Introduction

The international CBD industry is giving no indication of slowing down in 2025. With the industry projected to hit all-time highs, increasing numbers of entrepreneurs and wellness-focused brands are launching CBD businesses — from e-commerce websites to brick-and-mortar dispensaries.

But with as much potential as there is out there, there remains still one barrier in the path of most CBD businesspeople: getting a compliant, trustworthy CBD merchant account.

CBD merchants are not the typical retail company; they belong to a high-risk category of company due to complex legal guidelines, state-to-state and country-to-country varying laws, and higher chargeback rates.

As a result of this, most traditional banks and payment processors stay away from CBD payment processing, which leaves business owners looking for solutions that serve their business and compliance requirements.

A CBD merchant account in 2025 is essential to facilitate safe transactions, healthy payment processing, and regulatory compliance to enable companies to overcome high-risk issues while maintaining customer trust and company success.

CBD credit card processing allows companies to receive payments safely, eliminating high-risk barriers and ensuring easy transactions for CBD sales.

Working with an unsuitable CBD merchant account provider can lead to blocked funds, suspended accounts, and interrupted cash flow, whereas a suitable partner like CBD Merchant Solutions can facilitate secure CBD payments and guaranteed growth of your business.

The ideal CBD merchant account provides secure processing, excellent approval rates, competitive rates, and customized support for the ever-evolving CBD market.

Through this blog we are attempting to walk you through all the crucial points regarding how to choose the best CBD merchant account in 2025.

Also Read: CBD Merchant Accounts Vs Regular Merchant Accounts

What is a CBD Merchant Account?

A CBD merchant account is a high-risk account that allows businesses dealing in cannabidiol (CBD) products to accept debit and credit card payments safely and legally. Because CBD businesses have unique financial and legal needs, they require expert payment processors with high-risk business experience.

This CBD-supportive merchant account is typically offered by a CBD-friendly acquiring bank in partnership with a high-risk payment processor who knows the uniqueness of selling hemp-derived products.

