Introduction

In the era of e-commerce and digital transactions, fraud, and chargebacks are quite common and major headaches for companies. The payment industry saw an estimated 238 million chargebacks in the previous year. By 2026, it’s anticipated that this volume would have increased by 42% to 337 million chargebacks.

And most chargebacks are due to fraud and these cost businesses a lot of their hard-earned money. This is common among all businesses, and CBD companies are no exception. The CBD market has grown remarkably in the last few years.

However, when it comes to processing payments, CBD businesses face a lot of loss & challenges because of fraud and chargebacks. This is quite common in the CBD industry because of the shifting regulations and the dynamic nature of cannabis products.

To know more about the chargebacks & frauds in the CBD business and how to avoid it, this blog is all you need. Let’s keep reading and find out more.

Also Read: Guide to Start a CBD Business

What are ChargeBacks in CBD Businesses?

When a credit cardholder discovers a charge on their card that they did not make, they typically file a chargeback (also known as an unlawful transaction). The cardholder reports the transaction to the credit card company and asks for a refund in order to dispute it.

After that, the bank that issued the credit card handles chargebacks and conducts an investigation to see if the chargeback is legitimate.

Chargebacks differ from refunds because they are initiated by the credit card company. This is because the bank will often withdraw funds from the CBD business and put a hold on the account throughout the chargeback process. Once the chargeback is verified as legitimate, the issuing bank will reimburse the consumer for the money.

Also Read: Which Banks Supports CBD Businesses

What are Frauds in CBD Businesses?

Unfortunately, the majority of chargebacks result from fraudulent activity. The extent of the problem varies according to studies, although some statistics indicate that 50% of chargebacks are fraudulent, while others suggest that the proportion of fraudulent chargebacks might be as high as 86%.

However, apart from chargebacks – there are other types of fraud as well. It can trick businesses with fake payment systems, identity theft, and phishing, using stolen personal data to make unauthorized transactions.

Why Chargebacks & Frauds are Common in CBD Businesses?

Chargebacks & frauds are growing for eCommerce businesses, but when it comes to CBD businesses – they are quite common. There are quite a few reasons why these are common. Let’s find out why.

- Legal Ambiguity:

The legal status of CBD products is not universally clear, with different states and countries having varying regulations.

It creates confusion among consumers who are not fully aware of the legality of their purchase, leading them to dispute transactions, They often claim that they either didn’t authorize the payment or didn’t receive the correct product. These disputes often result in chargebacks.

- Banking Hesitation

Many banks and payment processors are reluctant to work with CBD businesses due to concerns about legal compliance and the potential for high-risk transactions.

As a result, CBD companies need to rely on third-party processors that are less secure or more prone to fraudulent activity. This creates a higher likelihood of chargebacks and fraud.

- Target for Fraudsters:

The CBD industry is often viewed as more vulnerable to fraud because of its complex regulatory environment, not availability of reliable payment processors, or large volume of transactions. Fraudsters exploit these vulnerabilities, using stolen payment information or fake payment systems to carry out unauthorized purchases.

- Consumer Confusion:

A lack of clear understanding about CBD products, their benefits, and the laws surrounding them can lead to customer dissatisfaction.

Issues such as delayed shipments, incorrect product orders, or misunderstandings can cause customers to initiate chargebacks, falsely claiming that they were either misled or didn’t receive the expected goods.

- Stigma Around CBD:

The social stigma associated with cannabis-related products can increase the occurrence of “friendly fraud,” where customers intentionally file chargebacks or fraud claims to get a refund.

In some cases, consumers may feel justified in making false claims about their purchase, knowing that the complex legal environment makes it harder for businesses to challenge the dispute, especially if the consumer is in a region where CBD laws are unclear.

Also Read: How to Open a CBD Business Bank Account

The Impact of Chargebacks & Frauds on CBD Businesses

It comes as no surprise that chargebacks can cost organizations a lot more than just their bottom line. Here is all about it:

- The credit card company or bank will charge merchants a fee ranging from $30 to $100 for every chargeback, regardless of the outcome.

- Every chargeback will take merchants 1.8 hours on average to resolve.

- Merchants with a large number of chargebacks will face greater fees from payment service providers, and they may potentially lose their ability to process credit card transactions.

- Chargeback levels that exceed 1% are almost certainly indicative of fraud.

