Introduction:

CBD merchants face a confusing reality because even though hemp-derived CBD is widely sold, many banks still classify a CBD business as a high-risk merchant. Such classification directly affects credit card processing, pricing, and approval timelines.

Processors and acquiring banks consider CBD payment processing as riskier because of regulatory uncertainties(FDA restrictions on ingestibles, patchwork state laws, increased chances of chargebacks from card-not-present orders, and inconsistent product labeling. Underwriting teams require confidence that your operation is legal, stable, and customer-friendly before they will board your CBD merchant account.

This blog explains why CBD businesses are classified high-risk and how to get approved for credit card processing with minimum hassle. You will get to know what underwriters actually verify like KYC or KYB, corporate documents, bank statements, supplier licenses, and fulfillment workflows and how your website can make or break an approval. We will also outline practical gateway and fraud-control settings like AVS, CVV, 3-D Secure, velocity limits and smart retries that lower chargebacks and keep ratios within network thresholds.

Finally we will set expectations on pricing models like interchange-plus versus flat-rate), rolling reserves, funding timelines, and descriptor discipline, then provide a simple approval checklist you can follow like fix claims, publish COAs, map blocked states, assemble documents, select a CBD-friendly processor, and launch with measured volumes.

So if you are selling oils, gummies, topicals, pet tinctures, or beverages, the path to a durable CBD merchant account is straightforward: demonstrate legal compliance, operational stability, and customer-first support. Take these steps in order to accept cards confidently, minimize disputes, and grow with fewer surprises.

The result is a payments foundation that satisfies underwriters, protects consumers, and unlocks sustainable growth across eCommerce, subscriptions, marketplaces.

Also Read: What is a High-Risk Merchant Account

Why CBD Is “High-Risk”

CBD merchants trigger multiple red flags in acquiring-bank risk models:

1. Regulatory Uncertainty:

Regulatory uncertainty prevails because Hemp-derived CBD which is ≤0.3% delta-9 THC by dry weight is federally lawful under the 2018 Farm Bill, but the FDA still bans marketing CBD as a dietary supplement or adding it to foods and beverages.

The FDA continues to issue warnings and take enforcement actions, especially against disease or therapeutic claims. As hemp sales are legal but marketing ingestible CBD is restricted, labeling, websites, and shipping fall into compliance gray areas. As the regulations and compliances surrounding CBD are unclear, banks see CBD as risky, so underwriters move slowly and carefully.

Also Read: Is CBD Legal in all 50 States

2. Patchwork State Rules:

State hemp rules are not the same. Where one state permits ingestible CBD with age gates and QR-linked COAs; another allows only topicals; while the third state bans delta-8 or delta-10 outright. Packaging, testing panels, milligram caps, and warning language differ, and legislators keep updating them through bills, emergency rules, or attorney-general guidance.

For processors and acquirers, this patchwork makes a shipment legal at origin and may break the rules in its destination state. Underwriters review your shipping matrix, blocked states, labeling controls, and ongoing compliance checks to prevent violations and fines.

Also Read: Top 5 Challenges in CBD Payment Processing

3. Elevated Chargeback Patterns:

CBD merchants face chargeback risks which are similar to nutraceutical and wellness brands, where expectations, auto-ship subscriptions, and fulfillment missteps drive disputes. Subscription auto-renewals often lead to “I didn’t authorize” or “I forgot to cancel” disputes. Overstated benefits, uncertain dosing, and influencer hype endorsements invite “item not as described” chargebacks.

Slower shipping or confusing returns drive customers to their banks instead of support. Card-not-present orders increase risk when AVS or CVV mismatch for first time buyers and gift shipments. Without clear policies, proactive updates, and flexible updates, chargeback ratios increase and tougher underwriter reviews.

Also Read: Why Traditional Bank Rejects CBD Merchant

4. Brand/Association Risk:

Card networks and banks handle cannabis-adjacent merchants cautiously because of reputational, regulatory, and chargeback risks that can spread across the ecosystem. To protect their brands and limit liability, they demand deep documents like KYB or KYC, COAs, labels which restrict products or states, cap volumes during ramp, and place merchants in heightened monitoring.