Also Read: How to Get a Merchant Account for CBD Business

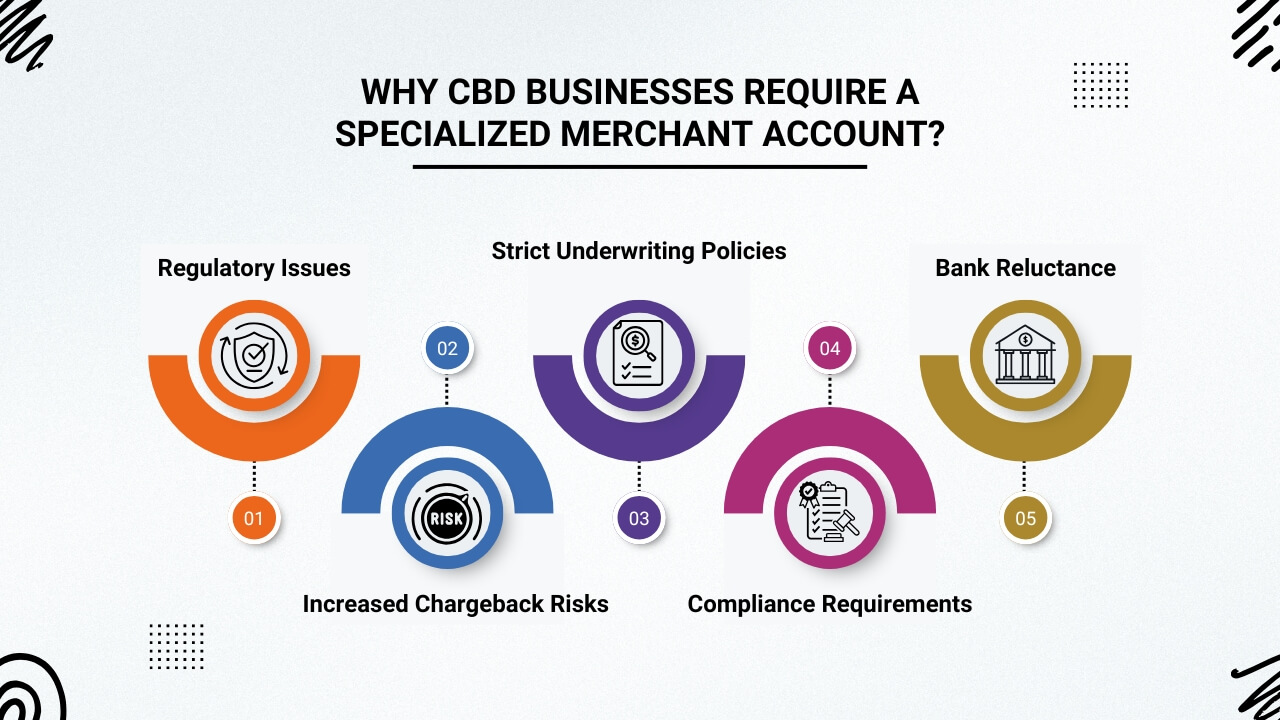

Why CBD Businesses Require a Specialized Merchant Account?

CBD businesses experience special challenges within the payment processing environment. Normal merchant accounts are not typically capable of managing the unique risk and regulatory complexities associated with the CBD. That’s why an account with specific capabilities is a necessity:

1.Regulatory Issues:

CBD involves high-risk payment processing because of inconsistent federal and state regulations. This complicates the process of obtaining financial institutions that are willing to fund CBD businesses.

Also Read: Why do CBD Business Struggle With Payment Processing

2.Increased Chargeback Risks:

As a result of product inconsistencies, late shipments, and changing legal environments, CBD merchants tend to have higher chargeback risks, which can result in account closure if not properly managed.

Also Read: How to Avoid Fraud and Chargebacks in CBD Payment Processing

3.Strict Underwriting Policies:

Strict underwriting policies for CBD businesses require extensive financial risk assessments, compliance standard checks, and documentation analysis, ensuring merchants meet strict requirements due to the high-risk nature of the business.

Also Read: Guide to Start a CBD Business

4.Compliance Requirements:

CBD companies need to adhere to strict compliance regulations, such as PCI compliance and state-related regulations, to escape hefty fines and account shutting down.

Also Read: How to Get a CBD License

5.Bank Reluctance:

The majority of traditional banks remain hesitant to work with CBD companies due to concern regarding reputational loss and possible federal consequences.

Custom CBD merchant accounts are meant to overcome these obstacles, offering individualized assistance, increased approval, secure, reliable payment processing to ensure the long-term success of your company.

