Introduction

Though CBD is widely sold, payment processors for CBD are still treated as high-risk. As a result, expect stricter underwriting, fewer mainstream checkout options, higher fees, and policies that can shift.

Through this blog we will help you compare CBD payment gateways, understand the difference between a CBD merchant account and a gateway, and select the best CBD payment gateway for your specific products, platform, and growth stage.

First we will throw some light on how hemp-derived CBD merchant accounts and a gateway, and why many merchants require a Shopify Payments CBD alternative.

We will outline when Square’s CBD program is best for a quick omnichannel setup, when Bankful or DigiPay suit Shopify stores, and how gateways like Authorize.net and NMI connect to high-risk acquiring banks.

We will compare interchange-plus and flat pricing, show how effective costs shift by AOV, and pinpoint when ACH/eCheck improves approvals and cuts fees. We will detail about how approval-rate tradeoffs, settlement timelines, dispute ratios, and support SLAs directly influence daily operations and long-term growth.

Since stability depends on compliance and fraud controls, we will cover PCI DSS v4.0 readiness, hosted fields, EMV 3-D Secure, AVS/CVV, device and velocity rules, and practical chargeback prevention.

You will also get practical checklists for KYB/KYC docs, batch COAs, compliant labeling, customer-friendly descriptors, and clear refund or fulfillment policies in order to accelerate onboarding and reduce rolling reserves.

Finally we will align recommendations to real use cases – topicals vs. ingestibles, single purchase vs.subscription, and web-only vs. POS/omnichannel, so you shortlist the best CBD payment gateway for your brand.

So, if you are launching your first store or scaling past six figures monthly, this blog will help you compare CBD payment gateways on stability, fees, features, and support, and select a CBD payment processing partner like CBD Merchant Solution which protects cash flow while boosting conversion.

Also Read: Why do CBD Business Struggle With Payment Processing

The CBD Payments Landscape in 2025

CBD may be mainstream but processors still classify it as high-risk, so merchants face strict underwriting, less big-brand options, and premium pricing.

On the platform side, Shopify allows hemp or CBD stores where legal but Shopify Payments does not process CBD in the United States; merchants must connect a compatible third-party CBD payment gateway like Bankful or DigiPay.

Of all the aggregators, Square’s CBD program offers the clearest public pricing, simplifying cash-flow modeling and hardware decisions. As of 2025, Square lists CBD rates at 3.8% + $0.30 online, 3.5% + 0.10 in person, and 4.4% + 0.15 for keyed or card-on-file, with custom pricing possible at higher volumes.

As of March 31, 2025, PCI DSS v4.x is in force requiring e-commerce payment pages to implement Req. 6.4.3(authorized script inventory/ integrity) and Req 11.6.1(change/tamper detection) for e-commerce payment pages.

In practice, CBD merchants should favor hosted fields or hosted checkout and add strong page-integrity monitoring to both shrink PCI scope and harden against e-skimming.

Visa combined fraud and dispute oversight into its Visa Acquirer Monitoring Program(VAMP), adding updated thresholds and monthly monitoring starting from June 1, 2025.

Visa Corporate underscores that this tiered enforcement pushes acquirers to implement stronger oversight and forces merchants to adopt more rigorous risk-mitigation practices.

While regulatory scrutiny continues to shape underwriting. The FDA is still issuing warning letters to CBD marketers across both human and pet products for unapproved drug claims, misbranding, and other violations.

Continued enforcement pressures banks to stay vigilant and requires merchants to follow compliant labeling, adopt careful marketing, and provide COAs for every SKU or batch.

For operators, it typically means beginning with an aggregator for quick entry and stability, then moving to a high-risk merchant account and gateway(like Authorize . net or NMI) as sales scale or offerings expand into ingestibles and subscriptions.

Providers are most likely to require EMV 3DS, AVS/CVV checks, device intelligence tools, velocity monitoring, and in some cases rolling reserves during the onboarding phase.

To improve approval rates and cut fees, many merchants integrate ACH/eCheck as a payment option for higher-value orders.

In 2025, the most successful merchants will be those who view payments as both a compliance and customer experience function while using clear billing descriptors, fair refund terms, strong dispute management, and a checkout setup aligned with PCI v4 and card-brand standards without sacrificing conversion.

