The world of alternative wellness products has grown rapidly. Though the two products, Kratom and CBD continue to be at the center of debates regarding increasing consumer demand, regulatory scrutiny, and which products payment processors are actually willing to support.

Although both Kratom and CBD are classified as high-risk products, their payment regulations, legal classifications, and banking requirements are very different.

Understanding such differences is important for merchants, payment processors and eCommerce brands who are trying to stay compliant and avoid account shutdowns, and secure reliable high-risk merchant accounts.

After the 2018 Farm Bill made the hemp-derived CBD with less than 0.3% legalized then the CBD(cannabidiol) emerged as a mainstream wellness category.

It is essential for CBD merchants to still follow strict compliance, labeling guidelines, FDA restrictions, and underwriting standards before processors or banks allow them to accept payments.

Card networks, acquiring banks, and payment gateways imposed clear rules on how CBD products can be marketed, and which formats are allowed like tinctures, topicals, and gummies and what types of claims are allowed.

Even today, CBD is treated as a high-risk industry, requiring specialized processors which understand hemp regulations, COAs, and age-verification requirements.

While Kratom on the other hand, faces a more complex and fragmented regulated environment. Although Kratom is federally legal in the United States, Kratom is banned or restricted in several states creating uncertainty for processors.

Many banks categorize Kratom under high-risk botanicals, due to which merchants are forced to seek specialized Kratom merchant accounts, providing improved due diligence, and stricter compliance checks.

As the legal status of Kratom is not uniform, many mainstream processors such as Stripe, PayPal, or Square mostly reject Kratom business completely.

For merchants who are selling CBD or Kratom online or in physical stores it is important to handle the differences in payment processing regulations, chargeback management, and banking policies.

It is only when a business clearly understands regulatory gaps, then more effectively they can select the right processor, stay compliant, and establish long-term stability in the high-risk payment environment.