Also Read: Which Bank Supports CBD Businesses

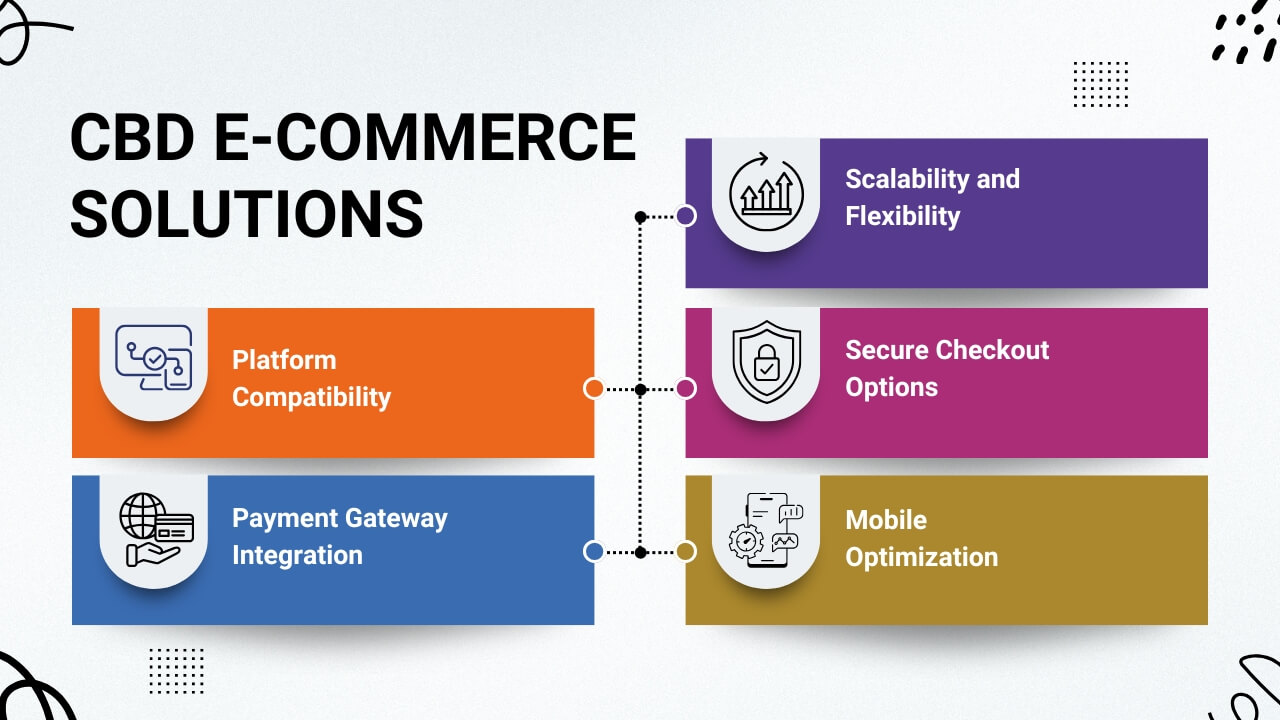

CBD E-commerce Solutions

For businesses that sell CBD, there must be a smooth e-commerce experience. This involves connecting your merchant account to a solid e-commerce platform to enable effortless transactions and customer satisfaction. Some key considerations are:

1.Platform Compatibility:

Ensure your merchant account provider is compatible with popular ecommerce websites like Shopify, WooCommerce, BigCommerce, and Magento which can accommodate the unique requirements of CBD sales.

Also Read: Best Ecommerce Platform for CBD

2. Payment Gateway Integration:

Utilize secure gateways like Authorize.net, NMI, or Square that support high-risk processing but are PCI compliant.

Also Read: Integrate CBD Payment Solution With Ecommerce Platform

3.Scalability and Flexibility:

Implement solutions that are scalable with your business, having features such as abandoned cart recovery, advanced analytics, and integration with CRM.

Also Read: How to Create an Effective CBD Business Plan

4.Secure Checkout Options:

Provide secure checkout options to reduce cart abandonment and instill trust in customers.

Also Read: How Fast Payouts can Improve Your CBD Business CashFlow

5.Mobile Optimization:

Since most customers are on mobile devices, make sure your website is very mobile commerce-optimized.

Also Read: Email Marketing for CBD Business

Key Points to Consider in Selecting a CBD Merchant Account

Choosing the best CBD merchant account is not just about comparing fees. The following are the essential factors to keep in mind:

1. High-Risk Tolerance:

CBD is considered a high-risk industry due to the regulatory problems, high chargebacks, and constant legal problems. This requires having a seasoned payment processor that has experience with high-risk merchant accounts.

Choose a processor like CBD Merchant Solution with a good track record in the CBD business because they would know the issues with compliance and financial risk better.

Also Read: Why Traditional Banks Reject CBD Merchants

2. Clear Pricing and Fees:

Transparency is important when selecting a payment processor. Hidden fees can quickly eat into your profit margins, especially in the CBD industry, where margins are generally thin.

Find a provider with open, flat-rate pricing, such as processing fees, merchant account fees, and chargeback fees.

Also Read: Selling CBD Products Online

3. Secure Payment Processing:

Security is always a top concern for any internet merchant, but particularly for CBD merchants because the business is considered high-risk. Your processor must offer PCI compliance, end-to-end encryption, tokenization technology, and advanced fraud prevention tools to protect customer information and prevent chargeback losses.