Also Read: Secure Payment Processing for CBD Ecommerce

Who Actually Supports CBD (and Who Doesn’t)

For operators in the CBD business, the bigger challenge is not only selling products rather than figuring out which partners will actually allow them to process payments.

Despite widespread consumer demand and the 2018 Farm Bill legalizing the hemp-derived CBD of below 0.3% THC at the federal level, payment acceptance is still highly complicated. Some financial institutions and service providers cautiously support CBD merchants, while others continue to block, restrict, or exit the category altogether.

1. High-Risk Merchant Account Providers:

Specialized high-risk payment processors and independent sales organizations(ISOs) have carved out niches in CBD. They understand the compliance requirements, chargeback risks, and reputational concerns banks face, and build underwriting practices to accommodate them.

These providers usually work with back-end sponsor banks that are comfortable boarding CBD merchants, provided that proper compliance, labeling, and supply-chain documentation are in place.

Also Read: How to Choose the Right Merchant Account

2. Select Acquiring Banks:

Only a select group of acquirers with greater risk tolerance are willing to handle CBD, as most banks still avoid the sector. While they tend to demand rigorous documentation, including certificates of analysis(COAs), SKU-level product transparency, age verification processes, and clear refund or return policies.

Their willingness to support the sector is often linked to fee structures that offset perceived risk, including higher discount rates or rolling reserves.

Also Read: Which Banks Supports CBD Businesses

3. Gateways and Platforms Serving High-risk Verticals:

Payment gateways like Authorize . net and NMI don’t always ban CBD directly, but depend on the acquirer or merchant account in place. These gateways can effortlessly handle transactions when linked to a merchant account that accepts CBD.

Similarly, some ecommerce platforms(e.g. BigCommerce and Shopify with third-party processors) allow CBD merchants, but only when transactions run through approved, compliant payment providers.

Also Read: What is a High-Risk Merchant Account

4. Alternative Payment Methods:

In addition to card payments, many CBD merchants depend on ACH/eCheck providers that specialize in serving high-risk industries. These options improve approval rates on higher ticket orders and reduce card network friction. A smaller but growing set of Buy Now, pay later or wallet providers is beginning to support CBD, though adoption remains uneven.

Also Read: How to Setup Online CBD Payment

5. Square:

Square’s United States CBD Program covers hemp-derived products with clearly published fees which is 3.8% + $0.30 online, 3.5% + $0.10 in-person, and 4.4% + $0.15 keyed which attracts merchants due to its quick and smooth onboarding.

Also Read: How to Choose the Best CBD Payment Processing Company

6. Shopify:

Shopify permits hemp and CBD stores in legal markets, but since Shopify Payments(powered by Stripe) excludes CBD in the United States, merchants must use third-party processors like Bankful or DigiPay, an option clearly outlined in Shopify’s help center with named examples.

Also Read: How to Integrate CBD Payment Solutions With Ecommerce Platforms

The Non-Supporters

1. Mainstream Acquirers and PSPs:

Large acquiring banks and processors like Chase, Wells Fargo, Square, and Stripe have declined CBD merchants. Their reasons are federal legal complexity, reputational risk, and the administrative burden of monitoring compliance. While policies evolve, most mainstream providers continue to exclude CBD from their permitted use cases.

Also Read: Marketing Ideas for CBD Business

2. Global Networks with Regional Restrictions:

Visa, Mastercard, and other card brands don’t ban CBD outright, but their regional member banks differ in how they interpret and enforce rules. It means a CBD merchant approved in one region may face declines or shutdowns in another. For global operators, inconsistency in card-brand acceptance remains a major barrier.

Also Read: Is CBD Legal in all 50 States

3. Conservative Platforms and Marketplaces:

Some ecommerce platforms, ad networks, and marketplaces still block CBD, even when payment is possible. For instance, Amazon restricts most ingestible CBD sales in the United States. This forces merchants into direct-to-consumer models, increasing the importance of reliable payment acceptance.

Also Read: How to Create an Effective CBD Business Plan

4. Stripe:

Stripe classifies CBD as a restricted category, with its FAQ clearly stating it cannot process payments for products containing CBD or THC.