Also Read: CBD Business Ideas to Start

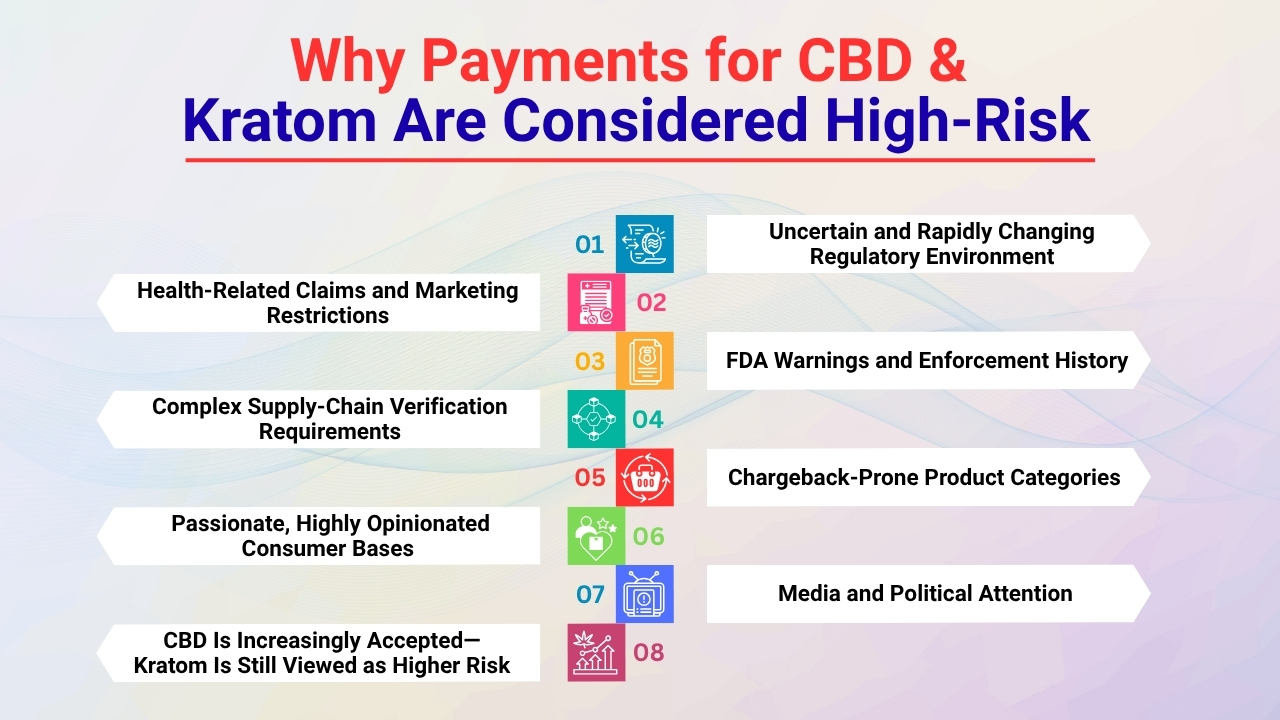

Why Payments for CBD & Kratom Are Considered High-Risk

Before comparing both CBD and Kratom industries it is equally important to understand why payment processors, banks, and merchant service providers mostly classify both categories as high-risk.

Although both CBD and Kratom differ in legality, supply-chain rules, and federal oversight, both product groups share characteristics that increase more concerns for underwriting teams.

Such concerns affect approval rates, transaction monitoring, chargeback limits, and overall payment stability for merchants.

1. Uncertain and Rapidly Changing Regulatory Environment:

One of the biggest reasons why CBD and Kratom comes under high-risk merchant categories is due to the unpredictable legal environment surrounding them. While banks look for consistency, clarity, and long-term compliance. But both CBD and Kratom operate in constantly changing regulations.

For CBD, the 2018 Farm Bill legalized hemp-derived CBD if there is less than 0.3% THC. Though this change in federal law gave new opportunities for retailers , there is still a lack of providing a full, clear regulatory framework.

The FDA still prohibits CBD in food and beverages at the federal level, and also the marketing claims are strictly monitored. Meanwhile states and counties implement their own local rules, so a CBD product which is legal in one region may be restricted in another.

For Kratom, the regulatory environment is even more fragmented. Though Kratom is federally legal in some states like Alabama, Rhode Island, and Arkansas have prohibited it completely while several other cities and counties enforce local bans.

The FDA has released several warnings and is still reviewing Kratom for possible scheduling, which makes payment providers treat it as a higher-liability, higher-risk business.

Processors must constantly track these regulatory shifts to avoid violations. This level of monitoring increases operational costs and risks, forcing processors to classify both CBD and Kratom as high-risk sectors.

Also Read: Why CBD Business are Considered High-Risk

2. Health-Related Claims and Marketing Restrictions:

Both CBD and Kratom operate in the wellness space, and any product marketed as having “health benefits” invites federal scrutiny. The FDA strictly regulates health claims to protect consumers from unverified treatments.

For CBD, it means businesses cannot claim their products “treat anxiety”, “heal pain”, “reduce inflammation”, or “cure diseases” without any clinical evidence. Many CBD merchants violate these rules unknowingly by posting aggressive health-focused marketing, causing bank concerns.

For Kratom, the situation is even more sensitive. Because Kratom interacts with the body’s opioid receptors so regulators watch it closely. Any merchant implying that Kratom relieves opioid withdrawal, reduces pain, or improves mood can be indicated for compliance violations.

Payment processors do not want to carry the liability of supporting merchants who would face FDA enforcement or legal action for improper claims. It adds more risk to both product categories.

Also Read: How to Avoid Frauds and ChargeBacks in CBD Payment Processing

3. FDA Warnings and Enforcement History:

Payment processors study historical enforcement patterns before approving a merchant type. Both CBD and Kratom have attracted attention.

The FDA has issued many warning letters to CBD companies for false medical claims, mislabeling, or selling products that have more than the labeled THC content. Such history indicates that the CBD market still has unpredictability.

Kratom has experienced even stronger enforcement attention. The FDA has warned importers, seized shipments at United States ports, and issued public health advisories regarding contamination, misuse, or adulteration. Because Kratom has no formal federal regulatory framework, banks fear that the industry could face sudden crackdowns, directly impacting merchant stability.

This enforcement history contributes heavily to why payment processors classify both CBD and Kratom as high-risk.

Also Read: How to Avoid CBD Merchant Account ShutDown

4. Complex Supply-Chain Verification Requirements:

Due to safety concerns, both CBD and Kratom merchants must follow strict sourcing and testing standards. Processors require merchants to provide Certificates of Analysis(COAs), Third-party lab test results, Hemp cultivation licensing, Documentation proving THC compliance, Batch tracking for contamination risks, clear ingredient labeling, and supply-chain transparency.