Also Read: How do You Integrate CBD Payment Solutions With Ecommerce Platform

4. Chargeback Management and Prevention:

Chargebacks can be very costly for CBD companies, leading to revenue loss as well as potential account closure. Select a merchant account processor that possesses good chargeback handling features, including real-time transaction monitoring, notice of chargeback, and chargeback mitigation. Implementing these pro-active features is likely to reduce chargeback ratios tremendously and safeguard your finances.

Also Read: How to Choose the Best CBD Payment Processing Company

5. Flexibility and Scalability:

As your CBD company expands, so will your payment processing requirements. Seek a vendor like CBD Merchant Solutions that provides adaptive solutions that grow with your company, such as multi-currency processing, mobile payments, and global payment processing if you aim to go global.

Also Read: How Much Does Average CBD Store Make

6. Banking Relationships and Stability:

Since CBD companies are so much in need of secure banking services, it is crucial to find a payment processor that has established good relationships with reputable banks. This kind of security can eliminate the risk of an immediate account closure and guarantee continued support as your company continues to grow.

Also Read: How to Open CBD Business Bank Account

7. Customer Support and Account Management:

Proactive, helpful customer service is most important to keeping things humming along, especially for high-risk transactions. Select a provider that has 24/7 support, individual account managers, and fast response times to help resolve problems quickly.

Also Read: How to Advertise Your CBD Brand in Best Possible Manner

How to Apply for a CBD Merchant Account?

1. The Application Process: What to Expect:

Obtaining a CBD merchant account is more complicated than an ordinary account because banks have to assess the risk of your company. Below is a step-by-step guide to simplify the process:

-

Business Licenses and Certifications:

Do provide evidence that your business is registered legally and compliant with state and federal laws.

-

Financial Statements:

Bank statements, profit and loss statements, and recent tax returns to demonstrate financial stability.

-

Processing History:

If you have processed payments before, include transaction histories to show payment volumes and low chargeback rates.

-

Compliance Documentation:

Certificates of analysis (COAs) for your CBD products, as well as documentation demonstrating compliance with the 2018 Farm Bill or state-specific regulations.

-

Website and Marketing Reviews:

A compliant, fully operational website with clear shipping, return, and privacy policies.

Also Read: Marketing Ideas for CBD Business

2. Complete the Application:

Complete the application from your preferred payment processor. Be complete and accurate, as incomplete or inconsistent data can result in a delay in approval.

Also Read: CBD Business ideas to Start

3. Underwriting and Risk Assessment:

Your application will undergo a detailed underwriting process, where the provider assesses the financial health and risk profile of your business. Be prepared for follow-up questions and requests for additional documentation.

Also Read: CBD Advertising Best Practices

4. Account Setup and Integration:

Once approved, you will work with your provider to set up your merchant account, integrate the CBD payment gateway with your website or point-of-sale (POS) system, and begin processing payments.

Also Read: How to Create Google Business Profile for CBD Business

5. Ongoing Compliance and Monitoring:

Even once approved, ongoing compliance is essential. Keep your certifications current, watch your chargeback ratios, and keep your website policies up to date to prevent account closure.

Why Are CBD Merchant Services Necessary for Online Stores?

Selling CBD online in 2025 is a thriving opportunity — but processing payments can be complicated.

Since CBD is considered a high-risk business, standard payment processors (such as Stripe, PayPal, regular Shopify Payments) frequently decline or freeze accounts selling CBD products.

In order to operate a successful online CBD store, you require special CBD merchant services that:

- Authorize CBD product sales (full-spectrum, broad-spectrum, and isolate)

- Secure compliant payment processing

- Shield your store from chargebacks and unexpected termination

- Provide integration with eCommerce sites such as Shopify, WooCommerce, BigCommerce, Wix, and WordPress

Why is The Right CBD Merchant Account Important?

In 2025, a trustworthy CBD merchant account is crucial for business continuity and expansion.

Since CBD companies are considered high-risk with uncertain regulatory conditions, conventional banks and most payment processors decline applications or have strict requirements.

