legal THC thresholds for cannabis products can also vary. Today, the United States, Canada, China, and the EU all considered hemp as being legal at THC content limits below 0.3 percent.

Also Read: 8 Best Marijuana Marketing Strategies

3. Legal Grey Areas:

Most cannabis ventures have difficulty gaining bankers since marijuana remains technically fully illegal as a Schedule 1 drug to the federal government.

Over 30 states have legalized marijuana for medical purposes, and 11 states currently have laws permitting use and sale of recreational marijuana, most recently being Illinois.

The 2018 Farm Bill made hemp legal, under new rules and regulations still being drafted and not yet enforced at either the federal or state level. And CBD is still in questionable legal grey areas.

Also Read: How to Create an Effective CBD Business Plan

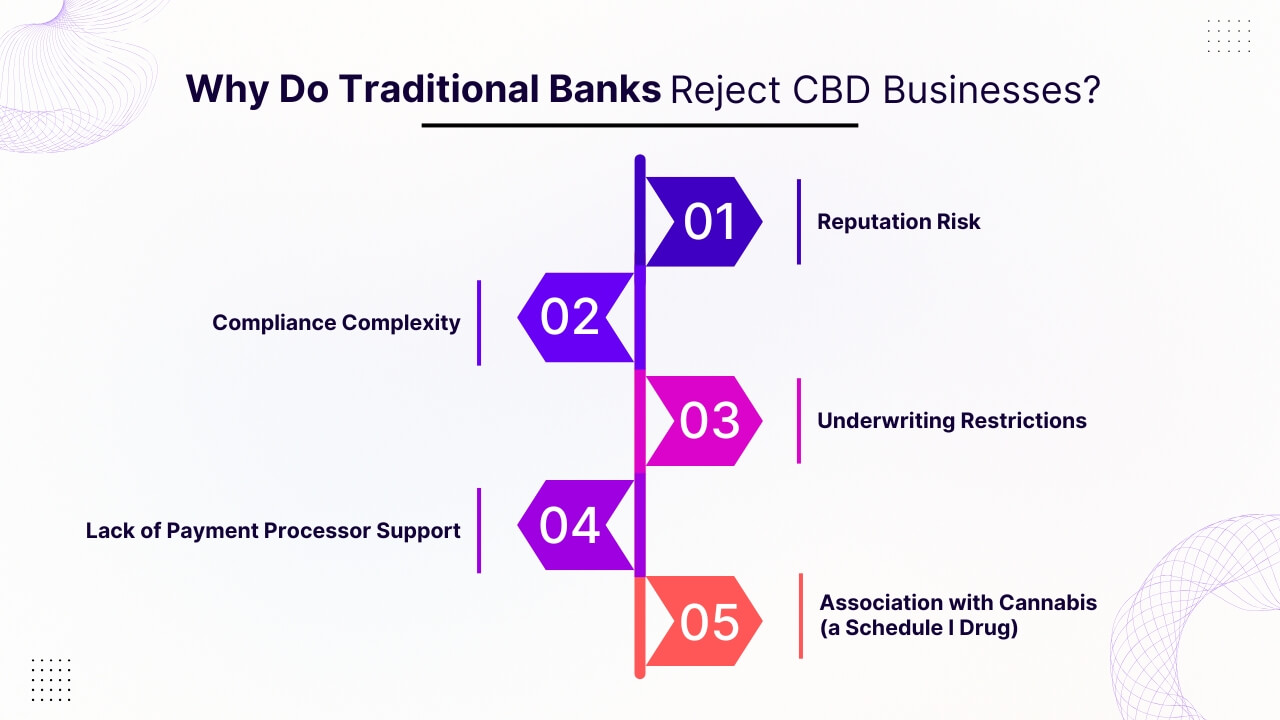

Why Do Traditional Banks Reject CBD Businesses?

1.Reputation Risk:

Many large banks fear that associating with sectors that are still “controversial” or federally gray-area (such as CBD and cannabis) may hurt their brand reputation among some stakeholders, regulators, or more conservative customers.

Associations with companies in federally grey areas such as CBD can pose reputational risks to banks. Banks have to think about how such alliances could be perceived by other customers, stakeholders, and regulators.

Even legitimate CBD businesses that operate within legal parameters could inadvertently draw unwanted attention to the bank.

Also Read: Can you Sell CBD on Tik-Tok

2.Compliance Complexity:

Compliance in the CBD business is very challenging owing to differing regulations at the state and federal levels, a changing legal environment, and the need for firms to comprehend limits on advertising and labeling.

CBD businesses are confronted with a complex compliance environment from mixed federal, state, and industry regulations.

