You have developed a full-fledged eCommerce website for your CBD business, but it is no use if you can’t be able to integrate the payment processor with it.

How your customers are gonna make payments to purchase your products?

In order to ensure a seamless, secure, convenient sales experience for your customers – having a reliable payment processor is the most important.

But, traditional payment companies are not willing to work with high-risk businesses like CBD. So, you need to find high-risk, dependable CBD business merchant account partners who are compliant with your business needs and can be easily integrated into your eCommerce store and other business solutions like CRM software, accounting software, etc.

Integrations offer you a seamless cohesive way of managing businesses & desired customer experience as well.

To know more about the importance of Integrating CBD Payment Solutions with e-commerce Platforms and its process – keep reading.

Also Read: Which Bank Supports CBD Businesses?

Understanding CBD Payment Gateways

It is critical to understand payment gateways in the context of online transactions since they serve as the vital link between clients and businesses in the CBD market.

CBD merchant services are specialized platforms that enable secure and effortless sales of CBD products.

Because of the regulatory constraints and the unique nature of the CBD market, regular payment processors are typically reluctant to partner with CBD firms. This is where CBD merchant services come into play, offering a solution made specifically to meet the requirements of CBD retailers.

These gateways include features like age verification, fraud protection, and compliance with industry rules, as well as the ability for businesses to take payments via credit cards, e-wallets, or other digital payment methods.

Here’s the catch though: they can provide all these services when you have integrated the CBD merchant account with the eCommerce website. So, let’s understand how to integrate CBD payment solutions with the eCommerce platform.

Also Read: How to Choose the Best CBD Payment Processing Company

What are the Crucial Payment Solutions Integrations for CBD Businesses?

You need to integrate your CBD payment solutions with e-commerce platforms, but there are other integrations as well that you need to keep in mind. Let’s find it out:

- E-commerce Platform Compatibility: The very first integration that is non-negotiable is with your e-commerce platform. While choosing the payment solutions provider, you need to make sure that it is fully compatible with your e-commerce platform.

Some platforms have plugins or extensions specifically designed for certain payment providers. If available, using these plugins can simplify integration. If a plugin isn’t available, you’ll likely need to set up custom API integration, which may require support from your provider or an experienced developer.

- Point-of-sale (POS) Integration for Omnichannel Sales: If you’re selling both online and in-store, you need to look for a CBD-compliant payment solution that integrates with POS systems for seamless omnichannel operations. This keeps your inventory and sales data consistent, helping you track transactions and manage stock in real time across all sales channels.

- API and Webhook Support: Also, make sure that your CBD payment solution with robust API and webhook options offers flexibility for further customization. With this, you can connect your payment system with other tools and automate tasks like order confirmations, inventory syncing, and customer data updates, tailoring the integration to your business’s specific needs.

- Integration with Accounting and Inventory Tools: Tracking the accounting and inventory as per the sales is important too. So, you need to choose a payment solution that integrates well with accounting and inventory software to streamline operations. This integration enables businesses in automatic transaction syncing, inventory tracking, and financial reporting, saving time and reducing manual errors.

- Mobile-Friendly Integration: Last but not least is mobile-friendly integration. It is quite important, especially if you have a strong mobile customer base. So, look for a payment solution that integrates with mobile wallets and payment apps, ensuring smooth mobile transactions that reduce cart abandonment, convenient payments, and improved user experience.

Also Read: How Much Money is Needed to Start a CBD Business?

How do you integrate CBD payment solutions with eCommerce platforms?