The Right Merchant Account Guarantees:

- Safe CBD credit card processing

- Regulatory compliance assistance

- Protection from surprise account freezing

- Fair rates and sustainable growth

Here, we present the best CBD payment processors at the forefront of the industry in 2025, and why each is special.

1. DigiPay Solutions:

DigiPay is a high-risk merchant services specialist with extensive experience serving the hemp and CBD markets. They provide tailored solutions specifically for CBD sellers.

2. PayKings:

PayKings has established a solid reputation as one of the best merchant account providers for the hemp and CBD industries. They specialize in speed and flexibility.

3. Easy Pay Direct:

Easy Pay Direct focuses on high-volume and subscription-based CBD businesses. Their proprietary Easy Pay Direct Gateway delivers robust customization for scaling operations.

4. Square (CBD Program):

Square is a reputable name in CBD small business payments and has an exclusive CBD Program. It’s an easy and cost-effective solution for new companies entering the market.

5. SMB Global:

SMB Global serves high-risk and international businesses, providing solutions for CBD merchants that need to sell worldwide.

Steps to Open a CBD Merchant Account:

Opening a CBD merchant account can be an easy process if done correctly. Because of the unique challenges of operating in the high-risk CBD industry, choosing the right provider and making a well-written application is essential. Here is the step-by-step way to do it:

1.Find CBD-Friendly Payment Processors:

Begin by looking for merchant account providers who focus on high-risk businesses such as CBD. Not all processors accept CBD, so seek them out to comprehend the financial and legal nuances involved. Look at fees, processing volume limits, chargeback procedures, and customer service.

Also Read: How to Expand Your CBD Business to New Market Without Payment Issues

2.Get Necessary Documents Ready:

Collect all the necessary documents, such as your business license, accounting statements, processing record, marketing literature, and voided business check. Be prepared to prove compliance with federal and state regulations and any applicable CBD product certifications.

Also Read: Which Bank Support CBD Businesses

3.Submit a Detailed Application:

After choosing a provider, fill out their application form with proper and detailed business information. Add information regarding your business model, sales forecasts, and risk management strategies to make your application more robust.

4.Become Subject to the Underwriting Process:

Anticipate the provider to conduct a thorough evaluation of your business. This entails determining your financial stability, business history, and possible risk factors. Be open and ready to answer any questions.

5.Install a Secure CBD Payment Gateway:

Once approved, install a secure CBD payment gateway to facilitate easy online and in-store payments. This step is necessary to protect customer data and avoid fraud.

Also Read: CBD Terms of Payment

6.Start Accepting Payments:

After your account is live, you can proceed to accept payments and give your merchants a smooth and secure payment experience.

Mistakes to Avoid When Selecting a CBD Merchant Account

Choosing a CBD merchant account correctly is crucial for the well-being and growth of your company. Alas, most CBD entrepreneurs enter into deals without realizing the specific risks of the industry. Below are the most prevalent mistakes to avoid when selecting a CBD merchant account in 2025:

1. Utilizing Mainstream Processors That Don’t Support CBD:

One of the greatest mistakes is trying to use such platforms as PayPal, Stripe, or Square (non-CBD accounts).

These processors generally do not take CBD-related transactions, and if they see your products, they freeze your money or put your account on hold without notice. Always make sure that a processor explicitly supports CBD and hemp products before becoming a member.

2. Disregarding Regulatory Compliance:

Certain traders downplay the significance of compliance documents, such as:

- Certificates of Analysis (COAs)

- FDA disclaimers

- Proper labeling

- Clear refund and privacy policies

Missing these steps or supplying stale documents will result in application denials or account holds. Your processor will check your site and business for compliance, so it’s crucial to keep up with federal and state regulations.

3. Not Reading the Fine Print:

Most high-risk payment processors employ convoluted contracts with:

- Tiered pricing structures

- High monthly minimums

- Early termination fees

- Hidden reserve requirements

If you don’t review the contract carefully, you might pay more than you need to or get locked into a hard-to-cancel agreement. Always demand clear pricing and seek out flexible terms.

