Introduction

The CBD industry keeps growing, but getting paid becomes the most difficult step. If you sell hemp-derived CBD with less than 0.3% THC online o, tiger underwriting in-store then you need a CBD merchant account which is a specialized high-risk merchant account built for stricter rules and actual chargeback controls.

Unlike mainstream processors, a true CBD payment processing partner understands compliance, allows you to accept cards securely, and won’t freeze funds without reason. Through this blog we will walk you through how CBD merchants work, and why banks classify CBD as high-risk, and what you do to get approved faster and process payments reliably.

With the right provider like CBD Merchant Solutions, you will connect a payment gateway to your e-commerce stack or POS in store, enable one-time and recurring billing, add intelligent fraud filters (AVS, CVV, velocity checks, and 3-D Secure) so disputed transactions stay under the 1% threshold.

Expect extra diligence through KYC or AML checks, COAs for products, clear refund and shipping policies and sometimes a rolling reserve to cover risk while you create history. You will also see higher per transaction fees than low-risk industries, but you gain stability, better authorization rates, and data you can use to grow.

Success happens due to three things: compliance(no unsubstantiated health claims, updated lab reports, operational readiness with accurate product pages, transparent terms, responsive support, and security(PCI DSS standards, tokenization, 3-D Secure where appropriate). Select a processor that openly supports CBD payment processing, offers clear pricing, and provides tools for chargeback prevention and analytics. If executed correctly, then a CBD merchant account is not just a way to accept cards, rather it’s the financial foundation which keeps your CBD brand to move ahead, grow, and protect.

Also Read: CBD Merchant Account Vs Regular Merchant Account

What Is a CBD Merchant Account?

A CBD merchant account is a specialized type of bank account which allows businesses to sell CBD products to accept both credit card and debit card payments. It is designed to support card payments while ensuring compliance with federal, state and card network regulations.

Though it seems that a CBD merchant account works like any other merchant account, when a customer makes a purchase, then the payment is authorized, funds are held temporarily and then deposited into the bank account of the business after settlement.

As CBD is derived from cannabis plants and governed by complex regulations, the process of getting approved and operating such an account is different from low-risk industries.

CBD businesses are classified as high-risk by banks and payment processors. It means only few banks are willing to provide accounts and the banks that do impose stricter underwriting, higher fees, and tighter compliance requirements.

It is because of the industry’s regulatory uncertainty, frequent association with marijuana, and the higher chances of chargebacks in online sales. Due to which traditional processors such as PayPal, Stripe, and Square mostly avoid CBD businesses or shut down accounts where in CBD transactions are detected.

CBD businesses should obtain a merchant account which is customized and is underwritten for hemp-derived products to maintain steady cash flow and prevent sudden interruptions in payment processing.

With a dedicated CBD merchant account lets businesses accept card payments safely, connect effortlessly with platforms like Shopify or WooCommerce, and support advanced features like recurring billing or subscription plans. In addition, these accounts usually include enhanced fraud prevention tools, PCI DSS compliance, and chargeback monitoring—critical safeguards for merchants in a high-risk space.

The approval process typically requires detailed documentation, including certificates of analysis (COAs) verifying THC content, business licenses, and transparent refund and shipping policies. While the fees are often higher than standard accounts, the benefits outweigh the costs.

A properly structured CBD merchant account provides stability, credibility with customers, and the ability to scale operations confidently in one of the fastest-growing industries.

Also Read: How to Open CBD Business Bank Account

Key Functions:

1. Transaction Authorization:

Verifies cardholder identity, checks available funds or credit, and route requests through card networks to the issuing bank, returning instant approvals or declines in order to keep checkout fast.

Also Read: Why do CBD Business Struggle With CBD Payment Processing

2. Funds Hold and Settlement:

Places an authorization hold to reserve the amount, then captures and settles batches to the merchant account, reducing failed payments and reconciliation issues.

Also Read: Why Traditional Banks Rejects CBD Merchants

3. Fraud and Chargebacks:

Uses risk scoring, AVS or CVV checks, velocity rules, and 3-D Secure, track disputes, submits representations, and offers alerts to reduce loss and protect margins.

Also Read: What is High-Risk Merchant Account and Why CBD Business Needs One

4. Seamless Integrations:

Connects with popular e-commerce platforms, POS systems, and gateways, via APIs or webhooks supporting tokens, subscriptions, refunds, and reporting for a unified, scalable payment stack.

