Introduction

In the world of CBD ecommerce, time is everything. Whether you are launching your brand new site or turning from a failed payment provider, setting up reliable online CBD payments fast can be the deciding factor between growth and stagnation.

But as you all know, CBD is considered a high-risk industry. So, traditional processors like PayPal, Stripe, and Shopify Payments may freeze or reject your account- even if you are operating business legally.

The good news? In 2025, it’s possible to get your account approved and accepting payments within 24 hours, if you have all the steps and have your documentation ready.

In today’s fast evolving and competitive market, every hour you are offline means missed revenue. Luckily, with the right merchant processor, documents, and technical integrations, you can go from “just browsing” to same day CBD payments.

Set up CBD payments quickly with a compliant processor to ensure fast approval, secure transactions, and reliable online payment acceptance.

This blog is your blueprint to getting it done. We will break down:

- The fastest CBD-friendly payment processors on the market.

- Which documents do you require and how to prepare them in less than an hour?

- How to integrate payment gateways into Shopify, WooCommerce, or BigCommerce?

- Tips to pass compliance checks easily.

- How to avoid hidden fees and long approval delays?

Also Read: Understanding CBD Payment Terms

The 24-Hour Promise: What’s achievable or realistic and What’s not

You may wonder, whether setting up online CBD payments in less than 24 hours is possible.

The answer is – yes, it is possible but with the right preparation and partners. Below is the breakdown for what’s realistic and what’s not if you are aiming for a same-day launch:

1. Realistic : Fast Approval with a CBD-Friendly Processor

CBD Merchant Solution emphasizes that when you partner with a high-risk payment processor that understands the risks involved in the CBD industry can speed up your account’s approval process.

If you have your documents ready and your business is compliant, then many CBD-friendly providers can approve your account and begin onboarding in just a few hours.

Also Read: How to Protect CBD Business From Payment Processor ShutDown

2. Realistic: Quick Integration with Platforms like Shopify or WooCommerce:

Most of the CBD-friendly payment gateways are built in a way to work smoothly with popular ecommerce platforms like Shopify, WooCommerce, and BigCommerce.

These plug-and-play integrations just require less technical effort and could be completed within minutes once your account is approved.

Provided with pre-built plugins or easy API connections, can help you get started with accepting online CBD payments without requiring any complex coding or development delays – saving time and avoiding the requirement for custom development.

Also Read: How to Integrated CBD Payment Solution With Ecommerce Platforms

3. Not- Realistic: Approval Without Required Documentation:

Skipping necessary documentation – like Certificates of Analysis(COAs), business licenses, or a compliant website with clear refund and privacy policies – will always delay or avoid approval.

Processors are required to assess risk and ensure legal compliance before providing access to CBD payment solutions.

Also Read: How to Get a CBD License

4. Not Realistic : Using Stripe, PayPal or Square for CBD:

Most of the mainstream payment processors like Stripe, PayPal, and Square generate do not support CBD merchants, even those businesses involved in selling legal hemp-derived products.

Such platforms often suspend or close accounts, generating significant risks and disruptions for CBD businesses looking for reliable payment processing.

By following a clear plan, partnering with the right providers like CBD Merchant Solutions and applying the right strategy can help you to confidently set up online CBD payments within 24 hours which is absolutely achievable.

Also Read: How to Choose the Best CBD Payment Processing Company

Why do CBD Merchants Need Specialized Payment Solutions?

Setting up payment processing is a crucial step for any ecommerce business – but if you are into selling CBD products, it’s not as simple as having an account in PayPal or Stripe.

Despite typical wellness products or skincare, CBD is labelled as “high-risk” by most traditional banks and financial institutions, even in 2025. And this label changes everything.

This classification is due to ongoing regulatory uncertainties, inconsistent state laws, and its association with THC-containing products. As a result, many traditional banks and mainstream payment processors often refrain from working with CBD businesses or may abruptly terminate services with little notice.

