Introduction

While the CBD industry has been legalized in many regions of the United States and other nations across the world, banking for CBD businesses remains challenging due to the inherent risks.

Despite the CBD industry’s rapid expansion since the US government removed hemp-derived products from the Schedule 1 substances list, commercial banks have been reluctant to provide business solutions to CBD entrepreneurs.

If you’re starting a CBD business, you’ll need a bank account with transaction processing capabilities, among other things. The current scarcity of accessibility to conventional forms of funding and transaction processing makes it exceptionally difficult for industrial enterprises to function and prosper in the same way that any other corporation must comply with state rules.

A small number of banks and other financial organizations do, however, back the CBD sector. In this post, we will discuss all of the banks that will support the CBD industry, as well as how you may get started.

Also Read: How to Open a CBD Business Bank Account

How Many Banks Are Supporting CBD Businesses?

Indeed. Early in 2021, 515 banks and 169 credit unions offered banking services to businesses associated with marijuana (MRBs), according to a study by the Financial Crimes Enforcement Network. Regretfully, hardly many banks publicly declare that they are cannabis-friendly or that they are eager to collaborate with MRBs.

Furthermore, even while there are banks that support cannabis, most of them have internal guidelines that restrict the number of high-risk clients they will accept. In the end, it is up to each financial institution to determine whether or not to offer banking services to a firm that deals with cannabis, whether it be hemp, marijuana, or other derivatives.

How Can We Find The Right Bank?

Finding and collaborating with a hemp and CBD-friendly bank or credit union may appear to be a checklist chore on the long list of things you need to do to establish a hemp CBD business, but it is an important choice.

It is important that you select a bank or credit union that you can trust to take money on your behalf, that won’t desert you, and that has your back. With federal and state red tape, your best hope for cannabis banking is to start with local community banks and credit unions, which are subject to fewer federal rules.

Nonetheless, the national bank is a better option if you require facilities like online wire transfers, ACH acceptance and sending, treasury management, etc. It never hurts to ask, as many banks don’t publicly announce that they serve cannabis companies. Find more about the rules, standards, and reporting processes for compliance set forth by the bank. Furthermore, be prepared to fulfill your due diligence by submitting all required paperwork.

Due to this, we have prepared a list of banks and credit unions that are friendly and willing to deal with hemp/CBD businesses.

Also Read: How to Get a CBD License?

Why are CBD banking services so complicated?

Contrary to popular assumption, the 2018 Farm Bill did not completely legalize all types of CBD statewide. CBD can be obtained from hemp, a non-psychoactive strain of the Cannabis Sativa plant.

THC, or tetrahydrocannabinol, the psychoactive ingredient in marijuana, is present in very small amounts in hemp (0.3%), which is the primary distinction between the two substances. This makes controlling hemp difficult because it is nearly identical to marijuana in appearance, smell, and even taste.

Different Legal Statuses

Although hemp-derived CBD is typically permitted at the federal level, state regulations vary. Just ask Robert Herzberg, who was carrying hemp from Colorado to Minnesota when he was detained in Jackson County, South Dakota, in spite of a federal memo from 2019 that forbids states from impeding hemp transit. Even though Herzberg had all of the necessary documents for his hemp shipment, local police confiscated it.

This conflict between federal and state rules poses a concern not only to hemp business owners but also to banking institutions that process and store hemp revenue.

Also Read: How Much Money is Needed to Start a CBD Business?

High-risk Valuations

Operating a CBD business may qualify it as a marijuana-related business (MRB). Banking institutions must expose you to increased risk assessment scrutiny when dealing with any MRB.

CBD and marijuana-related products are classified as “high-risk” because they operate in an industry with frequent chargebacks and changing legal statuses.

Despite the labeling, it appears difficult or impossible to determine which section of the plant was used to make a certain CBD product. However, the chances are not zero.”

Difficulty in Differentiating

Banks must face a difficult choice: which CBD businesses should they invest in? Because so many companies have jumped into this and started selling CBD, it is getting harder to differentiate the good ones from the misleading ones. Companies who fraudulently marketed CBD as a cure-all created a financial environment with unnaturally large chargebacks.