For CBD, it ensures products truly meet the federal definition of “hemp-derived”. For Kratom, third-party lab testing is crucial because contamination with heavy metals or adulterants is a known issue.

The need for rigorous documentation makes underwriting more complex. Banks must verify compliance at every level from manufacturing to labeling to distribution. Many merchants fail to provide adequate evidence, causing payment processors to deny or discontinue accounts.

Also Read: Innovative Cannabis Marketing Tips

5. Chargeback-Prone Product Categories:

CBD and Kratom are both tied to wellness outcomes that can differ significantly between individuals. When a customer does not experience expected results, they may dispute the charge.

Additionally, subscription models are common for both CBD and Kratom industries. Auto-billing always increases chargeback risk, especially if customers forget they signed up.

High chargeback ratios are a threat to payment processors because they cause penalties from card networks like Visa and Mastercard. To protect themselves from these potential losses, processors label both CBD and Kratom businesses as high chargeback risk from the start.

Also Read: Understanding ChargeBack in CBD Industry

6. Passionate, Highly Opinionated Consumer Bases:

CBD and Kratom attract passionate, vocal communities of consumers. While that isn’t automatically a bad thing, it often comes with more disputes, product complaints, pressure for fast delivery, higher refund requests, and loud backlash when something goes wrong.

Banks evaluate reputational risk when deciding whether to support a merchant category. Both industries carry more scrutiny, increasing the chances of negative press, which processors try to avoid.

Also Read: Marketing Ideas for CBD Business

7. Media and Political Attention:

The media frequently reports on CBD regulations, THC confusion, and FDA oversight. Kratom receives even stronger attention which is often linked to addiction, health concerns, or political campaigns calling for increased regulation.

Payment processors track these stories because public perception affects risk profiles. If Congress or federal agencies consider regulating or prohibiting a substance, banks hesitate to support that industry.

Also Read: How to Get a Merchant Account for CBD Business

8. CBD Is Increasingly Accepted—Kratom Is Still Viewed as Higher Risk:

While CBD is not risk-free, it has become more normalized in mainstream banking and eCommerce. Many payment processors now offer specialized CBD merchant accounts that still require strong compliance but are more accessible than they were a few years ago.

Kratom, however, remains significantly more unstable. It’s a legal patchwork. FDA resistance, and higher chances of enforcement make Kratom merchant accounts harder to secure and more expensive.

For transparent providers, Kratom represents higher risk, higher liability, and higher compliance difficulty than CBD. This distinction is crucial for merchants to navigate approvals and build stable payment infrastructure.

Also Read: Why CBD Business are Considered High-Risk

Legal Status Overview: CBD vs Kratom

1. Legal Status Overview: CBD vs Kratom:

Understanding the legal status of CBD and Kratom is essential for merchants, payment processors, and anyone navigating compliance in the high-risk payments space.

Although both CBD and Kratom products fall into the wellness and botanical categories, the laws that govern them are fundamentally different. Such differences directly affect banking approval, underwriting requirements, and payment processor acceptance.

Also Read: How to Choose the Best CBD Payment Processing Company

2. CBD Legal Status:

CBD derived from hemp, defined as cannabis containing less than 0.3% THC became federally legal in the United States with the passing of the 2018 Farm Bill.

This legalisation reclassified hemp as an agricultural commodity rather than a controlled substance, opening the door for nationwide participation in the hemp supply chain.

As a result, CBD businesses gained legal entry into farming, manufacturing, processing, transport and logistics, wholesale distribution, and retail and eCommerce sales.

However, making it legal at the federal level didn’t automatically translate into clear, comprehensive rules. Significant restrictions still apply:

- CBD is not approved as a dietary supplement, meaning companies cannot market it like other vitamins or nutraceuticals.

- CBD cannot be advertised with medical or therapeutic claims, like treating pain, anxiety, inflammation, or chronic conditions.

- The FDA continues to regulate CBD in foods, beverages, supplements, and ingestibles, creating a patchwork of rules that differ by state.