Above that, the industry witnesses higher chargeback rates and requires complex underwriting involving lab reports, licenses, and compliance with THC limits.

Specialized processors understand such nuances, providing solutions that ensure legal compliance, reduce processing interruptions, enabling merchants to accept credit card and online payments with confidence and speed.

Also Read: What is a High-Risk Merchant Account

Why is Selecting the Right Payment Provider Crucial for CBD business?

Choosing the right payment provider is important to ensure success and stability for your CBD business. As CBD is classified as a high-risk industry, all processors will not provide the support or compliance infrastructure required to operate smoothly.

Only the right provider such as CBD Merchant Solutions will understand CBD-specific regulations, provide quick approvals, and integrate easily with an e-commerce platform. Such providers will help to avoid hidden fees, chargeback issues, and unexpected account shutdowns.

Selecting a trusted, CBD-friendly processor not just ensures faster setup but also protects your business from costly penalties. Finally, the right payment provider becomes a long-term partner in your business growth and operational efficiency.

Also Read: How to Choose the Right CBD Merchant Account

What are the Common Mistakes to Avoid?

1. Submitting Incomplete Documentation:

Most of the CBD merchant providers fail to provide required documents like COAs, business licenses, or a compliant EIN, leading to set backs or outright rejection during the application process.

Also Read: Selling CBD Product Online

2. Using the Wrong Payment Processor:

Selecting mainstream processors like Stripe, PayPal, or Square can go wrong, if they often flag, freeze, or terminate CBD accounts due to strict internal policies against high-risk or regulated products.

Also Read: How to Protect your CBD Business From Payment Processor ShutDown

3. Ignoring Website Compliance:

A website missing key elements like refund policies, privacy terms, and disclaimers indicates non-compliance to underwriters, often causing delayed approvals or rejections of your CBD payment application.

Also Read: The Ultimate Guide to CBD Social Media Marketing

4. Not Testing the Payment Gateway:

Failing to test your payment gateway before going live can lead to undetected technical issues, failed transactions, and a poor customer experience – which often lead to lost sales or poor customer experience on day one.

Also Read: How Fast Payout can Improve Your CBD Business CashFlow

5. Overlooking Provider Reputation:

If you are going with the cheapest option without much research regarding support quality, uptime, or compliance history can often lead to costly long-term issues.

Also Read: Why Traditional Banks Reject CBD Merchants

What Do You Need Before You Start?

For setting up online CBD payments quickly and smoothly, you need to prepare important documents and establish your business complies with industry regulations.

Being properly organized upfront can speed approval and help you to set up online CBD payments within 24 hours.

1. Legal Business Setup:

Payment processors need to provide proof that your CBD business is legal. Gather:

- Business Formation Documents: Articles of Incorporation or LLC paperwork.

- Employer Identification Number(EIN): IRS-issued tax ID for your business.

- State Business Registration: Confirmation that your business is registered in your operating state where you conduct business.

Also Read: How to Start a CBD Business

2. Product Documentation:

As CBD is a high risk industry, processors always want to verify your products.

Prepare:

- Certificates of Analysis(COAs): provide lab results confirming legal THC levels.

- Product Descriptions and Ingredient Lists: provide clear, accurate details about the products and ingredients.

- Lab Contact Info: essential for verification of test results.

Also Read: How Much Does Average CBD Store Make

3. Compliant Website:

Your website must meet all the legal standards:

- Age Verification: To restrict underage access.

- Terms and Conditions, Privacy, and Refund Policies: Clear legal information.

- FDA Disclaimer: For Example: This product is not intended to diagnose, treat, cure, or prevent any disease.

- No Medical Claims: avoid promoting unverified health benefits.

Also Read: 10 Best Website Builders for CBD Business

4. Business Banking Information:

Try to link your payment processing to your business bank account:

- Business Bank Account: Your business bank account must match your business name.

- Blank cheque or bank letter: A blank cheque or bank letter is used to confirm your business bank account details for secure and accurate payment processing.