Underwriters may require clearer descriptors, tighter refund windows, and proactive dispute management. Expect regular reviews, on-site checks, and follow up remediation tasks. Noncompliance invites penalties like fines, program delisting, or abrupt account closure to maintain network integrity.

Also Read: How to Advertise CBD Brand in Best Possible Manner

5. CNP Exposure:

Because most CBD sales happen online, card-not-present transactions dominate, lacking EMV chip cryptograms and face-to-face ID checks, fraud and dispute increases. First-time shoppers, gift orders, AVS or CVV mismatches, and foreign BINs raise declines and disputes. Subscriptions auto-renewals often trigger “I forgot to cancel” disputes. To reduce risk, enforce AVS or CVV, require 3-D Secure for high-risk orders, set velocity caps, tokenize stored cards, and use clear billing descriptors. With trackable shipping and rapid replies, customers seek your help, and not a chargeback.

Also Read: How to Protect Your CBD Business From Payment Processor ShutDowns

Legal & Regulatory Backdrop

1. Federal: The 2018 Farm Bill:

The 2018 Farm Bill reshaped the United States hemp and CBD landscape. Enacted in December 2018, it delisted hemp cannabis with less than 0.3% THC from the Controlled Substances Act.

It legalized hemp cultivation and opened doors for CBD products at the federal level, while shifting oversight to the USDA and FDA. Even with complex rules, particularly for food and supplements, the bill established a platform for United States wide hemp growth and commerce.

Also Read: How to Get a CBD License

2. FDA’s Stance on CBD in Foods and Supplements:

The United States Food and Drug administration holds that CBD cannot lawfully be marketed in conventional foods or dietary supplements under current federal law. Because CBD is an approved drug ingredient (Epidiolex) and has undergone substantial studies, FD&C Act exclusions bar its use in foods or supplements.

The FDA has rejected multiple citizen petitions urging rulemaking to permit CBD in foods or supplements. The FDA has asked Congress for a fresh regulatory track that balances consumer access with safety concerns such as medication interactions, dose thresholds, and at-risk groups.

FDA maintains that CBD can’t be sold as a supplement or added to foods under current law; in 2023 it asked Congress for a new pathway, and enforcement for misbranding or adulteration or disease claims continues still unresolved in 2025.

Also Read: Selling CBD Products Online

3. States: A Moving Target:

Many states allow hemp-CBD, but rules vary such as age gates, QR links to COAs, packaging/labeling, ingestible limits, and bans or restrictions on intoxicating hemp(delta-8, delta-10, HHC). As regulators and courts move to close “loopholes”; it is essential to review updates before fulfilling.

It means acquirers will approve merchants that can prove lawful sourcing and compliant marketing for each shipped destination and that have support processes to prevent customer harm and cardholder complaints.