Here’s how chargebacks affect a merchant’s profitability and cash flow:

- Credit card processors incur fees.

- Wasted time and resources spent disputing chargebacks.

- merchandise loss and income from the goods or products that the person who filed the chargeback gets to keep

- Negative reviews can harm your brand’s reputation and affect how prospective buyers see it.

- Stress for eCommerce operations teams that are already overworked

and the list goes on!

Also Read: How to Choose the Best CBD Payment Processing Company?

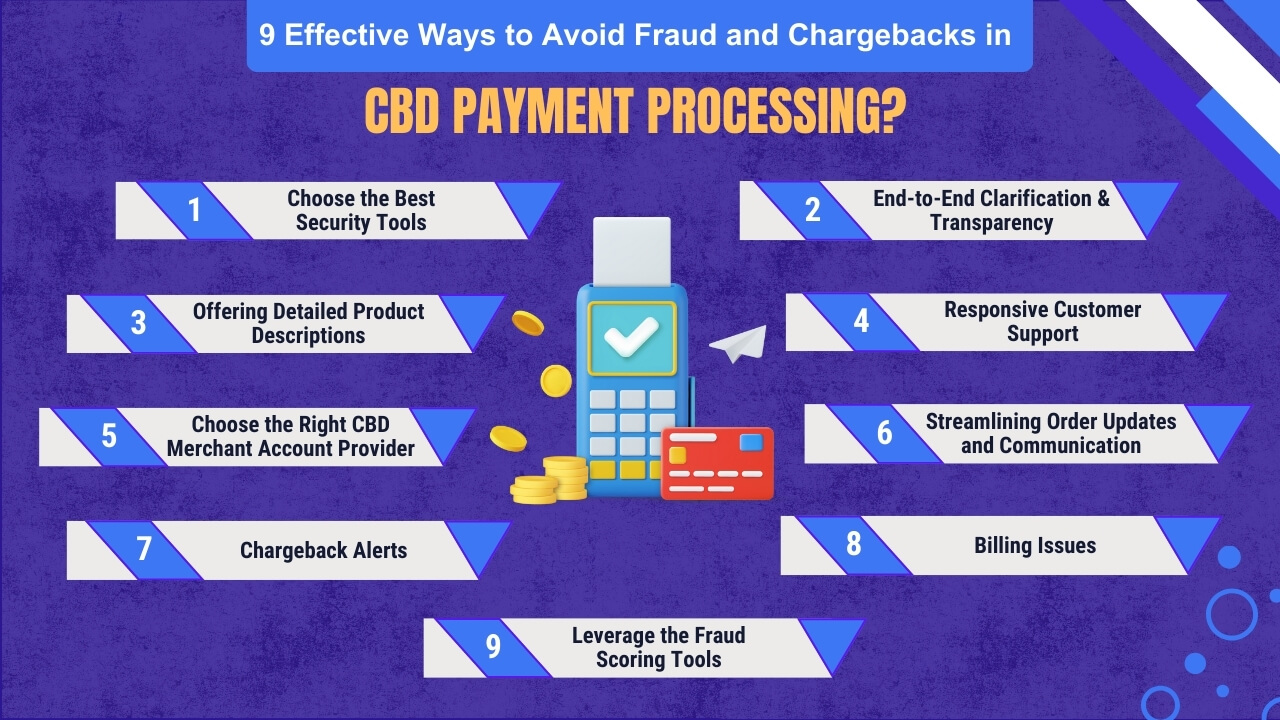

9 Effective Ways to Avoid Fraud and Chargebacks in CBD Payment Processing?

Well, chargebacks and frauds are quite common (in this growing digital realm), especially for the CBD businesses. But, that doesn’t mean businesses do not have any option or they just keep bearing the chargebacks & frauds. There are some ways to avoid frauds and chargebacks in the CBD payment processing. Let’s keep reading!

-

Choose the Best Security Tools

One good way to protect your CBD business from unauthorized transactions is to put strong fraud protection measures into place. A few efficient methods for verifying the identity of customers and lowering the possibility of fraudulent activity are as follows:

- Card Verification Value (CVV)

- Advanced Verification System (AVS)

- 3D Secure 2 (3DS2)

- Verified by Visa (VAU)

These tools function by cross-referencing consumer information, such as addresses and card numbers, with the issuing bank’s data, ensuring that the person making the purchase is the correct cardholder.