4. Selecting a Processor With No CBD Industry Experience:

CBD is a high-risk category that requires expertise. Working with an inexperienced processor that is unfamiliar with CBD regulation, bank underwriting, and chargeback processing can lead to delays, denials, or compliance issues. Choose a provider with CBD industry experience.

Also Read: How to Start a CBD Oil Business

5. Inadequate Platform Integration Verification:

All CBD merchant accounts do not seamlessly integrate with your website or eCommerce platform.

- Ensure your processor is compatible with:

- Shopify (via a third-party gateway)

- WooCommerce

- BigCommerce

- POS systems if you’re operating a physical store

Lack of integration can lead to clunky checkouts, lost sales, or the need to invest in costly development work.

Also Read: Why Every CBD Business Needs a Customized POS System

6. Ignoring Chargeback Management Tools:

CBD products, especially those involving subscriptions or therapeutic claims, are prone to chargebacks. Many merchants forget to ask about chargeback protection, alerts, and fraud prevention tools. A good processor will offer:

- Chargeback alerts (like Ethoca or Verifi)

- Fraud screening tools

- Best practices to minimize disputes

Not preparing for this can have your account closed if your chargeback ratio is over 1%.

7. Neglecting Customer Support:

Good, available support is too often neglected. Some processors outsource their support or are difficult to contact in an emergency.

Select a provider that provides:

- Dedicated account managers

- 24/7 or extended support hours

- Dispute assistance, technical support, and compliance notifications

CBD Payment Trends of 2025

Staying up-to-date requires selecting a provider that backs innovative payment technologies.

1.Subscription Billing:

CBD wellness brands increasingly offer monthly subscriptions. Monitor for recurring billing and automated dunning capabilities.

2.Mobile Wallets & Contactless Payments:

Customers expect to pay using Apple Pay, Google Pay, and Tap-to-Pay. Your merchant account should be able to handle these.

3.AI-Powered Fraud Detection:

Advanced fraud tools are necessary for defending your CBD eCommerce platform.

4.Cross-Border CBD Sales:

A few providers now enable international sales of CBD (where permitted), including multi-currency support and dynamic currency conversion.

Conclusion:

In 2025, it’s still a challenge but a necessity to work in the CBD payment processing environment. With laws always shifting, strict banking requirements, and greater scrutiny of hemp-based products, choosing an appropriate CBD merchant account is one of the most serious business choices you’ll ever need to make.

The correct partner does not merely enable transactions—they’re a strategic partner who keeps you in compliance, manages chargebacks, protects your revenue, and grows your business.

When making a choice, look for clear fees, high-risk merchant accounts know-how, regulatory expertise, and platform flexibility in integrating with Shopify or WooCommerce.

Avoid the trap of choosing by fees alone or convenience of signing up. Instead, focus on veteran CBD merchant account processors that understand your business and have support that scales with you.

For a high-risk category such as CBD, your best payment partner can give you the confidence and infrastructure needed to thrive. Take your time, ask the right questions, and use our checklist to guide your decision.

Having trouble finding the best CBD payment processing solution for your company? Phone us now or download our 2025 CBD Merchant Account Checklist and let’s get started.

Frequently Asked Questions (FAQs):

1. Will I be able to use PayPal, Square, or Stripe for CBD Payments?

Not Always. Because though Square supports CBD merchants, PayPal and Stripe usually do not allow CBD transactions due to their risk policies. So it is important to regularly check the current terms of service or opt for a CBD-specific payment processor to prevent sudden account shutdowns.

2. What type of fees should I expect with a CBD merchant account?

Owing to the high risk nature of the CBD industry, expect:

- Higher transaction fees(usually 4-6%)

- Monthly account fees

- Chargeback fees

- Rolling reserves(a percentage of funds held temporarily in order to cover potential risks).

Ensure you always compare fee structures between providers to avoid hidden costs.

3. Will I be able to accept International payments with a CBD merchant account?

Yes, but it depends on the provider. Some CBD-friendly processors provide facilities like multi-currency and international payment support, but you must comply with domestic and foreign CBD laws for cross-border sales.