While hemp-based CBD with less than 0.3% THC is legal under the federal system, the FDA excludes its use as an ingredient in food, beverages, and dietary supplements and regulates health claims associated with it.

State legislation is highly disparate, varying from differing labeling, testing, and selling requirements to more stringent regulation. The banking sector generally refuses to conduct business with CBD companies due to concern about regulatory risk and loss of reputation.

Furthermore, the advertising bans and stringent product testing conditions add to the complexity of conducting business, and thus the CBD market is one of high regulation and complexity.

Also Read: Why Every CBD Business Needs an Customized POS System

3.Underwriting Restrictions:

The underwriting of CBD businesses is greatly impaired by legal ambiguity, reputational risk, and compliance budget limitations.

The majority of large banks, insurance providers, and payment processors view CBD as a high-risk business, which requires more extensive due diligence, more documentation, and higher premiums.

The downfalls include determining product legality, determining THC content, keeping up with inconsistent state mandates, and monitoring possible infraction of FDA or FTC regulation.

Consequently, CBD companies have a tendency to depend on experienced high-risk underwriters or cannabis-friendly financial service firms.

Also Read: How to Protect your CBD Business From Payment Processor Shutdowns

4.Lack of Payment Processor Support:

CBD companies generally have a hard time getting payment processing assistance because their business is considered to be high-risk and the rules keep changing.

A majority of the payment processors, including mainstream players such as PayPal and Stripe, are unwilling to service CBD companies because there is the potential for loss and legal complications.

Payment processors assume financial risk by processing for CBD businesses because they open themselves up to being at CBD chargeback risks or lawsuits.

CBD businesses may be forced to seek other means of payment like cash, bank transfer, or cryptocurrencies to escape the limitations placed by traditional payment processing.

Also Read: How Fast Payouts can Improve your CBD Business Cash Flow

5.Association with Cannabis (a Schedule I Drug):

Although CBD is not marijuana, most banks categorize CBD businesses with cannabis-based businesses. As marijuana is still a Schedule I controlled substance on the federal level, any association adds perceived legal and reputational risk to banks.

This linkage to cannabis, whether justifiable or not, tends to cause automatic denial of CBD business banking applications and CBD credit card processing accounts.

Also Read: How to Market Cannabis

How to Get a CBD Merchant Account?

To acquire a CBD merchant account, you need to adhere to FDA regulations and furnish a Certificate of Analysis (COA) for every CBD product that is sold. Apart from regular business documents, you need to comply with state registration rules for the CBD sector.

1.Find a CBD-Friendly Payment Processor:

Search for the CBD Payment Processing Service that has experience with CBD merchant accounts and are familiar with high-risk businesses like CBD Merchant Solutions.

Also Read: Why do CBD Business Struggle With Payment Processing

2.Gather Required Documents:

Get your business license, EIN, government ID, bank statements, product information, and lab test results (COAs).

Also Read: How to Get a Merchant Account for CBD Business

3.Ensure Website Compliance:

Your website should include terms & conditions, privacy policy, refund policy, disclaimers, and show product lab reports.

Also Read: CBD Business Ideas to Start

4.Apply for a CBD Merchant Account:

Apply with all the supporting documents and be transparent about your business model and products.

Also Read: CBD Merchant Account Vs Regular Merchant Account

5.Underwriting & Approval:

The provider will examine your documents and business information for compliance with the law and risk assessment.

Also Read: How Much Money is Needed to Start a CBD Business

6.Start Processing Payments

Once approved, log in to your CBD payment gateway and start accepting credit and debit card payments online or offline.

Also Read: Which Banks Support CBD Businesses

Consequences Encountered by CBD Merchants:

CBD businesses incur various operating and financial consequences through regulatory complexity and high-risk classification.

They experience difficulty gaining access to standard banking, credit card payment processing, and insurance, normally paying elevated costs and transacting with niche, high-risk parties.

Advertising choices are narrow as a result of platform constraints, thus customer acquisition becomes tougher. Governmental oversight may result in warning letters, product recalls, or fines for violations against FDA, FTC, or state regulations.

Moreover, patchwork state legislation and labeling standards cause logistical and legal hurdles for national or online sales.

1. Difficulty in Securing Merchant Accounts:

CBD business owners are greatly challenged to obtain merchant accounts because the industry is considered high-risk and there are changing regulations.

Most legacy payment processors do not want to do business with CBD companies for fear of legal and banking penalties, which result in frozen accounts and surprise closures.

Obtaining good, high-risk payment processing options demands extensive research and close examination of many factors.

Even with expert solutions, CBD businesses may still have unforeseen account closures or freezes due to worries regarding the legality and regulatory framework of the industry.

