Cash flow is the lifeline of any business. But for CBD businesses, it’s often a frustrating waiting game.

Many payment processors delay transactions because the industry is high-risk. Due to industry regulations and restrictions, business owners can wait days or even weeks to access their own money.

Imagine having a surge in sales but being unable to restock inventory, pay employees, or invest in marketing because your funds are stuck. This is the harsh reality for many CBD businesses.

But what if you didn’t have to wait? And, you can get instant payouts within just a few days. That means better cash flow, smoother operations, less stress, and higher growth.

And, if you would like to experience this – then this blog is all you need. We’ll be covering how slow payouts impact CBD businesses and also sharing the best practices to ensure quicker access to your money. Keep reading to learn how to take control of your cash flow and keep your business moving forward!

Also Read: How to choose the best CBD Payment Processing Company

What Are Slow Payouts in CBD Businesses?

Slow payouts in CBD businesses refer to delayed access to funds from customer transactions. Unlike traditional businesses that receive payments within a day or two, many CBD merchants face longer settlement periods—sometimes taking several days or even weeks.

These delays occur because banks and payment processors classify CBD as a high-risk industry due to regulatory restrictions and fluctuating legal landscapes.

Many CBD companies rely on high-risk payment processors, but some impose rolling reserves, transaction holds, or extra verification steps, further delaying access to funds.

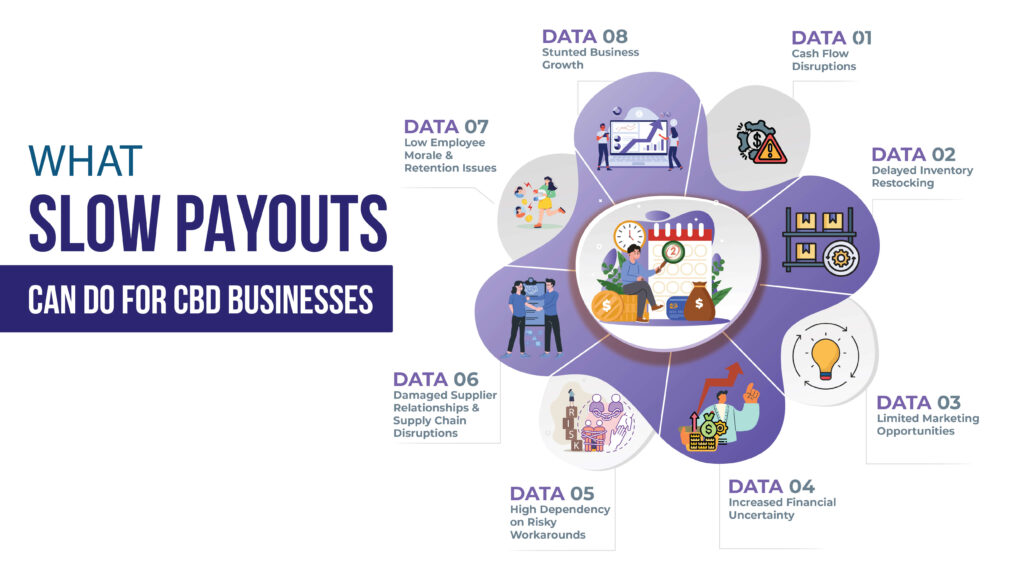

What Slow Payouts Can Do for CBD Businesses?

Slow payouts can cause problems for any business, regardless of the industry. And, this becomes even more crucial for high-risk businesses like CBD. So, let’s understand how slow payouts can impact CBD businesses as a whole.

1. Cash Flow Disruptions:

Cash flow disruptions are the number one challenge and among the biggest ones that CBD businesses face due to slower payouts. It is the lifeblood of any business, and when payouts take too long, it creates gaps in revenue.

Without a steady stream of funds, businesses may struggle to cover essential expenses like rent, utilities, and operational costs. This financial strain in fulfilling the basic expenses – can affect end-to-end business processes and operations at the core – making it incredibly harder to plan ahead.