- Labeling accuracy, THC compliance, and third-party lab tests remain compulsory for most retailers.

Also Read: is CBD Legal in all 50 States

3. Kratom Legal Status:

Unlike CBD, Kratom does not have federal legalization or uniform nationwide protection. Instead it exists in a complex and inconsistent legal landscape governed primarily by states and local municipalities.

Across the United States, Kratom falls into several categories like:

- Fully legal in many states.

- Completely banned in states like Alabama, Arkansas, Indiana, Rhode Island, and Wisconsin.

- Regulated locally in certain counties and cities.

- Under ongoing review by federal agencies including the DEA and FDA.

Some states have classified Kratom as:

- A controlled substance

- A banned product

- A restricted botanical with age requirements

- A legal supplement with strict labeling or purity rules.

Because Kratom lacks federal approval and faces active scrutiny from health agencies, its legal status varies dramatically depending on jurisdiction. So Kratom is federally unregulated and legally inconsistent across states creating a high-risk environment for merchants and payment processors.

Also Read: The Best Marijuana Marketing Strategies

Federal Regulatory Differences

Although CBD and Kratom are often discussed together within the broader wellness and botanical markets, their federal regulatory environments could not be more different.

Understanding how each product is monitored at the federal level is crucial for merchants, payment processors, and compliance teams, because regulatory clarity or the lack of it directly shapes underwriting requirements, payment acceptance, and long term business stability

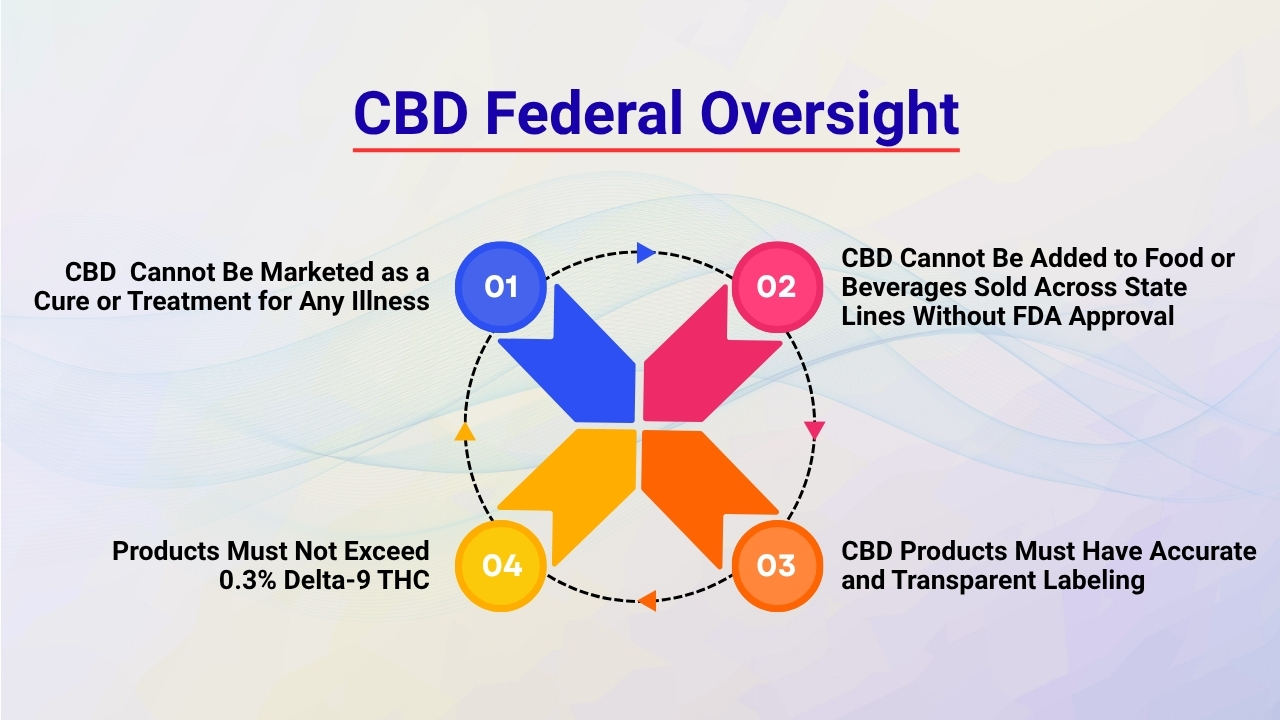

CBD Federal Oversight:

CBD derived from hemp is federally legal under the 2018 Farm Bill, but legality does not mean there is freedom from regulation. CBD is one of the most strictly scrutinized consumer botanicals at the federal level, firstly because it exists in the gray area between supplement, agricultural commodity, and wellness product.