Also Read: How to Choose the Best Website Builder for CBD Business

5. PayPal/Braintree:

PayPal and Braintree explicitly exclude CBD and hemp under their alternative payment method terms, with long-standing acceptable-use rules that classify CBD as a prohibited high-risk product.

High-Risk Specialists(Merchant Account + Gateway Combos)

1. PaymentCloud supports CBD merchants :

It includes topicals and where permitted ingestibles usually integrating with Authorize . net or NMI, and openly notes that high-risk accounts involve higher rates and possible reserves.

Also Read: How to Get a Merchant Account for your CBD Business

2. Easy Pay Direct (EPD):

It promotes its expertise in CBD merchant accounts across the United States and Canada, coordinating several acquiring banks to ensure reliability and growth capacity.

Also Read: How Fast Payouts can improve your CBD CashFlow

3. Bankful working with Pinwheel and partners:

It is a CBD-friendly processor integrated with Shopify that offers subscriptions, fraud prevention tools, and eCheck/ACH payment options.

Also Read: Why Traditional Banks Reject CBD Merchant

4. Gateways(technical bridges):

Authorize . net and NMI function as gateways, linking merchants to the acquiring bank that underwrites CBD; the bank sets the rules, while the gateway supplies technology like token vaults, APIs, and integrations.

Also Read: How to Avoid Frauds and Chargebacks in CBD Payment Processing

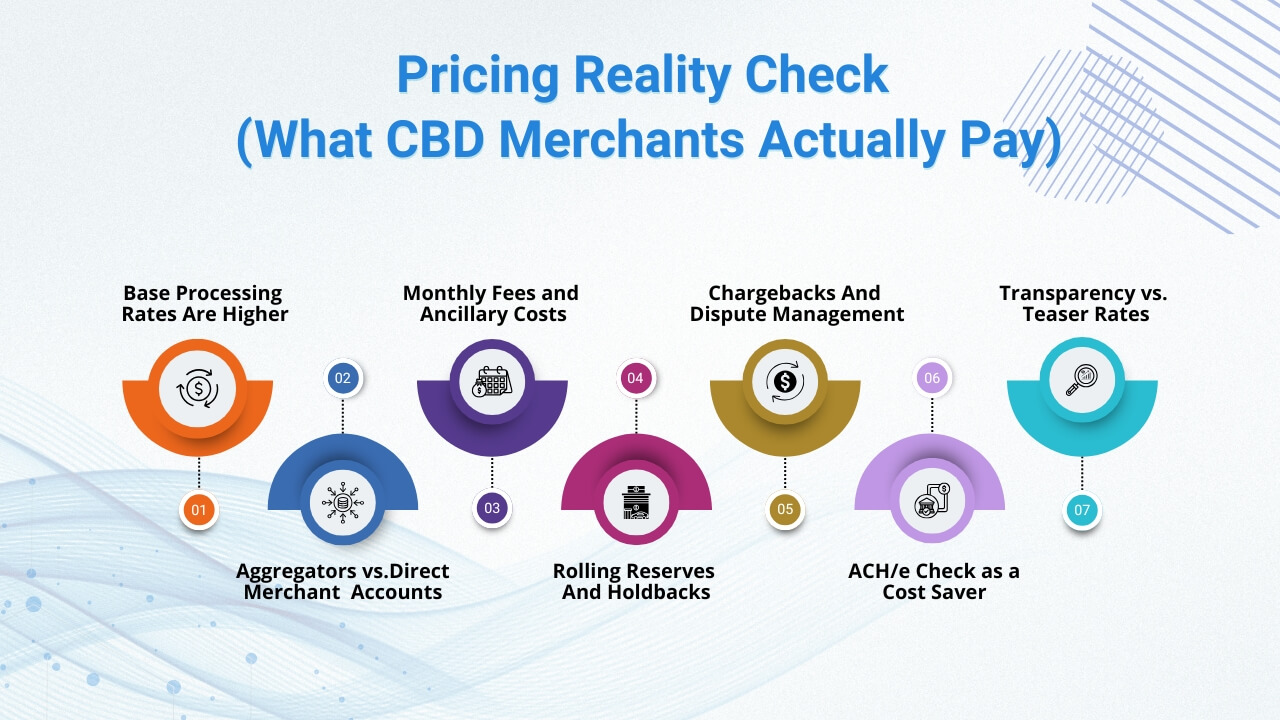

Pricing Reality Check (What CBD Merchants Actually Pay)

For CBD merchants payment processing is rarely as simple or as inexpensive as mainstream retail. While the 2018 Farm Bill legalized hemp-derived CBD at the federal level, the payment ecosystem still categorizes CBD as “high-risk”.