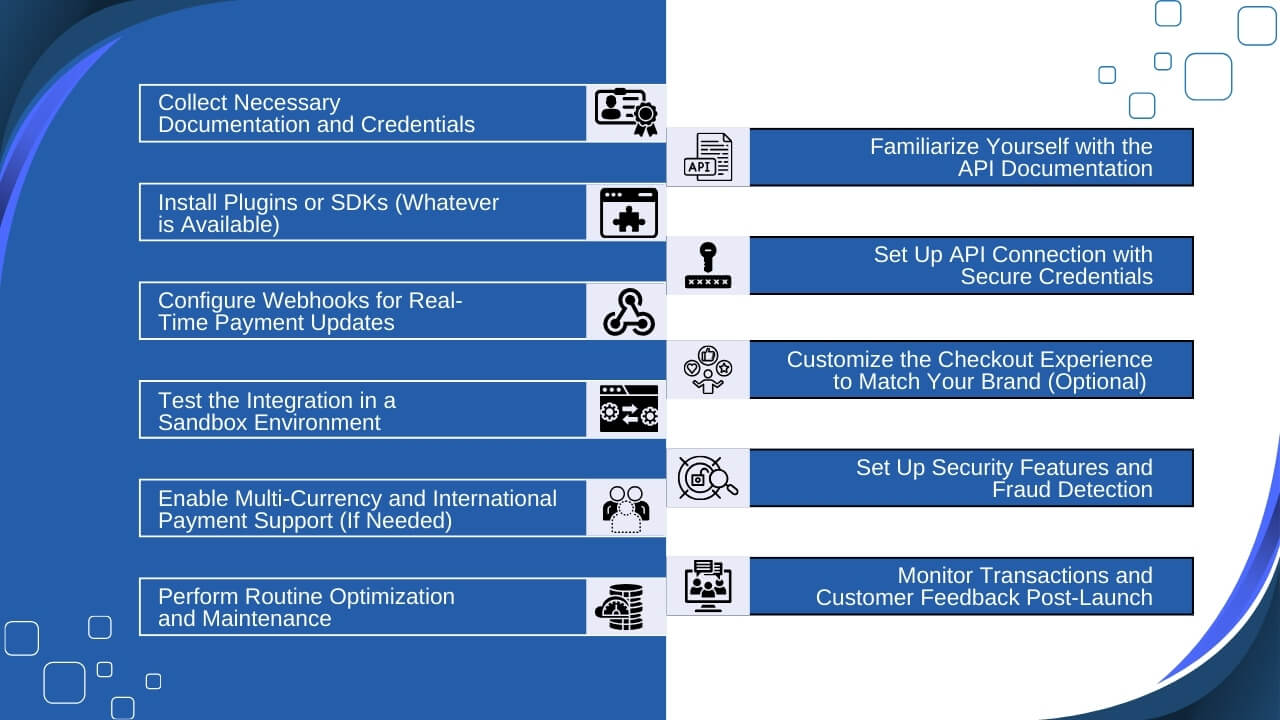

Given the unique challenges and requirements of the CBD industry, it’s essential to understand each step thoroughly and make the best use of your payment provider’s documentation and support. Here’s a detailed, step-by-step guide to help you achieve a successful integration:

Step 1: Collect Necessary Documentation and Credentials

- The very step in integrating CBD payment solutions with eCommerce platforms is collecting all the documentation and credentials needed from your payment provider. Since CBD is considered a high-risk industry, you are required to submit additional documents like your business license, CBD-specific compliance certificates, and any regulatory paperwork relevant to your products and region.

- After collecting all the required documentation and credentials and their validation – your provider typically provides API keys, account IDs, and secret tokens to authenticate your integration. You need to keep these credentials secure, as they’re crucial for connecting with your e-commerce platform.

Step 2: Familiarize Yourself with the API Documentation

- After getting the required API, documentation, and tokens – you need to review the API documentation provided by the payment solution. This documentation outlines the integration requirements, configuration settings, available endpoints, and sample code for embedding the payment gateway into your platform.

- To ensure seamless integration and transactions – you need to pay particular attention to all the detailed steps for setting up secure connections, handling errors, and customizing the checkout flow to align with your website. Good documentation will also include guides on testing transactions, handling refunds, and updating order statuses.

Quick-Tip: So, don’t forget to get the detailed documentation from the provider and abide by the process properly.

Step 3: Install Plugins or SDKs (Whatever is Available)

- If your CBD payment provider offers plugins, modules, or software development kits (SDKs) for your specific e-commerce platform, install them to streamline the integration process. These tools often include pre-built code and configurations that simplify the backend setup.