Without a CBD merchant account, you may be forced to depend on cash, money orders, or unstable third-party processors which is not ideal for scalability or professionalism.

Also Read: How to Setup Online CBD Payment in Less than 24 Hours

Why CBD Businesses Are Classified as High-Risk

Payment processors and banks use risk profiles to determine how safe it is to do business with a merchant. CBD businesses are often classified as high-risk by banks and payment processors because the industry is at the center of regulatory uncertainty, financial scrutiny, and operational challenges.

Although hemp-derived CBD is federally legal under the 2018 Farm Bill in the United States, rules may differ widely by state and country. Such laws create compliance risks for processors, who may fear penalties if a merchant violates local regulations.

Financially, CBD transactions often have a higher chance of chargebacks and refunds. Customers may often misunderstand product claims, experience dissatisfaction with results, or dispute recurring billing charges.

Since CBD is closely connected to health and wellness, regulators and card networks also analyze marketing language, product labeling, and third-party certifications, raising the compliance responsibilities.

Operationally, CBD merchants often sell online, where card-not-present transactions dominate. These naturally come with higher fraud and dispute rates compared to-in person purchases. Additionally, supply chain inconsistencies like unverified product sources or missing Certificates of Analysis(COAs) which can lead to reputational risks for payment partners.

Specialized providers also stay current with shifting state-by-state rules, reducing the risk of sudden account closures. They offer transparent underwriting customized to product types, pricing models, and fundamental methods. As a result, CBD merchants gain steadier approvals, lower dispute ratios, and faster, and more predictable payouts.

CBD businesses are indicated as high-risk due to legal, financial, and operational factors:

Also Read: CBD Industry Trends Challenges and Future Outlook

1. Regulatory Gray Area:

The CBD market operates in a true regulatory gray zone. Federally, the 2018 Farm Bill legalized hemp-derived CBD containing no more than 0.3% delta-9 THC, but it did not authorize all uses of marketing claims.

The FDA bans CBD in conventional foods or dietary supplements and closely reviews packaging and marketing to indicate any implied medical or therapeutic claims.

Without an approved new dietary ingredient(NDI) or GRAS status, ingestible CBD remains especially sensitive and both FDA and FTC analyze it and issue warnings for unproven health claims and deceptive marketing. Complicating matters even further, state rules vary widely.

Each state sets its own rules on allowed products, labeling, testing, THC thresholds, and who can buy. Some states permit ingestibles if they meet testing, QR code or COA, and batch-traceability requirements; while others allow only topicals or set different THC calculations.

Age limits, packaging warnings, serving caps, and retailer licensing can change at each border and local countries may add their own restrictions. While emerging cannabinoids like delta-8 or THCA introduce more ambiguity, as states treat them inconsistently.

For CBD companies, this patchwork demands state-by-state SKU, label, and messaging adjustments and rigorous compliance documentation. For CBD companies, this patchwork demands state-by-state SKU, label, and messaging adjustments and rigorous compliance documentation.

Due to changing, state-by-state rules, processors face higher underwriting risk; even small missteps can lead to fines, disputes, or closures, so CBD merchants are categorized as high-risk and placed under stricter controls.

Also Read: Why Every CBD Business Needs a Customized POS System

2. Association with Cannabis:

Even though hemp-derived CBD is non-psychoactive and is legal at less than 0.3% delta-9 THC, many banks still treat CBD as cannabis assuming higher scrutiny and reputational exposure even when products meet federal hemp limits.

Underwriters worry about THC exceeding limits, wrong labels, contamination between products, and unclear rules around delta-8 and THCA which complicate compliance.

They also face higher operational risk due to card-not-present sales, ad platform restrict promotion, age-gating must be enforced, and health-related claims might lead to FDA or FTC scrutiny of all conditions correlated with chargebacks.

When COAs, batch tests, or sourcing records are missing or outdated, underwriters treat the merchant as significantly higher risk which makes it harder for banks to verify ongoing compliance. Cross-border shipping rules and carrier policies add another layer of uncertainty.

From a portfolio perspective, one noncompliant merchant can draw card-network penalties, so many banks either price heavily for that risk or avoid the category outright.

So the result is tighter onboarding, higher fees, rolling reserves, and continuous monitoring. CBD businesses maintain rigorous testing, clear labeling, and conservative marketing usually fare better often by working with specialized high-risk processors who understand the nuances.