The U.S. Food and Drug Administration(FDA) plays the dominant role in overseeing CBD. Its stance includes several firm and non-negotiable guidelines:

1. CBD cannot be marketed as a cure or treatment for any illness:

Businesses cannot claim that CBD treats anxiety, depression, pain, inflammation, seizures, arthritis, sleep disorders, cancer, or any other medical condition.

Even soft claims like “supports pain relief” or “helps anxiety” can cause enforcement. The FDA strictly prohibits therapeutic or disease-related claims unless products have undergone clinical trials and received drug approval, something that most CBD products have not.

Also Read: Understanding CBD Payment Terms and How to Avoid Hidden Fees

2. CBD cannot be added to food or beverages sold across state lines without FDA approval:

This restriction is one of the most confusing for retailers. While many states allow CBD in food or drink within their borders, federally it remains unapproved as a food additive or dietary ingredient. It means interstate commerce involving CBD ingestibles is subject to enforcement, making many payment processors hesitant to support these product types.

Also Read: Selling CBD Products Online

3. CBD products must have accurate and transparent labeling:

The FDA requires proper labeling, which include ingredient lists, potency, serving sizes, and disclaimers. Mislabeling, especially inconsistent CBD content or undisclosed THC remains one of the most common violations seen in warning letters.

4. Products must not exceed 0.3% Delta-9 THC:

CBD is federally legal only when derived from hemp. Any product with THC above the legal threshold is considered marijuana and therefore illegal under federal law.

Because some products drift above 0.3% during manufacturing, processors require strict third-party testing(COAs)to confirm compliance.

Also Read: CBD Payment Compliance 101

Kratom Federal Oversight

Kratom exists in a very different regulatory space. Unlike CBD, Kratom has no federal legalization framework and no established federal safety guidelines.

The plant is neither banned nor approved at the federal level, creating a vacuum of regulation which leads to inconsistent state laws, higher liability concerns, and stricter payment acceptance conditions. The FDA has been the main federal agency monitoring Kratom and its stance has been consistently cautious and if not outright aggressive. Key elements of federal oversight include:

1. Issuing public health warnings:

The FDA has already released multiple advisories warning consumers about potential risks with Kratom like contamination, misuse, or lack of regulatory testing. And such warnings influence how banks and processors evaluate Kratom merchants.

Also Read: How to Create an Effective CBD Business Plan

2. Blocking and seizing certain imports:

Since Kratom is primarily imported, the FDA has authority over its entry into the United States. It has seized shipments at ports and detained products which are deemed to be adulterated or improperly labeled. It creates unpredictable supply-chain challenges for merchants and raises underwriting red flags for payment providers.

Also Read: How to Expand Your CBD Business to a New Market

3. Targeting Kratom companies with enforcement actions:

The FDA has tracked companies selling contaminated, mislabeled, or medically advertised Kratom products. While their enforcement actions include warning letters, injunctions, product seizures, and requests for voluntary recalls. Payment processors see this as a major compliance risk.

4. Declaring Kratom “not approved” for consumption:

The FDA has clearly stated that Kratom is not approved as a dietary ingredient, food additive, or supplement. Such classification means Kratom is legally sold only in a gray category typically as a botanical, ethnobotanical, or “not for human consumption” production depending on state law.

Also Read: How to Get a CBD License

State-by-State Variations

Both CBD and Kratom function within complex legal environments, while state-level laws create different challenges for each industry. CBD usually benefits from broader acceptance nationwide but Kratom faces more fragmented and unpredictable laws.

1. CBD State Laws:

Though most U.S. states permit the sale of hemp-derived CBD, each state sets its own set of rules for compliance. Some states restrict CBD in foods and beverages but they permit tinctures or topicals.

Others require manufacturer or retailer registration, product-specific labeling rules, or batch-specific THC testing in order to verify if the compliance is within the 0.3% legal limit.