This labelling has a direct impact on cost. From higher discount rates and per-transaction fees to reserves and compliance overhead, the reality is that CBD businesses almost always pay more than traditional merchants. Understanding such cost drivers is important to setting realistic expectations and negotiating the right agreements.

1. Base Processing Rates are Higher:

In low-risk industries, merchants may pay interchange-plus pricing near 2.0-2.5% per transaction, or flat-rate models like Square’s 2.9% + $0.30. On the contrary, CBD merchants often witness 3.5%-6% discount rates on cards, plus per transaction fees of $0.10 – $0.50.

These higher costs are due to greater chargeback exposure, tighter regulatory requirements, and the small number of acquirers prepared to support CBD. Even providers that market themselves as “CBD-friendly” generally charge about one percent more than standard industries.

2. Aggregators vs. Direct Merchant Accounts:

Smaller or new CBD brands often begin with aggregators like Square’s CBD Program. Merchants are attracted by the simplicity which is fast approval, limited documentation, and upfront transparent pricing.

For instance, Square CBD pricing is 3.8% + $0.30 online and 3.5% + $0.10 in-person. While it is slightly higher than traditional rates, it removes the guesswork.

As merchants scale, however, they may seek a direct high-risk merchant account with a gateway like Authorize . net or NMI. Here, pricing may vary widely.

While some acquirers set rates around 4.5% + $0.30 with rolling reserves, others may reduce pricing to about 3.%% for compliant, low-risk merchants with higher volumes.

Also Read: CBD Merchant Account Vs Regular Merchant Account

3. Monthly Fees and Ancillary Costs:

High-risk accounts usually include monthly account fees($25-$50), gateway fees($10-$25), and sometimes PCI compliance fees($5-$20). Services like fraud detection, recurring billing, and chargeback management often involve extra fees, usually adding $50-$100 monthly on top of standard processing costs.

Also Read: Understanding CBD Payment Terms

4. Rolling Reserves and Holdbacks:

One of the biggest invisible costs is the rolling reserve is a percentage of each transaction(often 5-10%) which is held by the processor for 90-180 days to cover potential chargebacks.

For instance if a CBD merchant processing is $50000 a month with a 10% rolling reserve means $5000 of cash flow locked up every month, even if the business operates with minimal disputes. Although reserves are eventually released, they can restrict cash flow in the short term, creating difficulties for smaller businesses.

Also Read: Why Every CBD Business Need a Customized POS System

5. Chargebacks and Dispute Management:

Card networks monitor chargeback ratios closely, and CBD is already considered higher-risk. Providers often enforce tighter velocity rules, require address verification(AVS) and CVV checks, and encourage EMV 3-D Secure for online orders.

While these tools help prevent fraud, these hurdles can introduce extra hurdles for customers during checkout. Some providers may also charge per-chargeback fees($20-$25 each). Considering disputes is essential to accurately measure overall processing expenses.

Also Read: Email Marketing for CBD Business

6. ACH/eCheck as a Cost Saver:

Many CBD merchants add ACH/eCheck processing for higher-ticket sales. Typical ACH fees range from 1%-2% per transaction with lower per-item charges($1-$2), making them significantly cheaper than card acceptance.

Approval rates are often higher for large orders, reducing declines that might otherwise push customers away. While ACH has its own risks(e.g. Returns for insufficient funds), it can improve overall profit margins when used strategically.

7. Transparency vs. Teaser Rates:

An ongoing risk for CBD merchants is getting drawn by teaser pricing. Some processors promote rates starting at 2.95%, yet merchants soon find that products like ingestibles, subscriptions, or specific SKUs always come with added surcharges.