Also Read: CBD Merchant Account Vs Regular Merchant Accounts

5. Processing History:

If you have processed payments before, then prepare 3-6 months of transaction history for negotiating better terms.

Collecting all the necessary items before you start will ensure a smooth and speedy payment setup.

Also Read: Secure Payment Processing for CBD Ecommerce

Recommended CBD-Friendly Processors(2025):

Selecting the right processor can either make or break your CBD store’s success.

Below are some of the best options for 2025:

- EasyPay Direct : ideal choice for scaling operations.

- Square(CBD Program): Square works as a good option for smaller brands or startups.

- PaymentCloud: it works as a great support and supports fast approval for CBD businesses.

- NMA(National Merchant Alliance): it offers customized high-risk solutions.

- DigiPay Solutions: This is an ideal choice for merchants looking for CBD subscriptions.

- Shift Processing: this processor is known for its excellent customer service.

Also Read: Is CBD Legal in all 50 States

Step-by-Step: Set Up CBD Payments in less than 24 hours:

Step 1: Organize your Documents(1-2 hours):

Create a folder with all the requisite documentation:

- Articles of Incorporation

- EIN letter from the IRS

- COAs for each product

- Product catalog or price sheet

- Website URL with legal policies

- Blank cheque or bank letter

- High-quality product images.

This process usually requires 1 or 2 hours.

Also Read: CBD Industry Trends Challenges and Future Outlook

Step 2: Apply to a High-Risk Payment Processor(1-2 hours):

Go to your selected processor and start the application:

- Fill out your product details accurately.

- Upload all the requisite documents in one batch.

- Respond quickly to underwriter follow-ups.

Many processors like NMA and PaymentCloud can approve your accounts in a single day if all your documents are proper and complete.

Also Read: Can You Sell CBD on TikTok

Step 3: Integrate with your Website(1-2 hours)

Once your account is approved, then integrate the payment gateway to your ecommerce platform:

- Select a payment gateway like NMI, Authorize.net, or eMerchantBroker.Use platform-specific ecommerce platforms:

- Shopify: Connect with a supported third-party processor

- WooCommerce: Try to install the appropriate plugin

- BigCommerce: Use API credentials or hosted checkout

After integration, run a test transaction to ensure everything works smoothly.

Also Read: Best Website Builders for CBD Business

Step 4: Launch and Monitor

Once your payments are live, it’s time to go public and keep your tabs on performance:

- Announce your store launch through email and social media.

- Monitor your payment dashboard for activity and errors.

- Review Analytics and chargeback report everyday.

- Use tools like alerts and logs to catch suspicious behavior early.

Also Read: Guide to Start a CBD Business

Speed Hacks to avoid delays:

If your aim is to get your CBD payment system online in less than 24 hours, then every hour counts. Below are some proven speedy hacks to avoid unnecessary obstacles and to get approved quickly.

1.Get Your Documents in Order(Before you apply):

CBDMerchantSolutions emphasizes that one should be ready with your paperwork before time which is the biggest time-saver ever. Use a shared folder like Google drive or Dropbox to save your documents and name each document clearly. Be ready with everything from your COAs to your Refund Policy formatted and ready to upload.

Also Read: Why Every CBD Business Needs a Customized POS System

2. Make Compliance Effortless:

Processors will not approve your account only if your website is fully operational and compliant with CBD industry rules.

- Use AI-based compliance tools like Enforce.io to scan your whole website for risky language.

- Double-check that you have not made any medical claims in your product descriptions.

- Ensure that your COAs are visible and downloadable on every product page.

- Age verification if you are selling ingestibles.

Also Read: How to Expand Your CBD Business to a New Market

3. Communicate Like a Pro:

In order to keep your account moving, ensure:

- Ensure you reply to underwriters within 30 minutes during business hours.

- Try to set up email notifications on your phone so that you don’t miss any requests.

- Make sure you provide a direct phone number in your application. Most of the time approvals are delayed simply because a processor could not reach you.