Although CBD is widely permitted, compliance obligations differ, and merchants must adjust operations on the basis of state’s regulations to stay fully legal.

2. Kratom State Laws:

Kratom’s legality is significantly more inconsistent. Some states ban Kratom outrightly while other states regulate Kratom through the Kratom Consumer Protection Act(KCPA) that imposes testing, labeling, and age limits.

Some regions permit Kratom with 18+ or 21+ age restrictions while some cities impose their own local bans even when the state laws allow it.

This patchwork creates major challenges for merchants especially regarding shipping policies, payment processing approval, e-commerce storefront restrictions, and underwriting, since processors must evaluate each merchant’s exposure to banned jurisdictions.

Also Read: Which Bank Support CBD Business

FDA Position: CBD vs Kratom

The FDA’s position is one of the clearest and most influential differences between the CBD and Kratom industries. Because payment processors and banks closely follow FDA guidance when determining risk categories, the agency’s stance directly affects merchant approvals, underwriting difficulty, and long-term payment stability.

1. FDA’s CBD Position:

The FDA recognizes that hemp-derived CBD is federally legal, but it still imposes strict limitations. So CBD cannot be marketed as a drug or medical treatment unless it has undergone FDA approval while companies are prohibited from making therapeutic claims such as “treats pain” or “reduces anxiety”.

Also FDA takes strict action against CBD products that are mislabelled, contaminated, or inaccurately represent their THC or cannabinoid content. Though there are restrictions, compliant CBD brands have to operate within a regulated framework giving more confidence to processors in supporting the category.

2. FDA’s Kratom Position:

However, Kratom faces a more harsher federal outlook. Though the FDA has stated repeatedly that it considers Kratom unsafe and warns consumers against its use, it does not permit it in dietary supplements. The FDA also highlights concerns because of dependency, misuse, and contamination.Such a negative stance influences processors heavily.

As a result, CBD merchants have more approval chances than Kratom as it remains significantly higher-risk.

Also Read: How to Create Google Business Profile for CBD Business

Card-Network Policies (Visa, Mastercard, AmEx, Discover)

The outlook of major card networks such as Visa, Mastercard, American Express, and Discover play a major role in determining whether CBD or Kratom merchants can accept card payments.

While banks and processors handle underwriting, the card brand sets the overarching compliance rules that all merchants must follow. Their policies greatly influence approval difficulty, accepted product categories, and overall payment stability.

1. CBD Card-Network Acceptance:

CBD enjoys significantly broader acceptance across the major card networks, but only when merchants meet strict compliance requirements. Visa, Mastercard, AmEx, and Discover generally allow CBD transactions under the following conditions:

- The product contains less than 0.3% Delta-9 THC, meeting the federal definition of hemp.

- Third-party lab Certificates of Analysis (COAs) are available and displayed clearly, proving potency, purity, and safety.

- Products do not include banned SKUs such as CBD-infused alcohol, unapproved pets consumables, or products marketed with therapeutic claims.

- The merchant avoids any medical or disease-related claims in advertising, labeling, or product descriptions.

- The business passes high-risk underwriting, including product reviews, website audits, COA verification, marketing review, and identity/business checks.

- Each SKU is compliant with FDA and state regulations, including proper labeling and batch traceability.

Because CBD is federally legal and increasingly normalized, the card networks provide a structured compliance pathway. This gives merchants more opportunities to secure domestic payment processing—though always under the classification of high-risk.

Also Read: Comparing CBD Payment Gateway

2. Kratom Card-Network Acceptance:

Kratom faces a far more restrictive environment. Major card brands consistently classify Kratom as high-risk, restricted, or often prohibited under standard MCC (Merchant Category Code) guidelines. This is due to:

- The FDA’s strong negative stance on Kratom

- Active DEA review for potential scheduling

- State-level bans and inconsistent legal status

- Concerns regarding misuse, dependency, and contamination

- Higher-than-average chargeback rates in the supplement space

As a result, many traditional acquirers and domestic banks refuse to board Kratom merchants. To process Kratom payments, businesses typically rely on:

- Offshore acquiring banks

- Specialized high-risk processors

- Custom MCC classifications designed for botanicals or restricted supplements

- Aggregators that accept elevated liability under stricter terms

These arrangements come with downsides, including:

- Higher processing fees (often 5%–8%+)

- Tighter transaction monitoring

- More documentation requirements

- Greater underwriter scrutiny

- Limited chargeback thresholds

Because card networks view Kratom as a volatile and compliance-heavy category, acceptance remains limited, costly, and difficult to secure.