The effective rate often ends up closer to 4% to 6%. Merchants should always ask for a detailed fees schedule, including reserves, chargeback costs, monthly minimums, and early termination clauses.

Compliance & Risk: The Part You Can’t Skip

The CBD market has seen explosive growth since hemp-derived cannabidiol was legalized under the 2018 Farm Bill. Oils, tinctures, topicals, and gummies are now available in neighborhood shops and online platforms.

Despite this growth, CBD merchants often face a major challenge which is payment processing. Accepting card payments is far more complicated in this sector than in most, and the key reason is compliance.

For banks and processors, CBD falls into the high-risk merchant category. This labelling is not just about the legality of the product itself, but about the risks surrounding it.

Regulations vary widely by state, where enforcement is inconsistent and product quality varies. Higher chargebacks and strict oversight from card brands and regulators make acquirers cautious.

Why Compliance Matters

In CBD payments, compliance is the difference between predictable cash flow and abrupt processor shutdowns. First, CBD lives in a gray regulatory zone with overlapping federal rules, state laws, and card-brand policies.

Under current FDA guidance, CBD cannot be marketed as a dietary supplement or added to foods, and the agency continues to scrutinize labeling, safety, and disease claims.

Marketing that suggests treatment, cure, or prevention invites enforcement as proven by FTC actions against CBD brands for unsubstantiated claims.

Taken together, these factors make strict claim controls, accurate labeling, and evidence-backed substantiation the minimum to secure and keep payment processing.

Second, card networks track fraud and chargeback risk across entire portfolios and not just individual merchants. Through VFMP and VDMP, Visa tracks each merchant’s fraud and chargeback ratios.

If you exceed those thresholds, your acquirer can impose penalties, require remediation, raise reserves, or terminate the account.

Therefore, compliant checkout practices like clear terms, visible refund policy, descriptor testing, and strong post-purchase support, and a disciplined chargeback program are compulsory operational controls and not optional add-ons.

Third, data security is non-negotiable. If you accept cards online, PCI DSS v4.0 brings tougher e-commerce requirements by March 31, 2025 which most notably script authorization or inventory and change-and-tamper detection for payment pages.

Expect acquirers to demand recent ASV pass reports, the correct SAQ with evidence, and proof of live script inventory/alerting at onboarding and again during scheduled re-reviews.

Treat PCI as an ongoing program not a checkbox at onboarding to avoid fines, breached-account fallout and reputational damage. Fourth, hemp-legal does not mean automatic approval, processors still verify THC limits, COAs, age checks, and no health claims.

Fourth hemp legal does not mean automatic approval, processors still verify THC limits, COAs, age checks, and no health claims. Practically, you will need state-by-state geofencing, age gates, and per-lot COAs showing total THC(not just Δ9) to keep intoxicating hemp SKUs within local rules.

Update it continuously as laws change, bind it to your catalog and shipping APIs, and display per-ZIP eligibility, age checks, and COA requirements across PDP, cart and checkout.

Fifth, the downstream risk is real. Once listed, most acquirers auto-decline boarding; delisting typically requires the original listing acquirer to submit removal after you prove remediation and sustained low dispute rates.

Even if you do find a willing acquirer, expect extended EDD, personal guarantees, possible site inspections, higher MDR/per-txn fees, rolling reserves, and probationary volume caps until you prove sustained low risk.

Allocate budget to airtight controls, state geofencing, per-batch COAs, clear refunds, rapid support, and pre-dispute tools so you can stay within thresholds and off MATCH.

Operationalize it with pre-live reviews, strict change control on PDP/checkout, real-time dashboards, and escalation playbooks so risks are detected and fixed before your acquirer ever flags them. Get these right and underwriting gets easier, fees drop, and the odds of a mid-month shutdown shrink immediately.

Maintain up-to-date state or local business licenses and relevant permits(e.g., reseller, health) and keep copies ready for underwriting to quickly confirm legal authority to operate.

Provide third-party, batch-specific COAs verifying ≤0.3% Δ9-THC and full-panel contaminant testing(pesticides, heavy metals, residual solvents, microbials), with QR-linked access on labels and PDPs.