Also Read: CBD industry Trends Challenges and Future Outlooks

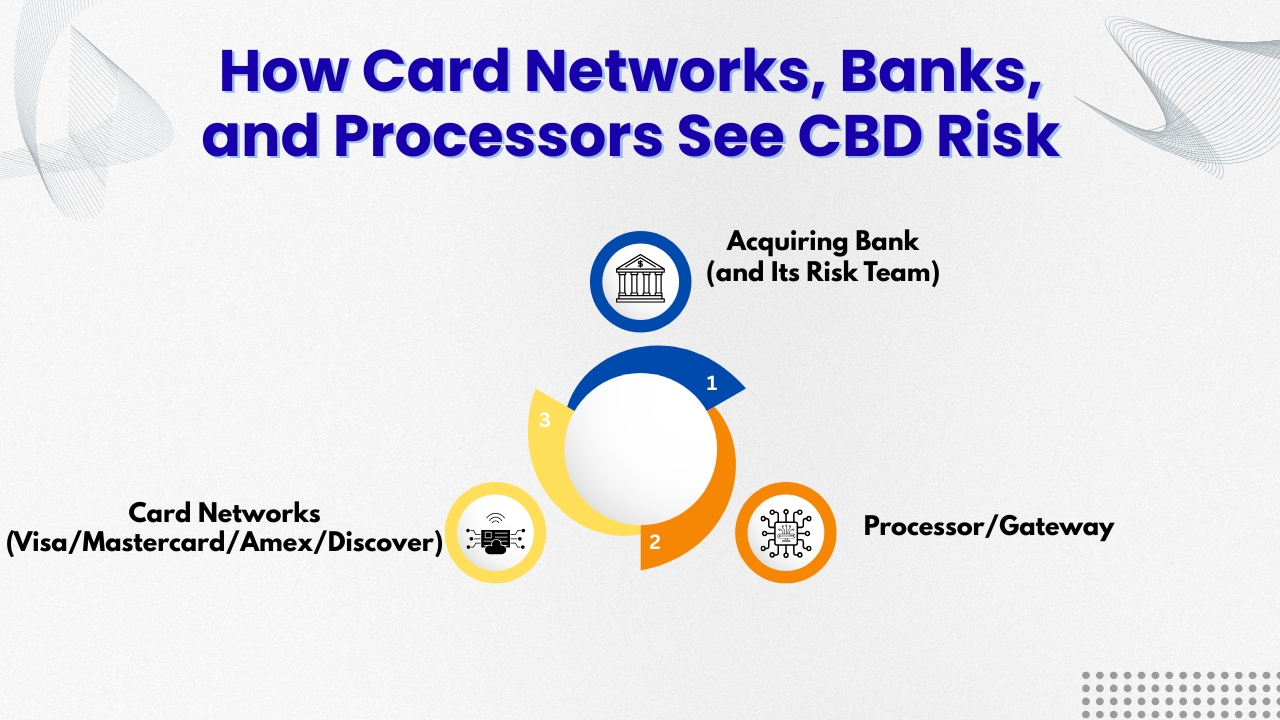

How Card Networks, Banks, and Processors See CBD Risk

When you apply for card processing, your application covers three layers:

1. Acquiring Bank(and its risk team):

They are ultimately responsible for your merchant account. So they will evaluate your business model, products, and compliance controls under networking and banking standards like AML/BSA, KYC/KYB). Under Visa’s programs, acquirers must actively prevent illegal activity and monitor high-risk merchants.

Also Read: How to Open CBD Business Bank Account

2 Processor/Gateway:

The technology and operational layer that onboards, monitors, and supports you. Many mainstream providers ban CBD outright, while others offer CBD-specific programs.

Also Read: Secure Payment Processing for CBD Ecommerce

3. Card Networks(Visa/Mastercard/Amex/Discover):

Visa, Mastercard, Amex, and Discover don’t approve individual merchants; their operating rules send the guard for acquirers, defining acceptable categories, onboarding standards, monitoring expectations, and remedies for violations, ultimately shaping approvals and risk management processes.

Also Read: Understanding CBD Payment Terms

Practical Reality by Provider

1. Shopify Payments:

Shopify Payments does not accept CBD transactions entirely. Merchants selling CBD must instead integrate approved third-party gateways that support the category, ensuring compliance with Shopify’s policies while maintaining access to essential checkout, payment processing, and order management features.

2. Stripe:

Stripe continues to classify CBD as restricted and generally does not support direct processing. Merchants in this category are usually required to seek alternative providers or specialized gateways that allow compliant CBD payment acceptance and monitoring.

3. Square:

Square supports CBD through a dedicated program available in most United States states, with specific eligibility, documentation, and pricing. Policies change; apply through Square’s CBD intake and expect improved underwriting, product or state limits, and periodic compliance reviews.

Approval depends on finding the right acquiring path and showing you have your legal, labeling, and customer experience.