Also Read: How Much Does it Cost to Start a CBD Dispensary

2. Delayed Inventory Restocking:

CBD businesses need to keep up with consistent inventory restocking to meet customer demand and ensure no customer leaves empty-handed. But, if funds are tied up in payment processing delays, restocking essential products becomes a challenge.

No liquid funds and inventory restocking leads your CBD business to run out of best-selling items can lead to missed sales, frustrated customers, and a damaged brand reputation. Worse, customers may turn to competitors who have reliable stock, causing a loss of repeat business.

Also Read: How to Start a CBD dispensary in California

3. Limited Marketing Opportunities:

Effective marketing is essential for brand visibility and sales growth. And, in this competitive CBD market – investing in marketing opportunities is crucial. But when cash flow is inconsistent, businesses may not have the funds to invest in ads, promotions, or product launches.

If payouts take weeks to process, businesses could miss out on time-sensitive marketing opportunities, such as seasonal campaigns or trending product launches. This puts them at a competitive disadvantage and slows overall business growth.

Also Read: Marketing Ideas for CBD Business

4. Increased Financial Uncertainty:

Predictability is key to sustainable business growth and the last thing CBD businesses need is unpredictability(because they are surrounded by so many of it). However slow payouts create financial instability, making it difficult to budget, forecast, and invest in future opportunities.

Business owners may find themselves constantly worrying about when they’ll receive payments, affecting their ability to plan expansions, hire new employees, negotiate better deals with suppliers, market, etc. Also, the uncertainty of cash flow and payouts can make it harder to secure business loans or attract investors, as lenders prefer businesses with stable financials.

Also Read: How to Protect Your CBD Business From Payment Processor Shutdowns

5. High Dependency on Risky Workarounds:

CBD businesses are risky(you knew it, we all knew it). The last thing they want is more risks. But, with slow payouts and tight cash flow – they have no chance but to take risks such as taking short-term loans, cash advances, or high-interest credit lines to cover immediate expenses.

While these options provide temporary relief, they often come with steep interest rates and additional fees, further reducing profit margins. Over time, relying on these risky financial workarounds can lead to debt accumulation and long-term financial instability.

Also Read: How to Advertise CBD Brand in the Best Possible Manner

6. Damaged Supplier Relationships & Supply Chain Disruptions:

Suppliers want timely payments. If it happens occasionally, they will understand. But, if it’s a norm – they might not. Losing out on reliable suppliers can significantly impact your business operations and customer satisfaction.

When businesses face slow payouts, they may struggle to pay suppliers on time, leading to delayed shipments, canceled orders, or even higher costs due to late fees or stricter payment terms. Over time, this can weaken supplier relationships, making it harder to secure quality products and maintain a steady inventory.

Also Read: How to Create an Effective CBD Business Plan

7. Low Employee Morale & Retention Issues:

Employees are at the core of every business and they need consistent, timely payments. Slow payments and delays in employee payments can cause financial stress, reducing motivation and productivity in the workplace.

If late payroll becomes a recurring issue, it can lead to frustration, job dissatisfaction, and higher turnover rates. Losing valuable employees not only disrupts daily operations but also increases hiring and training costs, making it harder to build a stable workforce.

Also Read: Innovative cannabis marketing Tips

8. Stunted Business Growth:

Growth requires continuous investment, whether it’s expanding product lines, opening new locations, or upgrading operations. But, with slow payouts, slow processes and slow everything – businesses will ultimately struggle to reinvest profits into scaling efforts.

Without steady cash flow, businesses can’t be able to invest in long-term business growth and can miss out on opportunities like hiring skilled employees, launching new products, or entering new markets become difficult to pursue. Slow payouts can hold businesses back, forcing them to operate in survival mode rather than focusing on long-term success.

What are the Best Practices to Ensure Fast Payout and Improve CBD Business Cash Flow?