Use factual ingredients or serving info and only lawful structure-function language, include required warnings or age gates, and scrub labels or PDPs or ads of disease claims (for example, “treats anxiety” or “cures pan”).

Post clear policies on PDP and checkout – return window, RMA steps, shipping speeds with tracking, and support contacts – and issue refunds promptly to head off avoidable chargebacks. Without these basics, processors will decline applications outright. Even after approval, non-compliance can often lead to frozen funds, account termination, and placement on industry blacklists like the MATCH list.

Risk Factors CBD Merchants Face

CBD businesses face risk on multiple fronts:

1. Regulatory Volatility:

Due to changing state laws on Δ8/Δ9 limits, age gating, labeling, testing; noncompliance may lead to fines, seizures, retailer bans, and recalls.

2. Payments Risk:

High-risk MCCs, strict underwriting, reserves, scheme monitoring, MATCH exposure; disputes, chargebacks, or policy breaches threaten account stability pricing.

Also Read: How to Get a CBD License

3. Product Integrity:

Misses on batch-level COAs, total THC math, or contaminant testing invite recalls, forced refunds, reputational hits, and distributor delistings across channels.

4. Marketing Compliance:

Overclaiming benefits can violate FDA or FTC and platform rules, triggering warning letters, ad suspensions, marketplace delistings, and expensive relabeling with corrective ads.

5. Fraud and Logistics:

The result is higher chargebacks and write-offs, more customer churn, rising shipping or support costs, and heavy manual reviews when fraud increases, age or address checks fail, carriers refuse parcels, or state limits block delivery.

Because of these risks, many acquirers require reserve accounts, holding a portion of revenue for several months as protection against disputes. Cash flow may tighten, but reserves are the price of participating in card networks until your risk stabilizes.

Also Read: Top 5 Challenges in CBD Payment Processing

6. The Merchant’s Responsibility:

Owing product legality and labeling (batch-linked COAs), state-by-state shipping/age rules, PCI v4.0 page-integrity controls, AVS/CVV/3-D Secure and velocity limits, clear refunds/terms, and a dispute-prevention playbook—backed by current SAQ/ASV evidence and audit logs.

7. Compliance and Product Governance:

Keep batch-specific COAs, accurate labels with no disease claims, and age verification. Maintain a live federal or state rules matrix, geofence shipping, and auto-suppress restricted SKUs.

8. Security and Payments Controls:

Implement PCI v4.0 page-integrity with approved-script inventory, CSP/SRI, and tamper alerts; enforce least-privilege RBAC; require AVS/CVV with step-up 3DS on risk signals; apply card/IP/device velocity caps; and monitor live fraud/chargeback KPIs.

9. Transparency and CX:

Show honest pricing, recurring disclosures, and clear refund/return terms; issues refunds in less than 48 hours. Test billing descriptors, provide fast support, and track disputes with alerts and representation.

10. Underwriting readiness and governance:

Maintain current licenses and policy/evidence packs (SAQ/ASV), assign clear RACI owners, log every enforcement decision, audit quarterly with remediation, train teams continuously, and run to card-brand thresholds to stay off match.

Also Read: CBD Industries Trends Challenges and Future Outlook

The Main options, Explained

1. Square CBD Program – The Fast, Unified Path:

Square’s CBD Program offers a quick, unified way to start taking payments, building POS, Online, and Invoices with plug-and-play hardware and transparent, posted CBD rates. Onboarding is straightforward and policies are clearly documented, which reduces surprises for new merchants.

Downside of using Square CBD program: costs often exceed interchange-plus as volumes grow, while coverage is limited to United States merchants, and ingestibles or claim-heavy SKUs may be ineligible so verify product approvals and profit margins first.

2. Shopify Stores – Bankful or DigiPay(because Shopify Payments does not support CBD):

Shopify is the go-to DTC stack, but because Shopify Payments(Stripe) does not support CBD, merchants connect CBD-friendly processors like Bankful or DigiPay.

While Bankful focuses on high-risk verticals, offers Shopify integration, supports subscriptions, layered fraud tools, and eCheck/ACH which is useful for higher-AOV and continuity models.