Also Read: How to Market Cannabis

3. High Chargeback Ratios:

Since most CBD sales happen online, fraud, and disputes are more frequent which pushes chargeback rates higher than usual in-person retail. Customers may buy online, wait days for shipping, and then dispute if the product feels ineffective, arrives late, or does not match expectations of classic “friendly fraud”.

Health-focused marketing can also raise expectations, leading to more “not as described” disputes when results don’t match the implied benefits. Combine shipping delays, ad restrictions which draw low-intent shoppers, and complicated cross-border rules, and your dispute risk increases even more.

Subscription and recurring billing also add complexity. If billing cycles are not clear, then the customers may forget about an order, miss an email, or fail to recognize the descriptor causing chargebacks.

Free trials or teaser discounts can backfire when cancellation is confusing or renewal notices are weak causing surprise charges, complaints, and chargebacks. Using mixed “THC” and “hemp” working on labels or websites confuses customers, causing misunderstandings which often lead into disputes.

Reduce disputes by using 3-D Secure, AVS or CVV and velocity checks with fraud scoring, posting clear policies, sending shipping or renewal reminders offering easy cancels or refunds, and aligning product pages with COAs.

Clear billing descriptors, responsive support, and post-purchase education reduce “didn’t work” claims; well-documented representations like proof of use, delivery, and consent, recover revenue and steady chargeback ratios.

Also Read: Top 5 Challenges in CBD Payment Processing

4. Evolving Industry:

The CBD industry is evolving fast, and that speed creates uncertainty for risk teams. New product formats like vapes, edibles, beverages, pet tinctures, nano-emulsions arrive quicker than regulators can issue clear guidance, so rules are interpreted differently by states, card networks, and marketplaces.

Each product type has unique risks like vapes face flavor bans and strict age checks; edibles raise serving size, packaging, and child-resistance requirements; beverages demand stability testing, shelf-life validation, and unique distribution rules.

Cannabinoids like delta-8, THCA, and HHC keep rules in fluctuations, blurring legal lines and forcing continuous, state-by-state compliance checks.

On the operational side, direct-to-consumer ecommerce dominates, bringing higher card-not-present fraud and chargeback ratios and recurring billing risks when subscriptions or free trials are not managed transparently. Supply chains can be inconsistent like batch variability, COA gaps, or contaminated inputs which further complicates underwriting and ongoing monitoring.

When big ad platforms change their rules, demand can swing wildly bringing in low-content clicks which lead to sudden surges in low-intent buyers, more refunds, and an increase in disputes.

Cross-border shipping, carrier restrictions, and differing THC thresholds increase confusion and cost. For banks and processors, the changing rules demand stricter onboarding with enhanced KYC and SKU vetting, conservative terms like rolling reserves, volume caps, and ongoing controls like clear descriptors, 3-D Secure, dispute analytics.

Merchants who invest early in compliance, testing, and transparent customer experience usually secure better approval odds and more stable processing. Because of these factors, many traditional processors such as Stripe, PayPal or Square in standard mode decline CBD businesses outright or shut down accounts unexpectedly once when they detect CBD sales.