Using these advanced fraud prevention solutions, CBD businesses can drastically reduce their exposure to criminal fraud and even reduce the number of chargebacks by detecting and stopping unlawful transaction activity.

Also Read: How to Choose the best Website Builder for CBD Business

-

End-to-End Clarification & Transparency

As you are aware most of the chargebacks and frauds happen in the CND businesses because of the less transparency, information, knowledge, and credibility in the market about the products and even the businesses. But, there are ways to reduce these chargebacks & frauds by offering end-to-end clarification and transparency.

Retailers can foster transparency and trust by:

- Effective communication about billing descriptions can also assist in decreasing cases of friendly fraud

- Confirming the transaction and providing accurate details

- Clearly outlining the terms of payment

- streamlining the cancellation procedure

- Providing thorough product descriptions and outlining return policies in advance

- Constant availability

All of these steps help build the much-needed trust, credibility, and transparency among the customers which ensures lesser chargebacks, and frauds and leads to improved customer experience.

-

Offering Detailed Product Descriptions

Many times it might happen that customers have purchased CBD products out of the blue, unaware of what exactly it is, what it includes, its legality, its effects, and whatnot.

After they get to know about it, most of the time they request for the chargebacks, known as friendly frauds as well. That’s when the CBD merchants can step up and provide all the information about the products. Also, need to mention the product descriptions clearly (on the website and even on the products).

In order to help customers better understand cannabis goods and make educated purchasing decisions, be sure to give thorough product descriptions that include THC levels, strain type, and any side effects. You can also draw attention to important product attributes like terpenes, cannabinoids, and potency.

Product descriptions that work:

- Strike a balance between information that is useful and an emotional connection.

- Facilitate the conversion and pleasure of customers

- Reduce the possibility of friendly fraud

- Helpful for reducing misunderstandings and avoiding chargebacks

With detailed and helpful product descriptions, you can reduce the chargebacks.

-

Responsive Customer Support

Another effective to reduce chargeback on your CBD transactions is by providing robust customer support to address the customer’s queries effectively and efficiently. When your customers have any questions about the product, its usage, its legalization in the city, state, country, consequences, or anything else like that – then they can reach out to your customer support team.

When they have the convenience to connect with you – the chargebacks reduces. Because they know they have the support and everything is transparent & credible.

Here’s the tip: You need to make sure customers have access to multiple channels such as email, phone, or chat in case they want to reach out to you. Also, you can even integrate the automated chatbots or add a FAQ page to assist with common queries. It will not only automate the process but also handle customer queries effectively(regardless of time or date) therapy improving customer satisfaction and reducing chargebacks.

-

Choose the Right CBD Merchant Account Provider

Choosing the right CBD merchant account provider can make a big difference in reducing chargebacks and fraud for CBD businesses. Since the CBD industry is considered high-risk, a specialized provider knows how to handle the unique challenges, such as the regulatory issues and payment restrictions that come with selling CBD products.

They offer secure payment systems that protect online transactions, where most fraud tends to happen, and provide tools to detect suspicious activity before it becomes a problem.

These providers also have chargeback prevention programs that help businesses manage disputes and avoid losing money to false claims. Plus, they offer easy-to-understand reports and analytics, so you can spot trends and address any risks early on.

All in all, by picking the right CBD merchant payment provider, a CBD business can protect itself from fraud, reduce chargebacks, and ensure smoother operations.

Also Read: How to Get a Merchant Account for CBD Business

-

Streamlining Order Updates and Communication

One of the most efficient strategies to prevent chargebacks is to keep clients informed throughout the order process. From purchase confirmation to shipping revisions, clear and consistent communication can help to avoid misunderstandings and reduce the probability of chargebacks due to customers not receiving their goods or services.

Businesses can efficiently manage consumer expectations and lower the risk of friendly fraud chargebacks by proactively communicating with customers and giving them accurate information about their orders, including tracking numbers and projected delivery dates.

In addition to prompt updates, it is advantageous to keep an up-to-date online inventory and give customers accurate delivery information, including the shipping company’s name.

-

Chargeback Alerts

These alerts are a proactive tool that helps businesses manage and reduce chargebacks by notifying them as soon as a chargeback is initiated. When enrolled in a chargeback alert program, businesses receive real-time alerts whenever a customer disputes a transaction, giving them a critical opportunity to respond before the chargeback is finalized.