Also Read: How to Get a Merchant Account for CBD Business

The Approval Funnel: What Underwriters Actually Check

Think like an underwriter: “If we board this merchant, will we regret it?” Here’s what they examine.

Business Identity & Financials

-

KYB or KYC:

KYB or KYC usually requires legal-entity documentation like EIN or Tax ID, government IDs for beneficial owners, registered business address, and a recent utility bill, enabling acquirers to verify identity, ownership, and location before onboarding higher-risk merchants safely.

-

Banking Proof:

Banking proof generally includes a voided business check or an official bank letter, confirming account ownership and details. Acquirers will require this documentation to ensure settlement funds flow correctly, reduce frauds, and validate merchant banking relationships securely.

-

Financial Stability:

Financial stability checks usually involve providing 3-6 months of recent bank statements and if available, prior processing statements. Even non-CBD history helps acquirers to measure cash flow, risk exposure, refund patterns, and overall merchant financial health.

-

Operations:

Operations evidence should cover warehousing or 3PL arrangements, shipping providers, typical order processing and fulfillment timelines, refund and return policies, and clear customer support coverage that includes hours, SLAs, and channels demonstrating reliable logistics, responsive service, and dispute prevention practices.

Also Read: How to Expand Your CBD Business to New Market

Product Scope & Legality

-

Catalog List:

Organize your catalog by SKU with three primary categories which includes Ingestibles, Topicals, and Pet. For Ingestibles, segment gummies, capsules, tinctures, beverages, and powders by strength and flavor. Topical products like creams, balms, roll-ons, and patches should be organized by uses like relief, recovery, skincare, or targeted application. For pets, organize chews, tinctures, and balms by species, weight range, and active concentration, and track compliance documents, batch numbers, and expiry dates.

-

COAs:

Maintain current, lot-specific Certificates of Analysis(COAs) from ISO/IEC 17025 – accredited labs for every product. Ensure that every COA must confirm cannabinoid profile, potency, and contaminants. Also verify hemp items contain no more than 0.3% delta-9 THC on a dry weight basis. Store COAs by batch, attach them to matching SKUs, and make them available to regulators, partners, and customers.

-

Sourcing:

Collect and validate active supplier business licenses and where required, state hemp grower or processor registrations. Confirm scope, expiration dates, and jurisdictional coverage. Cross-check all vendors against federal and state sanctions and enforcement lists before onboarding and at regular intervals. Require written attestations of lawful cultivation, transport, and sale. Store documents by vendor and renewal data, set reminders, and block purchasing when credentials lapse or become suspended.

-

State Map:

Keep an always-updated, state-by-state shipping map that classifies each jurisdiction as allowed, restricted, or blocked. Record product-level rules, including ingestibles versus topicals, age gates, potency caps, labeling, and tax requirements. Mark states that ban hemp-derived ingestibles or delta-8, and block orders to those destinations. Automatically block checkout by address or ZIP, show only compliant options, and record any manual overrides with timestamps for audit trails. Update the map and rules immediately when laws change or carriers add new shipping constraints.

-

Website Compliance:

Website compliance requires careful attention to both content and functionality. Marketing claims must be truthful, substantiated, and free from unapproved health promises. Well-known disclaimers should clarify product intent and regulatory limitations. Use age-gating so only eligible customers can view and purchase restricted product categories. Make COAs easy to find and read so customers can confirm product safety and potency. Customer service information like phone, email, and response times, should be easy to locate. Policies covering returns, refunds, privacy, and terms of use must be clearly posted. At checkout, clearly disclose any recurring charges, applicable taxes, shipping restrictions, and how the order complies with relevant federal and state regulations.