Offshore vs Domestic Payment Options

Domestic payment acceptance differs between CBD and Kratom mostly due to differences in regulation and federal oversight. CBD enjoys growing domestic support as many U.S. banks and processors now approve CBD merchants which provide full compliance documentation, COAs, proper labeling, and THC-limit verification.This allows CBD businesses to secure reliable, domestic processing with standard underwriting.

Kratom, however, faces extremely limited domestic acceptance. As many U.S. banks avoid Kratom entirely as merchants depend usually on offshore acquiring banks, high-risk aggregators, or specialty processors who are willing to handle high liability.

These solutions typically involve higher processing fees, rolling reserves, longer payout cycles, and more rigorous compliance reviews. As a result, Kratom merchants face a far more challenging path to stable payment processing.

ACH, eCheck & Alternative Payments

Because card acceptance is often restricted, both the CBD and Kratom industries depend heavily on non-card payment solutions to maintain consistent cash flow. These methods provide lower fees, fewer chargebacks, and more flexible approval pathways for high-risk products.

1. CBD Alternative Payments

CBD merchants frequently use ACH, eCheck, digital wallets, bank transfers, and fully integrated high-risk merchant accounts. These options are supported by many domestic processors, making them reliable choices for recurring billing, subscription plans, and eCommerce checkouts. Non-card payments also help CBD businesses maintain stability in states where card-network rules are stricter.

2. Kratom Alternative Payments

Kratom sellers rely even more on non-card solutions due to limited domestic card acceptance. Some common methods include ACH/ eCheck, bank-to-bank transfers, while in certain markets, cryptocurrency for fast and low-risk transactions. Such payment options ensure continuity in a category where traditional card processors frequently decline applications.

Conclusion

The payment environment for Kratom and CBD is shaped by a complex mix of legality, federal oversight, card-network rules, and banking compliance. Though both Kratom and CBD come under the category of high-risk products, their regulations differ sharply and these differences determine how easily merchants can secure payment processing and build long-term operational stability.

Where CBD benefits from being legalized by federal, a clearer regulatory structure, and more predictable underwriting requirements. But merchants need to follow core compliance steps like providing COAs, maintaining accurate labeling, avoiding medical claims and staying below the 0.3% THC threshold who can generally access domestic processors, major card networks, and mainstream acquiring banks. Although CBD remains high-risk, it has defined approval steps that are responsible for businesses to direct successfully.

Kratom, by contrast, faces far greater regulatory uncertainty. With no federal legalization, conflicting state laws, and ongoing scrutiny from the FDA and DEA, Kratom remains a volatile category in the eyes of payment providers. This leads to stricter underwriting, limited processor options, higher fees, rolling reserves, and a greater likelihood of account denials or closures. Many merchants must turn to specialized high-risk acquirers or offshore solutions to keep their businesses running.

For merchants in either industry, the key to payment stability is proactive compliance—transparent sourcing, clean labeling, responsible marketing, and strong internal controls. CBD sellers can operate confidently within a regulated framework, while Kratom sellers must stay especially vigilant due to evolving laws and heightened scrutiny.

Understanding these differences enables merchants to choose the right partners, reduce risk, and create a sustainable payment infrastructure in an increasingly regulated high-risk marketplace. If you still have any query regarding differences in Payment regulations between Kratom and CBD then feel free to write to us at CBD merchant solutions and we are more than happy to assist you.

Frequently Asked Questions (FAQs):

1. Is CBD legal to sell online in the United States?

Yes, if hemp-derived CBD with less than 0.3% THC is legal federally under the Farm Bill. But each state has its own CBD regulations, labeling requirements, testing rules, and shipping restrictions due to which compliance becomes essential for payment approval.

2. Can CBD and Kratom merchants use Stripe, PayPal, or Square?

No. All major mainstream payment processors prohibit both Kratom and most CBD products. So merchants must use high-risk merchant account providers or specialized CBD or Kratom processors.