Also Read: Is CBD Legal in all 50 States

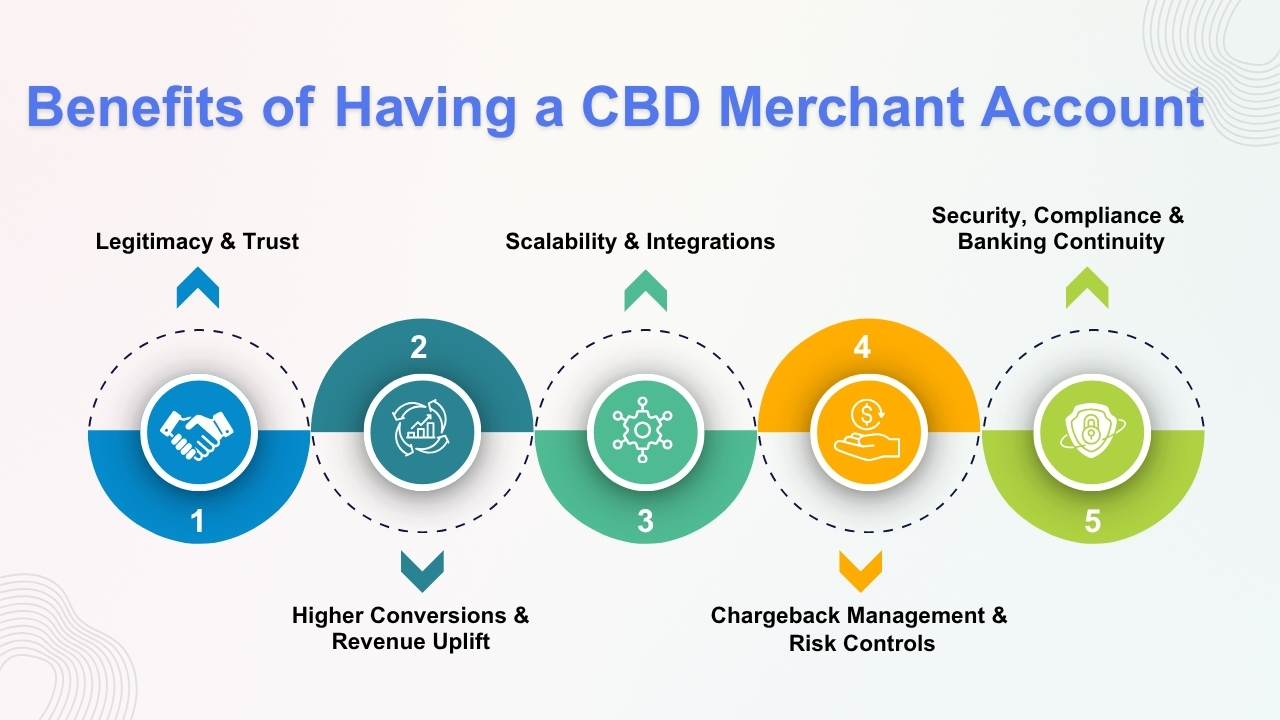

Benefits of Having a CBD Merchant Account

Despite the extra challenges, securing a dedicated CBD merchant account is worth the effort.

1. Legitimacy & Trust:

Accepting major cards shows you are a real, vetted business. Shoppers expect to see Visa or Mastercard or Amex at checkout; when they do, they are more comfortable completing the purchase and returning later.

A proper merchant account also gives you professional billing descriptors, branded receipts, and refund flows which are small details that reassure the customers, reducing, “is this legit?” tickets and prevent confusion-driven disputes.

Also Read: Guide to Start a CBD Business

2. Higher Conversions & Revenue Uplift:

Card acceptance removes friction compared to cash, bank transfers, or clumsy alternatives. You can offer one-click checkouts, saved tokens, digital wallets, and subscriptions. It converts into better conversion rates, higher average order values(AOV), and improved repeat purchase behavior.

With a CBD-friendly processor, you can safely enable upsells, bundles, and recurring shipments turning convenience into revenue instead of struggling with your payment stack.

Also Read: How Much Does it Cost to Open a CBD Dispensary

3. Scalability & Integrations:

A CBD-ready merchant account connects clearly to e-commerce platforms like Shopify alternatives, WooCommerce, custom cards, POS systems, and CRMs.

You get webhooks and APIs for real-time order sync, inventory updates, accounting exports, and marketing automation for instance win-back campaigns, churn prevention.

As you add channels like marketplace listings, unified reconciliation, and flexible settlement schedules.

Also Read: Comparing CBD Payment Gateway

4. Chargeback Management & Risk Controls:

High-risk processors bring tools customized to CBD such as AVS/CVV checks, 3-D Secure, velocity rules, device fingerprinting, and score-based screening.

They also provide dispute portals and representation playbooks which are proof of delivery, usage, and consistency that help you win cases and keep ratios stable.

Clear descriptors, renewal reminders, and one-click cancellations reduce friendly fraud. And the net result will be fewer losses, more recovered revenue, and stronger processor relationships.

Also Read: Why CBD Business are Considered High-Risk

5. Security, Compliance & Banking Continuity:

You benefit from PCI DSS compliance frameworks, tokenization, and encryption along with KYC or AML onboarding that matches the regularity reality of CBD such as COAs, age gates, SKU reviews.

Specialized underwriters understand state-by-state nuance and set policies which you can actually follow which means fewer surprise shutdowns.

With time, clean processing history lowers reserves and improves terms, giving you predictable cash flow and the confidence to invest in growth.

In short, a CBD merchant account is the financial backbone which allows your business to operate professionally and securely.

Also Read: Secure Payment Processing for CBD Ecommerce

Challenges of Getting Approved

1. Strict Underwriting (Heavy Documentation & Compliance Scrutiny):

CBD is classified as high-risk, so processors conduct intense line-by-line underwriting before approval. You will be required to provide business licenses, recent bank statements, detailed product catalogs with batch specific COAs along with website screenshots and marketing materials for review.