Also Read: Why do CBD Business Struggle in Payment Processing?

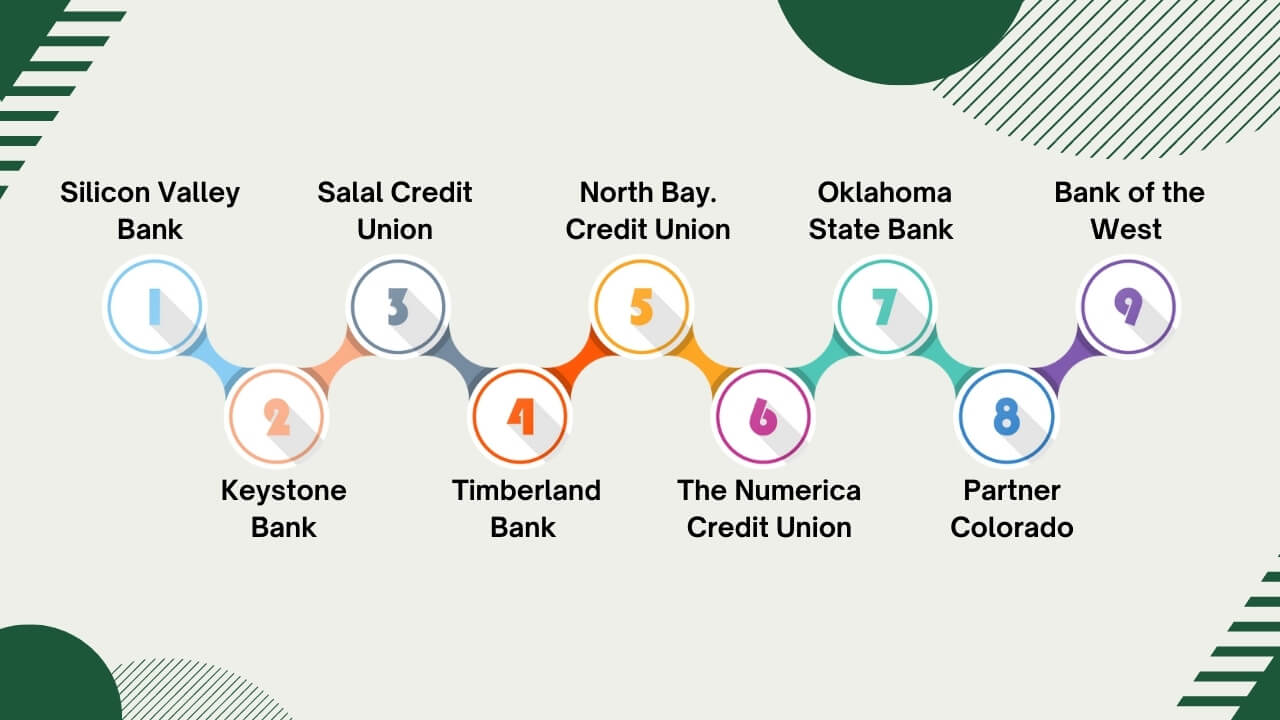

9 Best Bank, Unions & Financial Institutions for CBD Businesses!

Because of the many rules and regulations from the government, not every bank or financial place wants to work with CBD businesses. But don’t worry! We’ve made a list of the 9 best banks and credit unions that do want to help CBD businesses.

They offer special services just for CBD companies, so you can find the right place to manage your money. Let’s keep searching until we find the perfect fit for your CBD business!

Silicon Valley Bank

Silicon Valley Bank is the best option if you’re searching for a proactive, progressive bank that accepts CBD. This organization is constantly committed to technological advancement and innovation. Their goals, programs, and even technical advancements all reflect this reality. For this same reason, they are willing to consider lending money to a CBD organization.

CBD products are considered wellness supplements, according to Silicon Valley Bank. As a result, they are eager to give CBD companies the same level of service as healthcare professionals. Another reason you should register a CBD business account with Silicon Valley Bank is that they provide regular reports that the government then uses to better serve their clients’ needs.

Also Read: How to Get a Merchant Account For CBD Business?