-

Risk Controls

Implement layered risk controls across checkout and post-purchase flows. Enforce AVS with ZIP+4, require CVV, and automatically decline transactions with address mismatches or cards from high-risk BINs. Apply velocity limits on each card, device, IP, and email to detect rapid retries or basket stuffing. Maintain strict refund discipline through documented policies, timely credits, and partial-refund workflows. Detect misleading trial or auto-ship offers by requiring explicit consent, a clear billing cadence, and a double opt-in. Use 3-D Secure selectively on the basis of risk scores and issuer geography in order to gain liability shift while preserving approval rates. Establish a chargeback program that manages alerts, deflection, compelling evidence, and representments, backed by root-cause analysis, continuous monitoring, detailed reporting, and ongoing improvement. The smoother your application package, the faster you will be approved.

Also Read: How To Market CBD Business on Social Media

Website Compliance: A Merchant-Ready Checklist

Confirm truthful claims and clear disclaimers. Age-gate restricted items so only verified age customers can view and purchase them. Publish COAs, contact details, returns or refunds, privacy, and terms. At checkout, clearly show taxes, subscription terms, and shipping limits, and protect payments with AVS or CVV checks, velocity limits, and selective 3-D Secure. Maintain policies easy to find, maintain audit logs, and publish a live state shipping map showing blocked products and compliance flags.

Underwriters will browse through your site like skeptical consumers. Before you apply, fix these:

Must-Have Pages & Clarity

1. Contact Page:

Create a contact page that lists your physical business address(not just a P.O. box), along with a working phone number and an email or live chat option, ensuring easy customer access and regulatory transparency.

2. Shipping Policy:

Publish a clear shipping policy detailing processing and delivery timelines, carriers used, daily order cutoff times, tracking availability, and any restricted destinations. It should also include holiday exceptions, signature requirements, and how customers can contact support for delays.

3. Return/Refund Policy:

Post a transparent return and refund policy stating eligibility conditions, timelines for requests, whether an RMA is required, and responsibility for return shipping costs. Ensure customers understand approval steps, credit method, and expected processing timeframes.

4. Terms and Conditions and Privacy Policy:

Ensure your Terms and Conditions and Privacy Policy are current, written in clear, readable language, and linked in the website footer. Such documents should outline user rights, data handling, consent, and compliance with applicable regulations.

5. Age Attestation:

Implement an age attestation process requiring customers to confirm eligibility for instance above 21 years, before accessing restricted products. Adapt the requirement to local laws, differing by state or product type, and enforce at checkout for compliance.

6. FDA Disclaimer:

Include an FDA disclaimer where required like “These statements have not been evaluated by the Food and Drug Administration” and avoid making claims for disease treatment or therapeutic claims. Also ensure that all product descriptions remain compliant with applicable regulations.

Also Read: The Ultimate Guide of CBD Social Media Marketing

Product Pages

1. No Medical Claims:

Avoid medical claims entirely. Never say products “treat” anxiety, insomnia, or arthritis. Use permitted, non-therapeutic descriptions like “calming” or “relaxation” only if your jurisdiction allows them. Rather it is better to emphasize quality, ingredient sourcing, accurate potency, and third-party lab testing. FDA warning letters routinely target disease claims so it is essential to protect your brand by staying strictly within compliant marketing language and practices.

2. COA Access:

Provide clear COA access for every batch with a visible QR code on labels or a direct website link. Each COA PDF must list cannabinoid potency and full contaminant tests, including pesticides, heavy metals, residual solvents, and microbial panels. Prominent and verifiable COA build consumer trust, meet regulatory requirements, and support transparent quality assurance practices.

3. Ingredients and Allergens:

Display a complete ingredient list, including active cannabinoids and excipients, and clearly identify major allergens. It is essential to specify serving size, servings per container, and net quantity(weight or volume). Include manufacturer or distributor name, business address, and contact details. Whenever required, include Nutrition or Supplement Facts, with clear usage directions, and cautions that follow local labeling rules and industry standards.

Also Read: Marketing Ideas for CBD Business

Checkout & Customer care

1. Clear Descriptor Preview:

Provide a clear descriptor preview so customers know exactly how the charge will appear on their bank or card statement. It reduces confusion, lower disputes, and builds trust by ensuring billing transparency before checkout.