Also Read: Market Ideas for CBD Business

4. Use Pre-Verified Tech Tools:

- Select ecommerce platforms and plugins that have been already verified to work with your selected processor(for e.g. Shopify+DigiPay).

- Enable 3D Secure during gateway setup – it helps to prevent fraud.

- Activate fraud prevention add-ons like NoFraud, ClearSale, or Signifyd for extra security.

Also Read: CBD Content Marketing

5. Select the Right Processor:

Certain processors approve fast processing but are not certainly specialized in CBD. Select a provider from a fully verified list that specializes in CBD and offers same-day approval with smooth onboarding especially for high-risk merchants.

Also Read: How to Get a Merchant Account for CBD Business

6. Conduct a Test Transaction Immediately:

After integration, don’t wait to test. Run a $1 transaction to verify the whole workflow from checkout flow to confirmation emails. As you don’t want to discover any errors after your store goes live.

Also Read: What is a High Risk Merchant Account

7. Keep your Site Simple for Launch:

Start simple – avoid custom coding and flashy animations to help processors approve your website faster.

Send a short email to your processor when your site is fully ready.

Use these quick tips to speed up approval and start accepting payments on the same day.

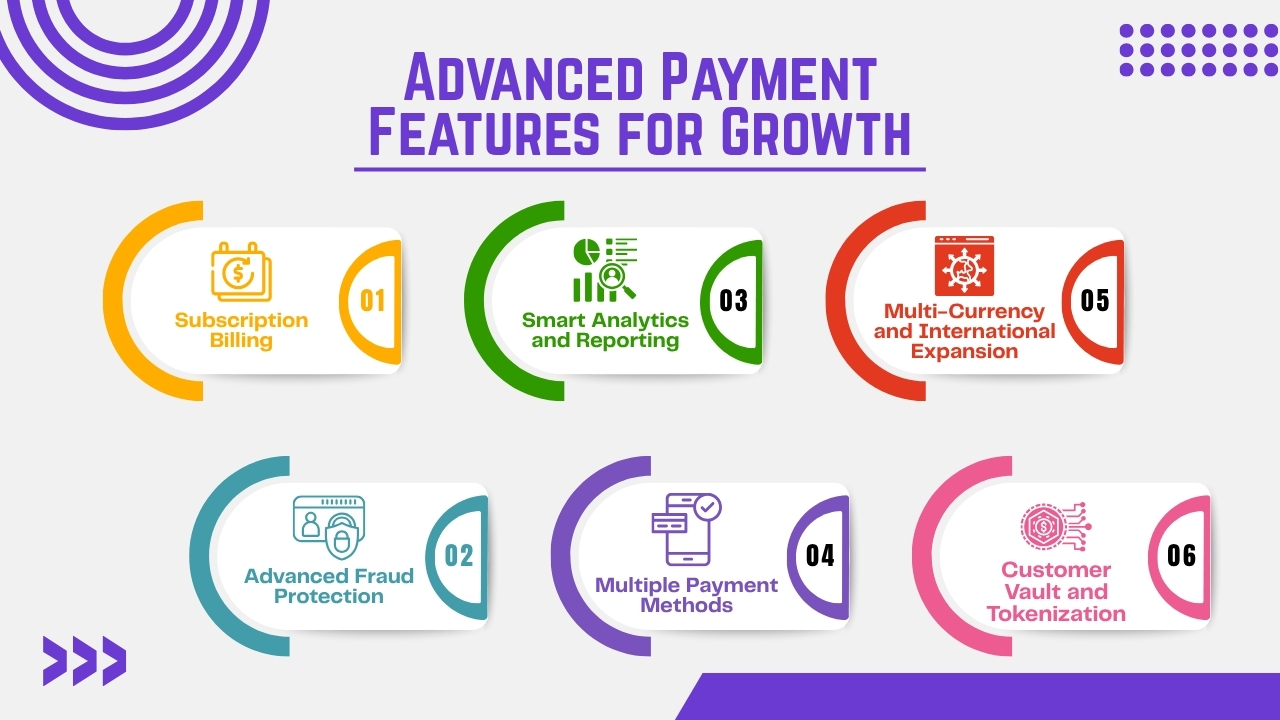

Advanced Payment Features for Growth:

Once your CBD payment system is up and running, it’s time to unlock features that drive long-term growth, increase retention, and streamline operations. Below are advanced tools and strategies that go beyond basic payment processing.