Keystone Bank

As a CBD business owner, banking with Keystone Bank is beneficial. The bank supports hemp-related firms in their day-to-day operations by using its resources and knowledge. Keystone Bank takes great satisfaction in its capacity to assist people. They have streamlined the majority of their processes, allowing you to open a new account with their bank very quickly.

The organization may also assist you with managing day-to-day transactions, creating an emergency safety net, evaluating and providing feedback on your daily activities, managing the input and outflow of corporate funds, and lending money to enterprises. With all of this in mind, a cannabis company can gain greatly by using its resources and skills.

Salal Credit Union

Salal Credit Union in Seattle received thousands of calls after it was announced that it would accept cannabis accounts. Since 2014, Salal, who primarily works in the medical field, has opened over 300 cannabis accounts. For cannabis-related enterprises in the area, Salal Credit Union provides a wide range of financial services, including international wire transfers, insurance, and tax services.

You’ll have a dedicated account manager, cash collection and delivery services, and employee accounts. Additionally, your company is eligible to qualify for real estate and secured capital equipment loans.

In addition, your company can apply for protected capital equipment loans and real estate loans.

Salal’s laws include the fundamental requirements of being licensed in the state, having good credit, and no unpaid taxes. Salal takes far longer than conventional accounts—ten days—to complete the required background checks for a CBD company.

Timberland Bank

Timberland Bank, based in Washington State, stands out because it’s one of the banks that help out cannabis businesses. These businesses often struggle to find banks that will work with them because of strict federal rules.

Timberland Bank doesn’t talk much about this on their website or in ads, probably to stay out of trouble with the law. They keep things low-key. They only have branches and ATMs in Washington, where both medical and recreational cannabis are legal.

This lets them focus on helping cannabis-related businesses without attracting too much attention. Unlike some credit unions that shout about supporting cannabis, Timberland Bank prefers to keep things quiet. They quietly help out cannabis businesses without making a big deal about it, so they can do it smoothly without causing any problems.

North Bay Credit Union

North Bay Credit Union is one of the few American banking organizations that officially admits to handling cannabis transactions, which they do privately for businesses located north of San Francisco.

It provides cannabis, CBD, and hemp company checking accounts with banking services such as electronic processing, electronic bill payments, and digital banking.

If you satisfy any of the following requirements, you are eligible to join:

- You operate a business in Marin, Sonoma, Napa, or Solano counties.

- You are a member of the Cannabis Industry Association of California (CCIA).

- You are an NCIA member or member of the Cannabis Industry Association.

- You’re a Sonoma County Farm Bureau member.

To control their capital ratios, the credit union restricts the size of deposits that these companies can make.

They require a nonrefundable application fee of $1,000. If authorized, North Bay Credit Union’s risk assessment of your business activities determines your monthly costs. It usually takes 30 days to open an account.

The Numerica Credit Union

Numerica is widely regarded as one of the country’s first financial institutions to deal with the cannabis business, having established cannabis accounts as early as 2014. They have opened almost 200 accounts since then. They provide all of the normal services for employees, such as wire transfers and direct deposits, but they also have a team specialized in cannabis business accounts, providing superior advice and services.

It should be noted that they exclusively provide services to companies in the state of Washington, where Numerica branches are located.

So, if you want to open an account from out of state (or even out of town), you will not be able to use their services. Finally, they demand businesses to be licensed and approved by their community, which has proven to be a major barrier for many dispensaries.

Oklahoma State Bank

Oklahoma State Bank is one of the largest financial organizations in the state and serves a wide range of industries. They support cannabis organizations with financing and other services, among other things. Furthermore, they will assist in paying your vendors and delivering staff payrolls directly to their individual banks.

In order to keep track of recent modifications to cannabis regulations and modify its funding methods accordingly, the bank also has access to the most recent software.

The Oklahoma State Bank keeps up with the latest developments in technology. The bank uses cutting-edge software to track recent modifications to cannabis regulations and modifies its financing plans as necessary.