2. Support Response Time:

State your support response times for instance replies within 24-48 hours and remind customers to contact you first before disputing charges, so issues can be resolved quickly, documentation is captured, and unnecessary chargebacks are avoided early.

3. Order Confirmation:

Send immediate order confirmation with full details, then provide proactive shipping notifications which includes tracking numbers, carrier updates, and delivery updates. Keeping customers informed at every step builds trust, reduces inquiries, and prevents disputes about order status.

Use this checklist to resolve the majority of underwriting objections upfront.

Also Read: How to Create a Google Business Profile for CBD Business

Product Labeling & Documentation

Whether you manufacture in-house or private-label, maintain complete ownership and control of all documentation like specifications, COAs, supplier attestations, SOPs, and traceability records so you can respond quickly to underwriter requests and prove compliance without depending on third parties.

1. COAs Match Labels:

COAs must align with product labels in order to maintain accuracy and trust. Ensure labeled potency aligns with the COA and your advertised range, maintaining consistency across batches to reduce compliance risk, avoid customer confusion, and demonstrate rigorous quality control.

2. Batch/Lot Numbers:

Include batch or lot numbers on every product label and ensure they link directly to the corresponding COA. Underwriters may conduct catalog reviews, requiring end-to-end traceability that proves each product’s COA clearly matches the batch or lot number printed on its label.

3. Serving Instructions and Warnings:

Always include clear instructions about servings and health warnings that align with state regulations. So whenever applicable, display required age restrictions and cautionary statements to guide safe, compliant use while protecting both your brand and your customer’s trust.

4. No Structure or Function Disease Claims:

Avoid structure or function or disease claims in all marketing. Train copywriters, affiliates, and partners to follow compliant language. As even one misleading blog post or social advertisement can risk merchant account approval. FDA keeps enforcing rules so that every channel is compliant to reduce risk and keep processors and underwriters confident.

If you offer intoxicating hemp derivatives(delta-8, delta-10, THC), expect increased underwriting investigation and frequent acquirer refusals, as states increasingly restrict such products and potential federal shifts are actively being considered.

Also Read: How to Expand Your CBD Business to New Market

Payments Architecture for CBD

There are three primary card-processing options for CBD business:

1. Aggregator with CBD program (e.g., a PSP That Explicitly Allows CBD):

Pros: It includes the fastest setup and launch with minimal friction, simple onboarding requiring fewer documents, and an all-in-one package that combines the payment gateway with built-in risk management tools, making it especially convenient for new CBD merchants.

Cons: Less control, higher pricing, and programs that can change with little notice; sudden volume spikes or catalog can also trigger reviews or account holds. For instance, Square’s CBD program is a well-known case that highlights such risks and limitations.

Also Read: How to Market CBD Products

2. Direct Merchant Account (MID) via a High-Risk Acquirer

Pros:

You get more stability and pricing power, better support for scaling and custom flows, and you can use multiple MIDs by product line in order to improve risk isolation, reporting, chargebacks, and overall resilience.

Cons:

Underwriting takes longer because of deeper, diligent documentation is extensive, and providers may need a rolling reserve; onboarding can last for weeks, funding holds are more likely early on, and compliance updates demand ongoing effort.

3. Platform Store with Third-Party Gateway

For instance: A Shopify store uses an external CBD-friendly gateway as Shopify Payments doesn’t allow it, which is common and fine as long as your gateway and acquirer clearly approve your exact product catalog.

4. Gateway Features to Insist On:

Include advanced AVS/CVV checks, optional or step-up 3-D Secure, configurable demanding and smart retry logic for subscriptions, granular block or allow lists, velocity controls by IP, card, or order, and real-time chargeback webhooks to trigger alerts, evidence workflows, and automated updates to risk rules and routing adjustments.

Also Read: How Fast Payouts Can Improve Your CBD Business Cashflow

5 Descriptor Discipline:

Always use a clear and recognizable statement descriptor which includes your brand name and a support URL or phone number. Many disputes begin simply because customers don’t recognize a charge, so making descriptors clear helps to reduce confusion, prevent unnecessary disputes, and build trust.