- To ensure seamless integration, you need to follow installation instructions carefully and ensure that the plugin or SDK is compatible with both your e-commerce platform’s version and any other plugins you may have installed to avoid conflicts.

Step 4: Set Up API Connection with Secure Credentials

- Use the provided API keys and other credentials to connect your e-commerce platform with the payment processor. Typically, you will need to enter these credentials in a designated area within your platform’s payment settings or through the plugin interface. You just need to follow the process as specified in the platform for end-to-end connection.

- Ensure all credentials are securely stored, as any exposure could pose a security risk. Many platforms also have security best practices, like IP whitelisting and two-factor authentication, that you should enable to protect your setup.

Step 5: Configure Webhooks for Real-Time Payment Updates

- Then comes the webhooks configuration part. With the webhooks configuration, the payment processor can send real-time updates on transactions, refunds, chargebacks, and other events directly to your eCommerce platform. You just need to set up webhooks to automatically sync these events with your order management system as well. This keeps everything(order, inventory, sales, customer data, etc in sync to ensure real-time updates.

- Configure your e-commerce platform to receive and respond to webhook notifications. This integration enables you to automate tasks like updating order statuses, managing inventory, and notifying customers without manual intervention.

Step 6: Customize the Checkout Experience to Match Your Brand (Optional)

- After you are done with the payment integrations with your CBD eCommerce website – it is now time to customize experience for your end users. You know your customers better, so if the checkout experience is customized for them – then it will simplify the process.

- Ask the payment provider if they provide the checkout customization so you to create a cohesive user experience. Adjust colors, logos, and layout options to make the payment page look and feel like the rest of your website. Ensure the checkout page is also optimized for mobile, as many customers may be purchasing on their phones.

Note: This is an optional step, but a good to have – as it builds customer trust and reduces cart abandonment rates as well.

Step 7: Test the Integration in a Sandbox Environment

- After the integration, you can’t just go out there and roll it for the users. Before making it live, you need to test the integration in the sandbox environment. It is usually provided by your payment processor to simulate transactions without involving real money. It helps you check the whole process if transactions are being processed correctly if order statuses update automatically, and if any error messages are clear or not.

- Test a variety of scenarios, such as successful payments, declined transactions, partial refunds, and chargebacks. Carefully review the platform’s handling of each scenario to ensure a smooth and reliable experience for customers. Also, when you are aware of what happens in each scenario – you can better guide the customers as well.

Step 8: Set Up Security Features and Fraud Detection

- Given the high-risk nature of CBD products, you need to look after and set up security features and fraud detection with the payment processes. The additional security settings offered by your payment provider, such as 3D Secure authentication and advanced fraud detection tools – will mitigate the risks of fraud and chargebacks, protecting your business and customers.

- Then comes the fraud detection tools – which might need specific configurations in the payment gateway or platform settings, so consult your provider’s documentation or support team to optimize these settings effectively.

Step 9: Enable Multi-Currency and International Payment Support (If Needed)

- If your CBD business serves an international market and your payment provider offers multi-currency and international payment support, then you need to configure multi-currency support. It makes checkout simpler for global customers. Many payment solutions allow you to set currency conversion rates and provide tax calculations specific to each region.

- For international sales, confirm that your payment gateway integrates with tools that help manage taxes, VAT, and shipping regulations across different countries. This will provide a smoother experience for customers and make compliance management easier on your end.

Step 10: Monitor Transactions and Customer Feedback Post-Launch

- After going live, closely monitor the initial transactions, customer feedback, and any error messages. Make sure payments are processed smoothly, customers are able to check out without issues, and there are no unexpected transaction failures. Keep track of all the transactions to track the ease of payment, time taken, success rate, failure rates, etc.

- Many providers offer dashboards or reporting tools where you can track payment activity in real time. With this real-time reporting and monitoring – you can keep track of everything and it will help you catch and address potential issues before they impact your business.

Step 11: Perform Routine Optimization and Maintenance

- Last but not least – you need to regularly check for updates from your payment provider and apply any necessary patches or upgrades to keep your integration secure and efficient. Also, stay in touch with your payment processor and be up-to-date with new features or security enhancements your provider releases to ensure smooth and uninterrupted services.