1. Subscription Billing:

Recurring revenue models are transforming how CBD businesses grow and retain customers. Whether you are selling weekly gummies, daily tinctures, or monthly wellness kits, subscriptions generate predictable income and will improve customer lifetime value.

- Use gateways like NMI or Authorize.net that support recurring billing.

- Partner with processors like DigiPay or GreenMoney for ACH-based subscriptions.

- Tokenize customer card data for secure re-billing without re-entry.

2. Advanced Fraud Protection:

As your store grows, so does your exposure to fraud and chargebacks. Hence, consider adding advanced tools like:

- 3D Secure 2.0 : changes liability to the card issuer during any disputes.

- Fraud detection services: NoFraud, Signifyd, and ClearSale use AI tools to identify risky transactions.

- Velocity checks: Block repeated transactions in shorter time frames from the same IP or cards.

Most of the CBD chargebacks often come from misunderstandings – clear refund policies and recognizable billing descriptors will also be helpful.

3. Smart Analytics and Reporting:

Your payment gateway is more than a tool for making money – it’s a data powerhouse. Advanced reporting can assist you:

- Identify best-selling products and high-performing time windows.

- Track failed transactions and abandoned carts.

- Track average order value(AOV) trends by region or device.

4. Multiple Payment Methods:

Today’s shoppers expect flexibility. Beyond credit/debit cards, consider:

- ACH transfers for lower fees on large orders.

- Buy Now, Pay Later options through platforms like Afterpay.

- Digital wallets like Apple Pay or Google Pay.

Providing customers more ways to make payments can improve conversion rates by up to 20%.

5. Multi-Currency and International Expansion:

If you plan to expand globally, then select a processor and gateway that support:

- Currency conversion and localization

- Geo-targeted fraud rules

- Language and tax adjustments for international shoppers.

CBD regulations differ by country – ensure your processor is compliant in your target markets.

6. Customer Vault and Tokenization:

Tokenization replaces sensitive card data with a unique identifier or “token”, that is stored separately in a secure, PCI-compliant vault. This enables:

- One-click reorders

- Easy refunds or adjustments

- Better security and PCI Compliance

Try to find PCI Level 1 gateways with built-in vaulting support.

Conclusion:

Setting up online CBD payments does not have to take weeks or months of back-and-forth with banks and processors. By keeping the right documents ready, CBD-friendly processors, and a smooth ecommerce platform, will enable your business to start accepting processors within 24 hours or even faster if you follow the speedy techniques outlined in this blog.

While operating in today’s competitive CBD market, the ability to go live quickly means capturing the early sales or losing to your rivals. It means less time waiting and more time growing- developing your brand, generating revenue, and serving customers.

Whether you are launching a new product line or migrating from a banned account, fast setup is your first step that ensures long-term success.

But do not stop there. Once payments are live, use advanced tools like subscription billing, fraud protection, and chargeback alerts to build a brand with resilience and scaling.

So, if your CBD store could be open for business by the end of today, Then, why wait? If you still have any query of setting up your Online CBD payments within less than 24 hours then feel free to reach us at CBD merchant solutions expertise and we are more than glad to assist you.

Frequently Asked Questions (FAQs)

1. Will it be possible to start accepting CBD payments in less than 24 hours?

Yes, with the right high-risk processor and a compliant CBD website, most of the merchants can get approved and go live the same – mainly if all required documents are ready.

2. Does Stripe, PayPal, or Square work for CBD payments?

These mainstream processors ban CBD because of legal and compliance risks. Using such processors may lead to frozen accounts or terminated services, even if your business appears compliant.