CBD business owners frequently need to find high-risk payment processing providers or merchant accounts specifically tailored for these businesses.

Also Read: How to Integrate CBD Payment Solutions with Ecommerce Platform

2. High Processing Fees:

CBD companies tend to have higher payment processing rates because they are labeled as high-risk based on legal ambiguities, changing regulations, and the likelihood of chargebacks.

Because of the nature of the CBD business, and the fact that there aren’t many CBD merchant accounts, the fees will be more. As a result, this can be a lot of money for low-volume CBD merchants and new ones.

These all pose a higher risk for payment processors, and therefore, the rates tend to be higher, usually between 3.49% and 3.95% per transaction.

Unlike regular merchant accounts, these tend to have higher fees because nearly all forms of CBD products are a high-risk industry with potentially many chargebacks.

However, the top companies provide wonderful features, gear, and good customer service to justify their charges.

Also Read: Secure Payment Processing for CBD Ecommerce

3. Limited Credit Card Processing Options:

CBD businesses have limited choices for credit card payment processing due to being deemed generally high-risk by traditional processors and, as such, many don’t want to deal with them.

This apprehension is founded on the developing regulatory environment surrounding CBD, in large part on the role the FDA plays within it, as well as fear of legal confusion.

Because of this, CBD traders frequently find themselves having to use specialized high-risk payment processors that are versed in their business and arena.

Also Read: How to Choose the Best CBD Payment Processing Company

What Other Payment Processing Options are Available for CBD Merchants?

1. Partner With CBD-Friendly Banks:

Banking for CBD companies is complicated because of regulatory uncertainties and perceived risk. But there are banks and financial institutions that support the CBD industry.

In the United States, Silicon Valley Bridge Bank, Timberland Bank, and Chase are some of the options available. In Europe, Electronic Money Institutes (EMIs) provide full-service facilities with specific IBANs for CBD companies.

Ensure compliance with THC concentration guidelines and proper documentation to establish your business legality before applying.

Having an effective CBD payment processor like CBD Merchant Solution is important to minimizing operational friction. As CBD Merchant solutions are experienced in dealing with high-risk markets and guarantee smooth CBD merchant services that uphold compliance requirements.

Why do Companies Associate With CBD Friendly Banks?

1.)Availability of stable banking services (merchant accounts, loans, payment processing).

2.)Support to meet compliance with state and federal regulations.

3.)Safe and compliant transaction processing.

4.)Customized financial instruments optimized for hemp/CBD companies (as conventional banking tools tend to keep them out).

Partnership Types You Might Consider:

1.Payment Processing Services:

Card processing for CBD businesses by banks or fintechs.

2.Merchant Bank Services:

CBD-specific business checking/savings, payroll, and tax assistance.

3.Business Loans & Credit Lines:

CBD-friendly lending institutions or banks with reasonable rates and terms.

4.Joint Marketing or Community Events:

Collaborate with the bank for CBD educational events, product demonstrations, or wellness expos.

Examples of CBD-Friendly Banks and Fintech Companies:

– North Bay Credit Union (California)

– Partner Colorado Credit Union

– Safe Harbor Financial

– Dama Financial

– West Town Bank & Trust

– Lighthouse Biz Solutions

Also Read: Guide to Start a CBD Business

2. Use High-Risk Payment Gateways:

CBD companies are required to employ high-risk payment gateways. Banks and traditional payment processors generally classify the CBD industry as high-risk, so it can be difficult to get regular merchant accounts.

High-risk payment gateways provide enhanced fraud detection, competitive rates, and regulatory compliance support.

These gateways have expertise in processing companies operating in high-risk sectors, providing solutions specific to their requirements.

Using a high-risk payment gateway is essential for CBD companies to be able to receive and process payments safely and effectively, even with the difficulties of working in a high-risk business.

Nomupay and PayKings are some popular providers for CBD companies.

Also Read: How to Avoid Frauds and Charge Back in CBD Payment Processing

3.Work with Experienced Merchant Service Providers:

To partner with veteran merchant service providers (MSPs) for CBD companies, look for those that deal with high-risk sectors.

These MSPs provide tailored services and expertise in dealing with the regulatory issues and payment processing intricacies involved with CBD, as per a guide by Stripe.

They can assist in maintaining compliance, getting payment processing secured, and possibly mitigating the risk of account suspension or other problems.

Search for MSPs that specialize in covering CBD or other high-risk industries because they recognize the specific challenges.

A quality MSP will have good underwriting procedure and ongoing account management to keep you in compliance and steer you clear of problems.