- Consider scheduling periodic audits of your integration settings, security configurations, and fraud prevention measures to ensure optimal performance and customer satisfaction.

Also Read: How to Get a Merchant Account for CBD Business

Can CBD Merchant Solutions Provide Easy Integrations?

We are a leading CBD payment provider company with diverse payment options, customized Solutions, 0% processing charges, faster payouts, and robust fraud protection. We have worked with the top CBD merchants across the USA and can even help your business not only survive but thrive in the competitive CBD landscape with the best & convenient payment solutions.

CBD Merchant solutions are all of that CBD eCommerce business needs.

On top of that, we believe in this competitive digital realm – integrations are at the core of all businesses. So, we ensure easy, seamless integrations of our CBD payment provider with your eCommerce platform, POS system, and other tools as well.

We have a team of professionals and extensive documentation to help you with integrations and deal with any challenges that come in between the integration and even beyond it.

To know more about us, our services, how to get started, post-installation support and everything in between – book a free consultation with us, and our team will get back to you.

Looking forward to hearing back from you.

To Wrap Up!

All in all, here’s the guide to the basics of payment processing, what are some of the common integrations, and the comprehensive integration process to get the desired results.

By following each step carefully—from gathering essential documentation to final testing and ongoing maintenance—you can set up a payment system that not only meets regulatory requirements but also streamlines customer experience and improves your bottom line.

With these integrations, you are creating a cohesive ecosystem that supports your business’s growth while offering your customers a smooth and satisfying purchasing journey.

When you partner with CBD Merchant Solutions, we have a simple, quick & straightforward process along with a professional team who will assist with end-to-end support in setting up and beyond.

To get to know us better and our payment solutions – book a free consultation call right away!

Frequently Asked Questions (FAQs)

What happens if my eCommerce platform undergoes an update—will it impact my payment integration?

Yes, it might happen that the platform updates can sometimes affect payment integrations. So, when your CBD eCommerce platform updates its platform in any way, reach out to your payment processor to know if it is compatible with the updated version or if it needs some updates or changes as well. If some updates are needed, make sure to do it as soon as possible to ensure there is no inconvenience for the end customers and smooth business operations as well.

Are CBD payment gateway fees higher than standard payment gateways?

Although, it varies from provider to provider and your business needs. But, yes due to the higher risk associated with the CBD industry, payment processors often charge higher transaction fees compared to standard businesses. But, in order to get the best rates – you can consult with the payment processing provider and compare rates and look for options tailored to CBD businesses to find a cost-effective solution.

How Much Time Does it Take to Get Approval with CBD Merchant Solution?

Well, the time it to get approval with us as your CBD payment provider is dependent on your business needs and the documents you have. If you have all the licenses, and permits and your business is compliant – then you can get next-day approvals as well. So, it all boils down to your needs.

Can I integrate additional payment options like digital wallets or buy-now-pay-later (BNPL) with a CBD payment gateway?

Well, this is subject to the CBD payment provider you have chosen for your CBD eCommerce platform. Some CBD-friendly payment providers support additional payment methods such as digital wallets and BNPL. However, not all CBD processors offer these features, so it’s best to ask beforehand with your provider beforehand to see if they can accommodate diverse payment options as part of their solution.

Will using a CBD payment gateway affect my customers’ ability to pay with credit cards?

Most CBD-friendly payment gateways support major credit cards, but some individual card networks or banks may restrict CBD-related purchases. So, make sure to choose the CBD payment provider that accepts all the credit & debit cards. Even if there are some that they don’t support – communicate it clearly with your customers to avoid confusion and 100% success of payments.

Can I integrate my CBD payment gateway with multiple online stores under the same brand?

Yes, you can. There are so many CBD payment processors that allow multi-store integration, so you can manage transactions across different online stores from a single account. If you operate various websites or locations under the same brand, then look for a CBD payment provider who can help you with multi-store integration. It simplifies the entire process, the payments, consolidates sales data, and simplifies financial reporting.