DigiPay, which is listed by Shopify as hemp/CBD compatible, can board a wide range of SKUs with rates and potential reserves scaled to your risk profile and product or marketing claims.

This route fits Shopify-first CBD sellers especially ingestibles or mixed catalogs who need tighter controls (3DS, AVS, velocity) than aggregators; budget for formal underwriting and possible reserves, and verify app or theme compatibility plus descriptor testing before launch.

This route fits Shopify-first CBD sellers—especially ingestibles or mixed catalogs—who need tighter controls (3DS, AVS, velocity) than aggregators; budget for formal underwriting and possible reserves, and verify app/theme compatibility plus descriptor testing before launch.

3. High-Risk Merchant Account + Gateway( Authorize .net or NMI):

Pairing a high-risk merchant account with a gateway like Authorize . net or NMI fits CBD sellers who want lower effective rates at scale, more tolerant underwriting for ingestibles or vapes(where permitted), multi-MID redundancy, and enterprise features(recurring, call center, routing).

Expect longer onboarding, heavier documentation, possible rolling reserves, and monthly gateway fees. Placement partners like PaymentCloud help navigate reserves, compliance, and integrations.

Easy Pay Direct is popular for the United States or Canada and multi-acquirer setups. Authorize . net and NMI are gateways and not banks with broad cart support and eCheck/ACH and reporting.

Feature Checklist that Actually Matters for CBD

1. Underwriting and Compliance:

Explicit CBD policy(allowed SKUs or claims, THC thresholds, geographies), formal KYC, PCI DSS v4.0 page-integrity, age or ID gating, COA retention.

2. Pricing and Reserves:

Look for transparent MDR, per-transaction, and monthly or gateway fees, clearly stated reserve percentages with release timelines, explicit chargeback fees, and funding speed details including weekend details.

3. Fraud/SCA:

AVS/CVV checks, 3-D Secure, velocity throttles, device fingerprinting, block or allow lists, and adjustable risk-scoring rules.

4. Prioritize Platforms with Subscription Essentials:

Smart retries or dunning, account updater, pause or skip controls, and trials and alternative rails like ACH/eCheck or pay-by-bank and native split settlement support.

5. Reliability, Routing and Disputes:

Require 99.9% + uptime with a public status page and webhook retries, multi-MID routing or failover, and strong dispute tooling which order insight or Ethoca alerts representation workflows, and win-rate reporting.

Conclusion:

There is no single “best” CBD gateway which is only the best fit for your products, risk profile, tech stack, and growth horizon. While if you need speed and simplicity to validate demand, Square’s CBD program is the most turnkey choice.

If you are committed to Shopify and need subscriptions with stronger fraud controls, integrating Bankful or DigiPay keeps you native and compliant. While if you are past six figures a month or need redundancy, smart routing, and enterprise controls will upgrade to a dedicated high-risk merchant account paired with an NMI or Authorize . net gateway.

For edge-case SKUs or difficult markets, offshore acquiring can unlock access—but use it sparingly, as fees are higher and funding timelines are slower. Add ACH or pay-by-bank as a cheaper backup rail to cut fees and increase payment resilience.

Prioritize providers with CBD-specific underwriting (clear allowed SKUs/claims), transparent pricing and reserve terms, 99.9%+ uptime with routing/failover, deep fraud/SCA controls (AVS, CVV, 3DS, velocity), strong dispute tooling (alerts, representment, win-rate reporting), solid subscription features, and responsive support.

Start with a single processor pilot measure approval rates, blended costs, chargeback levels, and weekend deposit speed then add a second MID for failover.

Verify descriptors across issuers, maintain COAs and age-gate evidence, and meet PCI DSS v4.0 page-integrity; the best gateway is the one that protects margin, weathers policy swings, and scales when your volume doubles.

Frequently Asked Questions (FAQs):

1. Can I use Stripe or PayPal for CBD?

Neither Stripe nor PayPal natively supports CBD. Stripe classifies it as a restricted business, and PayPal’s AUP or APM terms ban CBD or hemp.

2. Is CBD allowed on Shopify?

Yes, Shopify platform allows hemp or CBD where legal but Shopify Payments does not process CBD. Use a third-party like Bankful or DigiPay.