Partner Colorado

Partner Colorado Credit Union offers cannabis banking to approximately 500 cannabis accounts through Safe Harbor Financial, a part of the credit union. To be eligible, you’ll need to finish a drawn-out application process, which usually takes three weeks. The procedure entails presenting extensive financial records, an interview, a site visit to the company, and a third-party compliance audit.

Businesses that have been approved can access armored carrier services for daily cash deposits. As a further incentive, cannabis business owners can qualify for house mortgages and commercial real estate loans after a year of maintaining a cannabis account with Safe Harbor.

Bank of the West

Bank of the West is a leading bank that offers specialized banking services for cannabis-related businesses. As part of the BNP Paribas Group, it brings a lot of resources and expertise to this field.

Bank of the West provides various services to meet the needs of CBD companies. These include business checking and savings accounts tailored specifically for CBD businesses. They also offer comprehensive cash management services to handle large cash transactions securely, and lending solutions to support business growth and operations.

Additionally, the bank offers merchant services to help with payment processing, ensuring CBD businesses can operate smoothly and stay within legal boundaries. With its focus on compliance and deep industry knowledge, Bank of the West is a reliable banking partner for CBD businesses navigating a complex regulatory environment.

Also Read: Secure Payment Processing for CBD Ecommerce

Banking advice for the CBD businesses!

In order to assist the banking sector view your company as legitimate, consider the following techniques and tricks:

- Comprehensive records. Prepare yourself for the bank’s questioning regarding your due diligence. This implies that in order to ensure that you abide by banking standards, you might be required to provide copies of your cannabis license, sales records, and inventory logs.

- Transparent communication. When your company undergoes changes after becoming a customer, be sure to keep an open and sincere relationship with your bank. In this manner, your bank won’t report these modifications as potentially dangerous transactions or activities that could compromise your account.

- Steer clear of illicit works. Banks must follow the Financial Crimes Enforcement Network (FinCEN) requirements, which include attempting to conceal or disguise marijuana-related commercial activity by utilizing an intermediary to deposit funds or stuff like that.

To Conclude

In this blog, we’ve highlighted the 9 best banks and credit unions that support CBD businesses, offering a range of financial services to help them thrive. We’ve discussed the common banking challenges CBD businesses face along with some practical tips to help you secure quick approvals and ensure smooth banking operations.

Now that you have insights on securing the right banking partner, it’s important to also streamline your payment processing. And, if you are looking for one, CBD Merchant Solutions can help you out. We offer best-in-class payment processing solutions and a reliable POS system specifically designed for CBD businesses.

Our solutions can help you manage transactions efficiently, reduce the risk of payment processing issues, and ensure compliance with industry regulations. This allows you to focus more on growing your business and less on the complexities of financial transactions. To learn more about how we can help CBD businesses with secure and efficient payment processing, reach out to us right away!

Frequently Asked Questions(FAQs)

What should I do if my bank suddenly decides to close my CBD business account?

If your bank decides to close your account, it’s essential to understand the reason behind the decision. You may need to seek alternative banking options or consult with legal experts familiar with cannabis banking regulations to address the issue effectively.

How can payment processing solutions help streamline operations for CBD businesses?

Payment processing solutions like the one by CBD Merchant Solutions, which are tailored for CBD businesses can help manage transactions efficiently, ensure compliance with regulations, and provide secure payment options for customers to simplify the payment process and improve the overall customer experience.

What documents do I need to open a bank account for my CBD business?

To open a bank account for your CBD business, you’ll typically need to provide a range of documents to verify your business’s legitimacy. This includes business incorporation documents, licenses or permits related to your CBD business, a tax identification number (EIN), and financial statements to showcase the financial health of your business.

Are credit unions more likely to work with CBD businesses than traditional banks?

Credit unions, particularly those with a community-focused approach are suitable for CBD businesses. Credit unions often have more flexibility in their decision-making processes and may be more responsive to the needs of their customers. However, it’s essential to research and then approach credit unions to find the right fit.

How can CBD Merchant Solutions benefit CBD businesses?

Our solutions empower CBD businesses by providing them with the tools they need to operate efficiently and effectively. From secure payment processing to inventory management and compliance tools, we offer a comprehensive suite of services.