Also Read: How to Get a CBD License

4.Prepare Thorough Compliance Documentation:

An in-depth compliance documentation package is prepared to satisfy the rigorous regulatory standards of financial institutions offering services to CBD and hemp companies.

It promotes transparency, legal compliance, and operational responsibility, allowing CBD businesses to secure and maintain compliant, secure banking relationships.

The package contains comprehensive business establishment records, product testing reports, licensures, disclosures on finances, and strong internal compliance policies.

It also includes anti-money laundering (AML) protocols, Know Your Customer (KYC) policies, and risk management strategies specifically designed for the cannabidiol (CBD) marketplace.

This set of documents not only secures banking approvals but also safeguards CBD businesses from legal, financial, and business risks in a complicated regulatory environment.

Important Inclusions:

- Business formation & licensing papers

- Disclosures of ownership and management

- Lists of products, Certificates of Analysis (COAs), and labeling compliance

- Anti-Money Laundering (AML) policy and Know Your Customer (KYC) guidelines

- Transaction monitoring and internal audit guidelines

- Financial statements and merchant account history

- Insurance certificates and legal compliance documentation

- Risk assessments and business continuity planning

CBD Payment Processing Companies:

1. North Bay Credit Union:

Location : California

One of the only American banks openly acknowledging it does business with cannabis companies, North Bay Credit Union does so in secrecy for businesses based north of San Francisco.

The credit union caps the size of the deposits such businesses can make to help control their capital ratios.

Nevertheless, North Bay Credit Union faces federal prosecution for processing these transactions — still a crime under federal law — but serves their customers despite those threats.

2. Easypay Direct:

Location : Austin, TX

Easypay Direct has significant experience handling high-risk merchants and will make payments on all the major credit cards for CBD.

They include a patent-pending load-balancing functionality so that merchants may accept large amounts monthly—all at competitive rates without early termination charges.

3. PayKings:

Location: St Petersburg, FL

Pay Kings has an established set of more than 20 acquiring banks to provide you with the greatest chances of approval for your CBD business.

If you’re selling CBD Oil, Pay Kings has a “fast approval” program that will get your products into online shopping carts in no time.

4. Chase Bank:

Chase Bank will open its vault to CBD-related bank accounts, but not its payment processing services yet. Most likely, Chase will hold out for the SAFE Banking Act or some other CBD financial services-permitting bill that will make the industry less tenuous.

Resourceful in terms of size, Chase will also likely hold out for information to accumulate on what successful CBD businesses resemble in order to appropriately screen potential customers in the future.

Conclusion:

Traditional banks tend to reject CBD traders on the basis of regulatory and financial risks posed by the sector, along with legal concerns and risk to their reputations.

To overcome such difficulties, CBD traders might be compelled to look into other forms of payment processing like CBD Merchant Solutions as well as approaches to establish proof of compliance and reduce risk.

Legality and regulation regarding CBD products are not the same in all areas, making things ambiguous for banks.

Banks might face fines or penalties if they process transactions for businesses that deal in potentially illicit activities.

Alignments with the CBD industry might damage the reputation of a bank, particularly if it’s viewed as a sponsor of potentially unsafe products.

Banks have limited internal procedures for how they deal with CBD transaction processing, so it’s hard to analyze risk and make a judgment.

To ensure smooth transactions, CBD companies must locate dedicated payment processors that work in the CBD sector and understand its regulatory context.

Present documentation proving your company is operating legally and is meeting all relevant regulations.

Implement controls to minimize the risk of fraud or money laundering, such as intensive customer due diligence and intensive transaction monitoring.

Create an intimate relationship with your payment processor so they are familiar with your business and your needs.

Concentrate on developing a direct customer relationship, even bypassing use of traditional payment processors altogether.

If you still have any query regarding why traditional banks reject CBD merchants and what are the alternative methods to be implemented, then you may reach us out at CBDmerchant solutions and we are glad to assist you.

Frequently Asked Questions (FAQs)

1. Are there any banks that deal with CBD businesses?

Yes — there are CBD-friendly banks, credit unions, and fintech processors that serve the industry. They deal with high-risk industries and have made compliant processes to service CBD business accounts legally and securely.

2. Are CBD companies charged more in banking fees?

Yes — because of the added compliance work, transaction monitoring, and risk management involved, CBD banking services also tend to carry higher fees than regular business accounts.

This might include monthly maintenance fees on accounts, transactional fees, as well as higher compliance review charges.

3. Can CBD companies accept credit card transactions?

Yes — but not through most traditional payment processors like Stripe, Square, or PayPal. You’ll need a high-risk merchant account or a CBD-friendly payment gateway provider that can legally process CBD transaction processing while meeting banking regulations.