For example, if a customer disputes a CBD product purchase due to misunderstandings about its legality or effects, the business can quickly reach out, clarify the issue, and possibly refund or replace the product, preventing the chargeback from going through.

Resolving the issue at this early stage can help avoid additional fees and protect the business’s chargeback ratio, which is important for maintaining a good relationship with payment processors.

Additionally, these alerts allow merchants to gather any necessary evidence (such as proof of delivery, transaction details, or customer communication) to challenge fraudulent or invalid chargebacks, giving them a better chance of winning disputes.

-

Billing Issues

Even the smallest thing that you might have ignored can lead to higher rates of chargebacks for your CBD business. And, one such thing that you should avoid to prevent the chargebacks is discrepancies in billing.

It involves making several charges or submitting inaccurate invoice totals. So, in order to guarantee accuracy and consistency, merchants should periodically assess their billing procedures and systems.

Providing clear and accessible billing information, such as invoices and receipts, can assist customers in understanding and verifying their costs, lowering the risk of billing-related disputes and even chargeback proportions.

-

Leverage the Fraud Scoring Tools

Fraud scoring tools evaluate the risk of fraudulent activity in a transaction by analyzing various data points like customer behavior, payment patterns, and geolocation. These tools use algorithms to assign a risk score to each transaction, flagging those that exhibit suspicious or unusual characteristics.

These tools enable CBD businesses to identify potential fraud before it occurs, preventing unauthorized transactions, minimizing chargebacks, and ultimately protecting revenue. By monitoring every transaction and assigning a risk score, CBD businesses can quickly assess whether to approve, decline, or further investigate a payment, ensuring both security and smooth operations.

To Conclude

Here’s the wrap. And, we hope this blog has helped you get to know everything about the basics of chargebacks & frauds in the CBD industry, why it happens, why its prevention is necessary, and effective ways to avoid it.

You can strengthen both your reputation and your bottom line by acquiring a thorough grasp of the problem and taking proactive steps to address it!

There are different ways to address chargebacks & frauds – but choosing the right CBD merchant payment processor who is well aware of the CBD business, and its challenges and ensures the best-in-class support to deal with payments, chargebacks, frauds, and everything in between will make a world of difference.

If you are looking for one reach out to CBD Merchant Solutions – your trusted partner for handling payments for your CBD business. With us – you’ll be getting diverse payment options, tailored Solutions, free processing, and faster payouts followed by unrivaled chargeback management and fraud protection.

So, what are waiting for? Book a free demo now and find it yourself.

Frequently Asked Questions (FAQs)

What is the difference between refunds & chargebacks?

There are two different ways to address client dissatisfaction: chargebacks and refunds. A chargeback happens when a consumer uses their credit card company to challenge a purchase and involves an outside arbitrator in the dispute resolution process. On the other hand, a refund is a more direct method in which the client requests a transaction reversal from the CBD business directly. It is a simple, human-to-human transaction correction.

Can merchant accounts minimize chargebacks?

Merchant accounts can avoid chargebacks by using advanced fraud detection systems, maintaining safe payment processing, providing transparent customer interactions, and providing responsive customer service to resolve disputes quickly.

Why do I have to pay a chargeback fee if the transaction is valid and the client initiated the chargeback?

The chargeback cost is applied to all chargebacks received, regardless of how the case is resolved. This fee covers the administrative costs of processing the chargeback.

How does CBD Merchant Solutions help businesses prevent fraud and chargebacks?

CBD Merchant Solutions provides advanced EMV terminals equipped with chip technology that enhances payment security by generating a unique transaction code for every purchase. This makes it nearly impossible for fraudsters to replicate card information, significantly reducing the risk of fraud. Our terminals also support contactless payments for added security and comply with the latest standards to help businesses minimize fraud and chargeback risks efficiently.

How can I protect against chargebacks for CBD products that I specially ordered and that require a deposit and the customer didn't want it later on?

Getting cardholder signatures for every transaction and correctly documenting and getting the cardholder to sign the cancellation/return policy on every order is a CBD merchant’s greatest line of defense. Additionally, it’s critical to manage the customer’s expectations up front, keep track of your progress, and collaborate directly with the cardholder to settle disputes or misunderstandings.