Underwriters carefully examine product labels, marketing claims, age-verification measures, refund and shipping policies, and may request supplier information or proof of regular product testing. Any mismatch like health claims, missing COAs, unclear THC thresholds, or confusing terms which can pause underwriting or lead to a straight denial.

Also Read: CBD Content Marketing

2. Higher Costs (Fees, Reserves, and Risk Pricing):

Because processors assume greater exposure to disputes and regulatory shifts, CBD merchant accounts carry premium pricing. You may see one-time setup fees (often $200–$1,000), higher per-transaction rates (commonly 3–7% vs. 2–3% for low-risk), and monthly gateway or risk-tool fees.

Rolling reserves are common: processors hold 5–10% of sales for 90–180 days to cover chargebacks and volatility. While these costs feel steep, clean processing history, low dispute ratios, and strong compliance (clear descriptors, COAs, conservative marketing) can help you negotiate better terms over time.

Also Read: Understanding CBD Payment Terms

3. Limited Provider Options (Fewer Banks/ISOs Willing to Underwrite):

Only a few banks and ISOs are willing to underwrite CBD businesses, and their approval criteria often change in response to changing regulations and card network policies. Because of limited availability, CBD merchants often face tougher approval standards, longer onboarding, and fewer options when it comes to pricing or contract terms.

Some mainstream platforms may decline ingestibles or specific cannabinoids, due to which need to depend on niche providers. Improve approval odds by submitting a tight compliance with current COAs with QR codes, clear labeling, no disease claims, transparent subscriptions, clear refund terms, and age verification where required.

A thoroughly prepared application signals lower risk, increasing your pool of willing providers and improving the pricing and terms you are offered.

Also Read: CBD Merchant Account Vs Regular Merchant Account

How to Apply for a CBD Merchant Account

The application process for a CBD Merchant account is more detailed than a standard merchant account.

1. Choose a High-Risk Payment Processor:

As CBD businesses come under the high-risk category, begin by researching processors which specialize in CBD and hemp industries. Find processors that have a track record with CBD businesses, offer strong compliance assistance, and maintain positive client feedback, as partnering with the right provider such as CBD Merchant Solutions promotes faster approval and account stability.

Also Read: How to Protect Your CBD Business From Payment Processor Shutdowns

2. Prepare Essential Documentation:

Before applying, collect all required documents such as articles of incorporation, EIN, and government-issues ID. Also include recent bank statements of the last 3 or 6 months, and Certificates of Analysis(COAs) proving that your products contain less than 0.3% THC. Clearly show your refund and return policies to show transparency and compliance.

Also Read: How to Get a Merchant Account for CBD Business

3. Submit the Application:

Complete the online or paper application form carefully. It must be specific and honest about your product categories whether you sell tinctures, edibles, topicals, vape items, or pet products. If there is incomplete or misleading information then it can delay or disqualify your application.

Also Read: Best Ecommerce Platform for CBD

4. Underwriting Review:

Your processor’s underwriting team will evaluate your risk profile. They may request additional documentation, like supplier details or product images, to verify compliance with laws and payment network rules.

5. Approval and Integration:

After approval, you will be issued a Merchant ID. Integrate the payment gateway to your website or POS system, verify successful test transactions, and start accepting secure payments for your CBD business.

Alternatives to Merchant Accounts

Some CBD businesses explore alternatives if they can’t get approved:

1. Third-Party Processors:

Many CBD businesses use third-party processors that group multiple merchants under one shared account for faster setup, but this approach often leads to sudden account suspensions, frozen payments, and poor customer support.

2. ACH Bank Transfers:

ACH payments allow customers to send funds directly from their bank accounts. Although slower than card payments, they are dependable for recurring billing or backup methods when card processing is not available. However, settlement delays can affect cash flow.

3. Crypto Payments:

Accepting crypto payments can reduce costs and enable global transactions. However, unstable crypto values, low consumer adoption, and no chargeback protection make it unsuitable for most established CBD retailers.

4. Cash-Only Models:

Some local CBD stores operate on a cash-only basis, but this approach limits growth, increases security concerns, and reduces convenience making a proper CBD merchant account the most lasting long-term solution.

Though there are alternatives, none match the security, scalability, and consumer trust of a proper CBD merchant account.