6. Multiple MIDs:

If your catalog has both topicals and ingestibles then many acquirers prefer issuing separate MIDs for each category. Such separation isolates risk, simplifies reporting, and improves monitoring of chargebacks or compliance issues, ensuring clearer oversight and more flexibility in managing high-risk product lines effectively.

Chargebacks & Fraud: Prevention, Evidence, Thresholds

CBD merchants are rarely terminated because of one single major fraud event; it’s the drip of small disputes which accumulates, triggers thresholds, and lands accounts in network monitoring or chargeback programs

Prevention Blueprint

1. KYC for Your Customers (lightweight):

Use lightweight KYC that requires consistent customer name, phone, and email across checkout and account records, automatically indicating mismatches for review before fulfillment in order to reduce chargebacks.

2. AVS+CVV Enforced:

Enforce AVS and CVV checks on all transactions, and consider requiring 3-D Secure authentication for high-risk purchases or first-time customers to strengthen fraud prevention and reduce disputes.

3. Velocity Limits:

Set velocity limits by card, email, and IP address to block fast or repeated attempts, reducing fraud exposure and preventing automated attacks or suspicious purchase patterns effectively.

4. Subscription Sanity:

Ban free trials that convert into expensive auto-ship plans; clearly show billing cadence, total price, and cancellation steps to avoid disputes and build subscriber trust.

5. Fulfillment Receipts:

Provide fulfillment receipts with tracking numbers and delivery confirmation, and require photo or signature verification for higher-value orders to reduce disputes, prove delivery, and strengthen customer trust.

6. Customer Service over Disputes:

Prioritize customer service over fights when warranted, issue easy refunds usually cheaper than absorbing a chargeback plus fees, penalties, and monitoring risk, while preserving goodwill.

7. Evidence Kit (Keep it Ready):

Include order details, IP/device data, AVS or CVV results, 3-D Secure proof if available, shipment tracking with photo or signature, customer emails, COA link, refund or return policy screenshots, and descriptor disclosure consolidated in a clear evidence packet below 10 pages.

8. Thresholds to Watch:

Card networks scrutinize merchants with high chargeback ratios or fraud rates. Your acquirer will specify thresholds and early-warning levels. Operating well below those limits helps you avoid expensive remediation programs and preserves processing stability.

Also Read: Why Every CBD Business Needs a Customized POS

Step-by-Step: How to Get Approved (and Stay Live)

Phase 1 — Prepare (1–2 weeks)

1. Map Your Catalog:

Map your catalog clearly: separate ingestibles, topicals, pet products, devices like vape hardware, and accessories to smooth underwriting, risk controls, reporting, taxes, and inventory management.

2. Gather COAs:

Keep one COA per lot or SKU, recent and clearly confirming less than 0.3% delta-9 THC. Host PDFs in a public folder and link them from each product page to ensure transparency, quicker underwriting, and regulatory compliance.

3. Fix Your Website:

Fix your website by completing a compliance checklist: accurate product pages, clear policies, COA links, age gates, descriptors, accessible contact info, secure checkout with AVS or CVV.

4. Assemble Your Packet:

- Articles of incorporation or LLC and EIN letter

- Photo IDs for owners > 25%

- 3- 6 months business bank statements

- Prior processing statements if any.

- Voided check or bank letter.

- Fulfillment SOP(how orders ship or timelines).

- Refund or return policy

- Supplier licenses or registrations, hemp or hemp-product permits as applicable in your state.

- State shipping matrix

5. Decide architecture:

Join an aggregator CBD program for speed, work with a high-risk acquirer plus gateway for stability, or use a platform with a third-party gateway for flexibility, compliance, and scale.

Phase 2 — Apply (3–10 business days)

1. Submit full application:

Submit a complete application and show all categories including ingestibles if you sell them. Underwriters review your catalog and site; hiding items gets found, delays approvals, triggers holds, and creates trust issues that hurt pricing.