1. Work with the CBD-Compliant Payment Processor:

One of the most effective ways to ensure fast payouts is to work with a payment processor that specializes in high-risk industries like CBD. Many mainstream payment providers have strict policies against CBD transactions. Even if they initially approve your account, they can later freeze funds, impose long settlement holds, or even terminate your account without warning. This unpredictability can significantly disrupt your cash flow.

To avoid payout delays and financial setbacks, choose a payment processor that:

- Understands CBD regulations – The processor should have experience handling CBD transactions and be fully compliant with industry regulations.

- Offers fast payout cycles – Choose a provider that processes payouts within 24-48 hours instead of making you wait for weeks.

- Has minimal rolling reserves – Choose a processor with low or no rolling reserves, to access more of your revenue immediately.

- Provides transparent pricing – A reliable processor will offer clear, upfront pricing with no unexpected charges.

- Offers dedicated customer support – Choose a processor that provides 24/7 support so any issues can be resolved quickly.

2. Optimize Your Payment Methods for Faster Processing:

The types of payments you accept impact how quickly you get paid. Traditional payment methods, such as bank transfers and paper checks, can take several days to clear, creating cash flow bottlenecks. By diversifying your payment options and prioritizing faster methods, you can reduce waiting times and improve your cash flow.

To speed up payment processing, encourage customers to use:

- Credit and debit cards – These are the fastest and most widely used payment options, typically settling within 24-48 hours.

- E-wallets – Digital wallet payments often process faster than traditional bank transfers, with some allowing instant withdrawals.

- Cryptocurrency payments – Crypto transactions settle almost instantly, eliminating the delays associated with banks and financial intermediaries. This is a great option for businesses looking for borderless transactions.

- ACH transfers – While these can take 2-5 days, they are still faster and more reliable than paper checks. Some processors offer same-day ACH transfers for quicker access to funds.

3. Implement Automated Accounting & Payout Tracking:

Many businesses experience payout delays simply because they don’t actively track their payments. Without real-time financial visibility, you may not notice a delayed payout until it’s already affecting your operations. So, make sure to automate the payout tracking and accounting to check the payouts in real-time and report(if delayed).

Investing in accounting and payout tracking software allows you to:

- Monitor transactions in real-time – See when payments are processed, deposited, or delayed, so you can act quickly if an issue arises.

- Automate invoices and payment reminders – Set up recurring billing or scheduled payment reminders to ensure customers and vendors pay on time.

- Generate cash flow forecasts – Anticipate future revenue, identify potential shortfalls, and plan accordingly.

- Categorize and track transactions – Keep accurate financial records to reconcile accounts, track expenses, and prepare for tax filings.

4. Maintain a Financial Reserve to Cover Unexpected Delays:

Even with the best payment setup, unforeseen issues—such as banking holidays, processor system updates, or regulatory reviews—can cause payout delays. If you rely solely on incoming payments to cover daily expenses, then these disruptions can strain your business. But, that shouldn’t be the situation of your business.

Here are some tips to cover unexpected delays in unforeseen circumstances:

- Maintain minimum runway: Make sure you have a minimum runway of at least 2-3 months – so these situations won’t affect you and you can still pay rent, payroll, and suppliers even if there’s a temporary delay in payouts.

- Set aside a percentage of every payout – Allocate a portion of each deposit into a business savings account to create a financial buffer.

- Avoid depending on pending funds for daily operations – Instead, plan your expenses around available cash so that payout delays don’t leave you scrambling for funds.

- Consider a business credit – If needed, having a credit line can serve as a short-term backup for covering urgent expenses during slowdowns.

5. Negotiate Flexible Payment Terms with Suppliers:

CBD businesses are prone to slow payouts and cash flow problems(most of the time). And if you are struggling to pay suppliers on time and if payouts are delayed consistently then it leads to supply chain disruptions impacting overall business processes. So, it is best to communicate flexible payment terms with suppliers right from the start that align with your payout cycle.