What to Look for in a CBD Payment Processor

While evaluating providers, prioritize:

1. Experience with CBD and Hemp Businesses:

Select a processor which specializes in high-risk industries such as CBD and hemp. Their familiarity with federal and state regulations, THC limits, and labeling rules which reduces the risk of application rejection or account termination.

Also Read: CBD Business Ideas to Start

2. Transparent Pricing Structure:

Choose a processor that offers full transparency on set up fees, transaction costs, monthly charges, and reserves. Also it is essential to avoid companies with hidden fees or unclear pricing that can gradually reduce your profits.

Also Read: Selling CBD Products Online

3. Chargeback and Fraud Protection:

CBD transactions often face higher scrutiny in order to ensure that your processor includes tools for fraud detection, chargeback alerts, and dispute management to protect your revenue.

4. E-Commerce Platform Compatibility:

Make sure you select a processor that easily integrates with platforms like Shopify, WooCommerce, and BigCommerce. Smooth integration makes the setup more simple which ensures a smooth checkout experience for customers.

5. Responsive Compliance Support:

Ensure you work with a partner which provides hands-on compliance guidance, including COA verification, refund policy reviews, and website compliance checks.

6. Scalability for Growth:

As your CBD business grows, choose a processor capable of handling large transaction volumes, recurring payments, and multi-channel sales smoothly and without any interruptions.

Common Mistakes to Avoid

1. Applying to Mainstream Payment Processors:

Many CBD merchants waste time by applying to conventional processors such as Stripe, PayPal, or Square. These companies often reject or shut down CBD accounts once when they identify high-risk transactions. So it’s smarter to approach specialized CBD-friendly processors from the beginning.

2. Unclear Refund or Return Policies:

If your refund policy is unclear or missing, then it can raise warnings for both customers and payment processors. It increases chargeback risks and leads to higher fees or even account termination.

3. Making Unverified Health or Medical Claims:

Avoid marketing CBD products with claims like “cures anxiety” or “treat pain”. Such baseless claims violate FDA and FTC rules and can result in fines, warnings, or processor suspension.

4. Misrepresenting Your Business Category:

Falsely categorizing your CBD products to avoid restrictions is a serious offense that can permanently damage your business reputation and payment processing eligibility. Providing false or misleading information can place your business on the MATCH list, making it extremely difficult to obtain payment processing services in the future.

The Future of CBD Payment Processing

1. Mainstream Acceptance:

As regulations surrounding hemp and CBD products become clearer and more standardized, mainstream banks and financial institutions will accept CBD businesses. Such stigma will reduce the stigma and make it easier for merchants to obtain dependable payment solutions.

2. Lower Transaction Fees:

Increased competition among payment processors will lower transaction rates. While risk levels decline with better compliance and data transparency, CBD merchants can expect more affordable pricing structures.

3. Integrated E-Commerce Platforms:

Future platforms like Shopify, WooCommerce, and Wix will likely offer native integrations for CBD payments allowing businesses to set up processing with just a few clicks simplifying operations and compliance.

Conclusion

Though the CBD industry continues to flourish, accepting payments for hemp-derived is a major challenge because of strict regulations and different banking policies. A CBD merchant account is a specialized payment processing solution which is designed to help CBD businesses to securely accept both credit and debit card transactions online, in-store, or through mobile systems.

Traditional payment processors often categorize CBD as “high-risk” because of regulatory uncertainty and potential chargebacks. Due to which many popular processors like PayPal, Stripe, or Square often refuse or abruptly terminate CBD merchant accounts without prior notice. A specialized CBD merchant account is designed to manage such challenges effectively while maintaining compliance with federal and state regulations.

For qualifying, CBD merchants must provide detailed documentation like Certificates of Analysis(COAs), business licenses, refund policies, and clear labeling proving products contain less than 0.3% THC. The underwriting process is more strict than a standard merchant account, but once approved, businesses get access to stable payment processing, chargeback protection, and integration with major e-commerce platforms.

So, having a proper CBD merchant account not just builds trust and credibility with customers but also ensures long-term business continuity. As regulations evolve and mainstream acceptance grows, partnering with a dependable CBD-experienced processor will become essential for any business who are willing to scale sustainably in this flourishing market.

Frequently Asked Questions (FAQs)

1. Can I use PayPal or Stripe for CBD sales?

Most mainstream processors ban CBD transactions, often leading to frequent account closures and interruptions in payment processing for merchants.

2. Do I need a separate account for online and retail sales?

Certain processors allow CBD and non-CBD products under a single account, while others mandate separate accounts in order to maintain compliance and risk management.