2. Respond fast to conditions:

Respond quickly to underwriting conditions. They may request COAs, product label photos, or packaging proofs, and sometimes require claim edits or removals. As fast, complete responses build trust, prevent delays, and speed final approval.

3. Approve your descriptor and MCC:

During onboarding, confirm your statement descriptor and merchant category code. Let the processor assign the MCC on the basis of risk and rules; forcing it can trigger audits. Descriptors reduce confusion, prevent disputes, and support stable processing.

Phase 3 — Go-Live (Week 3+)

1. Enable risk settings:

Require AVS and CVV checks on all orders, apply velocity caps, and use 3-D Secure step-up for first-time customers or purchases over $150. Block high-risk BINs or geographic regions when necessary to reduce fraud exposure.

2. Start Clean:

Avoid spikes in the first week; ramp traffic and spend gradually so approval rates, fraud, and chargeback metrics stabilize, giving processors confidence and reducing risk of holds, monitoring flags, and pricing penalties.

3. Monitor daily:

Must daily track chargeback ratio, refund rate, fulfillment SLAs, top decline codes, and “unknown charge” inquiries; investigate inconsistencies immediately, adjust risk rules, coordinate with support and ops to prevent escalations, maintain approvals, and protect stability overall.

Phase 4 — Optimize & De-risk (Month 2 onward)

1. Subscription hygiene:

Maintain subscription hygiene with clear “cancel anytime” messaging, timely renewal reminders, and an easy self-service portal. Transparent terms reduce disputes, build trust, improve customer satisfaction, and demonstrate compliance, keeping recurring billing programs sustainable and processor-friendly over time.

2. CX Beats Disputes:

When you deliver proactive shipping updates and maintain a 24-48 hour response SLA. Quick, clear communication prevents confusion, reassures customers, reduces refund requests, and avoids costly chargebacks while strengthening brand trust and loyalty.

3. Quarterly Review with Your Processor:

Hold quarterly reviews with your processor to discuss potential pricing breaks, reserve reductions, and fraud patterns observed across CBD peers. Such proactive check-ins build trust, strengthen relationships, and help to optimize long-term stability, profitability, and compliance strategies effectively.

Conclusion:

CBD merchants are classified as “high-risk” not because the industry is doomed, rather because card networks, acquirers, and regulators witness fast-changing rules, inconsistent product labeling, and higher dispute rates than average commerce. It is absolutely possible to achieve approval because you just need to look like the easiest, safest version of a CBD business to underwrite.

So begin by fixing the basics with a clean, accurate website with clear policies, age gate, accessible contact information, and prominent COA links for every lot or SKU showing less than 0.3% delta-9 THC. Map your catalog like ingestibles versus topicals versus devices or accessories and be transparent in the application. Select the right processing architecture, aggregator for speed, high-risk acquirer and gateway for stability, or platform and third-party gateway for flexibility and let the processor assign the MCC. Approve a recognizable statement descriptor.

Operationalize risk by mandating AVS or CVV, add 3-D Secure step-up for first-time or high-risk orders, enforce velocity caps, and block high-risk BINs or regions as needed. Ship with tracking and photo or signature on higher-value orders, offers responsive support with reasonable refunds, and keeps subscription terms clear. Monitor chargebacks, declines, and refunds rates daily; ramp volumes, and meet quarterly with your processor about pricing breaks, reserve reductions, and peer fraud patterns. Do these consistently and you will not just get approved but also stay approved.

Frequently Asked Questions (FAQs):

1. Why do processors ask for COAs and supplier info?

It is essential to confirm that your products are hemp-derived, within the legal THC limit, and tested for contaminants and part of their risk and compliance obligations.

2. What about delta-8 or delta-10 and other intoxicating hemp products?

Many states restrict or ban them, and federal changes are being discussed. So selling them sharply narrows processing options, discourages banks, raises pricing and reserves, extends underwriting timelines, and heightens the risk of program changes or account holds.