By securing flexible supplier terms, you prevent financial stress and ensure a smooth supply chain, even if payouts take longer than expected.

Here are some tips for effective terms and negotiation:

- Request Net-30, Net-60, or Net-90 terms – These terms allow you to pay suppliers after receiving customer payments, easing cash flow pressure.

- Negotiate installment payments – Instead of paying suppliers in one lump sum, split payments over multiple months to manage expenses better.

- Strengthen supplier relationships – Establish long-term, reliable supplier relationships for convenient and flexible payment terms.

6. Use a CBD-Friendly POS System to Streamline Transactions:

Your Point of Sale (POS) system plays a key role in how efficiently payments are processed. Using a non-compliant or outdated POS system can lead to transaction errors, slow processing times, or rejected payments. So, make sure you upgrade to a CBD-compliant POS System to ensure faster payouts.

Here’s how a reliable CBD POS system helps:

- Provide real-time sales and payout tracking: It ensures you always know when payments are expected and can make the expenses and cash flow accordingly.

- Offer automated inventory management: It provides accurate forecasting to prevent stockouts and over-ordering – so you can better manage the resources.

- Enable multiple payment options: The best CBD offers multiple payment options such as credit/debit cards, e-wallets, and crypto, for faster transaction settlements and consistent cash flow.

7. Choose a Reliable Business Bank Account for Seamless Transactions:

A common reason for delayed payouts in the CBD industry is banking issues. Some banks restrict CBD-related transactions, leading to sudden account closures, withheld funds, or processing delays.

Even if your payment processor is CBD-compliant, working with a bank that doesn’t support high-risk businesses can disrupt your cash flow. To prevent banking-related payout delays, choose CBD-friendly banks to ensure you receive payments on time and avoid unnecessary account restrictions.

Here are some factors to look out for:

-

- Supports CBD businesses: When you choose CBD-compliant banks – they will closely understand the industry regulations, reducing the risk of slower payments and sudden account closures.

- Offers faster fund settlements: These banks ensure that transactions get cleared within 24-48 hours.

- Has strong integration with your payment processor: While choosing a CBD-compliant bank, make sure it can be integrated with your payment processor for smooth and quick fund transfers.

- Provides dedicated business banking services: The right banking provider will ensure end-to-end banking services that cover overdraft protection, high-yield savings, business credit lines, etc.

- Provides End-to-End Support: Lastly, choose the banking provider who ensures end-to-end support in case things go wrong and can assist you throughout.

8. Reduce Chargebacks and Disputes to Avoid Fund Freezes:

High chargeback rates are a major red flag for payment processors and banks. In the CBD industry, unclear product descriptions, delayed shipments, or unmet customer expectations often lead to chargebacks. If your chargeback ratio exceeds a processor’s threshold, they may impose rolling reserves, hold funds, or even terminate your account, causing payout delays.

So, as a CBD business – there are some best practices to follow that help you reduce chargebacks and avoid slow payouts, account freezes, and more such problems.

To minimize chargebacks and protect your payouts, you should:

- Define everything clearly: Clearly state your product descriptions and refund policies to set accurate customer expectations and reduce chargebacks.

- Provide each & every detail: You should provide real-time tracking details and delivery updates to prevent disputes over undelivered goods.

- Use the right tools: You can use the best fraud detection and even make sure to choose the payment processor with an in-build fraud detection tool to identify and block high-risk transactions.

- Offer excellent customer service: Customer service and support at at the core of reducing chargebacks and any such problem. It ensures that complaints are resolved before they escalate to chargebacks.

9. Stay Updated on CBD Regulations to Avoid Compliance-Related Delays

The CBD industry is highly regulated, with laws varying by state and country. Because of varying regulations and changing restrictions – processors and banks frequently update their policies to align with compliance requirements.

If your business unknowingly violates a regulation—such as selling products with excessive THC content or making unapproved health claims—your account may be flagged, leading to payout holds or even permanent bans. So, keep yourself updated, adapt in real-time, and ensure end-to-end compliance to avoid payouts.

- Stay updated: You need to stay updated and ensure compliance with local, state, and federal CBD laws.

- Work with experts: Partner with the legal and compliance experts who specialize in the CBD industry and can guide you further.

- Regularly review and update the crucials: Keep the crucials such as product labels and marketing materials to avoid misleading claims.

- Choose the right payment processor: Pick the one that actively monitors compliance and provides guidance on legal changes.

10. Regularly Review Financial Strategies to Maintain Cash Flow Stability

Fast payouts are just one part of maintaining a healthy cash flow. Without strong financial planning, unexpected payout delays can disrupt operations. By proactively reviewing expenses, revenue streams, and overall financial health, businesses can optimize their cash flow and minimize risks.

Solution:

- Monitor business expenses regularly and eliminate unnecessary costs.

- Diversify revenue streams to reduce dependency on a single payment channel.

- Implement cost-saving measures like bulk purchasing or operational efficiency improvements.

- Use financial forecasting tools to predict cash flow trends and plan accordingly.

- Maintain an emergency fund to cover unexpected payout delays.

By staying financially proactive, CBD businesses can ensure long-term stability while reducing reliance on fast payouts as the sole cash flow solution.

Conclusion

Slow payouts and slower cash flow can lead to so many problems in the CBD business and can significantly disrupt the business processes.

But, by covering the challenges that face and how fast payouts can solve these problems with the best practices – we hope this blog has helped you.

So, make sure you stick to the best practices, such as choosing the payment processor, CBD-compliant bank, CBD-friendly POS system, and others to ensure faster payouts, fewer hassles, and end-to-end support.

To make your search easier – you can connect with CBD Merchant Solutions. We are a CBD-compliant company – offering best-in-class CBD payment processing with zero fees and, the best support followed by a feature-rich POS system.

To know more about us, how we can help you and to get started – book a free demo right away.

Frequently Asked Questions(FAQs)

What should I do if my funds are suddenly on hold?

- Contact customer support of the payment processor or banks immediately to understand the reason for the hold.

- Review your transaction history for chargebacks, compliance issues, or suspicious activity.

- Ensure compliance with CBD regulations, as legal issues can lead to withheld payments.

- If the issue persists, consider switching processors or opening an account with a CBD-friendly bank.

Are there any fees for faster payouts?

Some payment processors offer expedited payouts for an additional fee. This may be a flat fee or a percentage of the transaction amount. Check with your processor to see if instant or same-day payouts are available and whether the costs are worth the benefit to your cash flow.

Do CBD businesses get same-day or instant payouts?

Yes, some payment processors offer same-day or instant payouts, but it depends on the processor, bank, and CBD business. To qualify for the same, here are some of the effective tips:

- Partner with the compliant CBD payment processor and bank.

- Maintain a low chargeback rate and a good transaction history.

- Choose a processor that offers expedited settlement options. Be aware that instant payouts may have additional fees.

- Offer multiple payment options(especially the ones with instant payouts).

How much does CBD Merchant Solutions charge for payment processing?

CBD Merchant Solutions offers a zero-fee credit Card Processing option through their Cash Discount Pricing model. It allows CBD businesses to offset processing fees by offering cash discounts to customers, effectively enabling merchants to pay zero credit card processing fees. Happy customers, happy merchants. A win-win.

Do you offer support for delayed payouts or payment processing issues?

Yes, CBD Merchant Solutions provides end-to-end dedicated support to address any payment processing issues, including delayed payouts. Our team works closely with businesses to ensure seamless transactions and prompt resolution of any concerns.

Can I use CBD Merchant Solutions for both online and in-store payments?

Absolutely! CBD Merchant Solutions offers comprehensive payment processing solutions that cater to both online and in-store transactions. Our services include CBD-compliant payment gateways, POS systems, and e-commerce integrations, ensuring seamless payment acceptance and faster payouts across various sales channels.